- US yields rose on Tuesday, widening yield differentials between the US and Japan

- The widening yield advantage is helping to fuel gains in USD/JPY

- There are no obvious catalysts that could lead to higher UD yields in the near-term

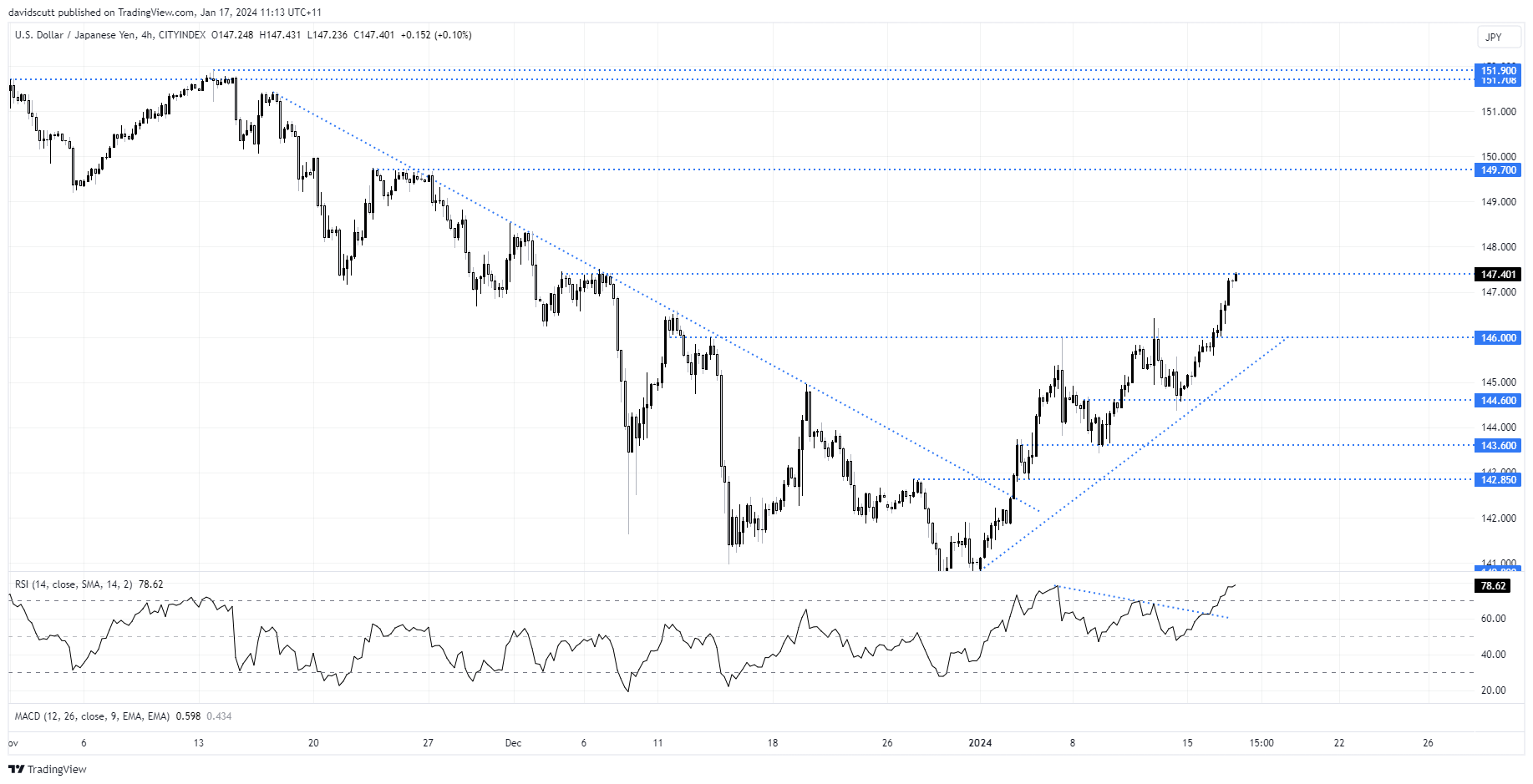

USD/JPY has surged to fresh one-month highs, aided by a lift in US bond yields which widened interest rate differentials with Japan. Given the risk-off tone seen across broader markets, it’s clear the yen is no longer the safe haven play it once was.

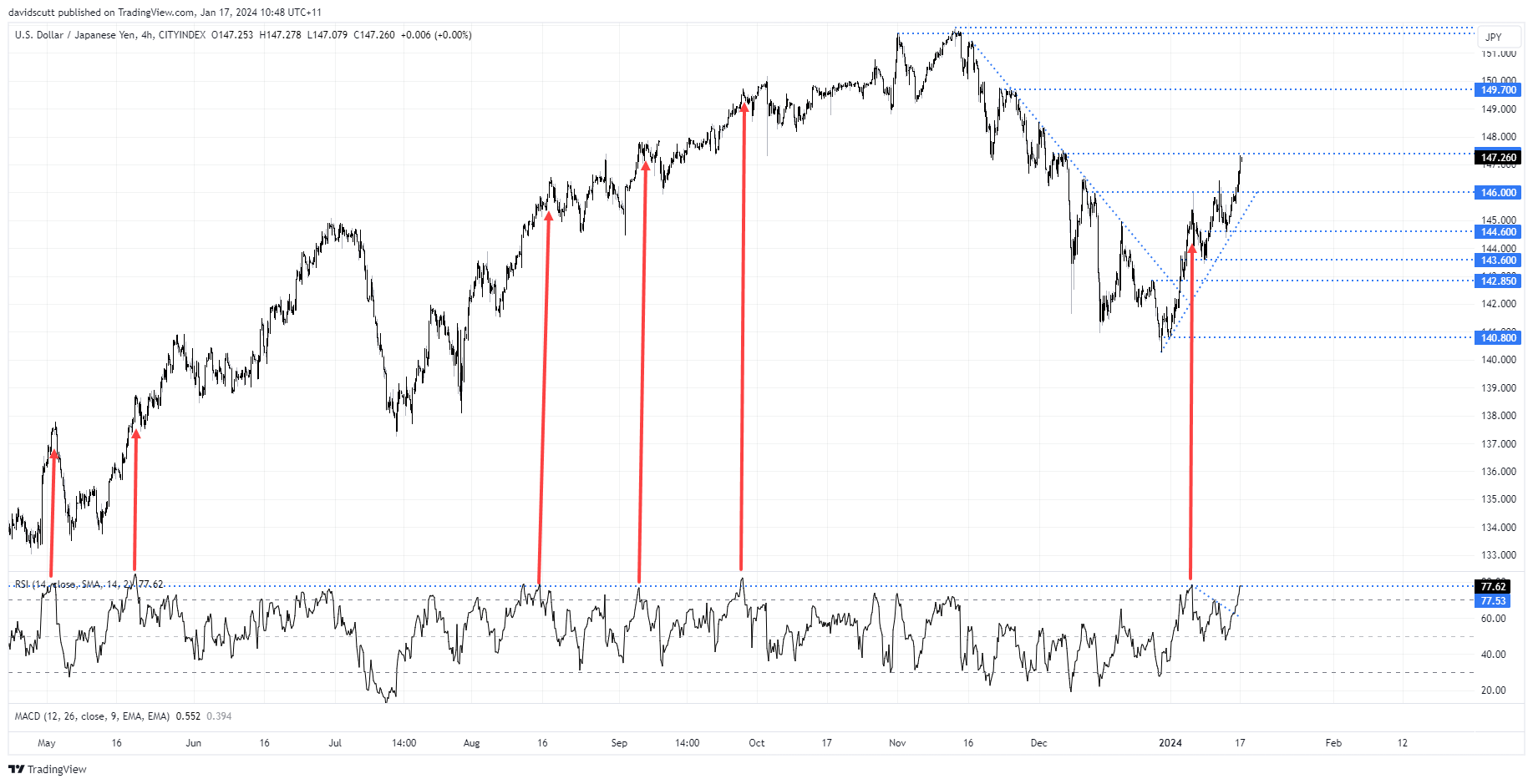

USD/JPY vulnerable to downside based on recent history

But the speed of the latest leg higher – driven by a modest recalibration in US interest rate expectations – has left USD/JPY overbought on a four-hourly timeframe, sitting at levels that have regularly occurred before short-term pullbacks in the past.

The chart shows the instances where RSI has sat at similar levels. While past performance is not indicative of future performance, recent form suggests it would be unusual to see some form of reversal from these levels.

Nothing on the calendar screams higher US yields near-term

From a fundamental perspective, you have to consider what could lead to a further paring of US interest rate cut expectations, leading to a continued selloff in Treasuries and higher yields? New York Federal Reserve President John Williams is scheduled to speak today, but it’s doubtful he’ll deviate too far from what Governor Christopher Waller flagged on Tuesday. The US economic data calendar is also sparce with only retail sales, initial jobless claims and University of Michigan consumer inflation expectations likely to garner any real attention. None are likely to move the dial on rates in isolation.

When it comes to Japanese yields, outside of official or unofficial speculation on the prospects for policy normalisation form the Bank of Japan, almost nothing domestically seems to move the dial for JGB yields, including consumer price inflation unless it’s a big deviation from market expectations. The nationwide reading arrives on Friday

USD/JPY sitting at useful levels on the charts

So we have a near-term backdrop where further upside for US yields appears limited, removing a key driver of recent USD/JPY gains. Zooming in on the four-hourly chart above, USD/JPY is testing resistance at 147.40, providing a level to build a trade around.

A failure at this level could allow shorts to establish trades with a stop above the level targeting a return to 146.00, where the pair only sat a day ago. For those considering longs, a break above 147.40 could target a move to 148.30, a minor resistance level dating back to early December. While I’m leaning towards a short given history and doubts about how much wider interest rate differentials can go near-term, I’m not wedded to the trade. Relentless upside is just one reason to show caution. Let the price inform you what do.

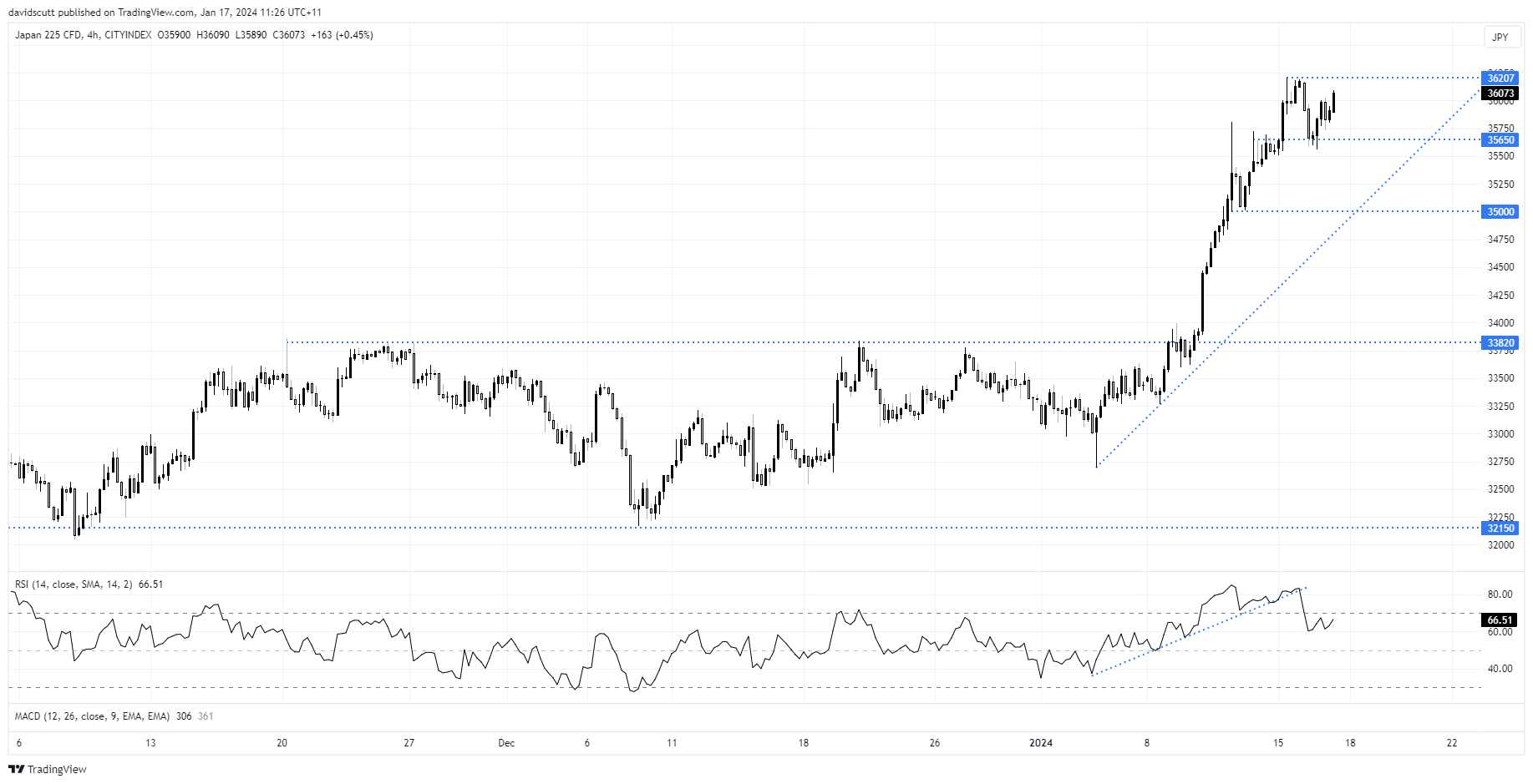

Nikkei eying off fresh highs on cheaper yen

Given the flow through effects to the Nikkei from a cheaper yen helping to juice exporter earnings, it’s worthwhile looking at the index quickly. On the topside, 36207 was the 34-year high set earlier this week, making that the first level of resistance. Below, 35650 has now acted as support and resistance, making it the first level of note.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade