- USD/JPY spikes above 160, the highest level since 1990

- Move was not driven by rate differentials with US Treasury markets closed

- The move looks speculative, a potential trigger for the Japanese government to instruct the BOJ to intervene in FX markets

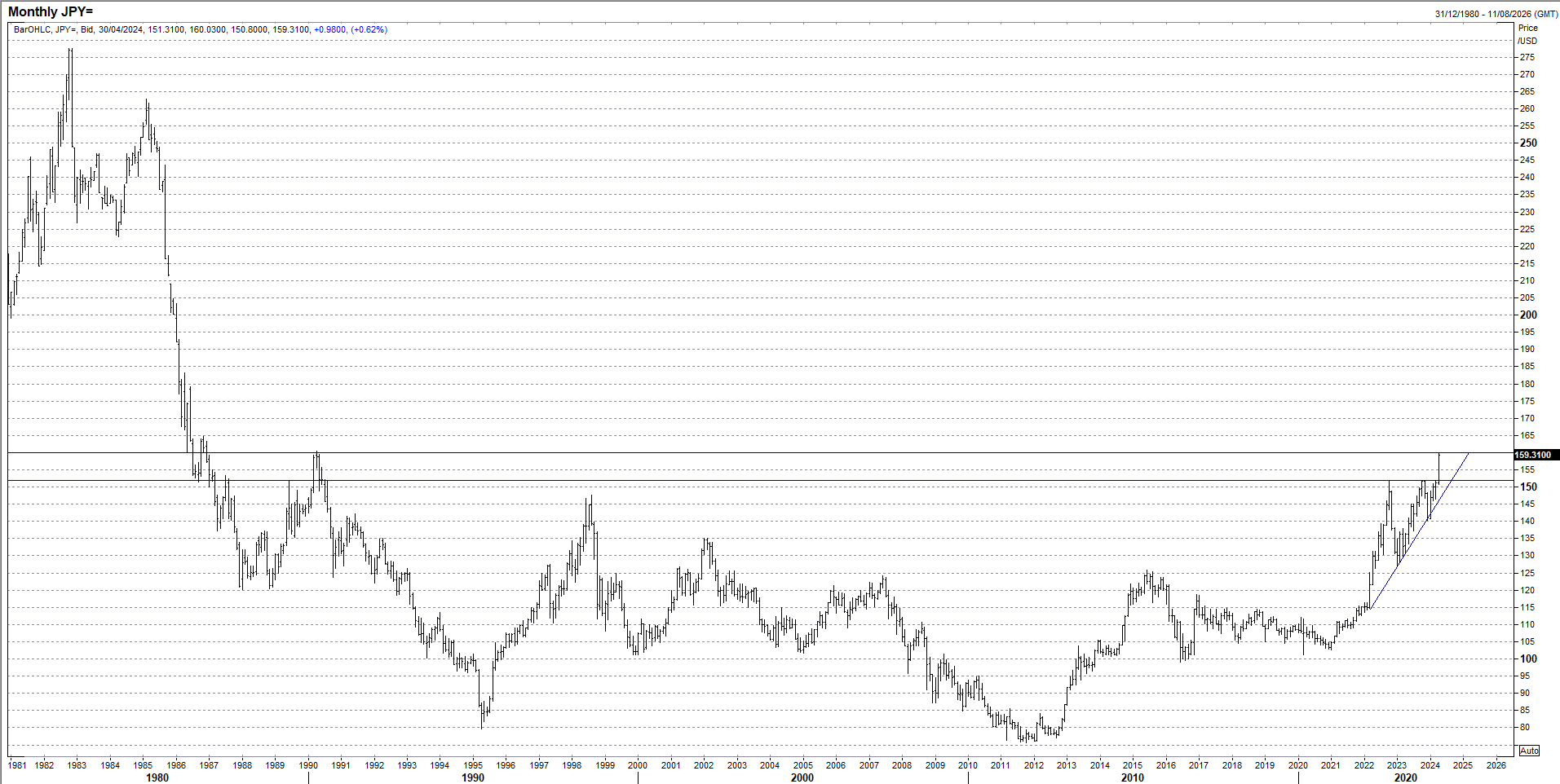

If Japan’s Ministry of Finance (MOF) was looking for a trigger to instruct the Bank of Japan (BOJ) to intervene in currency markets, they were just provided a big one. Because out of nowhere, on a public holiday in Japan, USD/JPY just suddenly spiked over 1%, seeing it briefly trade above 160 for the first time since 1990, taking out a key topside level.

Source: Refinitiv

USD/JPY spike driven by speculative forces

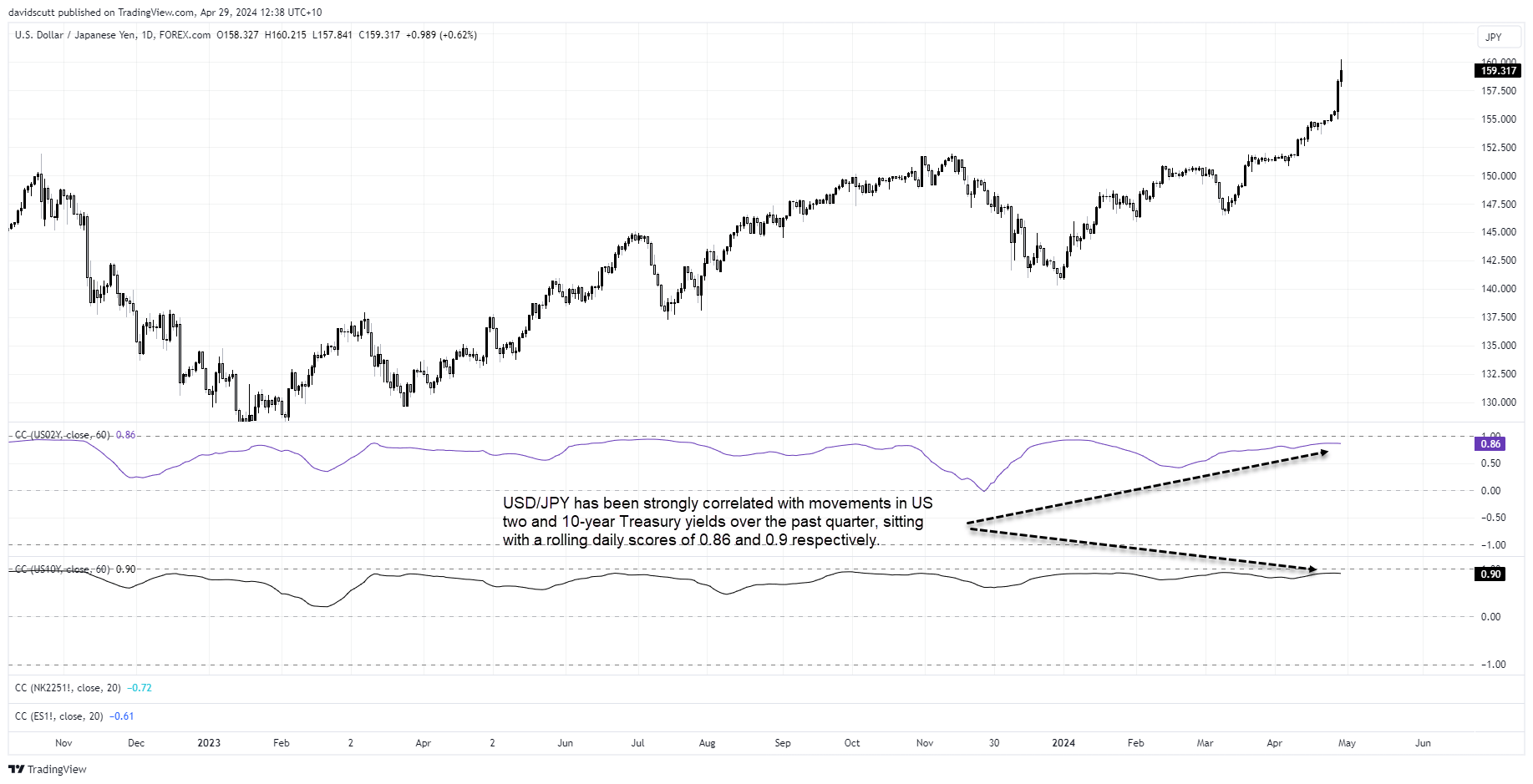

While USD/JPY upside is not unusual right now, what makes this move different is that it was not underpinned by any significant shift in fundamentals. US Treasuries are not trading due to the public holiday in Tokyo meaning the key driver of USD/JPY recently – ballooning yield differentials between the US and Japan – did not contribute to upward thrust. Nor was there any major change in risk appetite in Asia, broadly a continuing what was seen in Europe and North America on Friday.

And a deliberate attempt to bring an official policy response

No, the move looks entirely speculative. And, if I’m being honest, a deliberate attempt from a party or parties to bring the MOF from the sidelines. Suzuki, Kanda and other senior Japanese government officials have been warning for months about taking action to quash speculative movements. If they don’t instruct the BOJ to intervene following today’s abrupt bounce, when will they ever?

Traders should be on heightened alert for this risk.

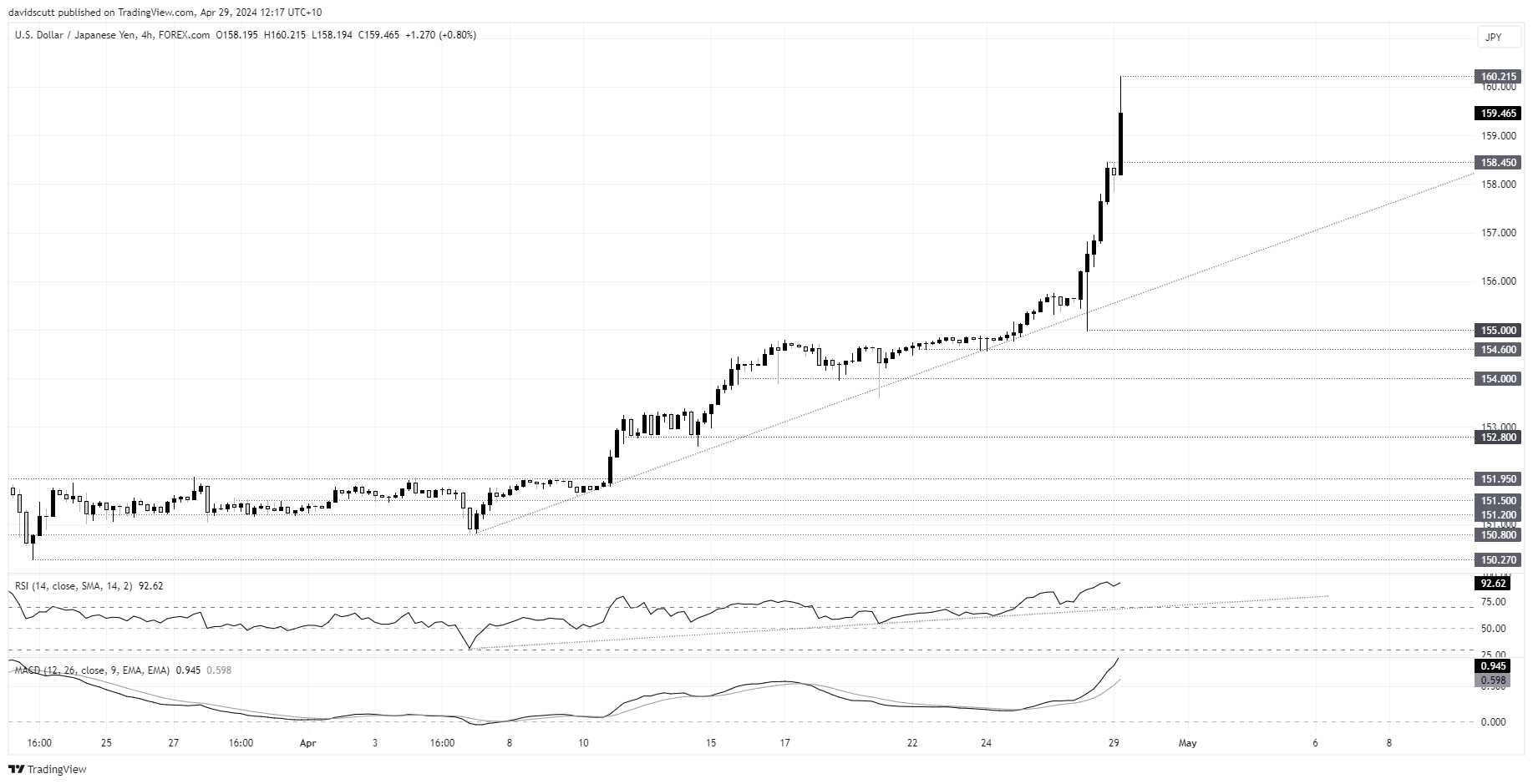

Key near-term USD/JPY levels

After 160, the next topside level for USD/JPY is 165. On the downside, USD/JPY has been supported on dips below uptrend support dating back to early April, including a suspected “market check” from the MOF last Friday. The low of 155 hit then is the first level for traders to watch with 152 the next major level after that.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade