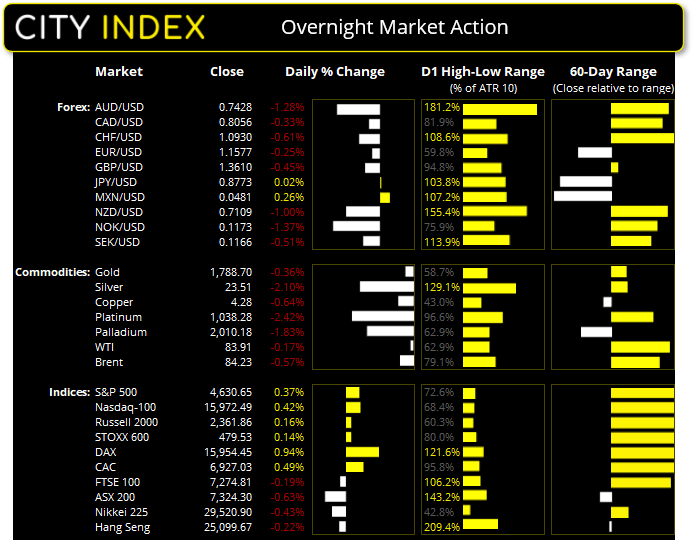

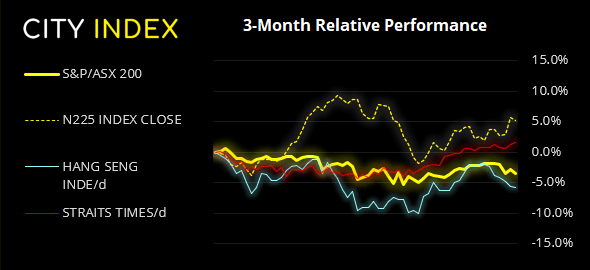

Asian Futures:

- Australia's ASX 200 futures are up 71 points (0.97%), the cash market is currently estimated to open at 7,395.30

- Japan's Nikkei 225 futures are up 10 points (0.03%), the cash market is currently estimated to open at 29,530.90

- Hong Kong's Hang Seng futures are down -55 points (-0.22%), the cash market is currently estimated to open at 25,044.67

- China's A50 Index futures are down -14 points (-0.09%), the cash market is currently estimated to open at 15,532.46

UK and Europe:

- UK's FTSE 100 index fell -13.81 points (-0.19%) to close at 7,274.81

- Europe's Euro STOXX 50 index rose 15.75 points (0.37%) to close at 4,296.22

- Germany's DAX index rose 148.16 points (0.94%) to close at 15,954.45

- France's CAC 40 index rose 33.74 points (0.49%) to close at 6,927.03

Tuesday US Close:

- The Dow Jones Industrial rose 138.79 points (0.39%) to close at 36,052.63

- The S&P 500 index rose 16.98 points (0.37%) to close at 4,630.65

- The Nasdaq 100 index rose 67.216 points (0.42%) to close at 15,972.49

Indices:

Joe Biden has said he has given a lot of thought to his Federal Reserve nominations, and that he will announce them fairly quickly. Jerome Powell’s four-year term ends in February 2022.

Another record close for US indices as earnings supported sentiment over rising inflation concerns. All major US indices closed around 0.4% higher. The Russell 2000 saw a minor intraday record high before closing on its March previously set all-time high.

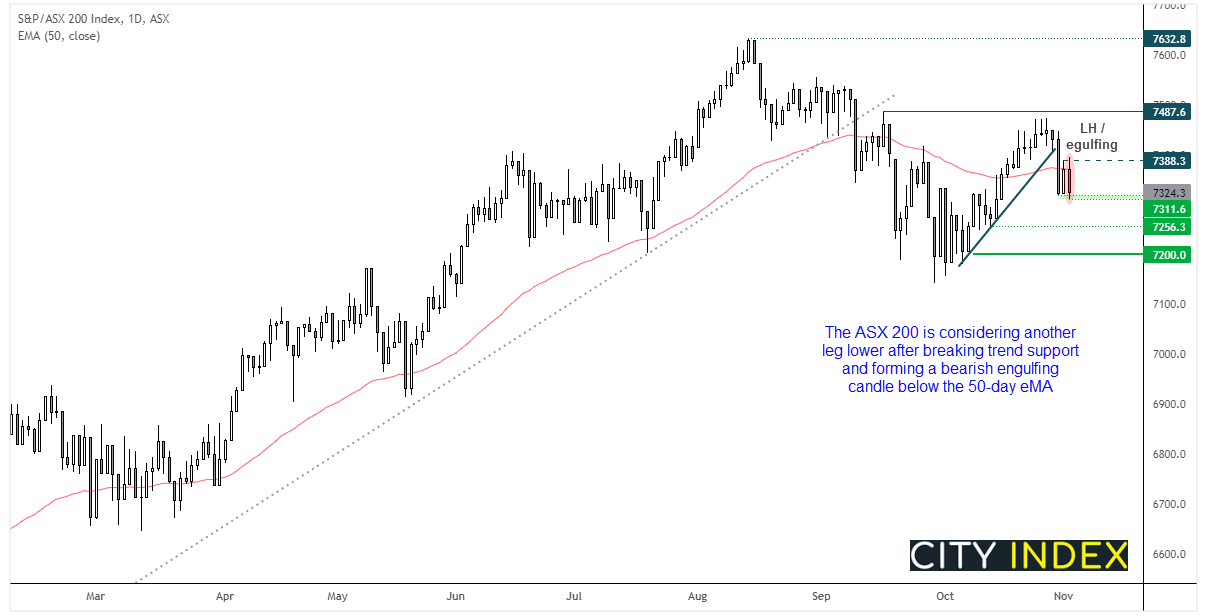

The ASX 200 looks set to take another dip lower after forming a bearish outside (and bearish engulfing) day yesterday. The 50-day sMA is capping as resistance and yesterday’s high could also be a lower high after its prior rally faltered below 7500 and broke trend support.

Intraday resistance sits around 7342 (yesterday’s most actively traded price) and 7370 (50-day eMA), making them levels for bearish swing traders to consider. Our bias remains bearish beneath yesterday’s high / 7400, with the 7256 low making a viable initial target.

ASX 200 Market Internals:

ASX 200: 7324.3 (-0.63%), 02 November 2021

- Real Estate (1.25%) was the strongest sector and Materials (-2.1%) was the weakest

- 6 out of the 11 sectors closed higher

- 5 out of the 11 sectors closed lower

- 8 out of the 11 sectors outperformed the index

- 61 (30.50%) stocks advanced, 129 (64.50%) stocks declined

- 66.5% of stocks closed above their 200-day average

- 51.5% of stocks closed above their 50-day average

- 51.5% of stocks closed above their 20-day average

Outperformers:

- + 5.57%-Goodman Group(GMG.AX)

- + 3.28%-Charter Hall Group(CHC.AX)

- + 3.21%-APA Group(APA.AX)

Underperformers:

- ·-9.54%-Whitehaven Coal Ltd(WHC.AX)

- ·-8.42%-IGO Ltd(IGO.AX)

- ·-7.22%-Champion Iron Ltd(CIA.AX)

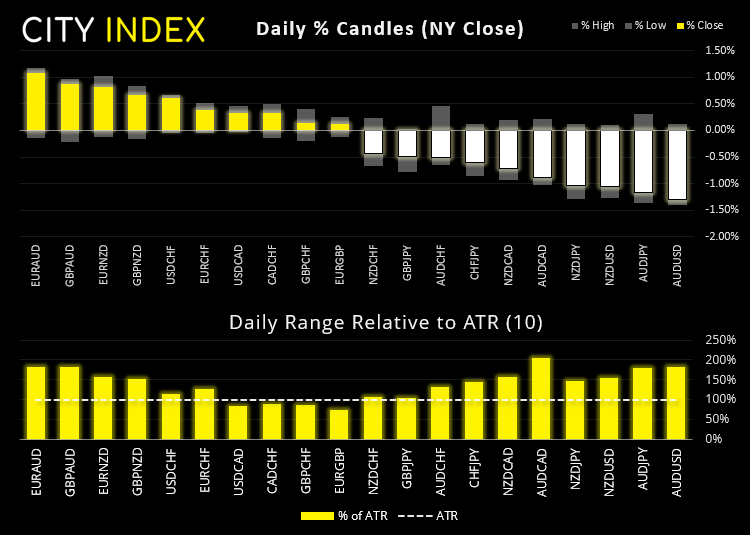

Forex:

AUD was the weakest major and broadly lower against its peers, after the RBA were more dovish (or much less hawkish) than anticipated at yesterday’s meeting.

AUD was the weakest major and broadly lower against its peers, after the RBA were more dovish (or much less hawkish) than anticipated at yesterday’s meeting.

NZD was also broadly lower as traders likely booked profits ahead of today’s events. Expectations of further hikes form the hawkish bank is not a new theme, but bond yields were lower for AU and NZ at the short-end of the curve following yesterday’s dovish RBA meeting.

New Zealand’s quarterly employment report is scheduled for 08:45 AEST. August’s report triggered fresh expectations for RBNZ to hike as job growth expanded at its fastest quarter in five and unemployment fell to 4%, its lowest quarter in six. Expectations are for unemployment to fall slightly further to 3.9% and employment rise at a slower rate of 0.4% q/q (1% previously). Shortly after, RBNZ governor Graeme Orr will also speak following the release of NZ’s financial stability report.

Commodities:

Oil prices were sent lower late in the US session as crude stock rose more than expected. WTI fell to 83.18, down form a high of 84.41. Next up for oil traders is the OPEC+ meeting tomorrow, which is gaining interest as members continue to ignore Biden’s request to boost output by any meaningful amount as inflationary pressures continue to pinch the consumer.

Silver failed to break higher as we’d anticipated, instead bucking under the pressure of a firmer US dollar ahead of the FOMC meeting (decision announced in early hours of tomorrow). The trend remains structurally bullish on the daily chart yet momentum is pointing the wrong way, so its one to step aside from for now.

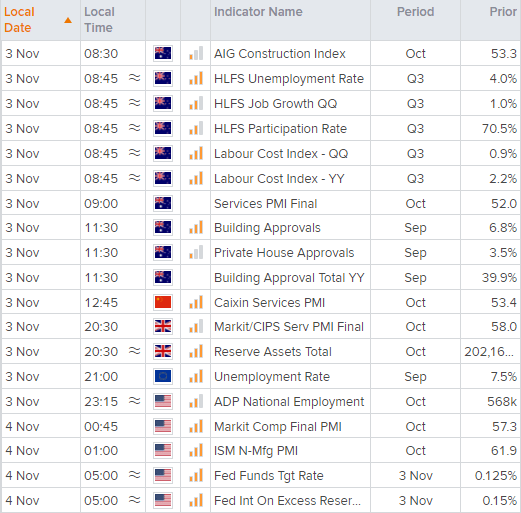

Up Next (Times in AEDT)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade