- EUR/USD outlook hurt by soft data, rising oil prices and risk off

- Investors eye key US data: ISM manufacturing & services PMIs and NFP

- EUR/USD technical analysis point to new 2023 low

The EUR/USD’s corrective bounce towards the end of last week faded, as we had expected, with the dollar continuing to find support even though we saw some notably weaker data, including pending home sales. There was some relief in the market after the US Congress agreed on a stopgap spending bill to avoid a government shutdown until November 17th. This caused US index futures to gap higher overnight, lifting the EUR/USD in early Asia session. However, it has since resumed lower alongside US index futures. Investors are clearly not impressed by the latest kicking of the can down the road. So, the focus has quickly returned to rising oil prices, and high interest rates. The bond market sell-off has resumed, further supporting the dollar. In other words, nothing has changed since last week. There will be lots of key US data to look forward to this week, which should keep the EUR/USD and other dollar pairs in sharp focus.

EUR/USD outlook hurt by soft data, rising oil prices and risk off

Data out of China and Eurozone continue to remain soft, which are among the key reasons the pressure on the euro has not been lifted. The renewed strength in oil prices and weakness in stock markets on Monday are additional factors weighing on the EUR/USD. Let’s have a closer look at these three influences, before discussing the US dollar.

EUR/USD weighed down by stock markets resuming lower

After an oversold rebound in global stock prices towards the latter parts of last week, we saw fresh selling creep into the markets in the second half of Friday’s session. Though the US debt deal helped to create a positive gap in US index futures at the Asian open overnight, that gap has since been completely filled on all major indices. In other words, the selling pressure remains strong.

It is worth keeping an eye on the indices if you trade the EUR/USD. For if we see further weakness in stock prices, then this should keep the risk-sensitive EUR/USD undermined, and the dollar underpinned. Concerns about high borrowing costs and stagflation are unlikely to go away quickly.

Rising oil prices pose additional risk for EUR/USD

Crude oil prices remain elevated after their recent OPEC-inspired gains. The group is unlikely to change its policy this week. Rising oil prices could make stagflation even worse for oil-importing countries in the Eurozone, Japan and China, among others. This comes as borrowing costs have skyrocketed across the developed economies. If crude oil were to rise even further, then this could further fuel inflation worries and thus drive bond yields even higher.

Eurozone, Chinese data remains soft

At the weekend, China’s official manufacturing (50.2) and non-manufacturing PMIs (51.7) showed barely any expansion and were bang in line with expectations. The Caixin PMIs (at 50.6 and 50.2, respectively) also showed similar readings, but these, trusted more by market watchers, were below expectations.

Eurozone’s final manufacturing PMI estimate was left unrevised at 43.4, as slightly better-than-expected showings in Spain, Italy and France were offset by weaker German PMI. This comes on the back of softer Eurozone inflation and German retail sales data released on Friday. The latest data therefore does not point to any improvement in Eurozone’s macro-outlook. This means that ECB President Christine Lagarde, due to speak at a monetary policy conference on Wednesday, is not going to be any less dovish than she was at the ECB’s press conference, which is when money markets have virtually priced out any further ECB tightening in this cycle.

So, unless we see further evidence of an even sharper slowdown in US economy to completely reverse the dollar’s bullish trend across the board, I am doubtful that the EUR/USD will be able to cling onto the 1.05 handle for too long.

EUR/USD outlook: Key US data to drive USD this week

Investors wills be looking forward to a busy week in US economic calendar.

Last week, we saw some more softer-than-expected US data, which should further discourage the Fed from tightening its belt further this year. Among the data misses was pending home sales, plunging 7.1% in August after the 0.9% monthly increase recorded in July. This was a lot worse than expected (-1.0%). We also found out that GDP was left unrevised, against expectations of a positive surprise, while the core PCE Price index rose (0.1% m/m) less than expected. But the UoM surveys showed both consumer sentiment and inflation expectations were higher than initially reported.

Still, given that US bond yields remain elevated near their recent highs, investors are not convinced the weaker data will help bring forward the timing of the Fed’s rate cuts. It is important not to jump into any conclusions as the monthly data can be quite volatile. The Fed looks at the trend of data than month-over-month volatility. More evidence is needed to reverse the sharp bullish repricing of US monetary policy that has helped to propel the dollar to new highs on the year and bond yields to their highest levels since 2007.

So, if, at worse, this week’s US data point to a mere soft landing, then this should keep the dollar supported on the dips.

ISM Manufacturing PMI

Monday, October 2

The immediate focus today will be on the ISM manufacturing PMI and, later, a speech by Federal Reserve chief Jerome Powell. It remains to be seen, however, whether he will provide any clues on the direction of interest rates. FOMC officials Harker and Barr will also be speaking today. The ISM manufacturing PMI is expected to show another subdued reading under the boom/bust level of 50.0. It is expected to come in at 47.8 versus 47.6 in the previous month.

US ISM Services PMI

Wednesday, October 4

There’s still a small chance that the Fed’s tightening cycle may not be over just yet, as macro indicators in the US have remained relatively upbeat compared to the rest of the world, though the market feels like it is probably done. The dollar bulls will be looking for further evidence in incoming data, such as Wednesday’s ISM Services PMI, to support the Fed’s view. But if we now start to see a trend of weaker data emerge, then this could be the catalyst to knock the dollar off its perch. Anyway, the ISM services PMI is expected to come in at 53.5 versus 54.5.

US nonfarm payrolls report

Friday, October 6

This week’s US data highlight will, of course, be Friday's release of the monthly jobs report. Analysts expect a steady 170,000 or so headline increase in September nonfarm payrolls, with the unemployment seen edging back down to 3.7% from 3.8%. Average hourly earnings, a key gauge for future inflation, are expected to tick up to 0.3% month-on-month, after rising less profoundly than expected in August.

Concerns over interest rates remaining high for longer in the US has caused lots of volatility in recent weeks. Until Thursday’s reversal, we had seen a sharp sell-off in stocks while bond yields climbed to levels last seen before the global financial crisis. The market is worried about inflation and oil prices remaining high, which could call for one more rate increase before the end of 2023, or keep rate cuts off the table until at least H2 of 2024. So, as well as the headline jobs number, this month’s wages data should be monitored closely. A bigger rise in wages should support the dollar.

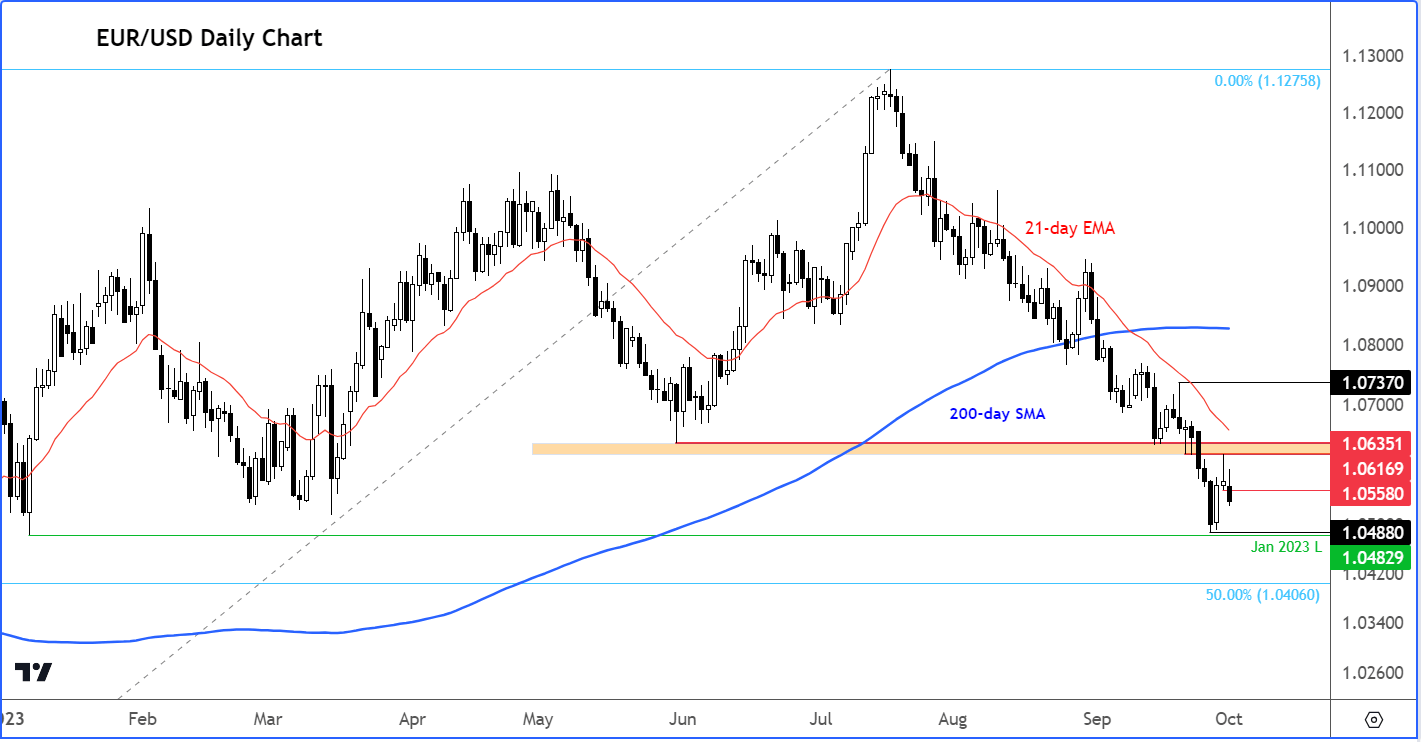

EUR/USD technical analysis: rates could drop to new 2023 low

Source: TradingView.com

Considering all factors, I believe that the EUR/USD still carries a bias towards the downside, and it may be heading towards the January low of 1.0482 from here.

Last Monday, the EUR/USD broke key support in the 1.0615-1.0635 range. This area was then retested from underneath on Friday, and this time it held as resistance. At the start of this week, the EUR/USD is finding itself below Friday’s range at 1.0558. This level is now the first important resistance that the bears must defend to maintain control

So far, therefore, we haven’t seen any technical developments to suggest that the bearish trend is over. Consequently, I am expecting rates to decline further with the next focus being on liquidity resting below January’s low at 1.0482.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade