Asian Futures:

- Australia's ASX 200 futures are down -86 points (-1.23%), the cash market is currently estimated to open at 6,931.80

- Japan's Nikkei 225 futures are down -530 points (-1.82%), the cash market is currently estimated to open at 28,570.38

- Hong Kong's Hang Seng futures are down -376 points (-1.29%), the cash market is currently estimated to open at 28,759.73

UK and Europe:

- UK's FTSE 100 index fell -140.21 points (-2.00%) to close at 6,859.87

- Europe's Euro STOXX 50 index fell -79.45 points (-1.98%) to close at 3,940.46

- Germany's DAX index fell -238.88 points (-1.55%) to close at 15,129.51

- France's CAC 40 index fell -131.58 points (-2.09%) to close at 6,165.11

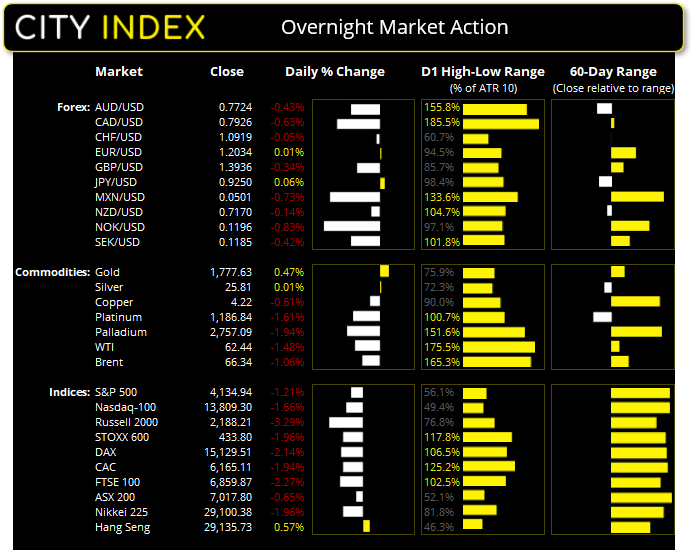

Tuesday US Close:

- The Dow Jones Industrial fell -256.33 points (-0.0075%) to close at 33,821.30

- The S&P 500 index fell -28.32 points (-0.69%) to close at 4,134.94

- The Nasdaq 100 index fell -98.367 points (-0.71%) to close at 13,809.30

Indices: European shares suffer worst day this year

Asian shares are expected to open lower following a weak lead from Wall Street and European bourses. Despite news that Europe will reimplement the J&J vaccine into their vaccination rollout, investors were more concerned with the rise of COVID-19 cases across Asia, particularly India.

The FTSE 100 led the way lower during the European session, closing -2.3% lower during its worst session in two months. The DAX led the declines with a -2.1% drop, the Euro STOXX 50 was close behind by falling -2% from record highs, whilst the broader Euro STOXX 600 fell -1.8%. It wasn’t much prettier on Wall Street either. The S&P 500 (-1.2%) fell to a 6-day low before recovering back above its 10-day eMA. The Nasdaq 100 (-1.7%) fell lower for a second consecutive session whilst the Russell 2,000 fell -3.3%.

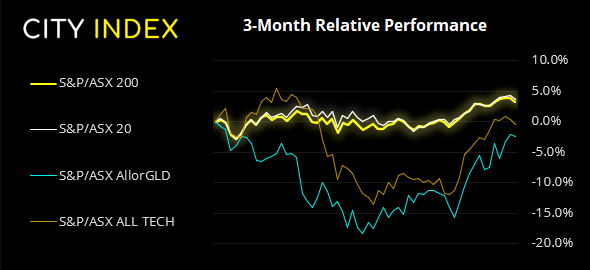

ASX 200 Market Internals

The ASX 200 began it corrective phase after breaking beneath Monday’s bearish pinbar and snapping a 5-day winning streak. The daily trend remains bullish above 6954, which leaves just under 20 points of downside util this level is tested. Given the weak lead from Wall Street overnight, it may well test (or even breach that level) today. Take note that BHP Group (BHP) release corporate sales at 08:30.

ASX 200: 7,017.8 (-0.68%), 20 April 2021

- Telecommunication (0.21%) was the strongest sector and Information Technology (-1.17%) was the weakest

- 10 out of the 11 sectors were in the red

- 49 (24.5%) stocks advanced and 135 (67.5%) declined

Outperformers

- + 3.02% - Mineral Resources (MIN.AX)

- + 2.69% - Bank of Queensland (BOQ.AX)

- + 2.69% - Healius Ltd (HLS.AX)

Underperformers:

- -15.8% - Challenger (CGF.AX)

- -8.30% - Lynas Rare EARTHS (LYC.AX)

- -5.24% - Altium (ALU.AX)

Learn how to trade indices

Forex: USD catches a safe-haven bid (and a little help from the Fed)

The US dollar regained its safe-haven status, although a letter from Jerome Powell sent to a US Senator revealed that the Fed are committed to controlling any inflationary overshoot. So, if inflation rises too fast and too far, perhaps they will act after all.

- The US dollar index (DXY) rose 0.2% although remains below 91.30/40 resistance. A break above here confirms a deeper retracement but, if it holds as resistance, then bears could look to drive it towards 90.63/79 support.

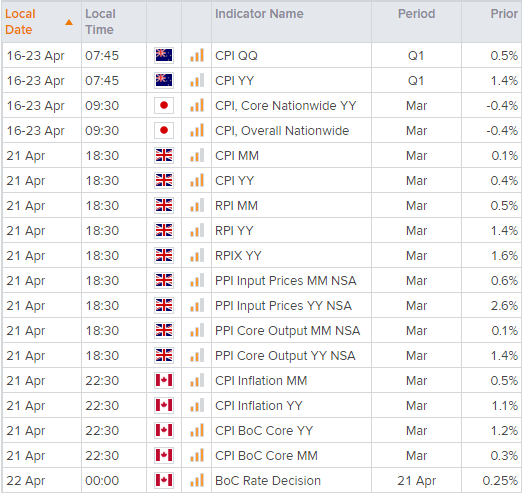

- The Canadian dollar was the weakest currency and AUD was the second weakest, as oil prices took a turn for the worse. The Japanese yen and US dollar were the strongest currencies, with EUR and NZD very closely behind.

- CAD/JPY and CAD/CHF fell to six-week lows and EUR/CAD rose to a six-week high. With Canadian inflation and BOC meeting on top, it will be a currency to watch over today’s US session.

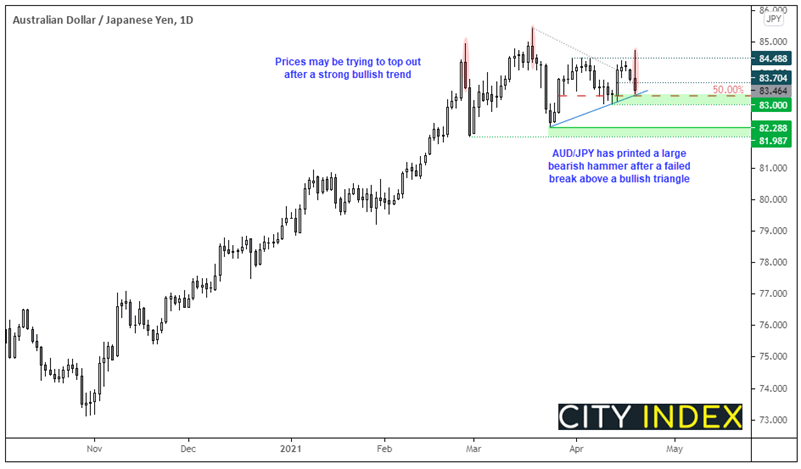

After a false break out of a symmetrical triangle, AUD/JPY prices have reversed sharply lower overnight and printed a large bearish hammer. If we take a step back, we also note that this is the third large bearish reversal candle since late February which highlights the potential for a larger topping pattern to form (even if it Is not exactly a textbook pattern or pleasing to the eye).

Interestingly, prices have found support at 83.33 where the trendline support and the Marabuzo line reside. The Marabuzo line is the 50% retracement between the open to close of the bullish Marabuzo candle on the 26th March.

- A break beneath 83 assumes further downside, it prices have then invalidates trendline support, the Marabuzo line and swing lows.

- The initial target is the lows around 82.30.

Learn how to trade forex

Commodities: Oil prices are shaken (but not stirred)

With higher COVID-19 cases comes lower oil prices, as traders look ahead to the potential for lower demand. Oil prices produced a bearish outside candle overnight, after reversing gains made on an earlier break to a one-month high. Yet WTI closed the session back above 62.27 support and held above last Wednesday’s (breakout day) low. So, whilst it appears oil is back within a corrective phases and oil bulls may be a little shaken, it is yet to reverse its trend bullish trend on the daily chart. So, it is a ‘step aside’ for us for now, until the picture becomes clearer.

Gold rose nearly 0.5% during the risk-off session, although failed to reclaim highs made on Monday before finding resistance at its 200-day eMA. Given it is now trapped between the 50 and 200-day eMA, its next directional break appears a little ambiguous.