BoE rate announcement: What to expect?

When is the BoE rare announcement?

The BoE is due to give its interest rate decision on Thursday at 12:00 noon BST. This is super Thursday, so we also expect to see new forecasts for growth and inflation.

Economic outlook

Heading towards the BoE meeting, the picture is pretty bleak. UK inflation sits just shy of 10%, UK retail sales have crumbled as the cost-of-living crisis deepens and PMIs show that the UK economy is teetering on the brink of recession. Meanwhile, unemployment fell to its lowest level in 48 years, and wages are being pushed up.

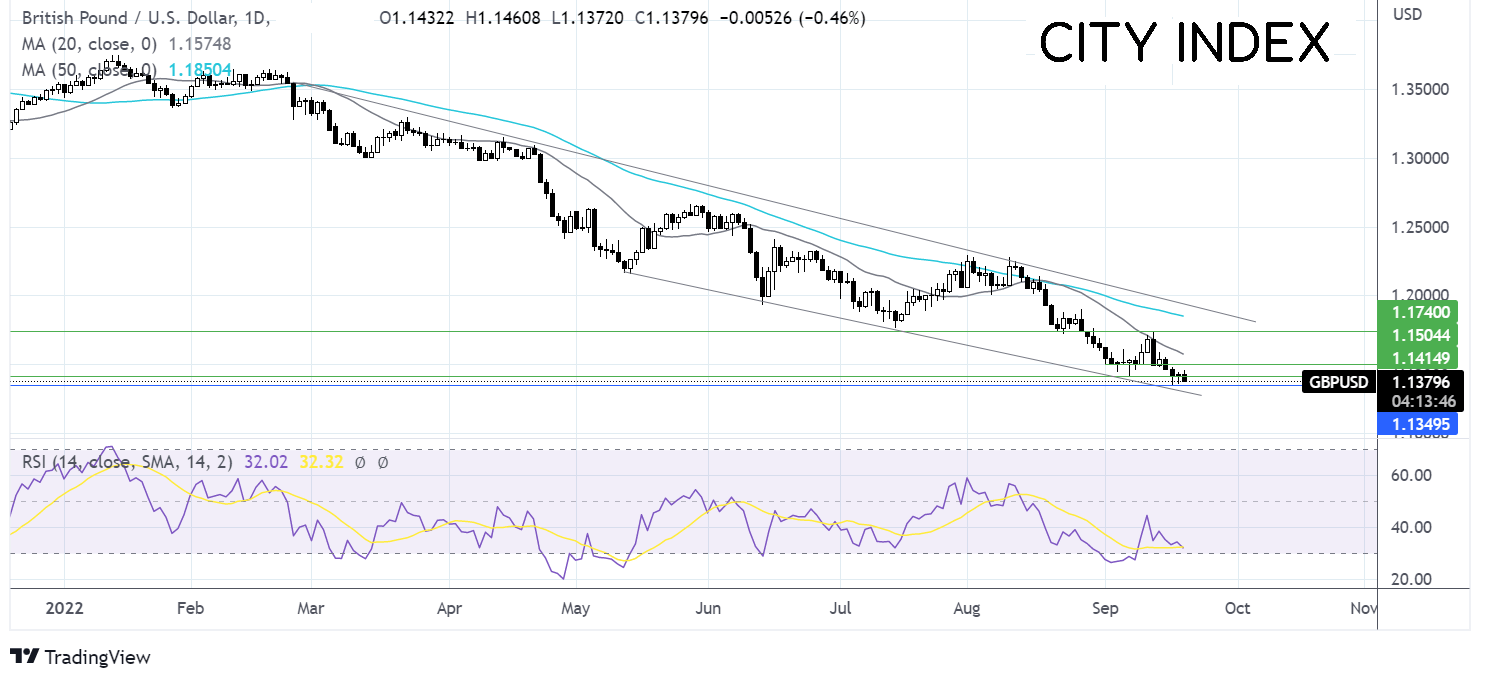

Meanwhile, the pound trades at 37-year lows against the USD, with weak sterling adding to the inflationary picture.

50 or 75 basis points?

With inflation now at five times the central bank’s target 2% level and with global central banks upping the pace of hikes, the pressure is on BoE Governor Andrew Bailey to pull something more aggressive out of the hat. The big question here is will it be 50 or 75 basis points?

Since the last meeting, the new Prime Minister Liz Truss announced an energy relief package, expected to cost the government upwards of £150 billion. The move to cap energy prices for households at approximately current levels could help slow inflation, which is a plus. Still, there are rising concerns that the BoE is just too relaxed over the pace at which it is hiking rates to control inflation. As other central banks hike at 75 basis points, the BoE has stuck with 50.

Could this change on Thursday? The market is pricing in a bias towards a 50-basis point hike. But could this be considered a dovish move in light of Liz Truss’ huge support package and falling confidence in the market? A 50 basis point hike could see GBP/USD drop towards 1.13, particularly given the Fed’s expected 75-point hike. Evan, if the BoE raised rates by 75 basis points, it’s unlikely to be enough to help the pou7nd out of its doom loop.

QT bad timing

Then there is also the added complication of the central bank’s aims to start selling off the £895 billion of assets that the BoE built up over the pandemic.

With Tuss’ plans to borrow to fund the energy relief package, doubts are rising as to whether the BoE can go ahead with its QT plans. Is this really a good time to sell gilts back into the market? The answer appears to be no. Demand for UK assets is weak. Yields on the 10-year gilt are at a decade high.

Its’ also worth noting that the MPC changed with known hawk Michael Saunders stepping down and being replaced by Swati Dhingra, whose position on rates is so far unknown.

Where next for GBP/USD?