Can the US dollar break out of its range? The Week Ahead

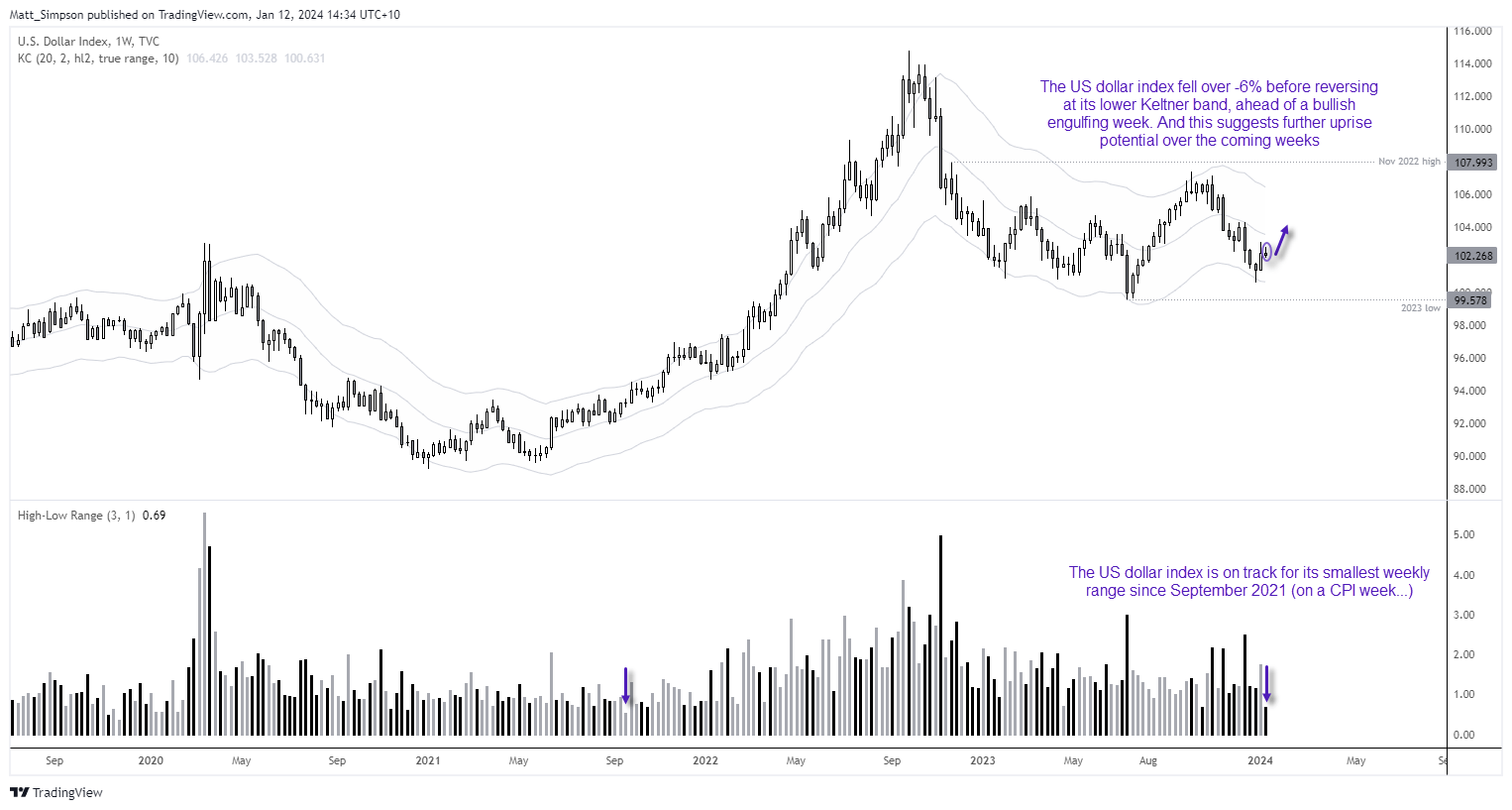

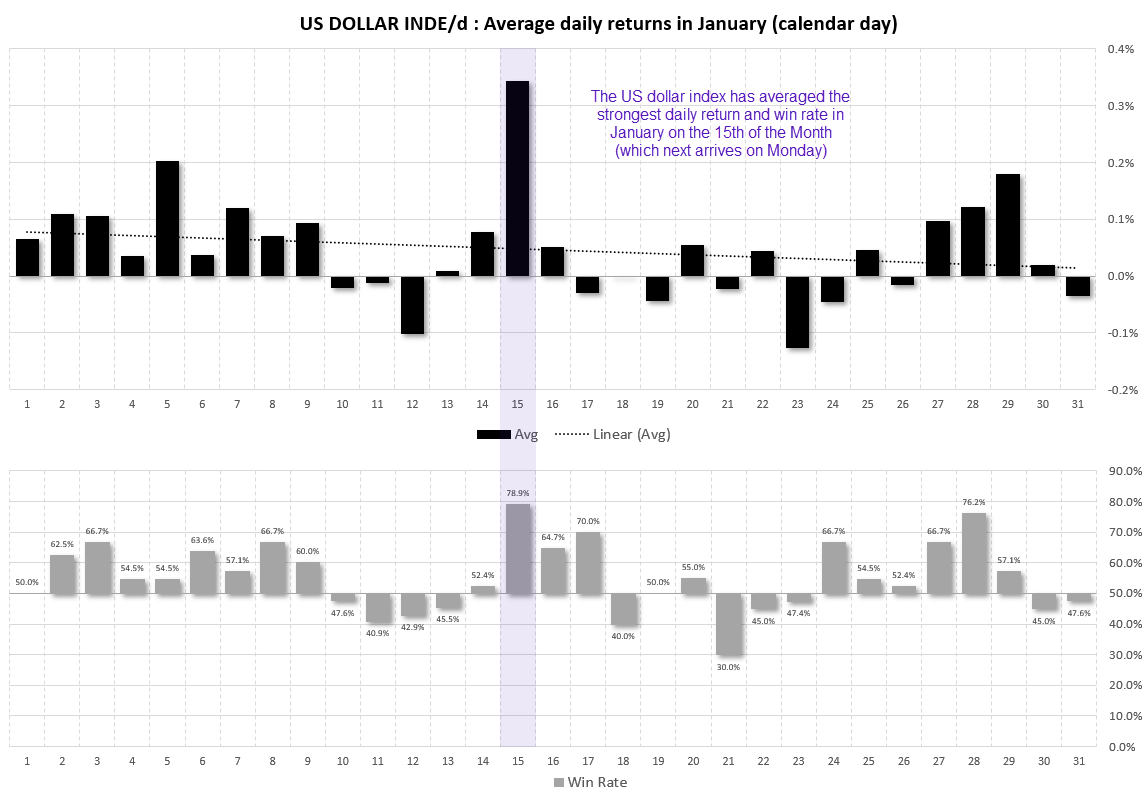

At the time of writing, the US dollar has printed its smallest weekly range since September 2021 at just 69 points. And that is quite remarkable when you consider it has landed on a US inflation report week. Yet daily seasonal data has reveal January 15th to have delivered the strongest average returns and win rate for the month. And that date so happens to be this coming Monday.

US dollar index technical analysis:

The weekly chart shows how small this week’s range has been so far, and there is little to indicate it will be bursting with energy next week given the economic calendar for the US specifically. However, I continue to suspect the US dollar has some upside potential given it fell over -6% from its cycle highs, reversed at its lower Keltner band before it formed a bullish engulfing week. Trading volumes are yet to be fully restored, so traders may be best to keep their bets on an ‘intraday basis’ and not seek home runs without a large macro driver.

However, it is worth noting that the 15th of January has delivered the strongest average returns and win rate of the month, which so happens to land on Monday. I do not know as to the reasons why, but perhaps it is because it is in the lead up to the annual World Economic Forum at Davos. Either way, a 78.9% win rate is not to be ignored, even if gains are not guaranteed.

The week that was:

- US inflation data was hotter than expected, yet Fed fund futures continued to imply a 72% chance of a March cut and five cuts this year – meaning the disparity between market pricing, economic data and the Fed’s narrative continues

- However, rising risks of a regional war in the Middle East seems to be the culprit behind the dovish market pricing, over the inflation report

- BOJ hawks were again left disappointed with the latest set of data from Japan, with household spending deflating, Tokyo CPI slowing and wages also lower. There had been some excitement for BOJ in Q1 but that seems less likely now

- Demand for European bonds hit record highs this week as investors rushed to lock in higher yields, in anticipation for yields to keep falling

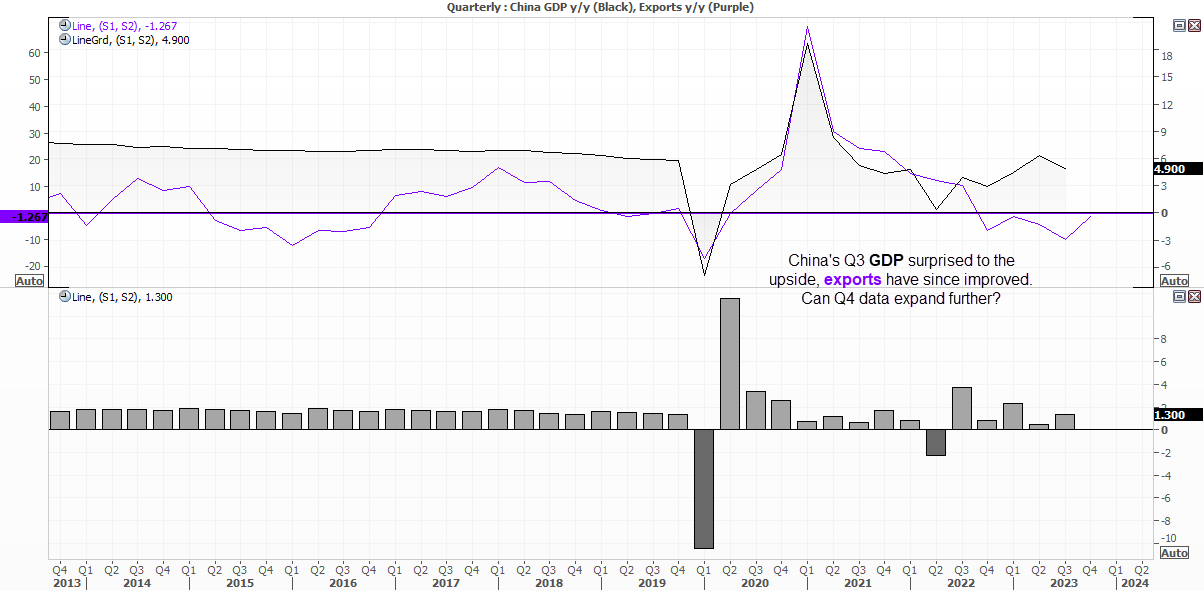

- Mixed data from China inflation contract -0.3% y/y but rise 0.1% m/m, and producer prices slow to -2.7% y/y. Yet exports rose 2.3% y/y to show global demand on the rise, and Iron ore exports rose to a record high (which is potentially good news for AUD/USD)

- Softer Australian inflation cements another RBA hold and the cash rate futures curve implies the current rate of 4.5% to be the peak

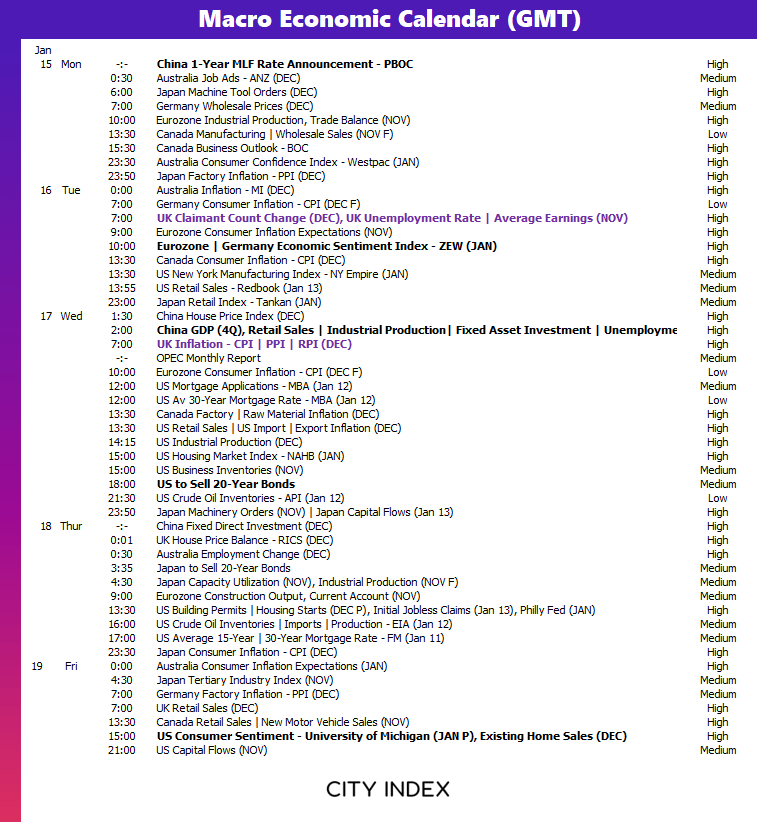

The week ahead (calendar):

The week ahead (key events and themes):

- US earnings

- Bond auctions

- UK employment, wages and inflation

- World Economic Forum at Davos

- China data dump

- Inflation Canada, Japan, Eurozone

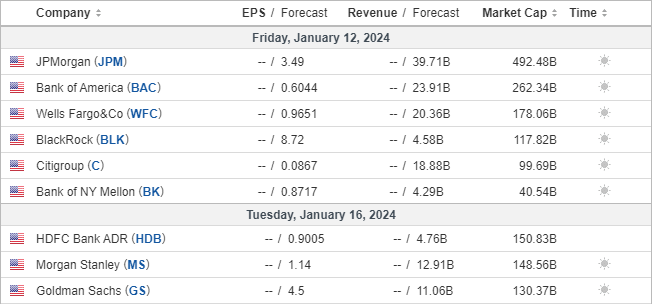

US earnings

JP Morgan Chance (JPM) and Citigroup (C) release earnings later today, and that could set the tone for expectations for Tuesday’s reports from Golman Sachs (GS) and Morgan Stanley (MS). However, the banking giants are tipped to report lower profits in Q4 due to souring loans, which itself provides a gauge on sentiment for US and global growth.

Trader’s watchlist: S&P 500, Nasdaq 100, JP Morgan Chance (JPM), Citigroup (C), Golman Sachs (GS), Morgan Stanley (MS)

Bond auctions

The majority of traders tend not to follow bond auctions, but they can provide another look at sentiment and expectations of monetary policy from a subset of traders who are usually assumed to ‘be right’. If inflation really has topped, we should continue to see a pickup in bond demand to weigh further on yields.

This week we saw a record level of investors pile into European bonds (particularly at the long end) and investors sat on cash happily jump into the UK gilt market.

For now, falling yields are helping to prop up Wall Street and could further boost sentiment next week if bond demand remains strong. However, that could change if a regional war escalating across the Middle East – although it could further boost demand for bonds in a risk-off environment.

Trader’s watchlist: S&P 500, Nasdaq 100, Dow Jones, US dollar, gold, VIX

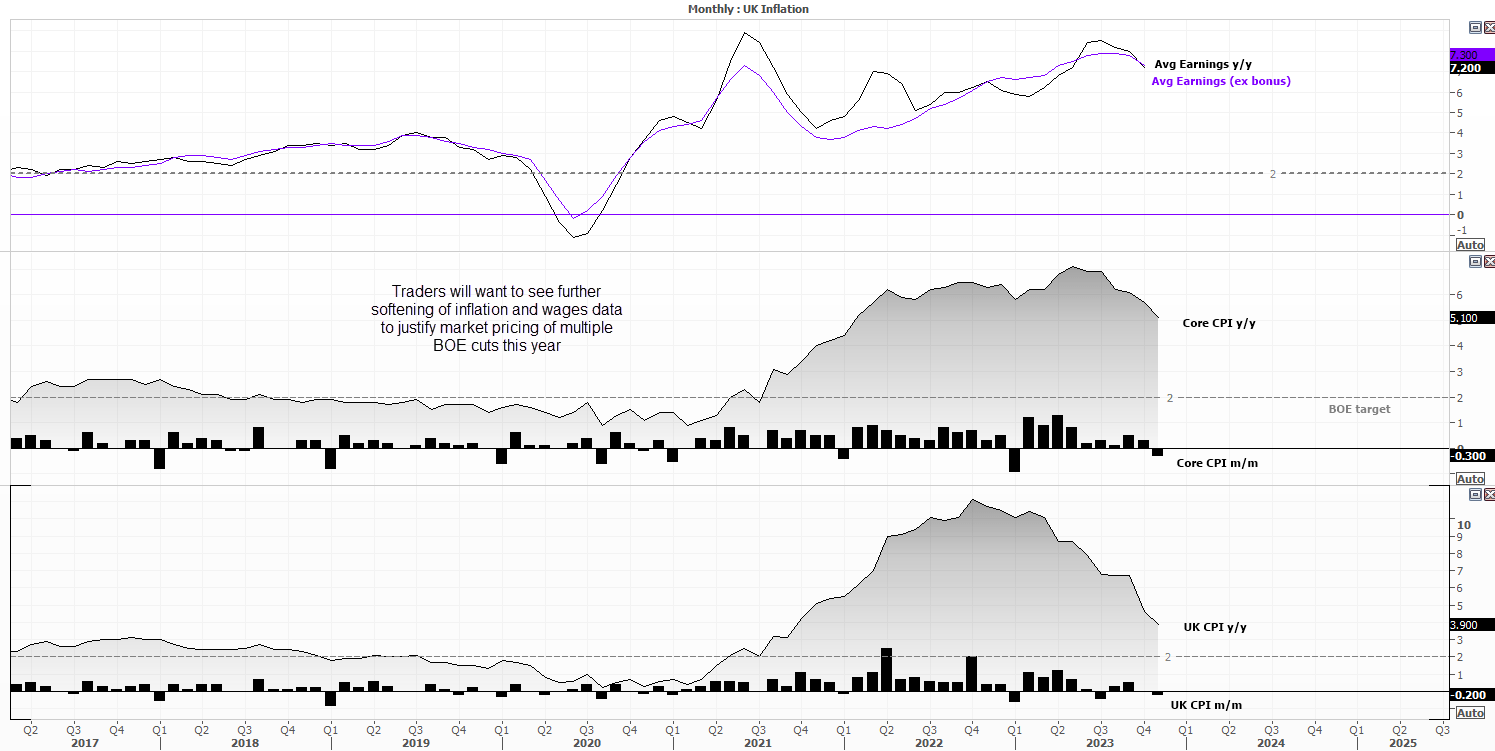

UK employment, wages and inflation

At the time of writing, we’re awaiting the monthly UK GDP report that could indicate whether the may have entered a technical recession in Q4 (although we’d need to wait for the official quarterly report for confirmation). But a weak set of figures today could help justify market pricing of several BOE cuts this year, which sets the stage for key data next week.

Employment and wages data are released on Tuesday ahead of Wednesday’s inflation report. In all likelihood, I suspect we’ll see a further softening wages and rise of unemployment claims. And if that were to be coupled with a soft inflation report, it could be ‘quids in’ for multiple BOE hikes, a lower GBP and higher FTSE.

But that doesn’t mean traders shouldn’t prepare for stronger data, as that could prompt the more volatile reaction. And as US inflation came in hitter than expected, it’s not impossible to expect something similar from the UK.

Trader’s watchlist: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

World Economic Forum at Davos

The annual WEF meeting at Davos takes place between January 15th – 19th. I doubt it will be a market-driving event, but it should still be on trader’s radars given the amount of world leaders and policy makers that will congregate at the event. ECB President speaks twice, with her initial speech titled “How to Trust Economic” so unlikely to cover monetary policy.

But occasionally there can be headlines generated by side-meetings among world leaders which can set the stage for future relations or deals.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

China data dump (GDP, retail sales, industrial production)

Weak inflation data from China and mixed trade saw APAC risk turn slightly bid on Friday in hopes of stimulus. And with their quarterly GDP report released alongside retail sales, industrial production and investment, it could further bolster calls for stimulus and support risk to a degree if it comes in weak enough next week. But perhaps the better result globally would be for us to see stronger data as it points towards a stronger-than-expected recover for global growth. Q3 data came in better than expected, so you never know – maybe Q4 data can as well.

Trader’s watchlist: USD/CNH, USD/JPY, S&P 500, Nasdaq 100, Dow Jones, VIX, AUD/JPY

As for the rest…

- US consumer sentiment: The University of Michigan release their preliminary consumer sentiment report which includes inflation expectations.

- German/ Eurozone ZEW: Economic sentiment was on the rise in December on hopes of ECB easing. More importantly, expectations was at its most optimistic level in 10 months. However, if economic data improves too much it could inadvertently reduce expectations of ECB easing.

- BOC business outlook: The Bank of Canada remain very much in pause mode, and have retained a hawkish undertone even though they seem on track to tame inflation. If we’re to build a case for earlier cuts, it would likely show up in the quarterly outlook report.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade