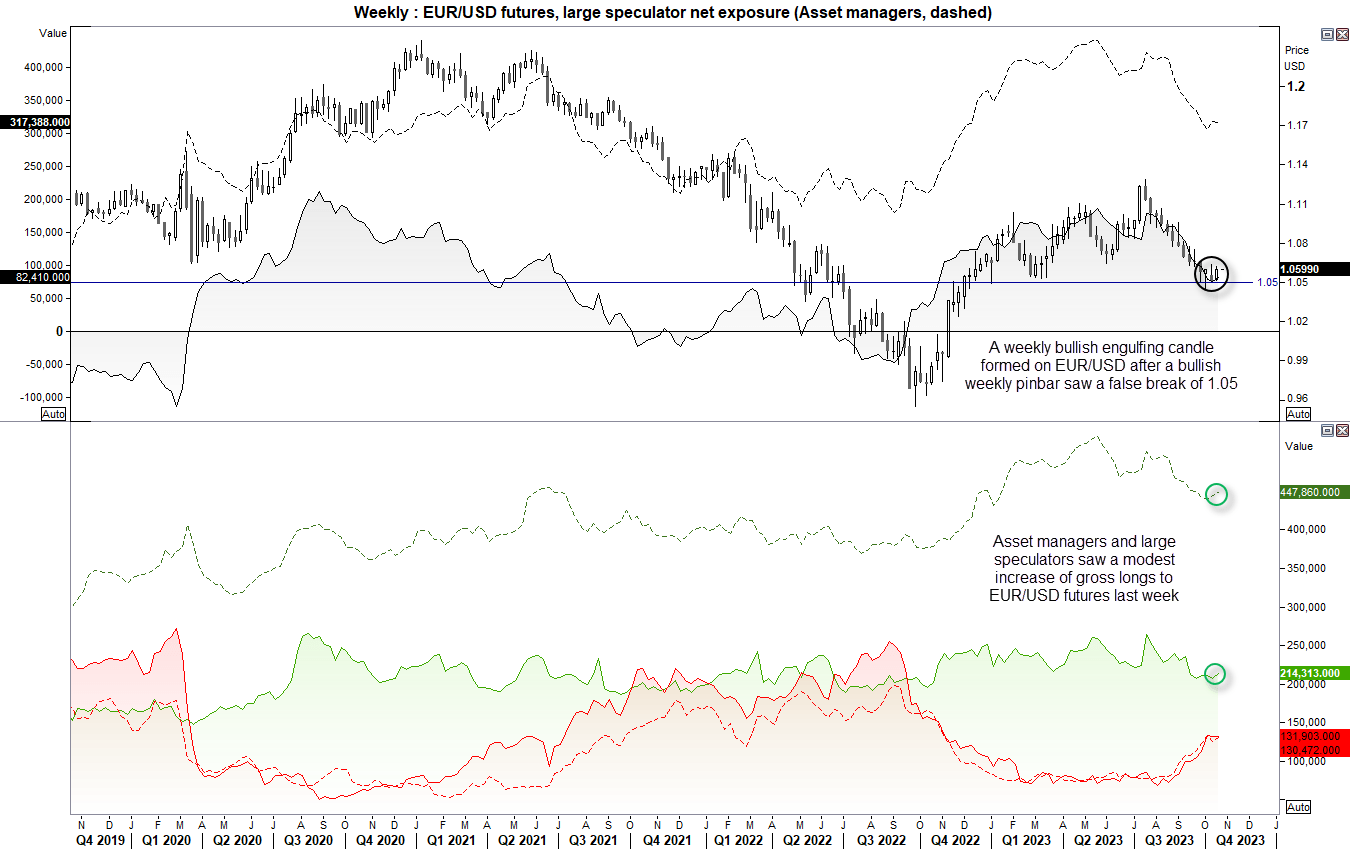

Whilst traders remain net-long EUR/USD futures, there are early signs of a turnaround in sentiment with asset managers increasing bullish exposure and prices holding above 1.05. Naturally, we’d need to see US yields pull back meaningfully from their highs, but all turning points have to begin somewhere.

Asset managers also increased their gross-short exposure to Japanese yen futures by 11.8% last week. It is therefore interesting to note that USD/JPY has failed to even retest 150, let alone break it, because increased bets against the yen assume a bullish breakout on USD/JPY.

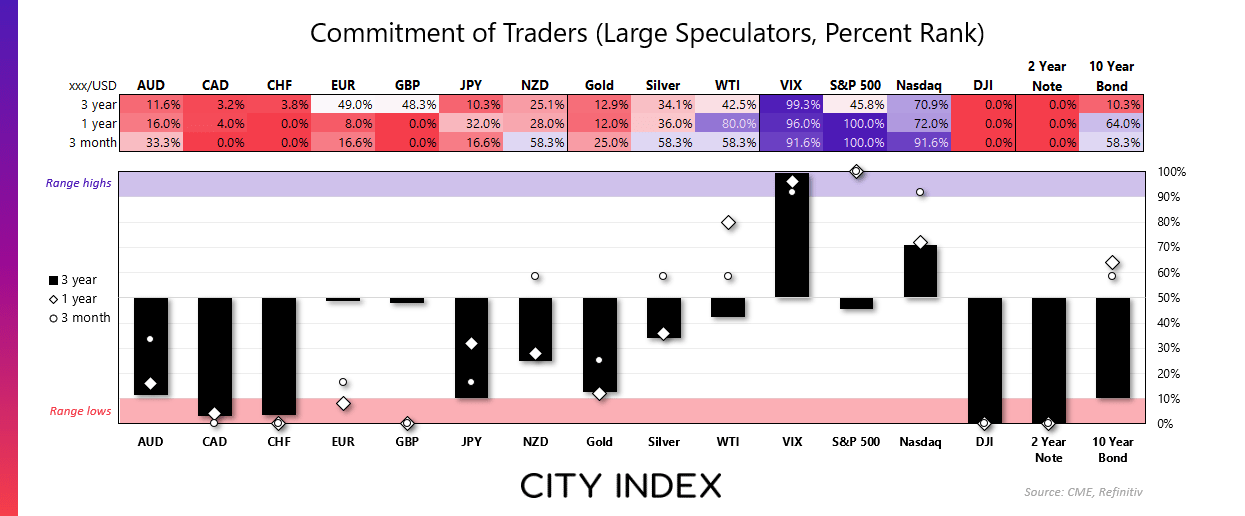

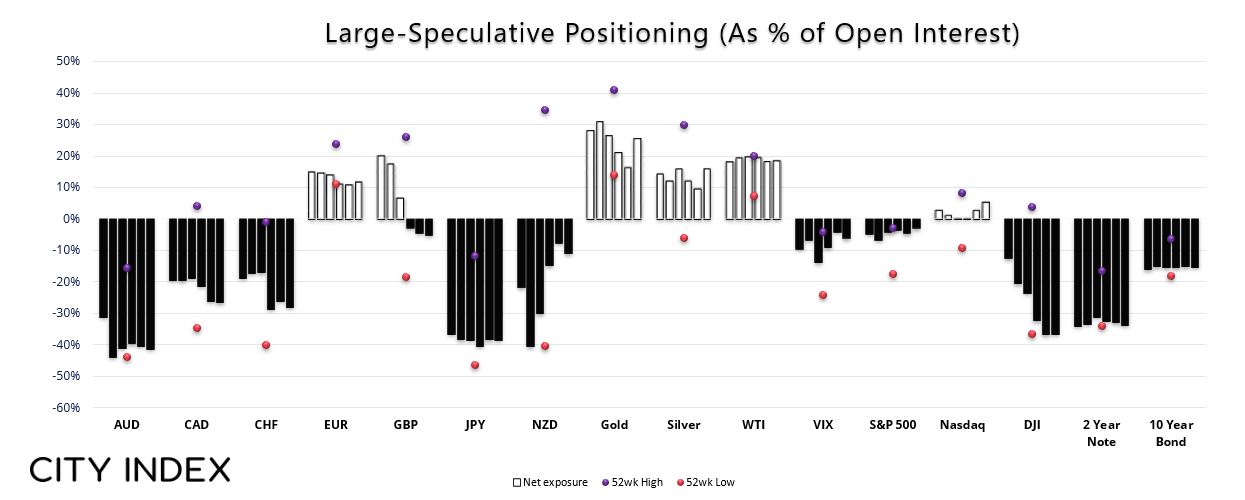

Overall, there were only minor adjustments to net exposure to forex majors among large speculators last week, with all changes ranging from -4.1k to 6.8k contracts.

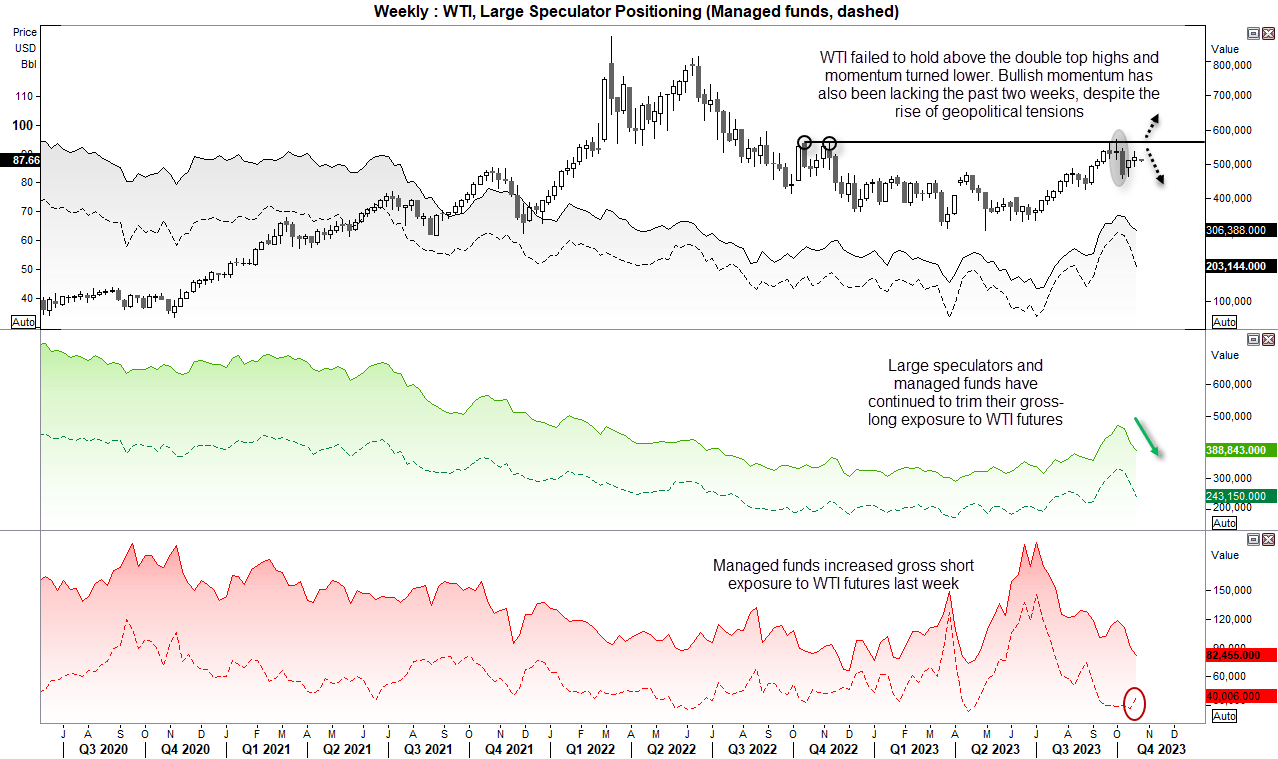

WTI positioning has also caught my eye as large futures traders have continued to reduce their long exposure while managed funds have increased their shorts, despite the rising risks around the Middle East conflict.

Perhaps not too surprisingly, asset managers flipped back to net-long exposure to gold and silver futures last Tuesday. And we can only assume that exposure is even more bullish now, given that gold rallied a further 3.8% into Friday's high.

Commitment of traders – as of Tuesday 17 October 2023:

EUR/USD (Euro dollar futures) – Commitment of traders (COT):

Traders remain net-long EUR/USD futures, despite the pair falling nearly -7.5% from its July high to October low. However, it fell in a relatively straight line and printed a record level of consecutive bearish weeks along the way. And that almost begs for soe mean reversion.

Over the past three weeks we have seen EUR/USD print a weekly bullish pinbar, failed break beneath 1.05 and bullish engulfing week. So it seems 1.05 is the level bulls are successfully defending, and if US yields retreat further it brings upside potential for EUR/USD.

WTI Crude oil future (CL) - Commitment of traders (COT):

The rise of oil prices and their sensitivity to the Middle East conflict have been well covered over the past couple of weeks. So I’m going to take the opposite side of the coin and discuss a potential bearish scenario.

Note that WTI crude oil’s Q3 rally faltered around the October and November 2022 highs, formed couple of weekly Doji’s before bearish momentum accelerated lower. And whilst WTI has risen for the past two weeks, bullish momentum has not recouped the losses sustained during WTI’s sharp selloff.

Moreover, large speculators and managed funds have continued to trim gross longs in recent weeks and managed funds increased gross short exposure last week.

Whilst the escalation of the Middle East conflict could easily send oil prices higher, I’m also on guard for a sharp move lower if tensions somehow reside. And that could make any move back towards the 93-94 highs an area of interest for bears.

Of course, headline risk is paramount for the direction of WTI from here, and traders should be on guard for volatile moves in either direction.

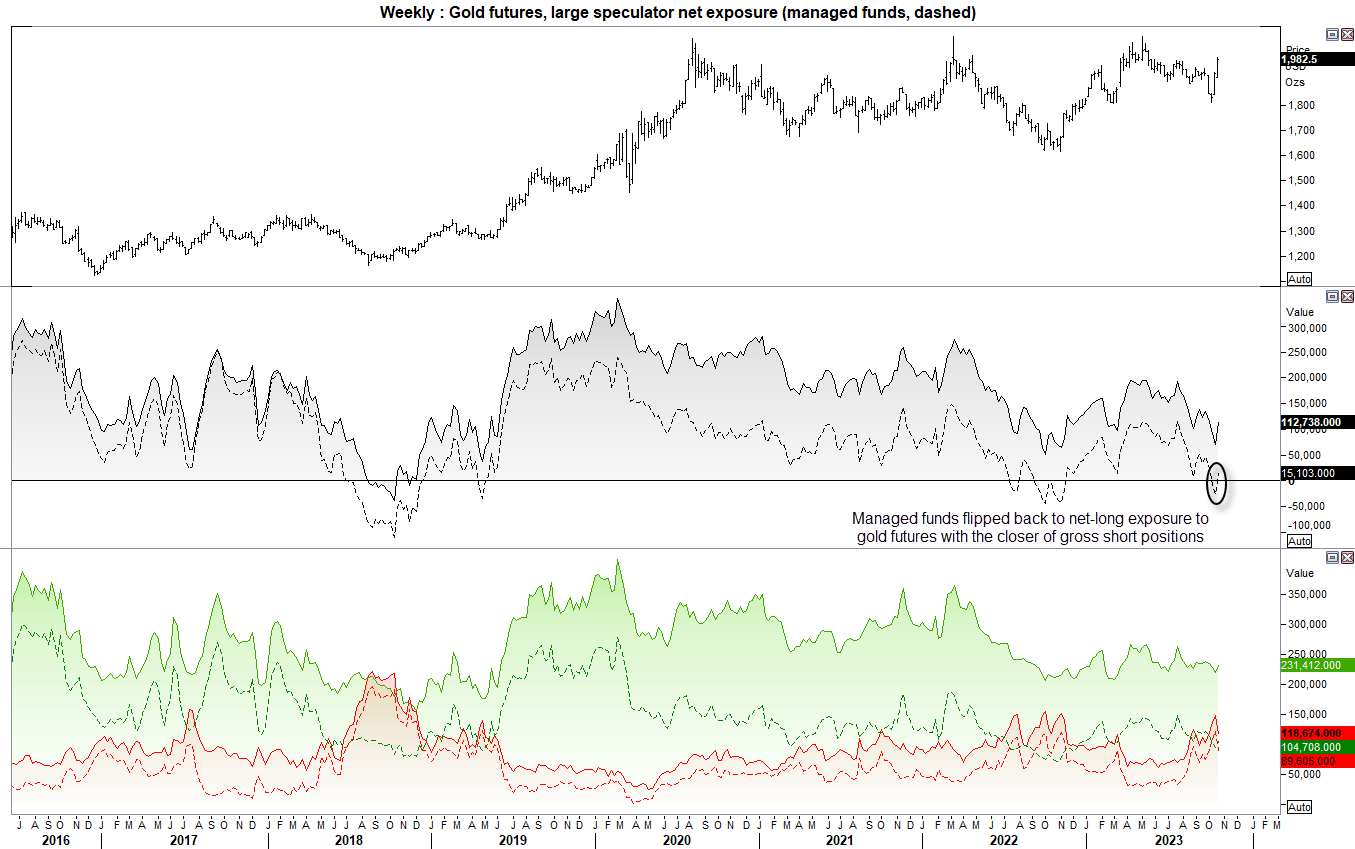

Gold futures (GC) - Commitment of traders (COT):

As noted in today’s Asian open report, gold managed to rise 10% in 10 days before stalling just beneath the big round number of $2000. Asset manages and large speculators closed round -60k short contracts between them last week alone, and that was before prices continued higher which suggests more longs may have since been added.

And as it is rare to see asset managers net-short gold futures, I have to wonder if we have seen the cycle low for net-short exposure and prices are now considering a break above $2000 and for a retest of its all-time high around $2075. Net-long exposure is not near an extreme for either set of traders, and that suggests there could be plenty of bullish money on the sideline looking to enter the gold futures market.

And if the Middle East conflict escalates and the Fed effectively confirm peak cycle, gold’s rally might just continue to impress, with the odd pullback here and there along the way.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade