WTI crude oil was up over 4% during the Asian session on reports that Israel’s middles had struck a site in Iran. Whilst the report remain unverified, it further fans fears of a broader-scaled war in the middle East. And one that could draw the US into the action.

An Iranian news agency claims explosions were head near an airport, prompting several commercial flights to divert their course over Iranian airspace. Even if the unverified reports turn out to be untrue, these headlines are likely to keep investors on edge as we approach the weekend, which leaves risks of weekend gaps.

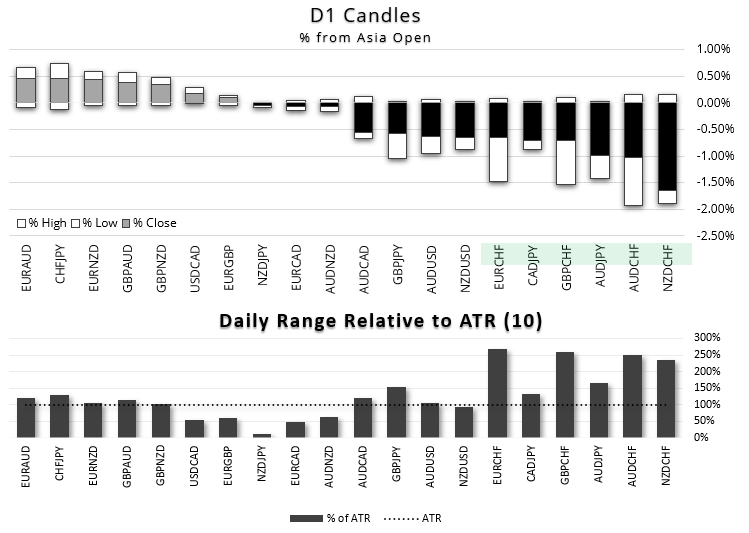

- Spot gold prices spiked above $2400 and are threatening a fresh record high

- Money quickly flowed into the Swiss franc as investors sought safety

- AUD/USD broke beneath 64c for the first time since December during risk-off trade and is the weakest FX major of the session

- S&P E-mini 500 futures broke beneath 5000 for the first time since mid February

- The ASX 200 also touched a 3-week low bout found support above 7,5000

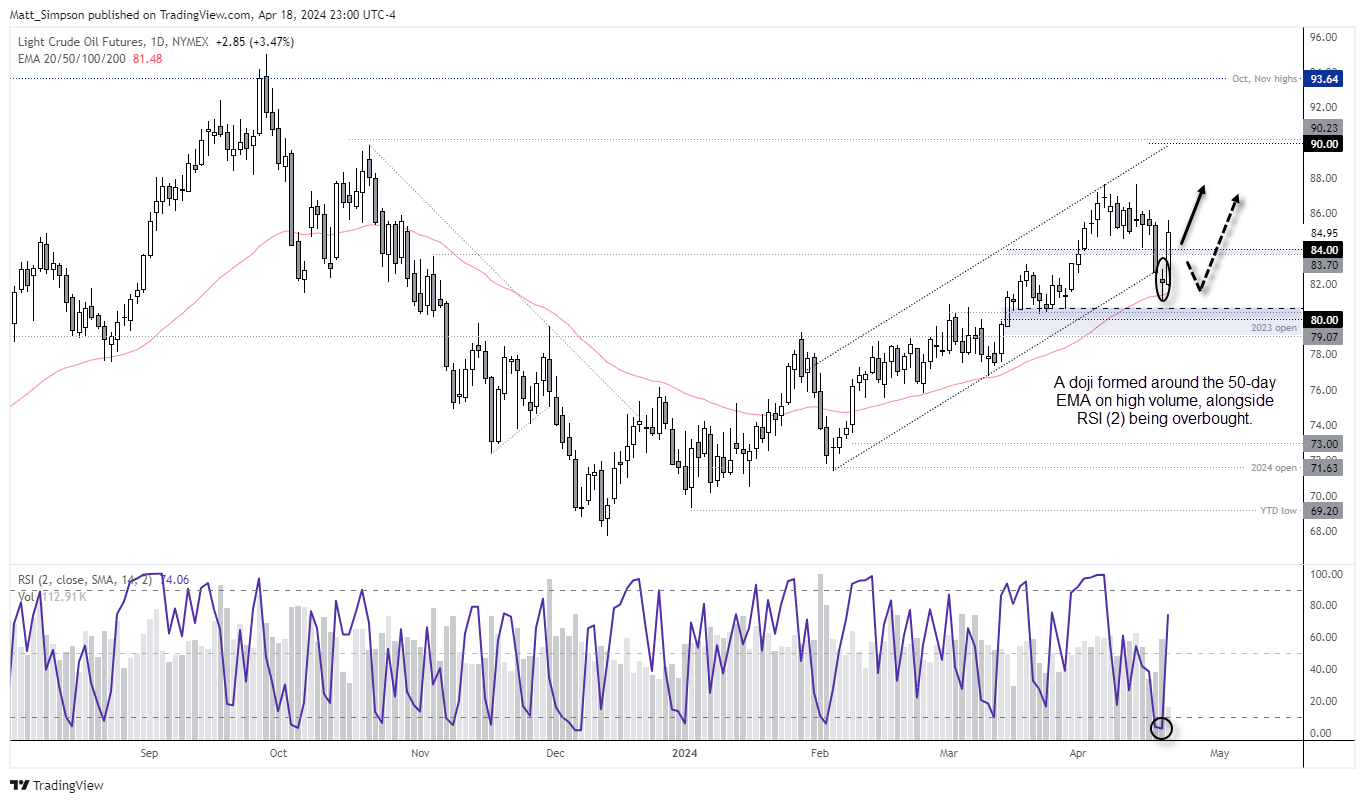

WTI crude oil technical analysis:

Crude oil prices were trading at a 3-week low ahead of the report, although bearish momentum was already waning with a small-ranged doji forming on Wednesday which closed just above $82. Currently up over 4% for the day, it is the most bullish day for crude oil prices this year, and the move above $84 appears may provide support should prices pull back.

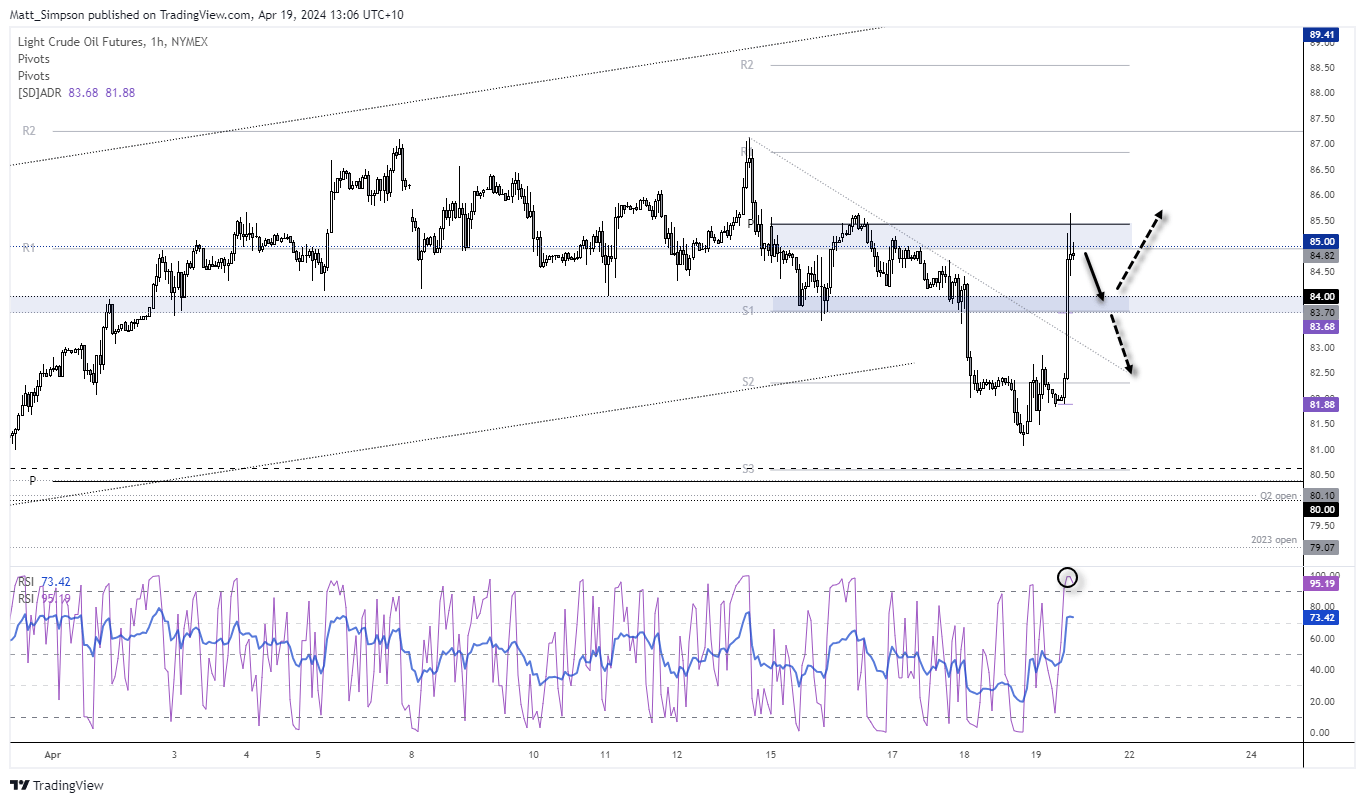

The 1-hour chart shows that momentum has stalled around the $85 handle, monthly R1 and weekly pivot point. And as RSI (2) is overbought on this timeframe, perhaps a pullback towards $84 is on the cards. Headline risks are likely to remain a key driver for oil which could leave it susceptible to sharp moves in either direction.

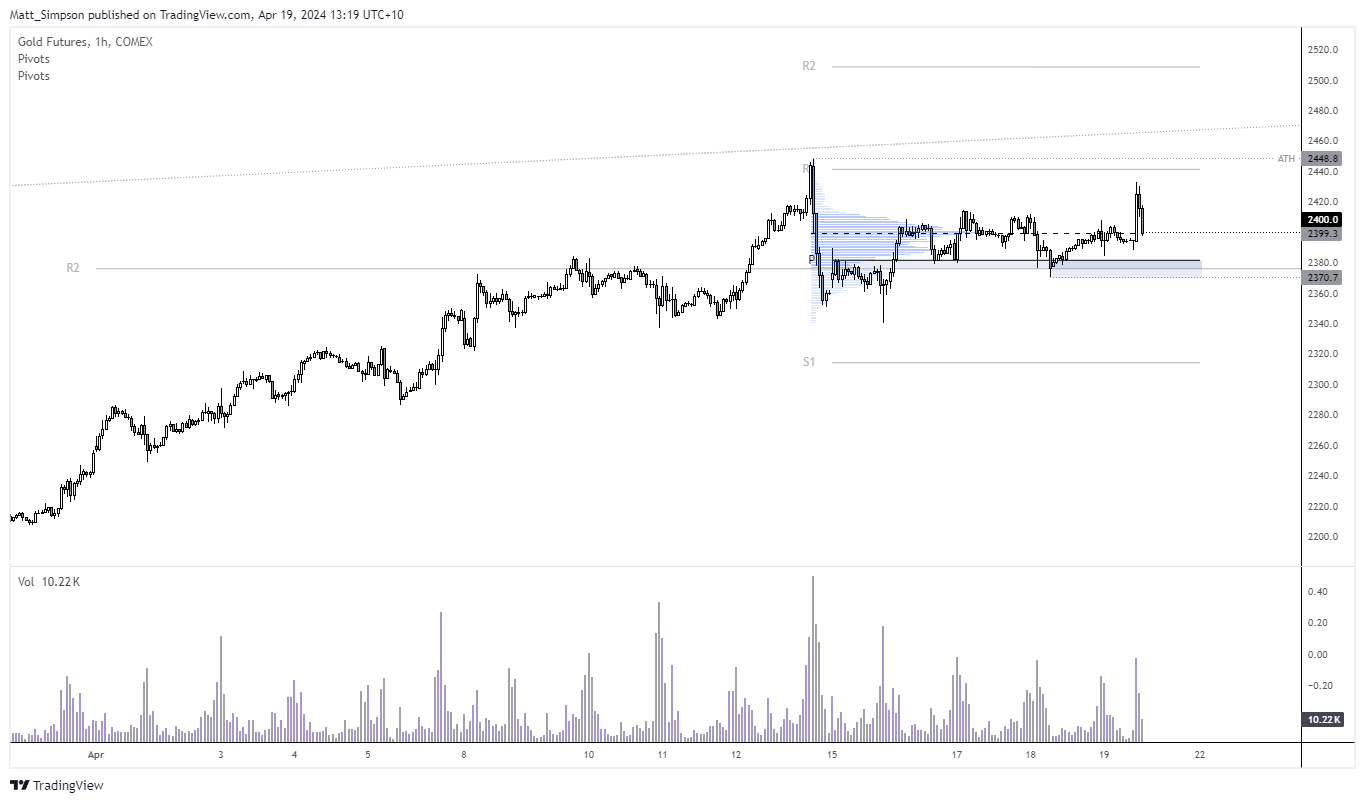

Gold futures technical analysis:

Gold futures spiked above $2420 but prices are now retracing, and trying to hold above $2400. This key level also coincides with the most traded price by volume since its record high, so there is a reasonable chance to expect some support around these levels. Should sentiment improve, a break beneath $2370 also invalids the monthly S2 pivot and weekly pivot point and assumes a deeper pullback.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade