Asian Indices:

- Australia's ASX 200 index rose by 9.3 points (0.13%) and currently trades at 7,318.50

- Japan's Nikkei 225 index has risen by 69.74 points (0.22%) and currently trades at 32,324.30

- Hong Kong's Hang Seng index has fallen by -267.58 points (-1.37%) and currently trades at 19,270.34

- China's A50 Index has risen by 19.41 points (0.15%) and currently trades at 13,220.58

UK and Europe:

- UK's FTSE 100 futures are currently down -7.5 points (-0.1%), the cash market is currently estimated to open at 7,546.99

- Euro STOXX 50 futures are currently down -4 points (-0.09%), the cash market is currently estimated to open at 4,333.50

- Germany's DAX futures are currently down -10 points (-0.06%), the cash market is currently estimated to open at 15,940.76

US Futures:

- DJI futures are currently down -56 points (-0.16%)

- S&P 500 futures are currently down -8.75 points (-0.19%)

- Nasdaq 100 futures are currently down -47.75 points (-0.31%)

The US dollar was broadly higher during Tuesday’s Asian session, during a mild risk-off session ahead of key inflation reports from China and the US this week. The stronger dollar also weighed on oil and gold prices, although gold was higher against all other major currencies except the US dollar.

China’s trade data continued to disappoint in July, with imports and exports slumping much faster than expected. Exports are falling at their fastest annual rate since the pandemic at -14.5% y/y (-12.4% previously, -9.8% forecast). Imports were down -12.4% y/y, compared with -6.8% in May and -5.6% expected. Lower exports continue to show dwindling global demand whilst falling imports underscores weakness in the domestic economy.

The PBOC (People’s Ban of China) loosened their grip on the yuan by setting a higher-than-expected yuan fix, sending USD/CNH to a 13-day high.

The BOE’s (Bank of England) chief economist Huw Pill warned that the UK’s high supermarket prices may not fall from painfully high levels, despite lower commodity prices. Whilst lower prices may feed through to the consumer at some stage, it would likely mark a halt in higher prices as opposed to lower prices. The BOE currently expect inflation to fall back to their 2% target by the first half of 2025.

Final inflation data for parts of Europe are scheduled for today. German CPI at 07:00 BST is expected to be revised lower to 6.2% y/y from 6.4% and the HCIP down to 6.5% from 6.8%, yet failure for it to be revised lower risks a burst higher for the euro. Inflation data is also released for France at 07:45, Spain at 09:40 and Greece at 10:00.

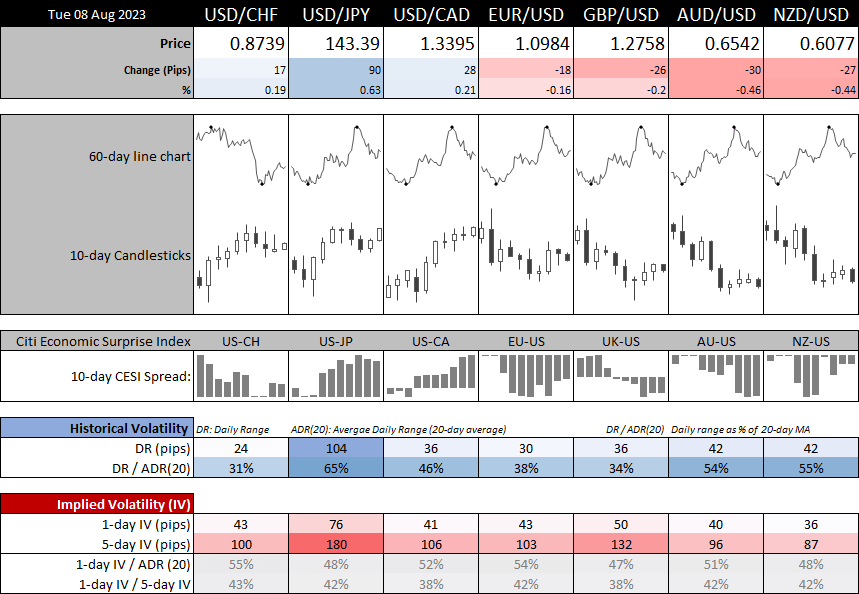

- 1-day implied volatility remains relatively low, with all FX majors coming in around 50% of its own 20-day average and all less than 43% of the 5-day IV

- The US dollar is the strongest major, although the current days ranges are also relatively low (USD/JPY has the highest at 65% of its 20-day average)

- Economic data seems to be supportive of the US dollar against JPY, CAD, EUR, GBP, AUD and NZD according to the CESI spreads (CESE is the Citigroup Economic Surprise Index and measures economic data relative to consensus forecasts)

- Gold has again pulled back to recent range low, so unless we see bullish momentum return soon the bullish bias is under threat (and invalidated with a break or close beneath 1930).

- WTI crude oil has fallen to 82 in line with our bearish bias, where a break below 81.50 would confirm a two-bear bearish reversal on the daily chart

AUD/USD daily chart:

Momentum turned lower on AUD/USD during Tuesday’s Asian session, which puts the Aussie on track to snap its 3-day rise. It now trades around the midway point between the March low and last week’s low, so increase its potential reward to risk ratio, bears may want to see if prices can retrace towards Monday’s lows before considering potential short setups on the daily chart, with a view to target last week’s low.

If sentiment continues to sour, perhaps bears can break it beneath that key low and head for a retest of its YTD low. Further out, a break above 66c would suggest the fall from the July high is complete.

EUR/USD 1-hour chart:

Yesterday’s retracement from Friday’s high almost perfectly respected Thursday’s high before posting a minor rally. However, the day ended with an inside day to show momentum is not yet ready to burst higher. However, we can see on the 1-hour chart that its latest dip lower is holding above several technical support levels including the 50-da EMA, trend support and Thursday’s high. We’re therefore once again looking for evidence of a swing low forming, but hopefully it can perform a stronger rally than yesterday’s. A stronger set of inflation reports from Europe could help the bullish bias, whilst a break beneath Thursday’s high invalidates the near-term bullish bias.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade