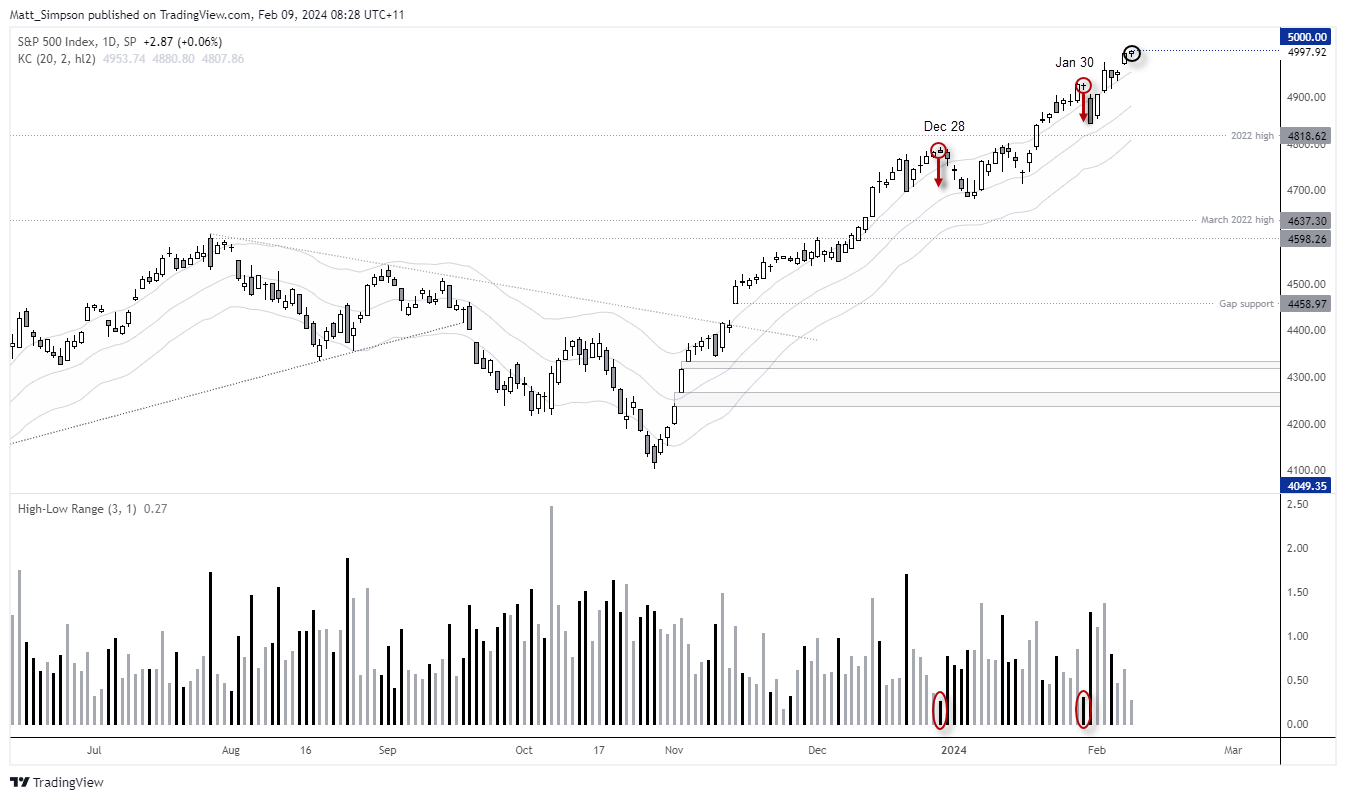

The S&P 500 posted its smallest daily range of the year, and second smallest since Dec 28th. That particular day marked an interim top. And whilst the S&P 500 tapped the magical 5k level, it was by just a smidgen.

We also saw a similarly small-ranged day on Jan 30th which was followed by a 1-day pullback, so I am left wondering if we'll see a retracement on Friday as traders may opt to lighten their load ahead of the weekend. But as mentioned in yesterday’s analysis, futures positioning and pricing suggests a break above 5,000 for the S&P 500 cash index. I mean, did it really come this far to not go further – retracement incoming or not?

Market Summary:

- Fed member Barkin was the latest member to push back on imminent rate cuts, saying “I think it is smart for us to take our time”.

- The yen was the weakest FX major on Thursday and the US dollar broke its 2-day pullback, allowing USD/JPY to reach a YTD high and hone in on my $150 target

- The weaker yen along with Wall Street playing with record highs has keeping the 40 to 47-day AUD/JPY cycle in play, which currently estimates its next trough to land between the end of March / beginning of April

- Gold continues to trade in a choppy range with the past two days effectively closing flat, with an upper wick on Wednesday and lower wick on Thursday.

- However, gold played very well with two swing-trade ideas on Thursday, but rising into the weekly and monthly pivots before reversing lower and reaching the 2040 target.

- Oil prices soared higher on headlines that Israel rejected the Gaza ceasefire proposal, fanning fears of a broadening conflict in the Middle East.

- WTI rude oil rose nearly 3.5% during its best day of the year and stropped just shy of my $77 target – but it shows the potential to continue higher should concerns over a full Middle East conflict continue to rise

- AUD/USD turned lower and closed back beneath 65c, to keep the downside target of 64c alive.

Events in focus (AEDT):

RBA governor Bullock speaks shortly to the Houser of Representatives. I doubt we’ll glean much more from her than already conveyed at this week’s meeting and press conference; inflation remain too high, a hawkish bias remains and it will take some time for CPI to return to their target. That said, any awkward questions can result in slip-ups, and they can move markets. And any hint of dovishness could send AUD/USD lower and the ASX higher.

- 09:30 – RBA governor Bullock speaks before the House of Representatives

- 14:00 – New Zealand inflation expectations

- 18:00 – German CPI

- 00:30 – Canadian employment report

- 02:30 – BOC Loan Officer Survey

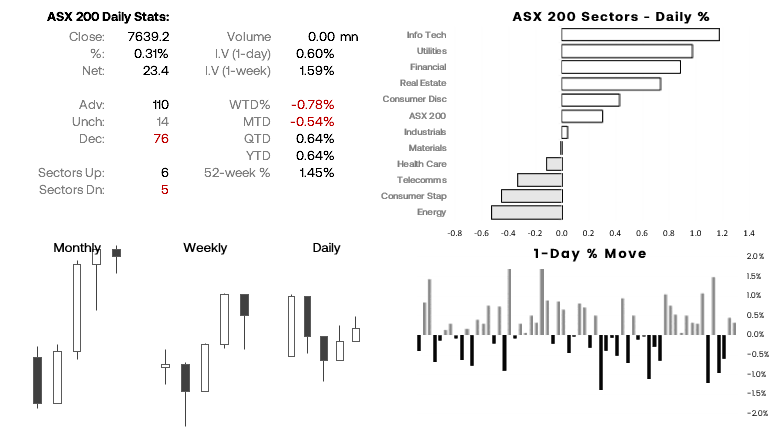

ASX 200 at a glance:

- The ASX 200 cash market rose for a second day, although its two-day range is roughly one half of the prior two-day bearish selloff

- SPI 200 futures were effectively flat overnight, although gains on Wall Street allowed it to recoup earlier losses and close flat (and leave a potential bullish pinbar on the daily chart)

- Today’s bias for the ASX is bullish and for it to have another crack the January high

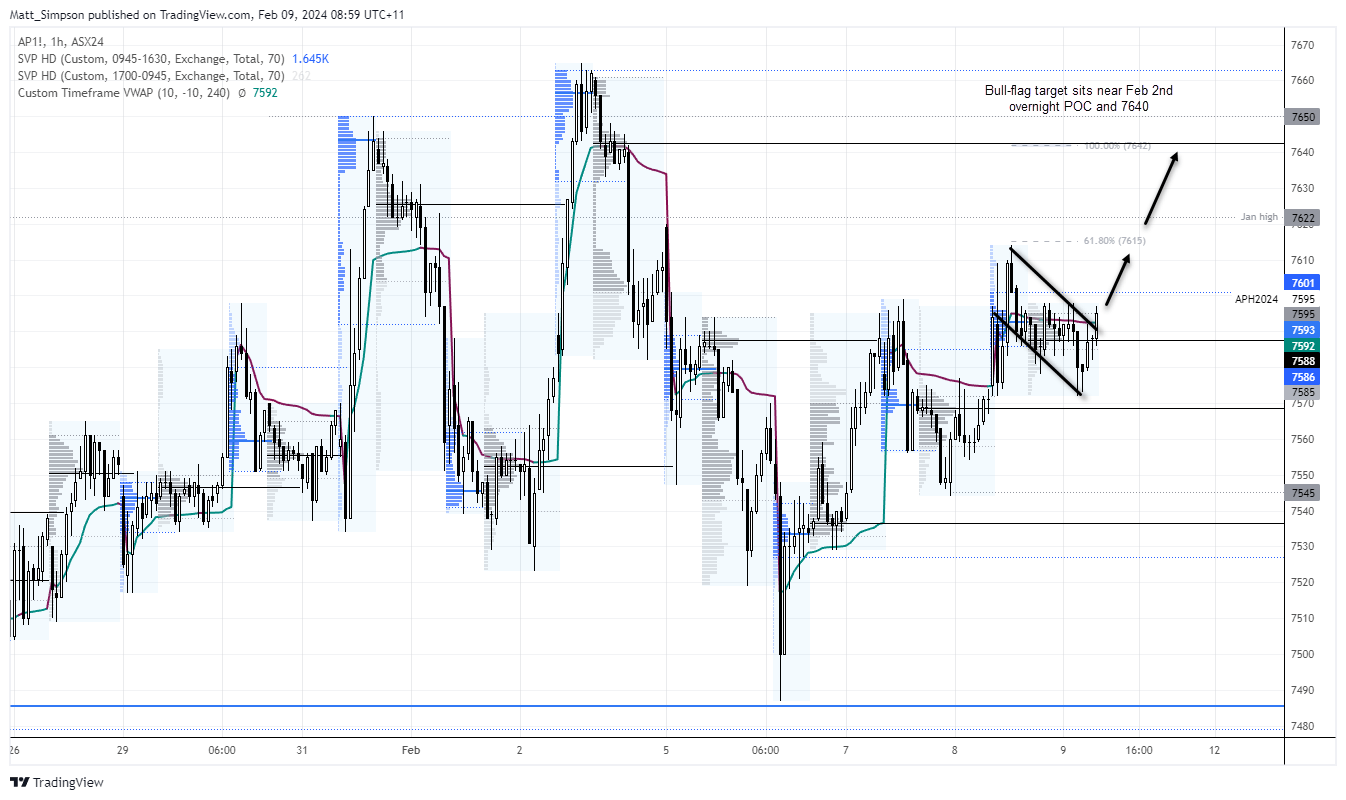

- A bull flag has formed on the 1-hour SPI 200 futures contract which projects a target near 7640 and the Feb 2nd overnight VPOC (most trading volume of the session)

- Resistance includes 7600, yesterday’s high around 7612 and the 7640 target

- Bullish can seek dips towards 7588 (overnight VPOC)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade