COVID-19 has been a headwind for CSL's supply chains and the collection of plasma, an essential raw material used to produce many of CSL's therapies, which account for almost half of CSL's sales. Based on Q3 reports from Japanese competitor Takeda last week, which showed a sizeable reduction in plasma collections, the Covid-19 headwinds are yet to ease.

As part of its plan to diversify earnings and promote long-term growth, CSL is buying Swiss Bio-Tech giant Vifor Pharma for $11.7 billion. Vifor Pharma specialises in iron deficiency and kidney disease. Once the buyout is complete, Vifor's research and development team and pipeline will complement CSL's own.

To help fund the deal, a $6.3bn capital raise was launched in December at $273. As CSL shares are currently trading below the price, a calculation is applied based on a 2% discount to the stock's average price for the five days leading up to the close of the offer. At this point, the price of the raise will be around $255.00 when it closes next week.

Also weighing on the share price a global selloff in growth stocks that commenced in late November. This has resulted in the price/earnings ratio of CSL falling from 44X FY 22s earnings to 37X, offering a more attractive valuation.

At its Annual General Meeting in October, CSL said at a group level they expect revenue growth to be in the range of 2 to 5% over FY21 at constant currency (USD), and net profit after tax (NPAT) was expected to be approximately US$2.15 to $2.25 billion at constant currency.

The market consensus is for CSL to report earnings (NPAT) of A$1.46 billion for 1H2022, with an interim dividend payout of US$1.13 per share.

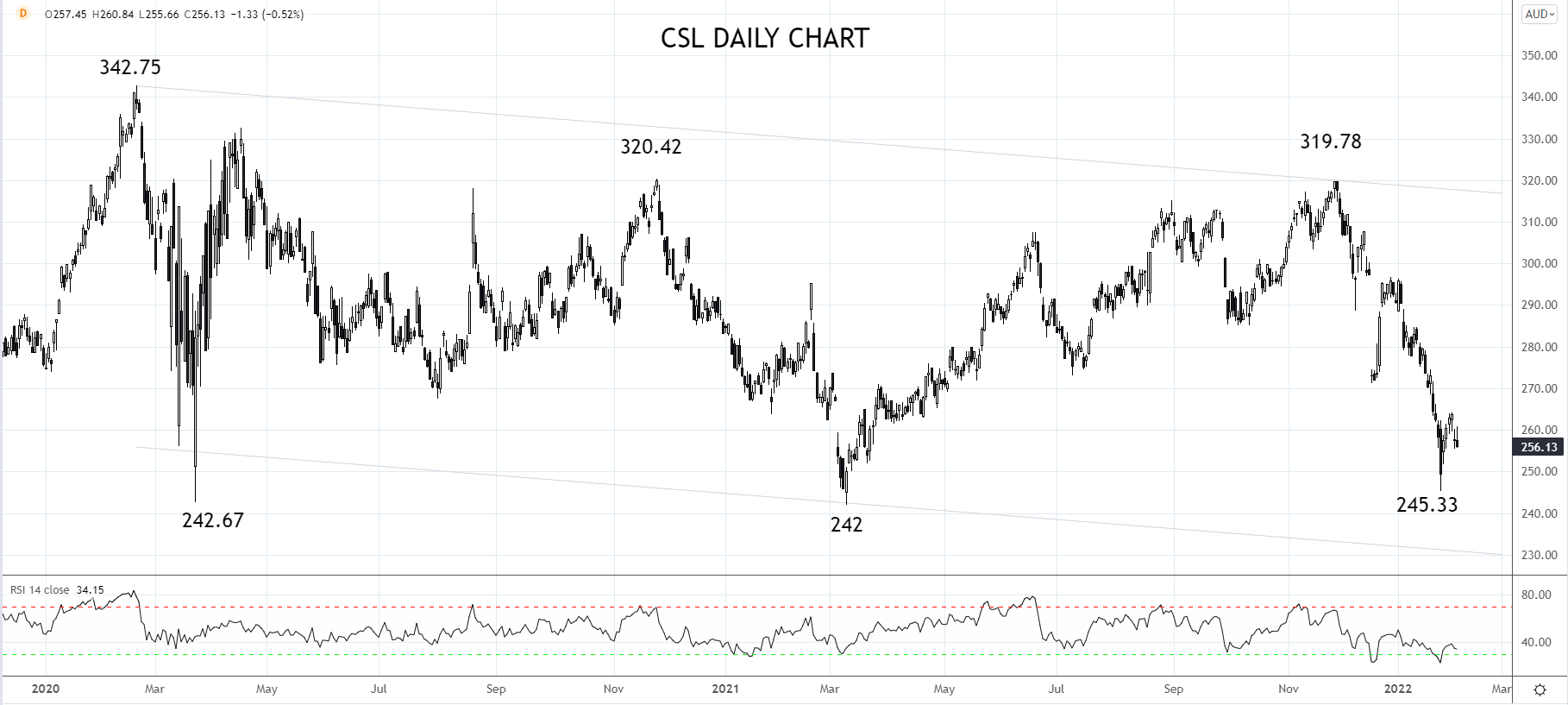

CSL Daily Chart

Technically, the decline from the $342.75 high of February 2020 appears to be a countertrend after a stunning multi-year rally. Once the correction is complete, the uptrend is expected to resume.

As such, consider buying CSL shares on a dip into support near $240/230, coming from trend channel support, looking for a retest of resistance at $320.00

Source Tradingview. The figures stated areas of the 4th of February 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade