- The US economy has far more momentum than other developed economies right now

- Traders are now pricing less rate cuts than the Fed in 2024, a stark turnaround from earlier this year when more than seven cuts were seen

- This recalibration has contributed to EUR/USD, GBP/USD and AUD/USD breaking their respective uptrends from late 2023

- US non-farm payrolls and ISM services PMI are the key market events this week, along with eurozone inflation data for March

The overview

The US economy is carrying far more momentum than other parts of the developed world right now, forcing markets to scale back expectations of rate cuts from the Federal Reserve. It's now plausible that other major central banks will cut rates before the Fed, seeing technical and fundamentals work in tandem to power the US dollar higher.

With EUR/USD, GBP/USD and AUD/USD breaking uptrends established when the Fed pivoted away from rate hikes in the December quarter last year, we look at the levels to watch ahead of key US non-farm payrolls and ISM services PMI releases later this week.

The background

The forecast US recession of 2023 that was delayed until 2024 looks like it will be postponed again until next year looking at how the US economy is performing, continuing to defy expectations that interest rate hikes from the Fed would eventually clamp down on activity levels. Instead, the economy is continuing to grow well above its estimated potential, seeing demand outstrip supply in key areas such as the labour market, keeping wage and inflationary pressures elevated.

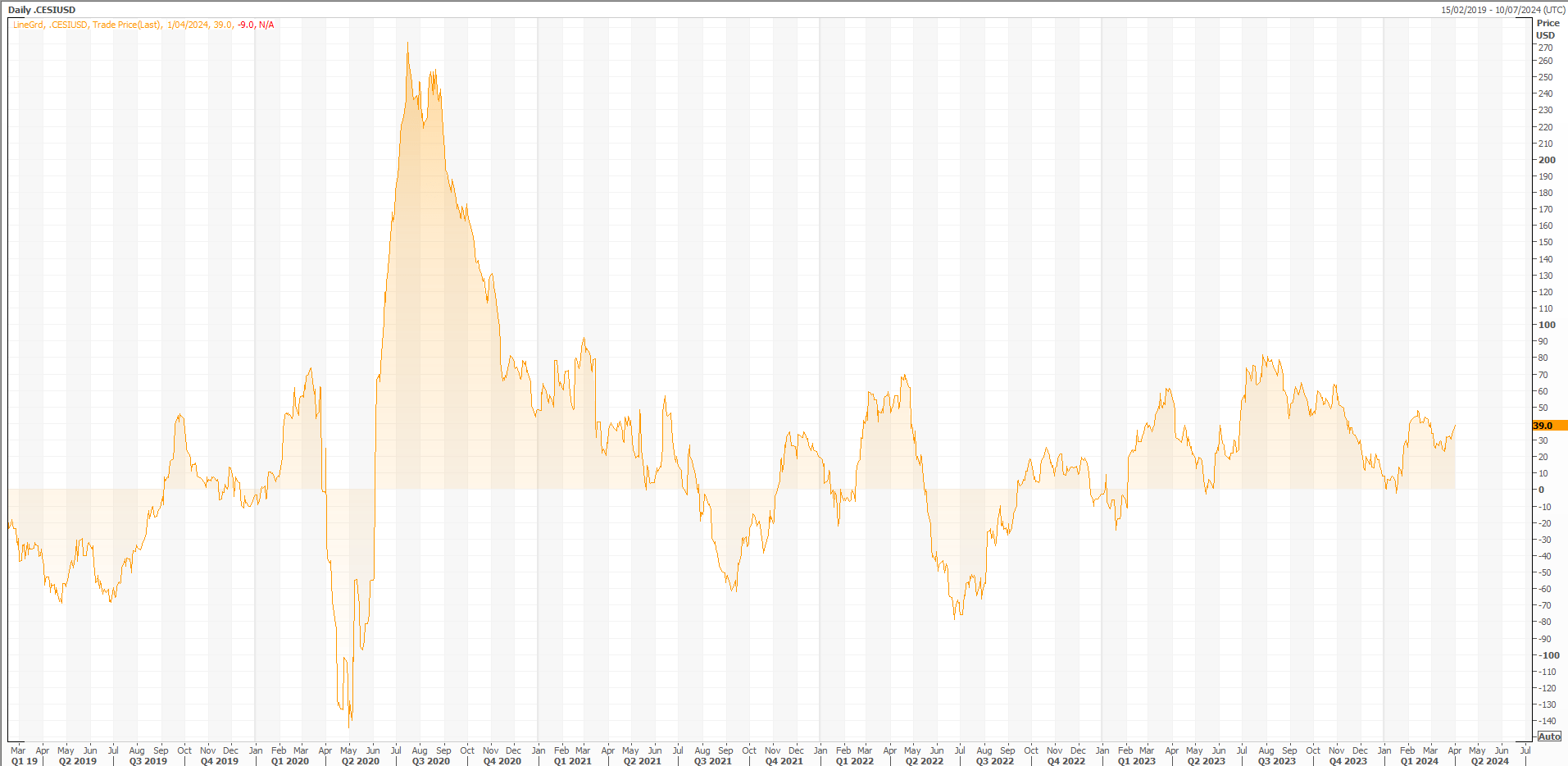

Citigroup’s Economic Surprise Index shows US economic data has been beating expectations almost non-stop since early 2023, with the breadth of upside surprises lifting again over the past month.

Source: Refinitiv

With the economy continuing to exceed levels consistent with stable inflation and unemployment, it’s rightfully seen markets reconsider whether monetary policy is really that contractionary with the Fed funds rate sitting between 5.25% to 5.5%.

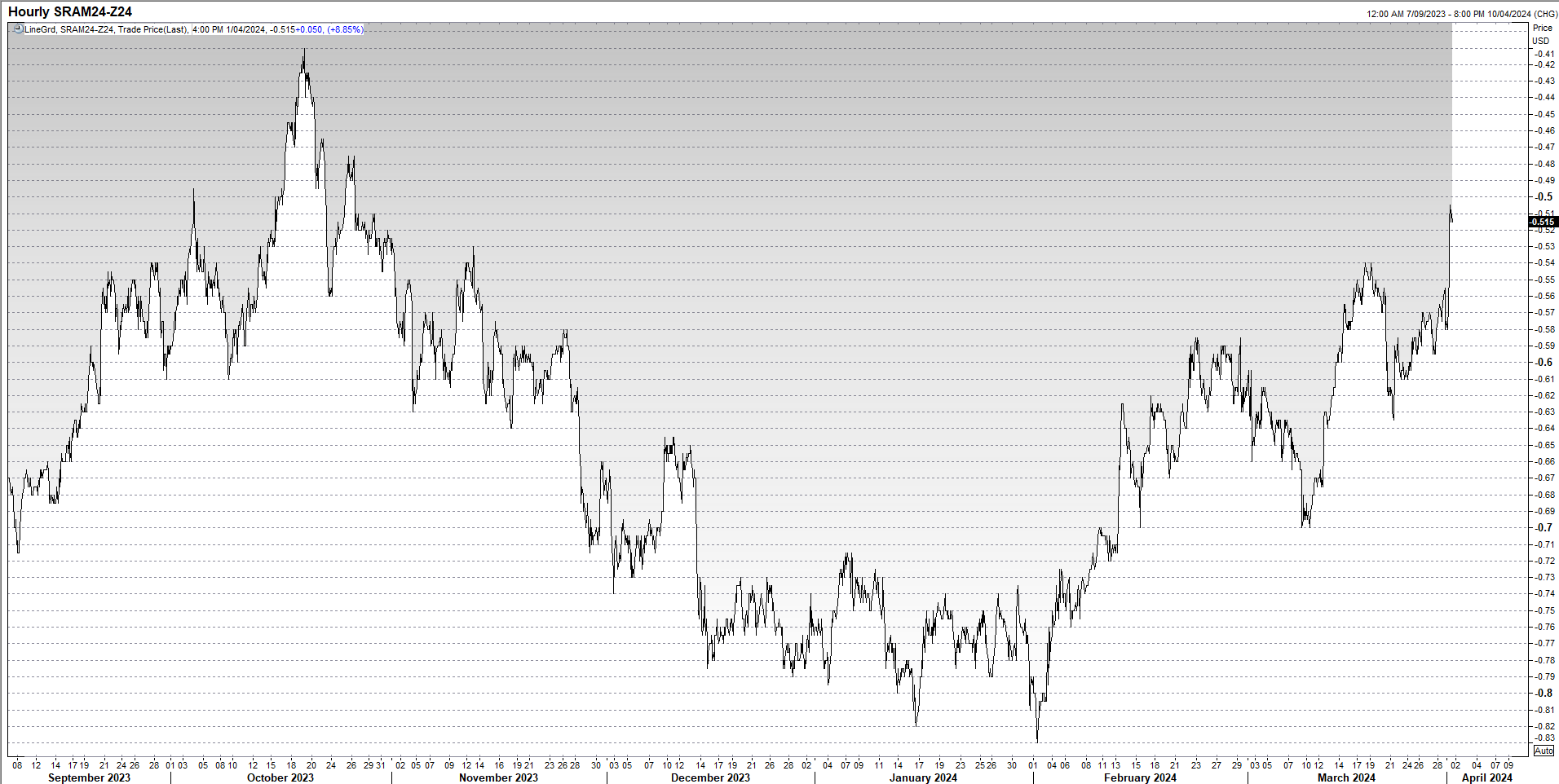

The recalibration has forced traders to scale back rate cut bets aggressively, seeing markets pricing less easing than the median FOMC member did only a few weeks ago. That’s a massive turnaround from the start of 2024 when markets expected more than seven rate cuts over the entirety of 2024. Fed funds futures are now pricing just over two this year.

SOFR futures – which can be used as a proxy for Fed funds expectations – have a similar amount of easing priced between June and December.

Source: Refintiiv

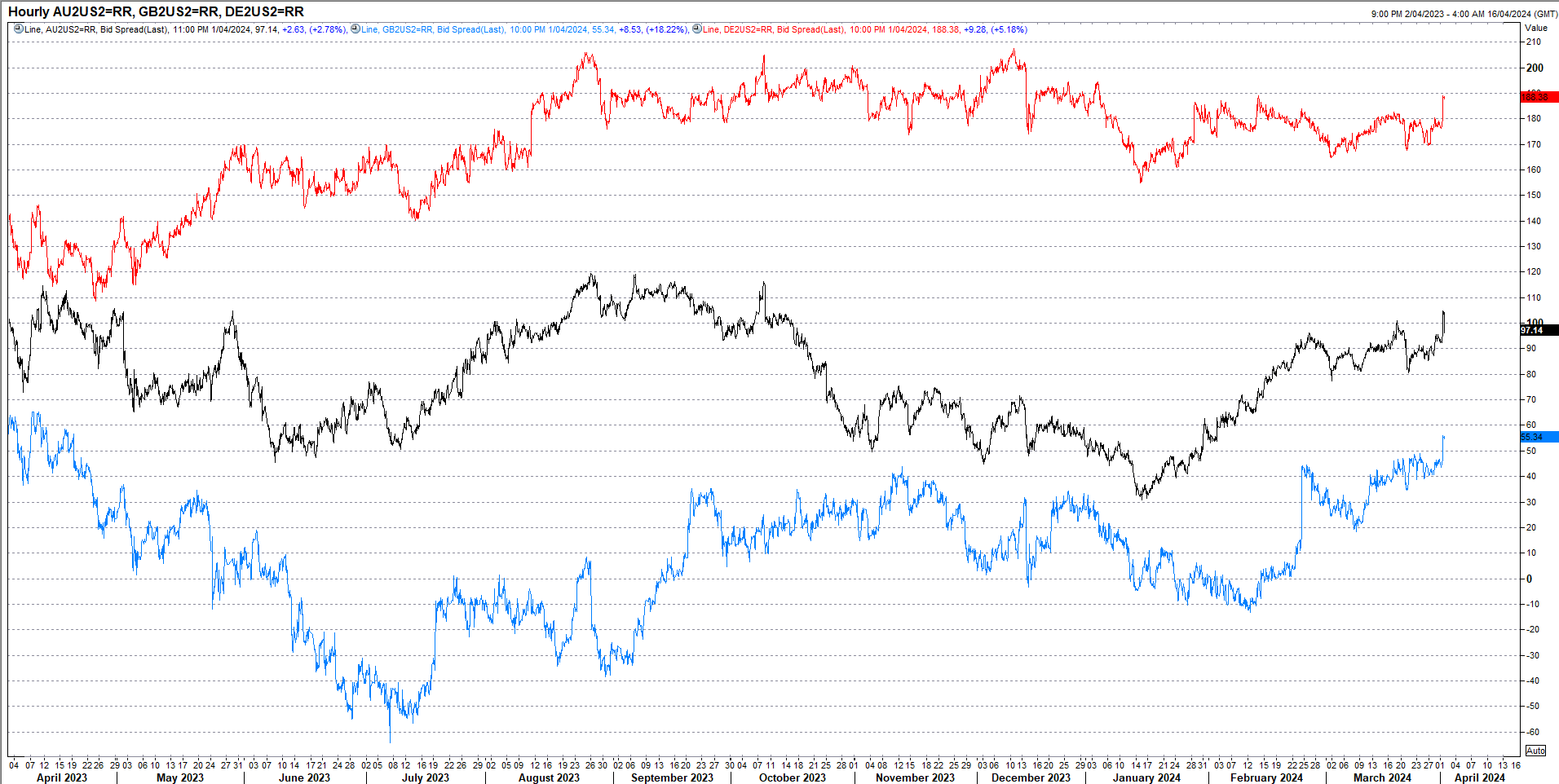

The unwind of aggressive rate cut bets has seen yield differentials between the US and other developed nations widen sharply at the front-end of the curve, reflecting the increasingly plausible risk that other central banks will be cutting rates sooner than the Fed. There’s even a growing school of though that the next Fed move may be a hike rather than a cut.

This chart shows the spread between two-year US bond yields with two-year yields from Germany (red), Australia (black) and UK (blue) over the past year. As two-year yields are highly influenced by central bank rate expectations, it comes as no surprise the US advantage over the three nations has blown out to levels not seen since the Fed pivoted towards signalling rate cuts.

Source: Refinitiv

As the yield advantage has ballooned in favour of the US, that’s contributed to EUR/USD, GBP/USD and AUD/USD breaking their respective uptrends dating back to the Fed pivot, pointing to the potential for the US dollar to strengthen further as technicals join with fundamentals in powering up the buck.

The trade setup

EUR/USD

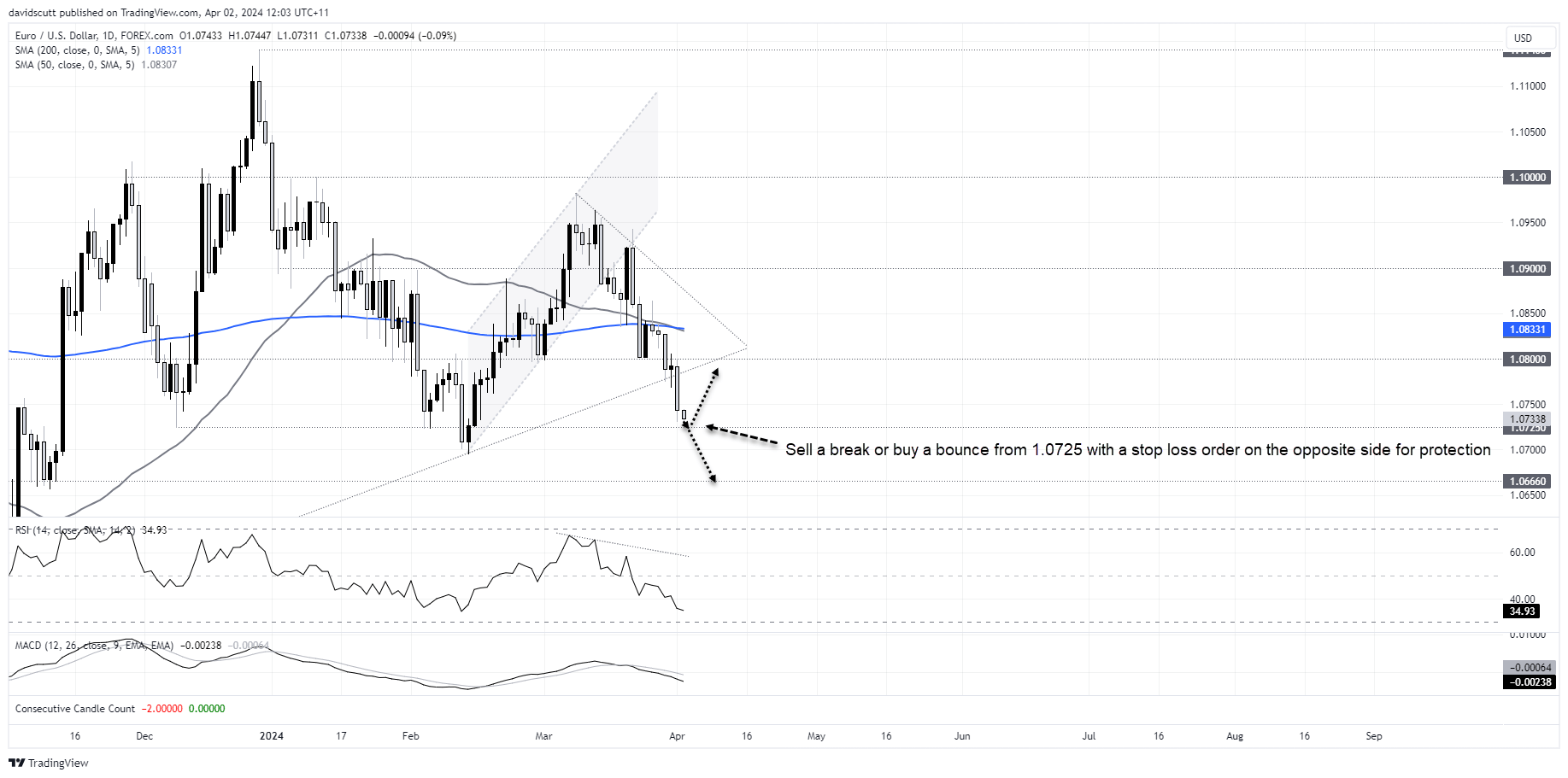

As flagged in an earlier post, EUR/USD was given every reason to rally following the Fed’s March FOMC meeting but couldn’t, providing a strong tell on the path of least resistance for traders. The downside flagged in the post subsequently materialised, seeing the pair break support at 1.0800 before doing away with uptrend support dating back to October on the resumption of trade following Easter.

Monday’s big, bearish candle shows traders were more than willing to sell the break of the uptrend, pointing to the likelihood of further downside ahead. 1.0725 – where the price found support on multiple occasions dating back to December – is the next downside level to watch.

A break of 1.0725 open the door for a retest of the February lows below 1.0700. Should that go, there’s not a lot of visible support evident until 1.0666, an ominous number for a potential bearish target.

While downside is favoured given the price action and momentum, should the price be unable to break 1.0725 with conviction, it will allow for traders to set longs targeting a rebound to the former uptrend just under 1.0800.

Whether you’re selling the break of buying the bounce, make sure you place a stop-loss order on the opposite side of 1.0725 to your entry for protection against a reversal.

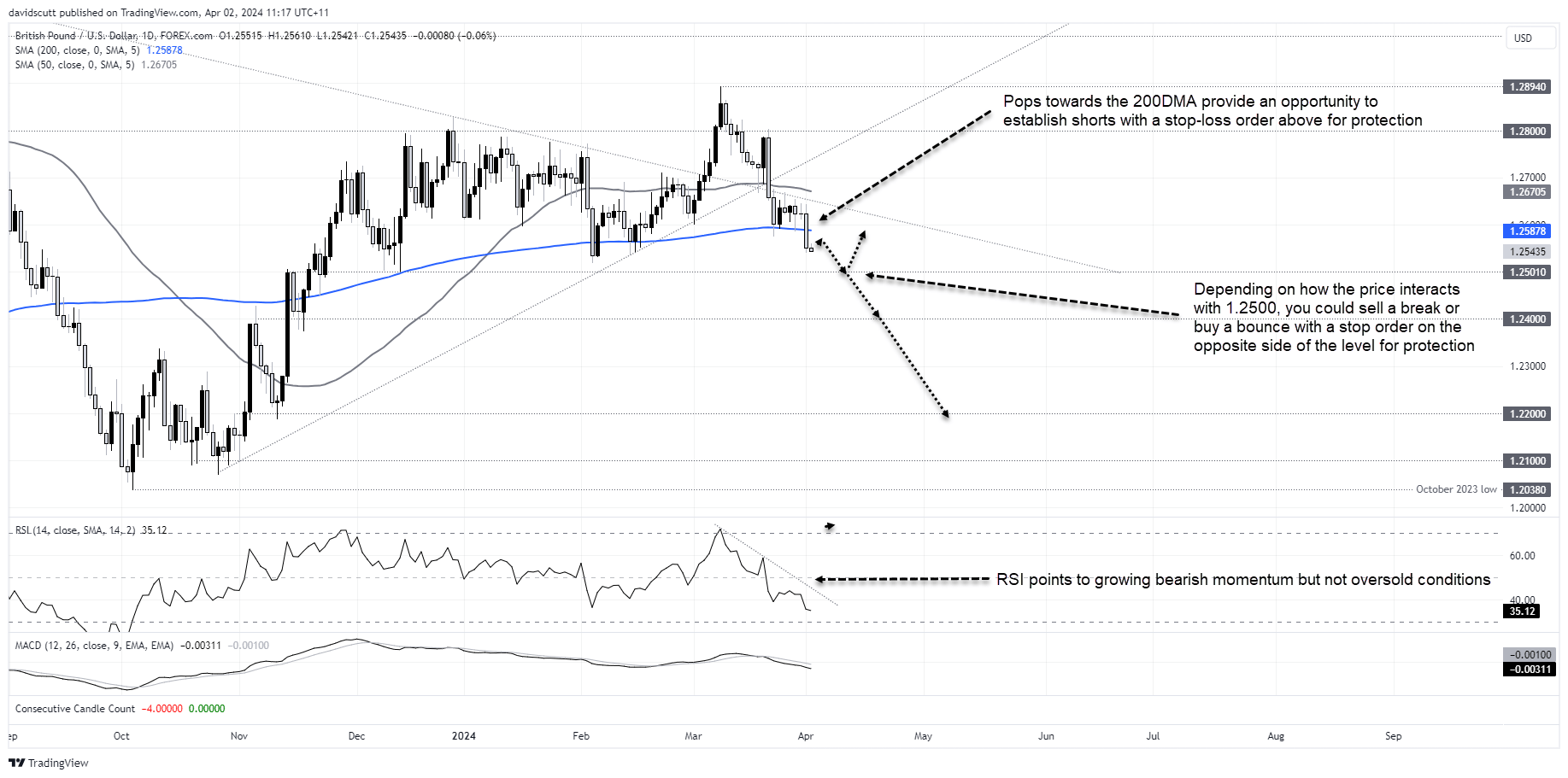

GBP/USD

The setup for GBP/USD is almost identical to EUR/USD, although its uptrend break occurred after the Bank of England signaled looming rate cuts at its March MPC meeting. Having found support at the 200-day moving average following the break, that too gave way to start April, paving the way for another potential leg lower.

Pops back towards the 200-day will improve the risk-reward for establishing short positions, allowing for stops to be placed above the moving average for protection. 1.2500 – a level the price did work either side late last year – would be the initial target for shorts.

Alternatively, traders could wait to see whether the price traders through 1.2500, allowing for shorts to be established with a stop above the level for protection. 1.2400 would be an obvious initial downside target with little on the charts below until 1.2200.

While selling rallies remains favoured given the price action and market momentum, should the price be unable to trade through 1.2500, it could allow for traders to set longs targeting a retest of the 200-day moving average. A stop below 1.2500 would offer protection.

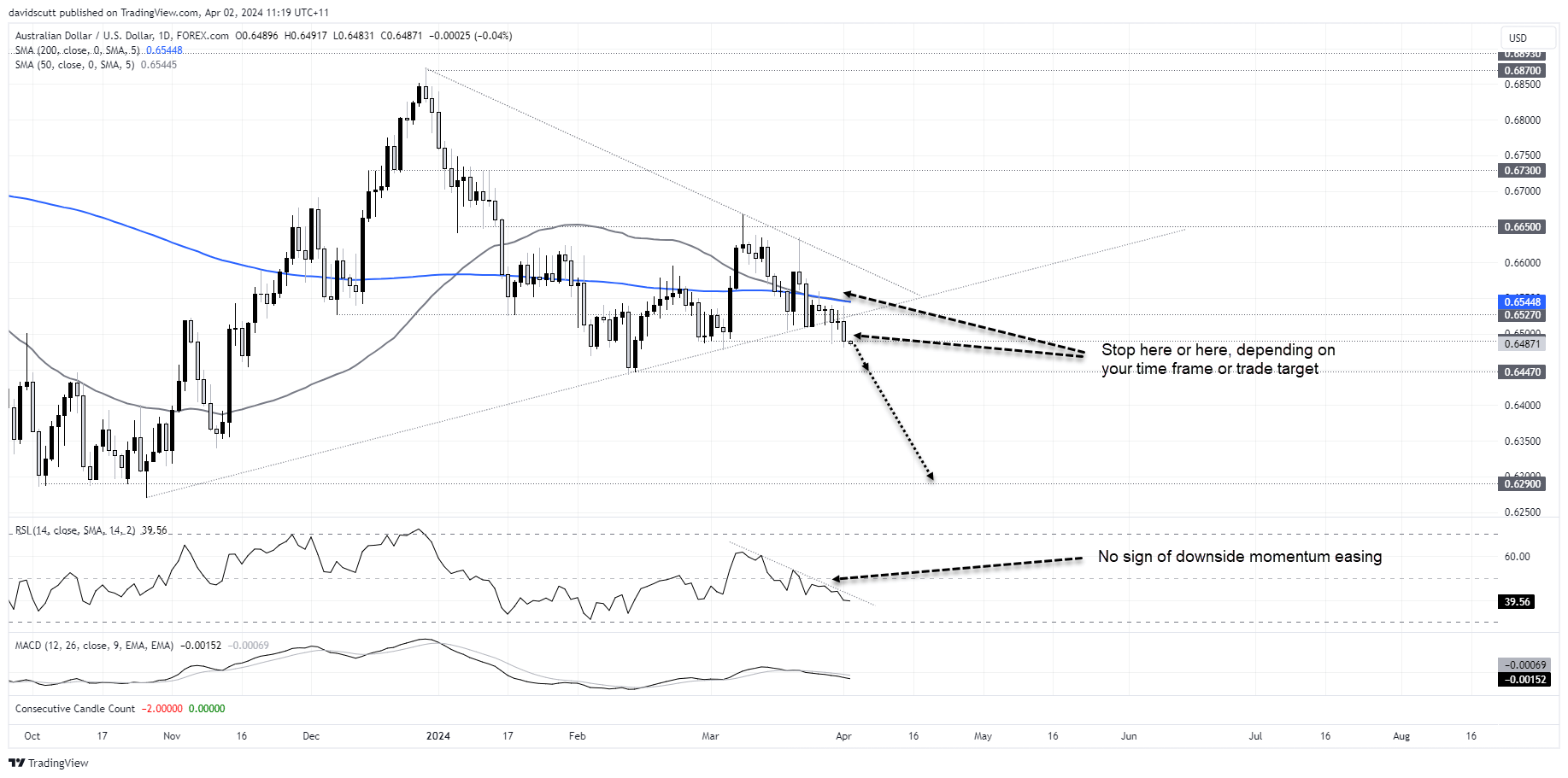

AUD/USD

Like the EUR/USD, the AUD/USD uptrend dating back to October became another casualty of continued US economic exceptionalism to start April, seeing the pair ease lower towards support located around .6490.

With momentum to the downside, a retest of the February lows around .6450 may be on the cards, providing an opportunity for shorter-term traders to sell a clean break of .6490 with a stop loss order above for protection.

Longer-term traders may want to consider selling the uptrend break with a stop-loss order above the 50 and 200-day moving averages for protection. Other than minor support at .6450 and .6350, there’s not a lot of major support evident until .6290.

The wildcards

It’s obvious the US dollar is garnering support from continued strength in economic data, a point reinforced by the reaction to the latest ISM manufacturing PMI which revealed activity expanded for the first time in 18 months in March, with prices paid and new orders accelerating from a month earlier.

As manufacturing only represents around 10% of the US economy, you could argue the reaction may be even larger should similar resilience be seen in the ISM’s services PMI survey on Wednesday. It accounts for around 90% of the economy, making it far more influential on policy settings. Later in the week, US non-farm payrolls on Friday is the other major event with average hourly earnings and unemployment rate arguably more important than the payrolls figure given the implications for wage and inflationary pressures.

Outside the States, early evidence suggests a very soft eurozone inflation report for March may arrive on Wednesday. While such an outcome is being quickly priced in, should it eventuate, it’s likely to help fuel further upside in the US dollar.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade