Sterling’s short-lived surge to a three-month high against the euro underscores both the ‘non-lethal’ nature of the ECB’s new bazooka as well as myriad Brexit pressures that remain for the pound. The rate’s immediate reaction was an 86-odd pip tip to tail slump to an almost three-month low (or high for the pound). But the euro subsequently moved to retake almost all of that a few hours afterwards.

The shared currency isn’t the only market that reacted like this. For instance, European bank shares went on a round trip that saw them shoot ahead of the overall market the instant the ECB said it was cutting rates and resuming QE, only to slump to the day’s lows soon afterwards. STOXX’s bank’s gauge eventually ended a tenth of a percentage point higher.

In many ways, the market anticipated this ambivalence quite accurately. For one thing, bank stocks have risen over the last few days, reflecting dwindling hopes of a ‘shock and awe’ policy announcement. Whilst overnight rate markets continued to price some sort of easing, the extent was doubtful. In the end, the 10-basis point deposit rate cut announced was close to the minimum the market was expecting. Investors also appear to have come to the same conclusion as ECB President Mario Draghi, who described the central bank’s package of measure as “adequate” this afternoon, possibly a signal that the Governing Council is coming around to the view that ‘unconventional measures’ are reaching the limits of their effectiveness. The bank’s new €20bn per month asset purchase programme has some mild tweaks relative to the previous round. That leaves the ‘tiered’ aspect of the new negative rates—which can exempt a large tranche of European bank deposits from punishment—as the key new condition overall.

Indeed, a rally across so-called core and periphery Eurozone sovereign rates suggests that the announcement of any new QE was a mild surprise to some investors, even if indications point to an expectation of increased QE to come.

All told, perhaps the pound’s modest reaction isn’t so much of a signal of the extent of underlying sterling weakness aa reflection of relatively tame ECB policy changes. On the other hand, sterling’s Brexit alert remains elevated, even during a Parliamentary hiatus. A Belfast Court added its verdict to those seen in recent days siding with the UK government, this time on whether a no-deal Brexit would break the Good Friday peace accord. Downing Street published no-deal plans as demanded by MPs, and they made for soberer reading than Prime Minister Boris Johnson earlier suggested. Either way, an early election which the market disfavours, and opposition politicians appear hesitant over, still looks to be on the cards this year. Sterling’s 4% advance off August lows was always going to be tough to extend on the back of ECB policy alone

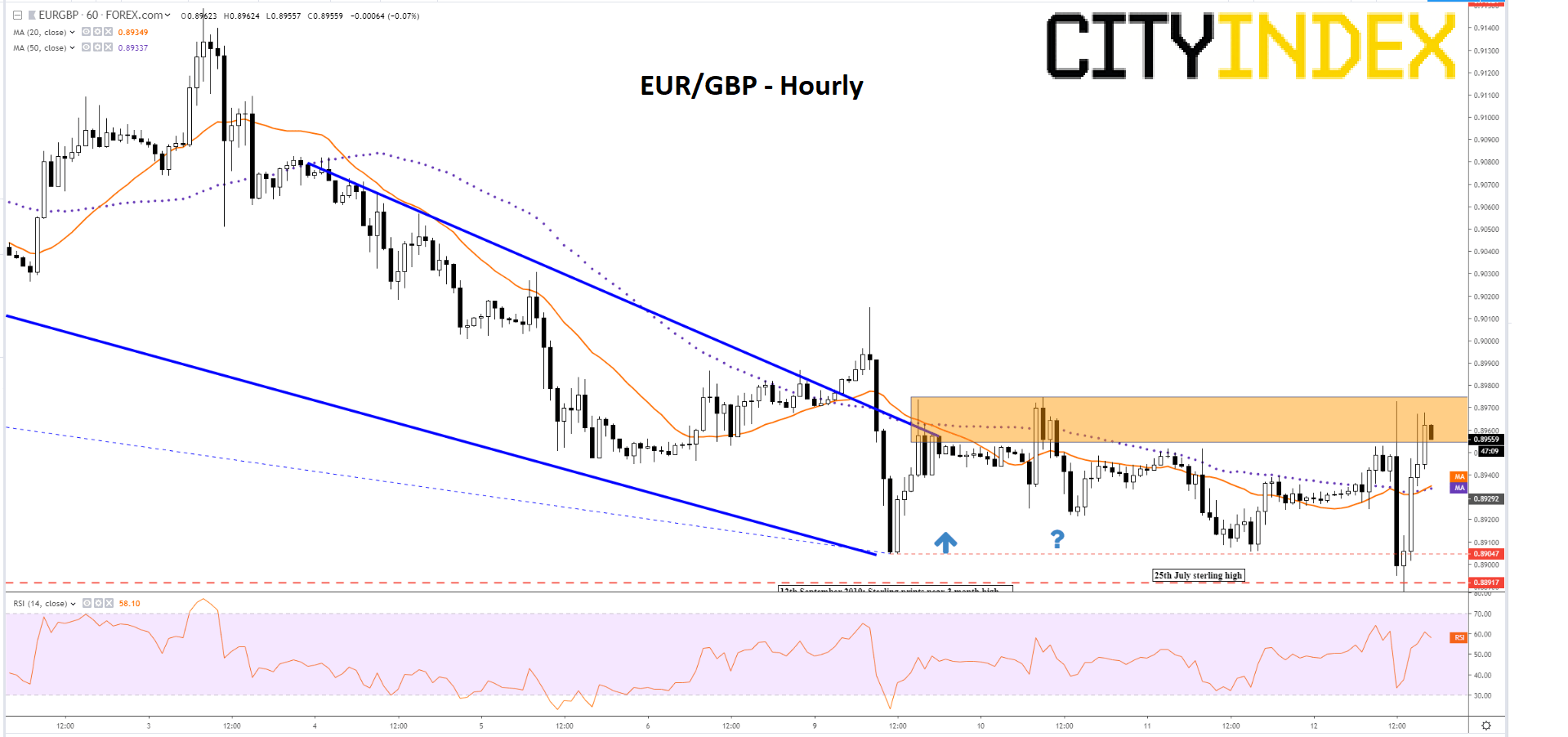

EUR/GBP: Daily

Source: City Index