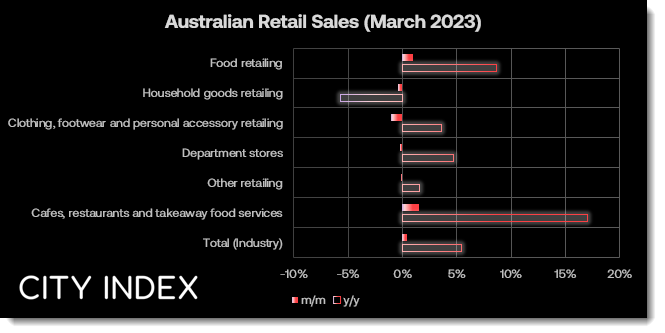

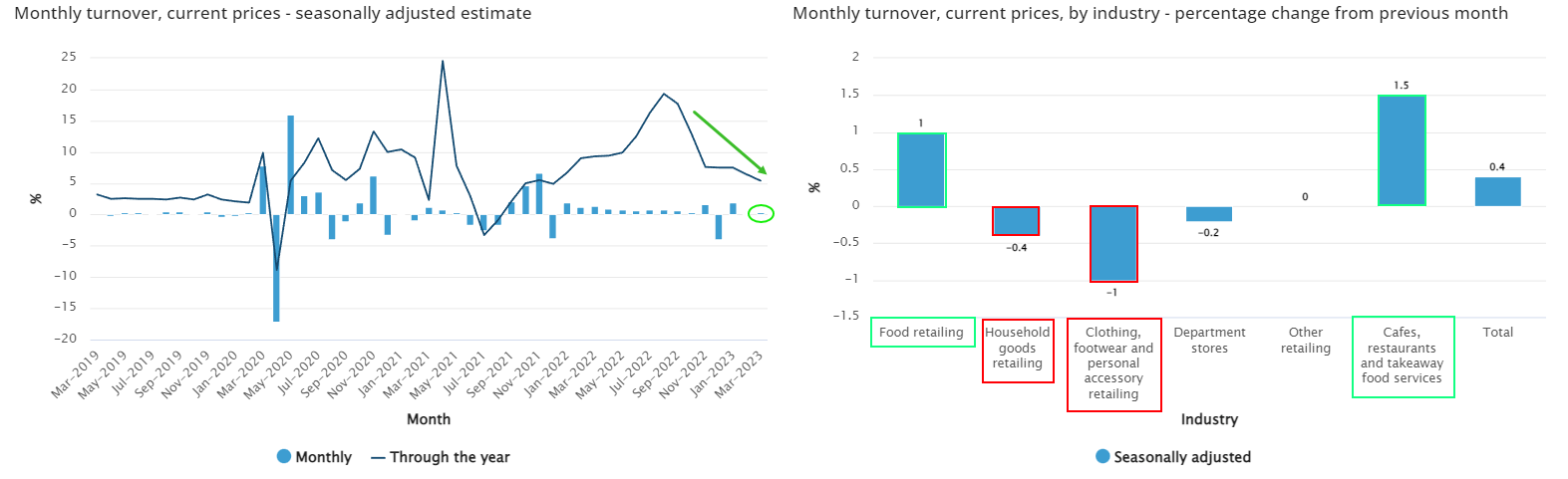

Australian retail trade in March 2023, ABS

- Retail sales rose 0.4% m/m (0.3% forecast, 0.2% prior)

- Annual retail sales rose 5.4%, its slowest pace since December 2021

- Momentum is slowing overall as consumers cut back on discretionary items

- Demand for cafés, restaurants and food remain strong

This image will only appear on forex websites!

This image will only appear on forex websites!

Retail sales continued to rise in Australia in March, despite consumers having endured ten consecutive rate hikes leading up to that period. At 0.4% it is not exactly red hot, but it shows demand from consumers is still present – even if the annual rate of 5.4% is at a 15-month low. But a look behind the headline figure shows that demand for discretionary items are waning. Household goods, clothing/footwear/accessories and department stores all contracted m/m and the annual rate for household goods fell over 5%.

Ultimately, it reveals a subtle shift in consumer spending but not at an alarming rate which could see the RBA announce a peak rate. Just yesterday they surprised markets with a 25bp hike and left the door open for more. Whilst it makes sense given the high levels of inflation, their communication over the past two meetings has completely thrown RBA followers off-of the scent (and not for the first time either). Thankfully (or not, depending on how one looks at it) Governor Lowe delivered a subsequent speech to clarify a few points.

You can see my notes below, but the biggest points to glean from it is that the RBA will see inflation at 3% in two years as a victory and that further hikes may be required. With headline inflation at 7%, the rate of higher prices has to more than halve over the next 12 months. And if the RBA see that as a victory, let’s just forget about any hope of the RBA cutting rates until 2025 (sorry mortgage borrowers).

Still, some potentially good news is that the RBA’s forecasting track record has been pretty abysmal. So with any luck, if they were late to recognise inflation pressures they will be pleasantly surprised if inflation falls faster than they currently anticipate. But before we get our hopes up for inflation to go down, we’ll likely need to see retail sales actually cool off, unemployment rise and job growth fall. And at present, the numbers are annoyingly good on net.

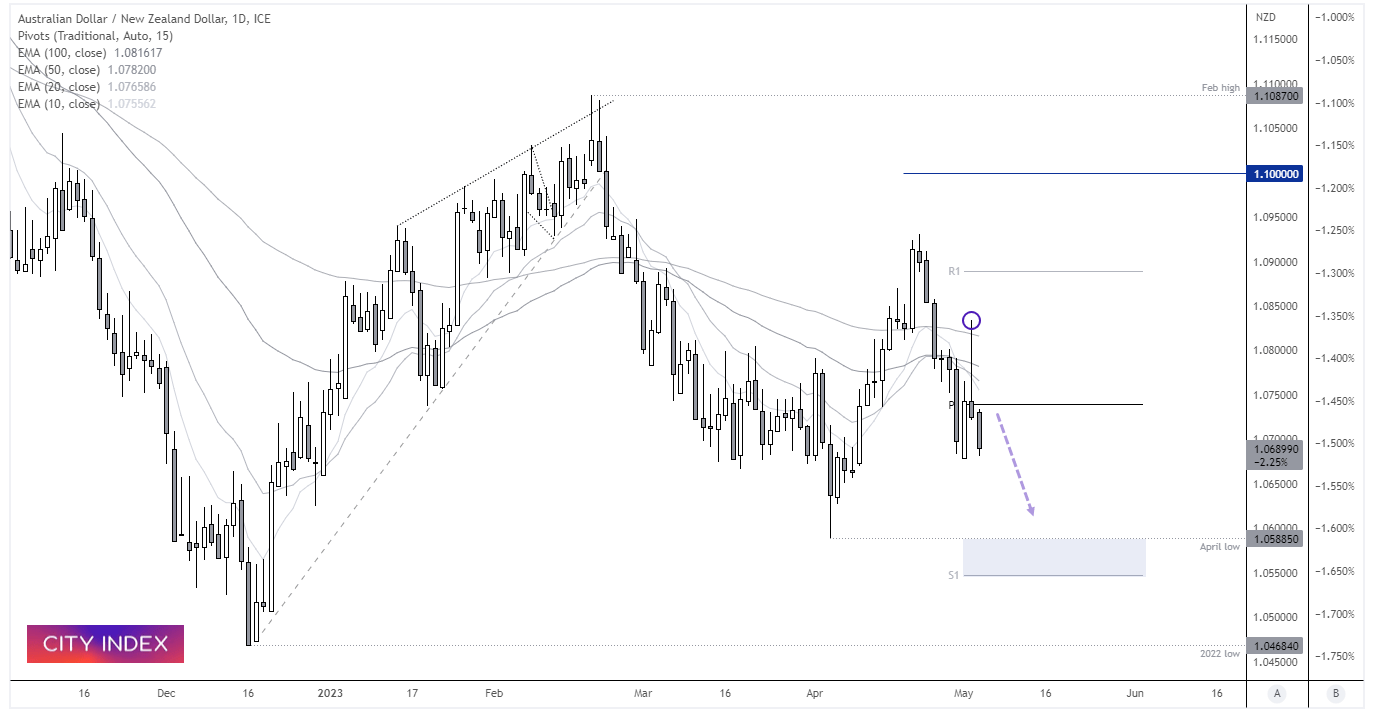

AUD/NZD daily chart:

The AUD/NZD cross has more than handed back yesterday’s post-RBA gains, forming a bearish hammer on the daily chart and falling to a two-day low. Prices ultimately failed to close above four major EMA’s or the monthly pivot point and prices are now back below 1.0700.

Despite the RBA’s change of sentiment, hot employment data keeps the RBNZ on track for a 25bp hike later this month and NZD to retain (and widen) its positive carry over AUD. We therefore expect prices to make a move for the April low, and bears could seek bearish setups below 1.0800.

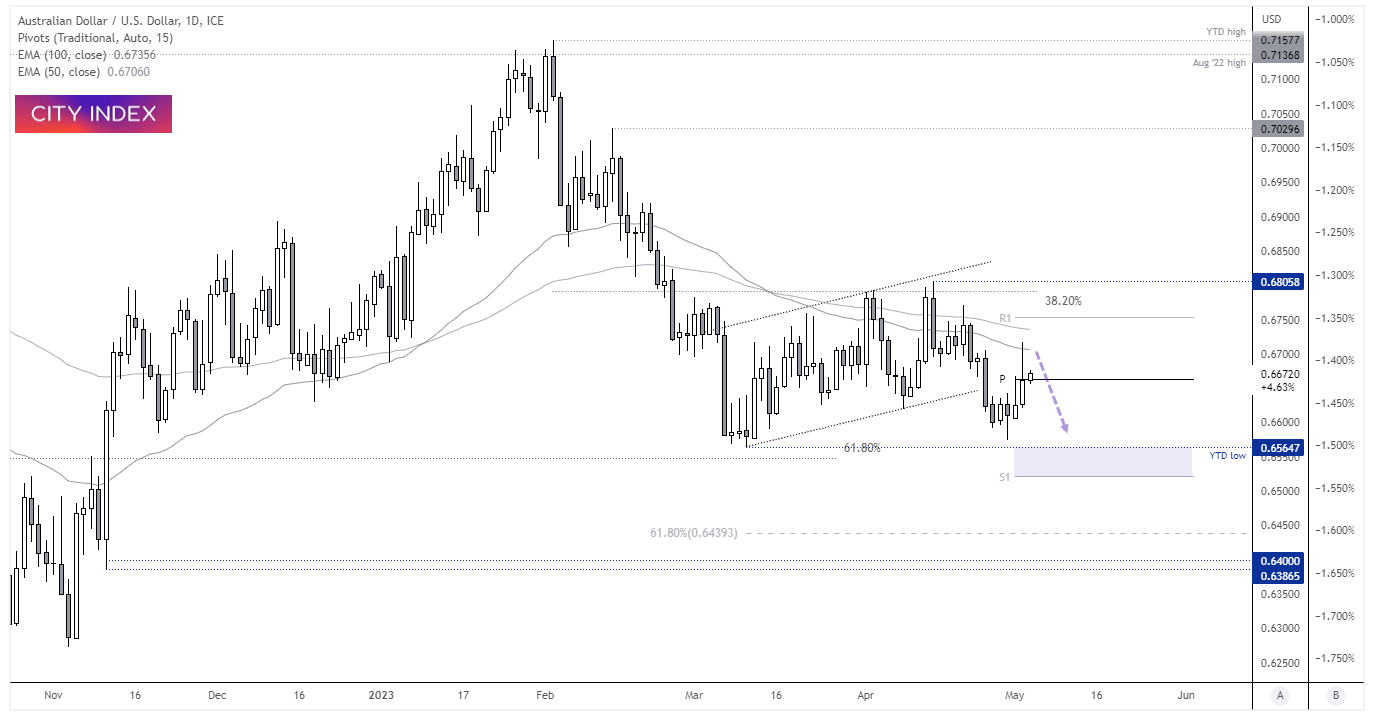

AUD/USD daily chart:

With the FOMC less than 24-hours away, there’s certainly room for some volatility on FX majors (and markets in general). But the Aussie remains beneath the 100 and 200-day EMA’s, which leaves the potential for a swing high to form should we not receive the dovish hike that markets want to hear. If so, a move to the YTD low seams feasible. Yet we should also consider the alternative scenario, where the Aussie could move swiftly higher if the Fed hint at a pause or concerns over the potential for the US to default by June, which could lead to a pause.

Notes of RBA Governor Low’s speech on May 2nd 2023:

- We paused after 10 hikes to provide us with more time to assess the pulse of the economy and the outlook.

- The Australian labour market is still very tight and services inflation is uncomfortably persistent abroad

- Peak inflation in Australia is now behind us

- But it will be some time yet before inflation is back in the target range

- Goods price inflation is slowing but services and energy price inflation is still high and likely to remain so for some time

- If people think inflation is going to remain high then firms will be more willing to put up their prices and workers will seek larger pay rises

- We don’t need to get inflation back to target straight away, but nor can we take too long

- Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe

- If we get inflation down to 3% in two years that would be a good outcome

- Getting inflation lower too quickly could cost too many jobs

- Quite plausible that Australia can avoid a recession

- Broadly speaking, the recommendations from the RBA review make sense

- The RBA is also investigating new forms of digital money, including a central bank digital currency.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade