The Canadian dollar may be nearing a sentiment extreme with net-short exposure hitting a 6-year high among large speculators. The BOC continue to make hawkish noises following their hawkish minutes, so if US yields and the dollar retreat then it’s likely to drag USD/CAD down with them.

Positioning for gold was little changed and, as managed funds and large speculators remain net long, I continue to suspect the current decline from the $2000 highs are corrective.

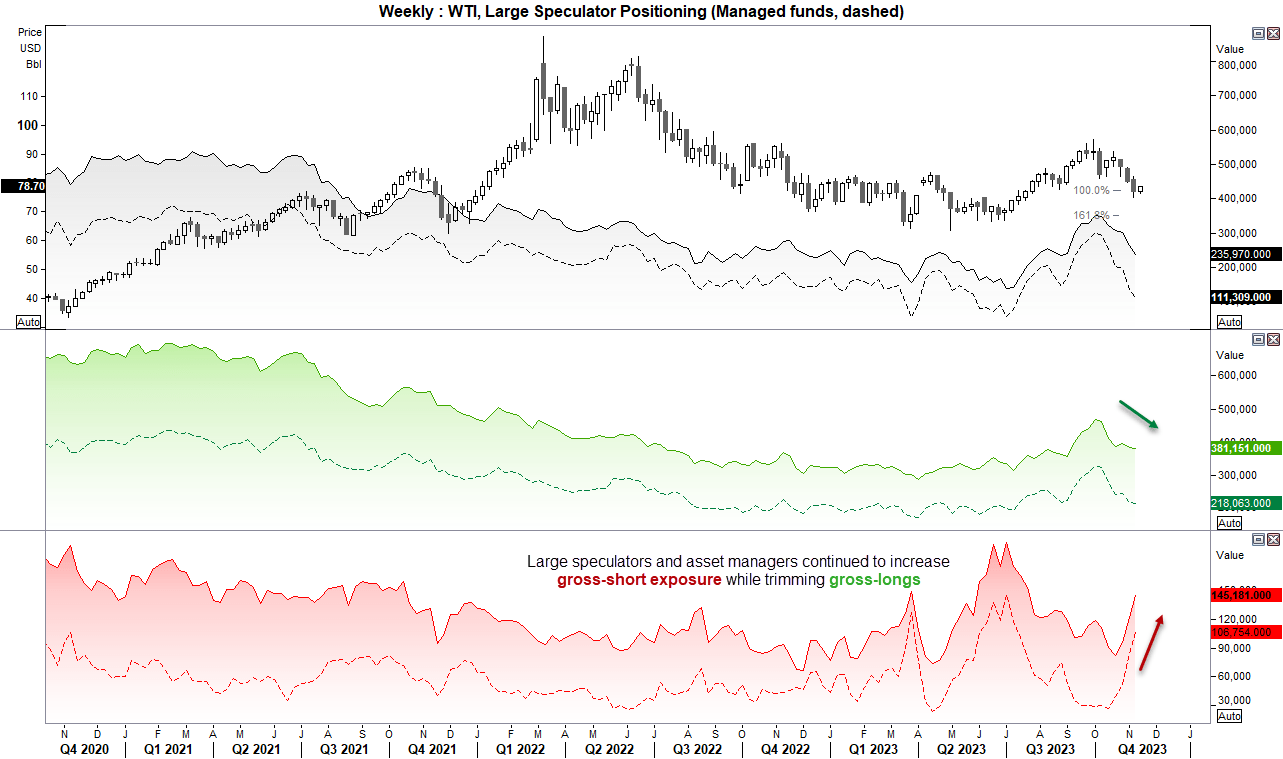

Large speculators and managed funds increased their gross-short exposure for a third week, although as noted below mean reversion is seeing WTI bounce from $75 and brings $80 and $83 resistance levels in to view.

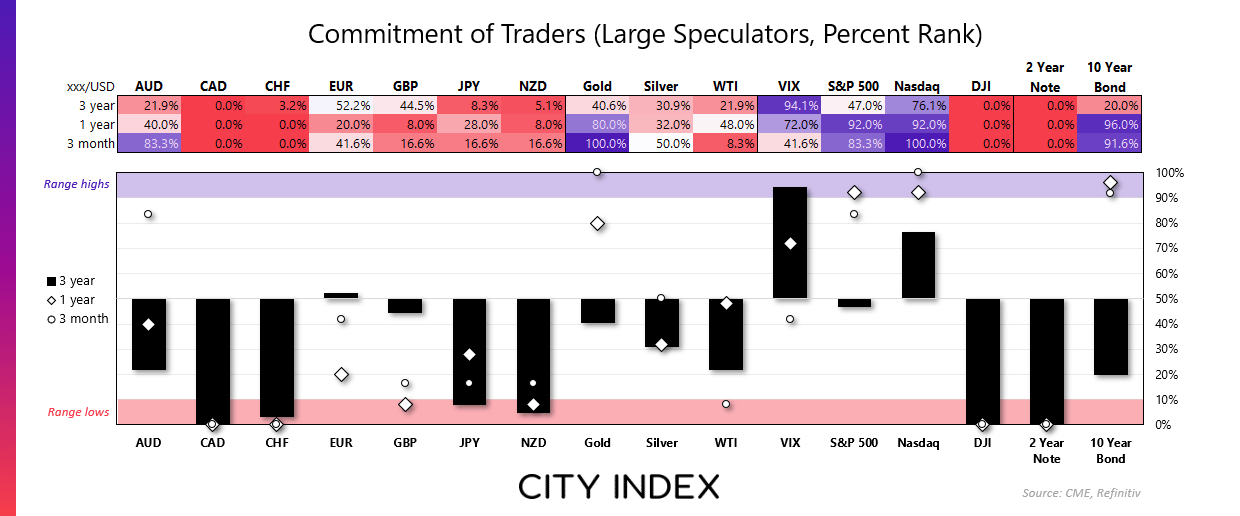

Commitment of traders – as of Tuesday 2023:

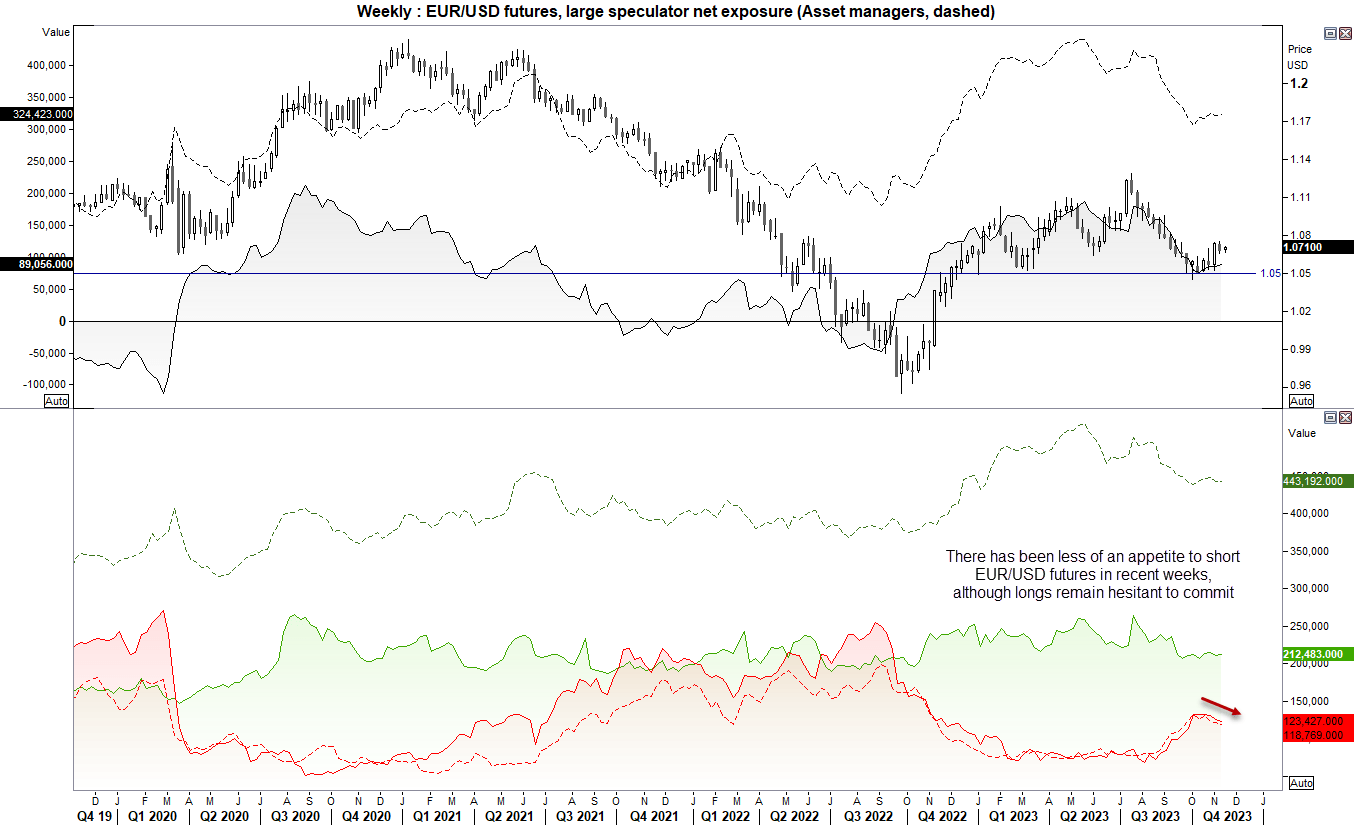

EUR/USD (Euro dollar futures) – Commitment of traders (COT):

There has been less appetite to short EUR/USD futures in recent weeks, although longs remain hesitant to commit. This has allowed EUR/USD to form a base around 1.05 and retrace against its bearish move. It is hard to be too bullish the euro now, but it may still be in a corrective phase against its dominant trend.

So that leaves bears with the option of stepping aside or waiting for evidence momentum has reverted to the downside. Otherwise, if we’re treated to a soft US CPI report, EUR/USD could be headed for 1.08.

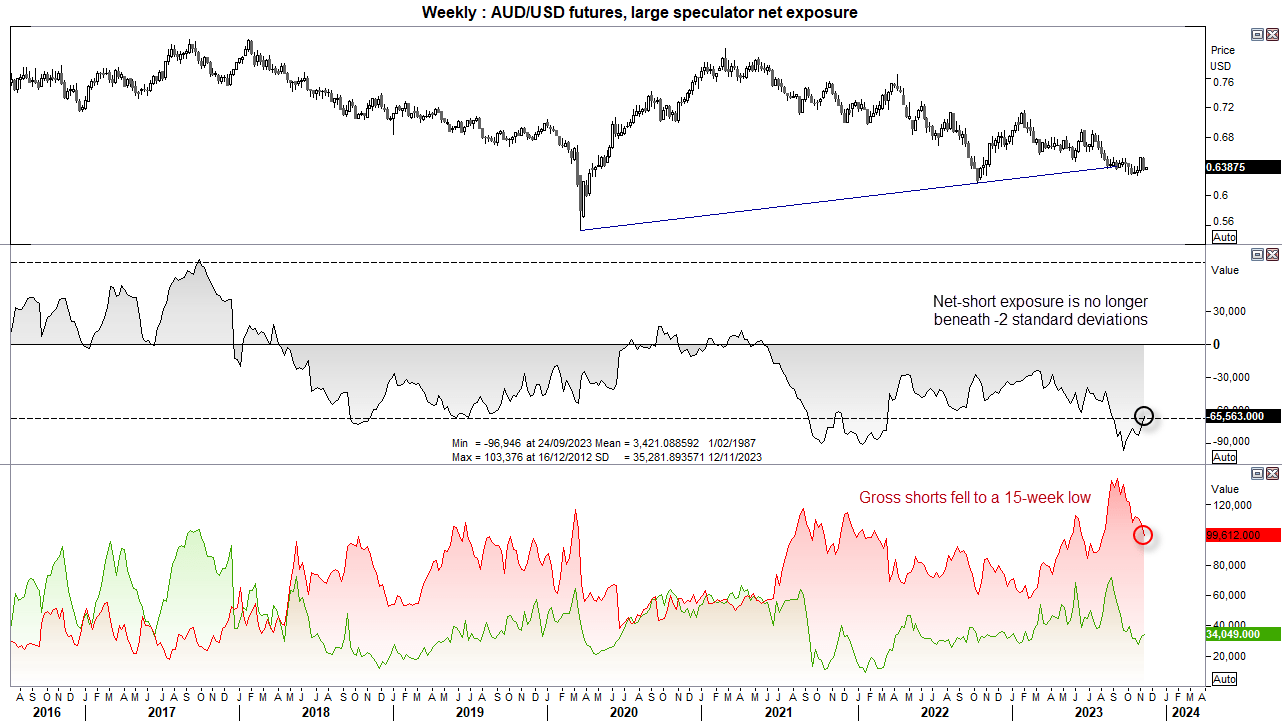

AUD/USD (Australian dollar futures) – Commitment of traders (COT):

Gross short exposure continued to fall for AUD/USD futures last week, which fell to a 15-week low to help net-short exposure move back above -2 standard deviations from its long-term average. We have already seen countertrend rally to 65c we hinted at earlier this month, but unless US dollar and yields surge again from here then I continued to favour AUD/USD holding above 63c over the foreseeable future. Especially if we’re treated to a softer US inflation report later today, and firmer wages for Australia tomorrow which will keep the hawkish pressure on the RBA.

Also keep an eye on China data this Wednesday which includes industrial production, retail sales, unemployment and fixed asset investment. With CPI moving back into reverse then we may see weakness in these figures, and that could potentially see AUD/USD move below 63c if coupled with stronger US inflation later today.

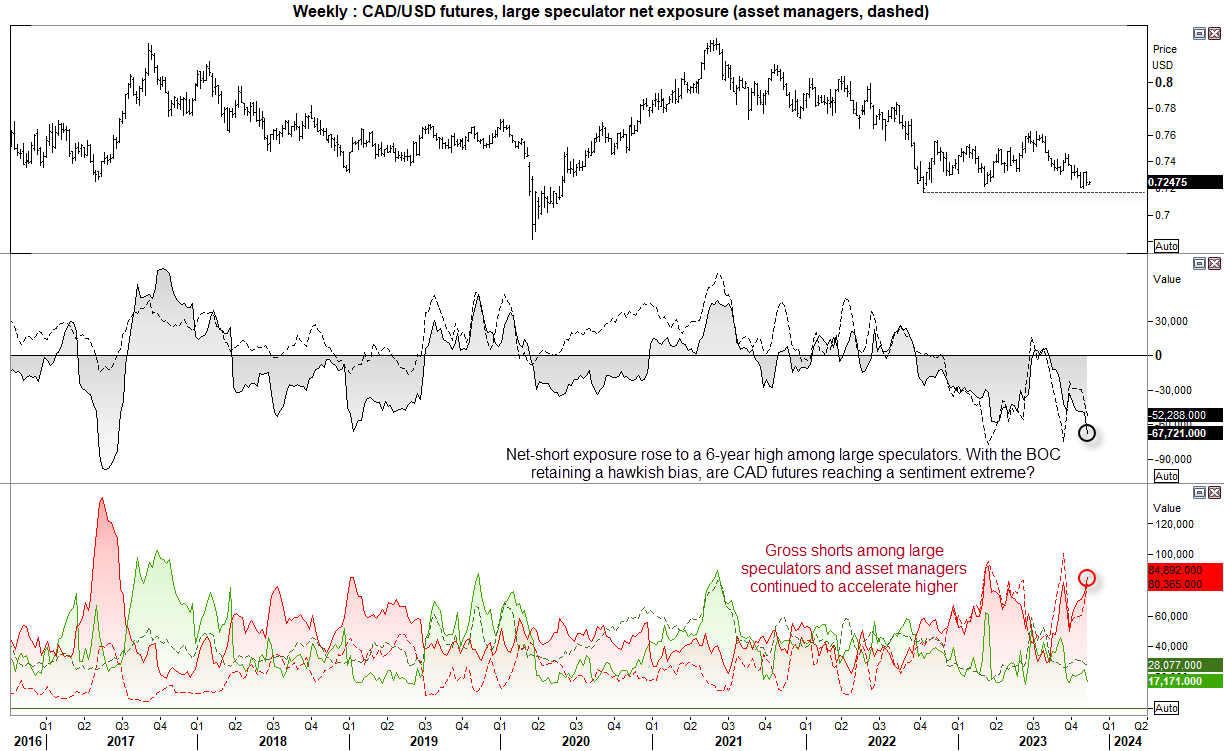

CAD/USD (Canadian dollar futures) - Commitment of traders (COT):

Large speculators and asset managed continued increase their level of net-short exposure to Canadian dollar futures (CAD/USD) last week, on bets that the central bank were done hiking. However, with the recent minutes of the meeting revealed that most members still expect a hike, even though the BOC held their cash rate steady at their last meeting.

Net-short exposure to CAD/USD futures rose to its most bearish level since June 2017 last week, with gross shorts rising to a 35-week high and gross longs falling at their fastest weekly pace in seven.

With CAD futures falling towards support around the March 2023 and October 2022, then USD/CAD may struggle to extend its rally if US inflation comes in softer whilst the BOC retain their hawkish bias over the coming weeks.

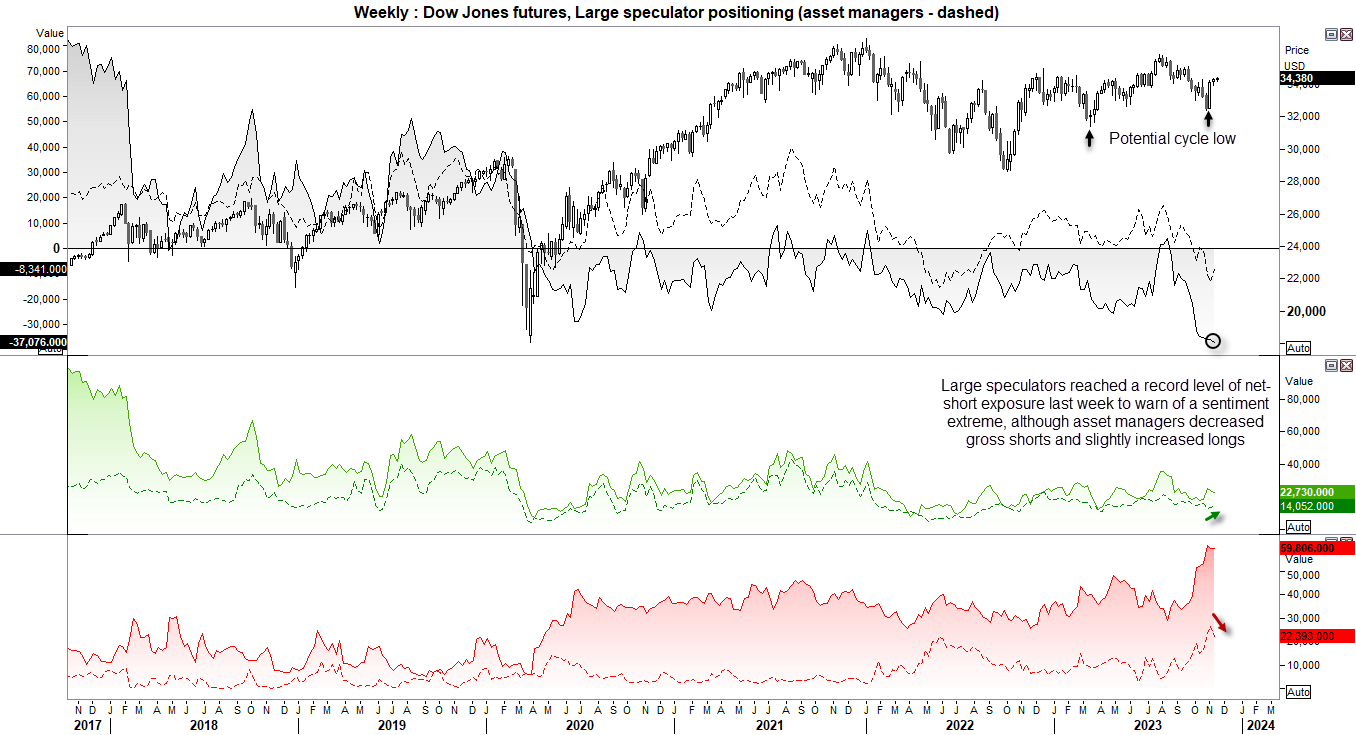

Dow Jones Industrial futures (DJ) - Commitment of traders (COT):

Large speculators pushed net-short exposure to Dow Down Industrial futures to a record high, yet asset managers increased their gross longs and trimmed shorts. Overall, this could point at a sentiment extreme for positioning, and suggest that the bullish engulfing week which formed two weeks ago could be an important cycle low.

WTI crude oil (CL) – Commitment of traders (COT):

Large speculators and managed funds continued to abandon oil by closing out longs and adding to their short exposure. And this saw WTI crude oil fall for a third consecutive week and test $75, a break beneath which brings the lower $70 target into focus which resides near a 161.8% Fibonacci projection. However, first I suspected prices will mean revert to the $80 or $83 resistance area before continuing lower towards the lower $75 target.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade