- Upstream inflationary pressures in Japan are waning

- Normalising monetary policy is risky for the BOJ given the macro backdrop

- We look at USD/JPY and the Nikkei 225 should the BOJ be unable to reach escape velocity

The BOJ’s normalisation dilemma

The Bank of Japan (BOJ) appears a long way off normalising monetary policy. Upstream price pressures a diminishing while the Fed and other major central banks are moving towards calling time on rate hikes, making it difficult for the BOJ to start tightening policy, especially when the recovery in the Japanese economy is already showing signs of flagging. Should the BOJ fail to reach escape velocity from its ultra-easy settings, this will have implications for the Nikkei 225 and USD/JPY as we move towards 2024.

It's not looking good for Japanese inflationary pressures

Data released Thursday underscores the risk posed to the BOJ normalising policy before inflationary pressures have become persistent. Wholesale prices, equivalent to measures of producer prices in other nations, fell unexpectedly in September, easing 0.3% against expectations for an increase of 0.1%. The monthly undershoot saw the annual increase slow to 2%, the lowest level since March 2021.

Along with slowing upstream price pressures, so too are core machine orders with a decline of 0.5% reported in August compared to an expected increase of 0.4%. Core orders – deemed a lead indicator on capital expenditure plans at Japanese firms, have now fallen 7.7% from a year ago. The government described the momentum in the series as “stalling”, adding to similar trends in household spending which is the largest part of the Japanese economy at over 50%.

Prematurely tightening reeks of policy error

Given the state of the Japanese and global economy, it would be a risky on the BOJ’s behalf to abandon yield curve control yet alone lift policy rates before there’s clear evidence that higher wages are feeding through to higher inflation and inflation expectations. If done prematurely, it would come across as a major policy error in the making.

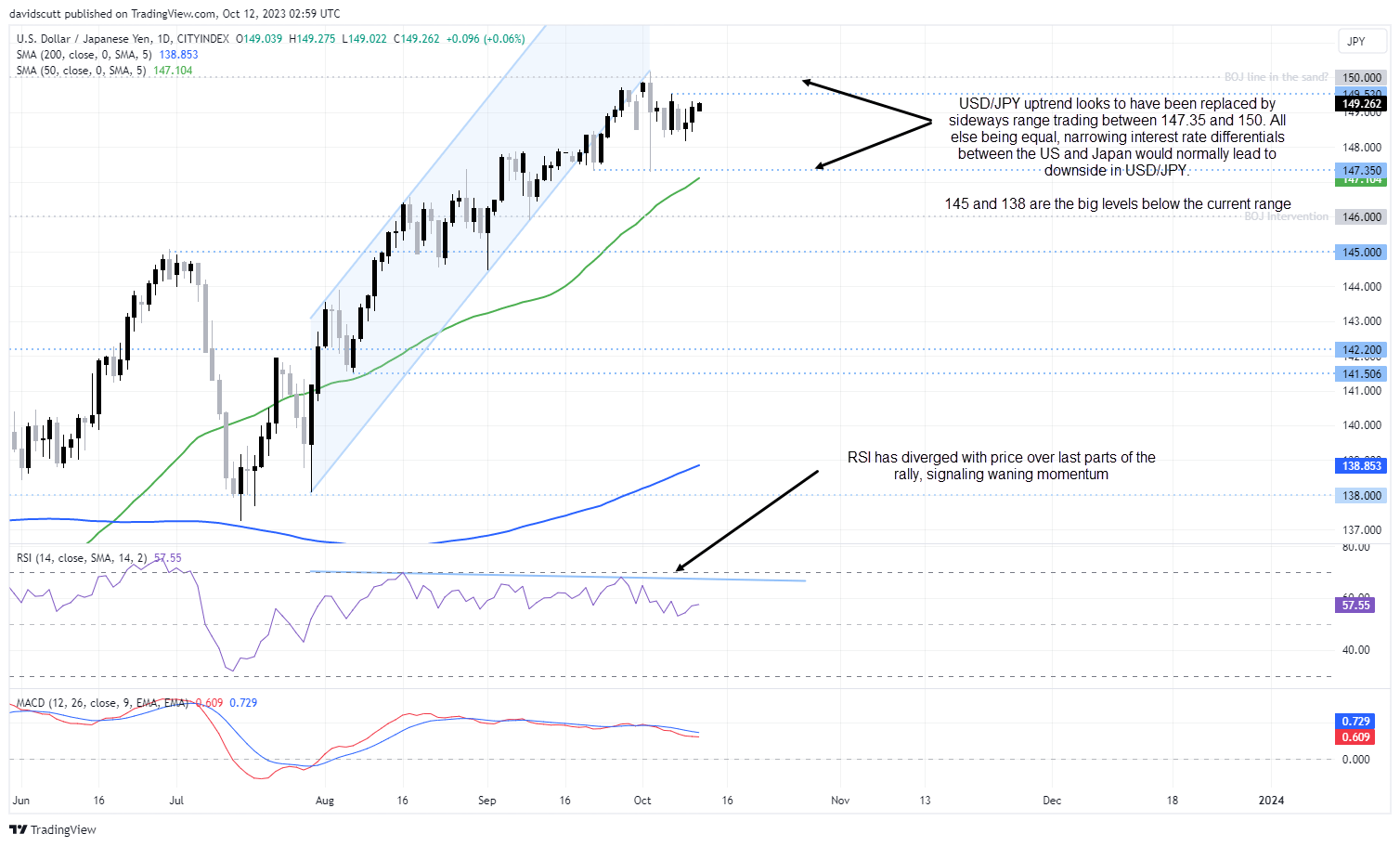

Should the Bank of Japan be unable to begin normalising policy, it would likely see USD/JPY be weaker than what would otherwise be the case given the important role interest rate differentials have been playing determining fluctuations in the pair in recent years.

USD/JPY downside risks evident even with no BOJ normalisation

Looking at the daily chart, the strong uptrend since July looks to be evolving now into a period of sideways range trade between 147.35 and 150 as yield differentials between Japan and United States are countered by the threat of FX intervention from the Bank of Japan, a fact reinforced by the significant decline seen last week when USD/JPY briefly ventured above 150.

In the absence of another leg higher for US yields which may be diminishing given rising risk aversion and a softer tone from several key Fed officials when it comes to the interest rate outlook, unchanged policy settings from the BOJ points to near-term yield differentials between the US and Japan remaining around these levels with risks over the medium-term likely skewed towards the downside.

That suggests risks for USD/JPY may also be shifting lower heading into next year, especially should the Fed begin easing policy a little earlier than anticipated. Over a longer time horizon, 145 and 138 are the first major downside levels to watch.

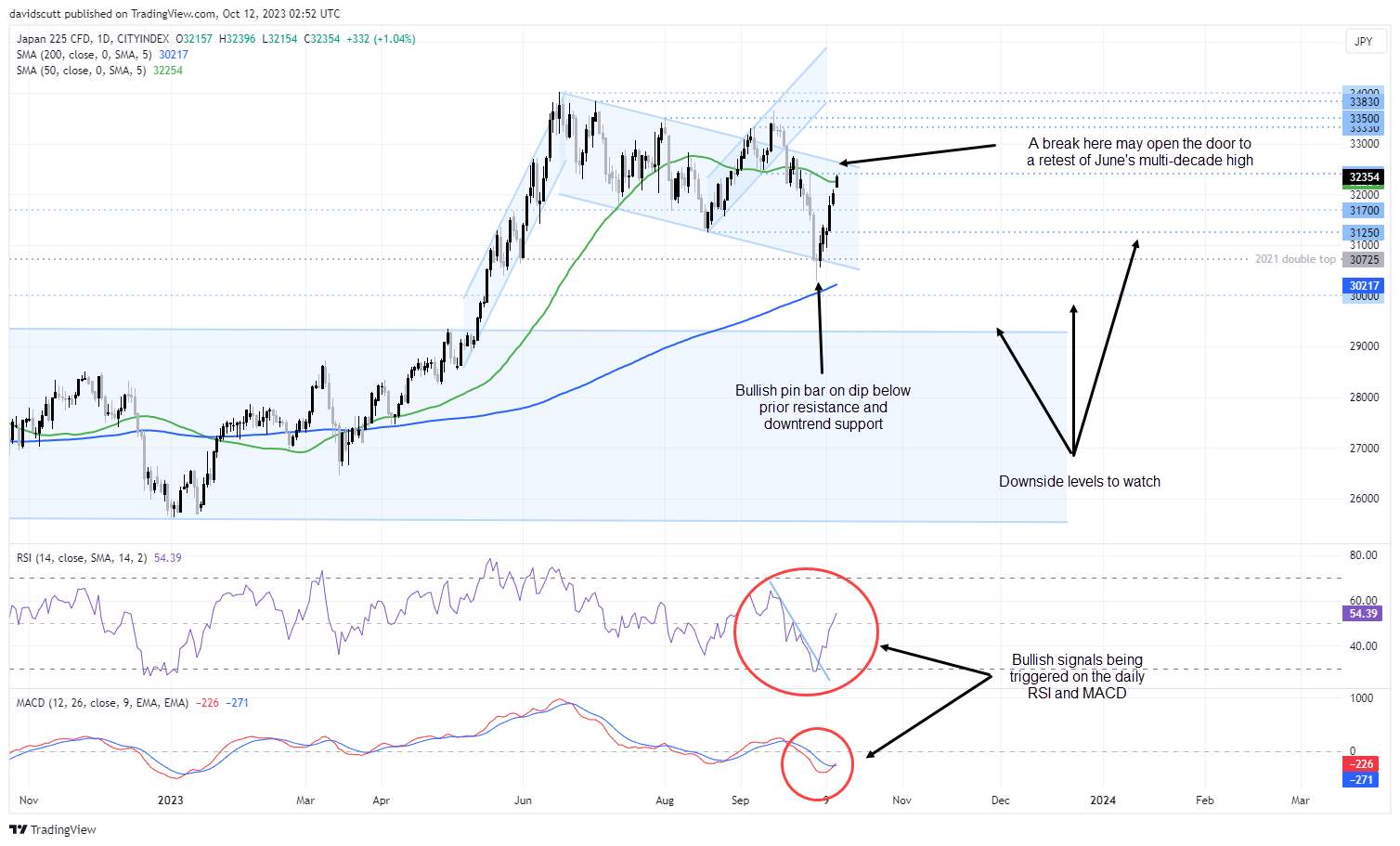

Nikkei bounces hard, easy policy will help longer-term

For the Nikkei 225, attempts last week to force it out of its downtrend channel were met with solid buying at a former resistance level, delivering a bullish pin bar which has seemingly acted as a slingshot higher ever since. It’s now tangoing with minor resistance at 32400 and seems destined for a test of retest of channel resistance above 32600. A break there may open the door to highs seen earlier this year, including the multi-decade peak of 34000 hit in June. An improvement in the Chinese economy would be a positive macro factor for the Nikkei, were it to occur. For longer-term traders, levels to consider on the downside include below 30725, 30000 and 29300.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade