DAX head higher shrugging off higher oil prices

- German exports jump to 4%

- EZ PPI expected to fall to 13.5% YoY

- DAX needs to break above 15700, the 2023 high to extend bullish trend

The DAX is advancing, reversing losses from yesterday as investors shrug off higher oil prices and cheered higher German exports.

German exports rose by 4% MoM in February, well ahead of the 1.6%MoM rise expected. Imports rose 4.6%, well ahead of the 1% rise penciled in. As a result, the foreign trade surplus was €16 billion up from €10.7 billion in the same month last year.

Investors remain wary over the prospect of further rate hikes in Europe and slowing growth after manufacturing PMI data fell to a four-month low in March.

Attention will now turn to Eurozone PPI data which is expected to cool to 13.5% YoY in February, down from 15%. Eurozone inflation expectations are also due.

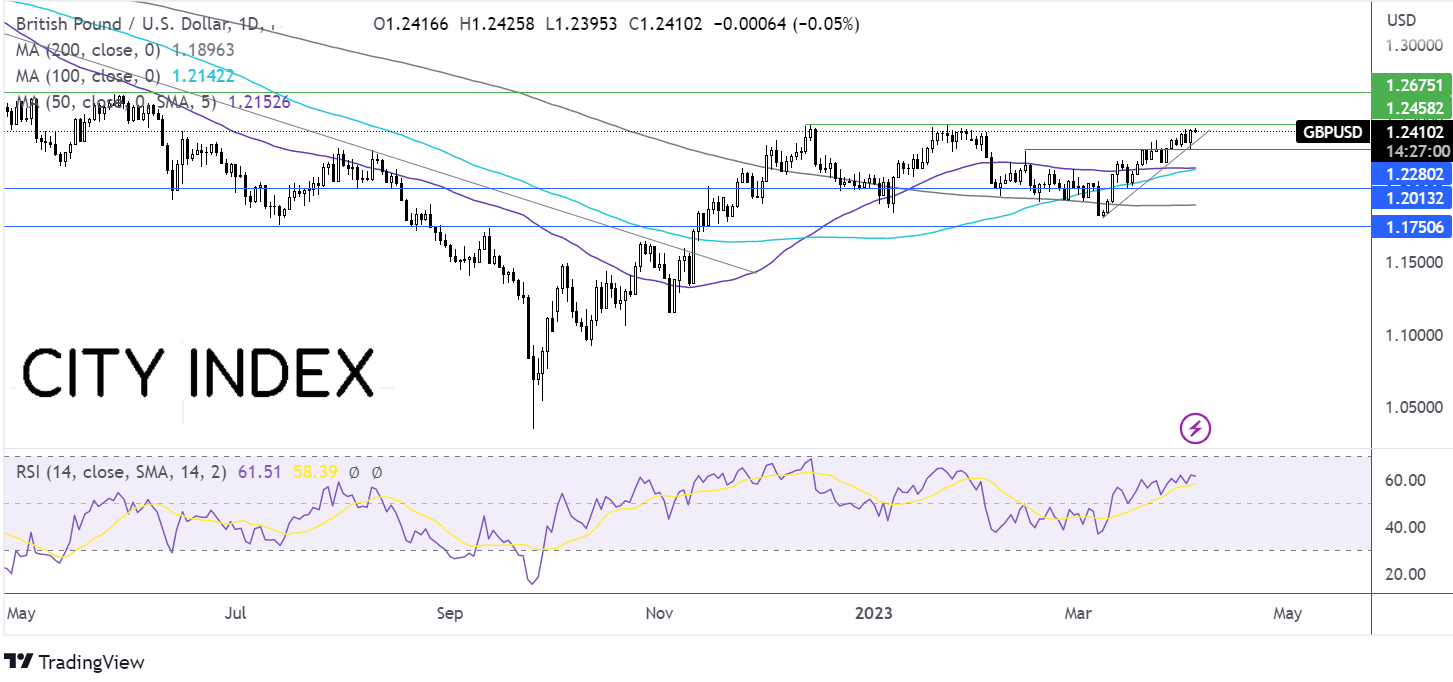

Where next for the DAX?

The DAX has surged 8% over the past 3 weeks, rebounding from a low 14450, the 100 sma, rising back into the multi-month rising channel and above the 50 sma. The RSI above 50 and the hammer candle keep buyers hopeful of further gains.

Buyers are looking for a rise above 15660, yesterday’s high, to attach 15700 the 2023 high. Beyond here 16000 round number and 16285 the January 2022 high come into focus.

Should sellers successfully defend 15700, the price could test support at 15300 the 50 sma, ahead of 15100 the rising trendline support. A fall below 14700 could see sellers gain momentum.

GBP/USD rises above 1.24 ahead of BoE, Fed speeches

- GBP/USD rises as US treasury yields fall

- BoE, Fed speakers & US data in focus

- GBP/USD looks to resistance at 1.2450

GBP/USD rises above 1.24 after jumping over 1% yesterday after treasury yields fell and weaker US ISM manufacturing data fuelled doubts over whether the Federal Reserve would raise interest rates again in May.

Meanwhile, with inflation still in double digits, the BoE may need to hike again. The central bank has said that it expects inflation to fall steeply from Q2. However, there has been little sign of this so far and with oil prices rising, it could take longer for inflation to ease.

Today attention is on US factory orders, JOLTS job opening and speeches from BoE and Fed officials, which could shed more light on the central bank’s next move.

US factory orders are expected to fall -0.5% MoM after falling -1.6% in January. JOLTS job openings are forecast to ease slightly to 10.4 million in February, down from 10.8 million. However, this is still elevated, highlighting the ongoing strength in the labour market.

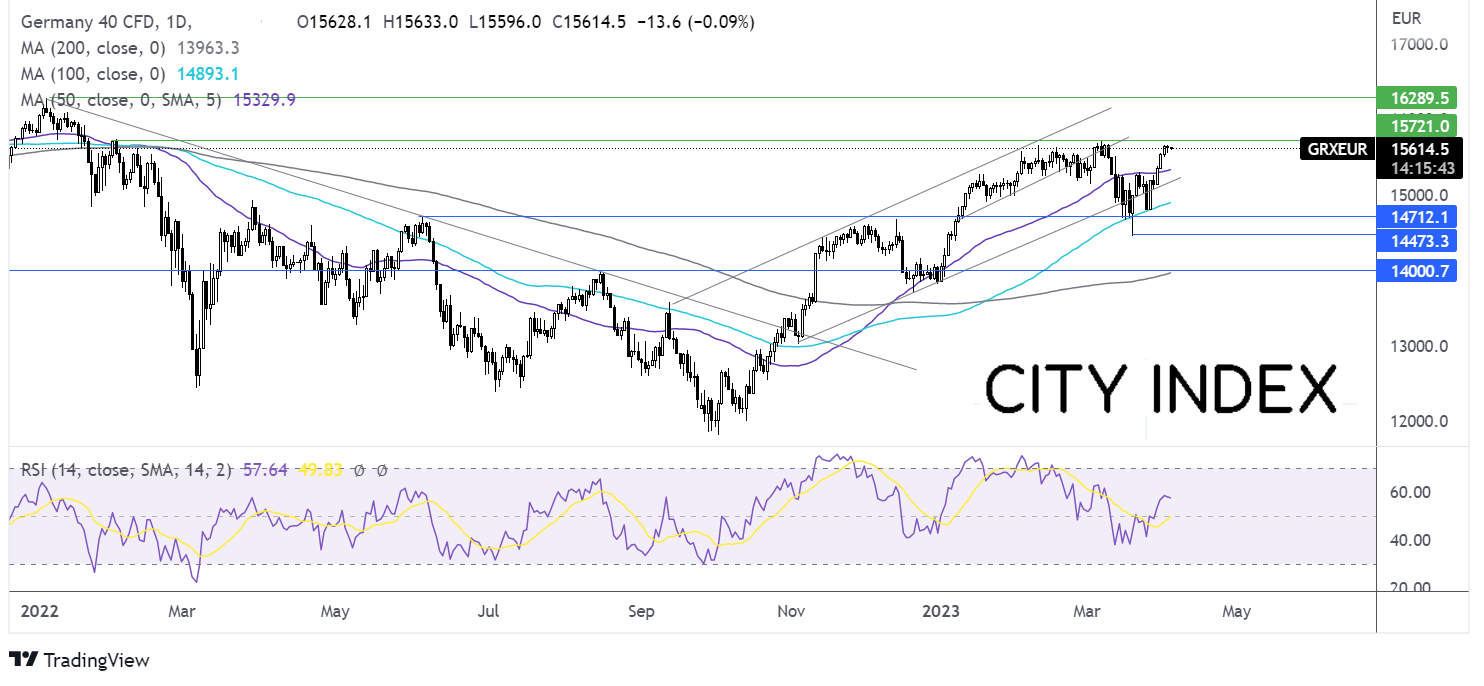

Where next for GBP/USD?

GBP/USD has extended its run up from the 1.18 low hit on March 8, rising above the 200, 100 & 50 sma, which along with the bullish RSI keeps buyers hopeful of further upside.

Buyers will look for a rose over 1.2450, the 2023 high, to extend the uptrend towards 1.25, round number and 1.2655 the May ’22 high.

On the flip side, sellers could look for a break below support at 1.2270 the weekly low to expose the 50 & 100 sma at 1.2155.