- Relative to the tone of the RBA’s monthly policy statement, the minutes of the past two meetings have screened as far more hawkish

- AUD/USD rose as much as 0.35% and 0.17% respectively in the hour following the release of the October and November minutes

- From a broader perspective, shifts in US 2-year yields are playing key role in dictating movements in AUD/USD right now

The tone of the Reserve Bank of Australia’s (RBA) minutes has come across as more hawkish than that of the monthly monetary policy statement under the leadership of Michele Bullock as Governor, pointing to the risk of a similar outcome when the minutes of the RBA’s December meeting are released later Tuesday.

RBA rate cuts getting priced for 2024

Up until the Fed’s dovish pivot last week, Australian overnight index swap markets were pricing a small risk the RBA would deliver a further increase in the cash rate early next year, taking it to 4.6%. However, so powerful has the Fed’s shift been on global interest rate expectations, the hawkish pricing has been all but erased with 12-month overnight index swaps currently sitting 15 basis points below the current cash rate of 4.35%.

But the RBA’s assessment may be far different

While the minutes are dated, not incorporating policy decisions from the Fed, ECB and BoE last week along with US PCE inflation and Australia’s jobs report, the risk is the tone will come across as hawkish when markets are now pricing in rate cuts.

For instance, the minutes expressed increasing optimism about labour market conditions, noted the cash rate was lower than in other advanced economies, acknowledged new forecasts were premised on the view there would be at least one more rate increase, or potentially two, and noted rising house prices mat indicate monetary policy may not be all that restrictive. That’s not the tone of a central bank considering cutting rates anytime soon. With recent domestic data providing no strong case to consider easing policy, the tone of the December minutes may screen as something similar.

Minutes to spark near-term upside in AUD/USD?

The divergent tone of the minutes and statement issued a fortnight earlier has seen modest AUD/USD strength in the hour following their release in both October and November, rising as much as 0.35% and 0.17% respectively.

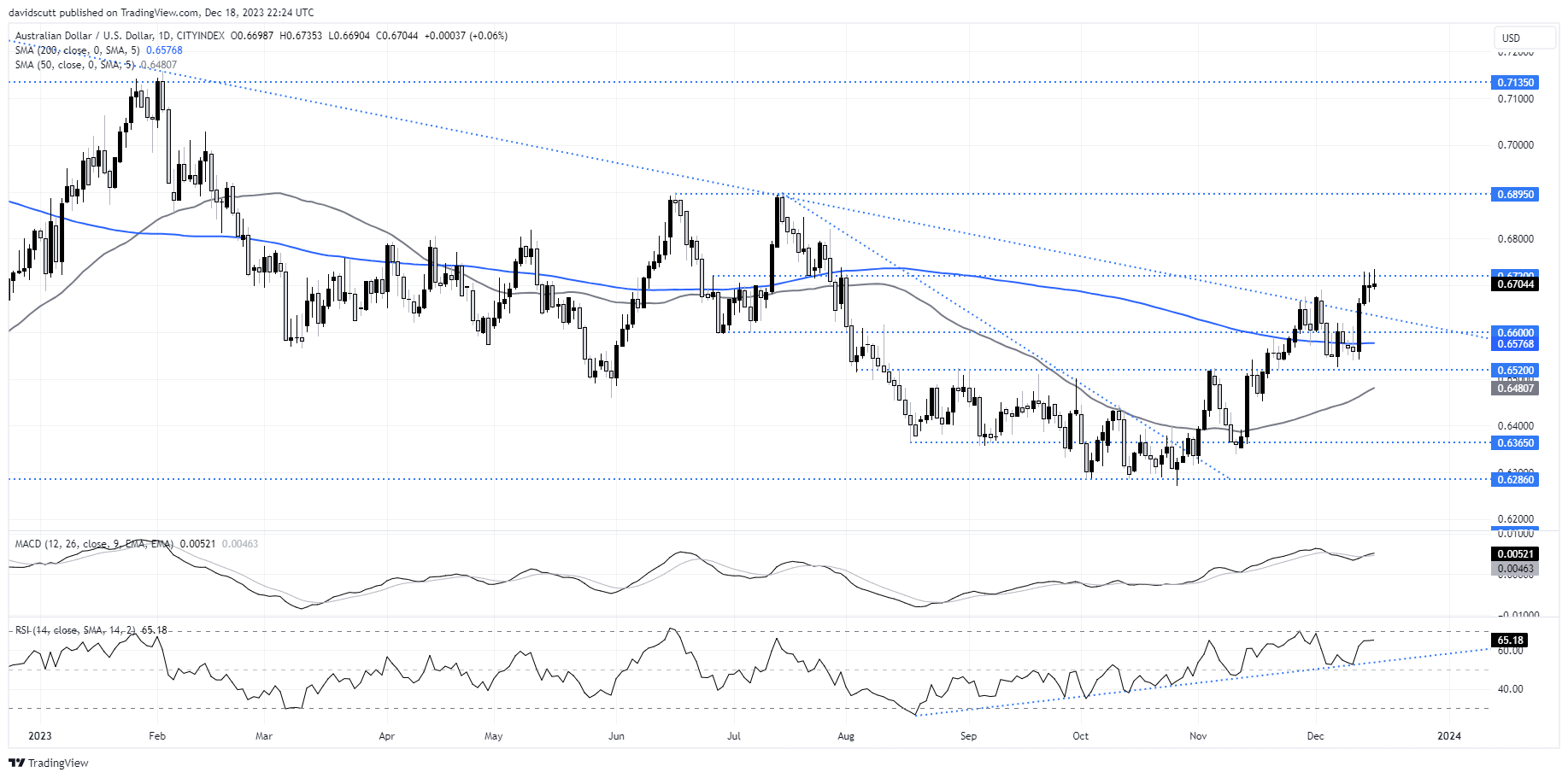

Looking at AUD/USD on the daily, its struggles above .6720 continued Monday, logging a third consecutive failure to close above the level. A reversal in US 2-year yields, sparked by further attempts from Fed officials to walk back market pricing for more than 140 basis points of rate cuts next year, appears to have been the catalyst, helping the USD recover earlier losses.

With three consecutive failures above .6720, including a bearish hammer to start the week, the case for near-term downside appears to be building even though the longer-term picture remains constructive. It may have to go lower to go higher, essentially, helping to attract new buyers looking for fresh highs.

On the downside, former downtrend resistance is located at .6630 with horizontal support located at .6600. With the 200-day moving average found at .6577 and more pronounced horizontal support located at .6520, any deeper pullback would likely require a change in narrative on the pathway for US interest rates next year.

Alternatively, should AUD/USD manage to break and hold above .6520, traders will likely eye off a retest of the double-top set in June and July just below .6900.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade