Nasdaq 100 Takeaways

- Earnings results from heavy hitters Microsoft and Alphabet/Google this afternoon will be a key catalyst.

- The year-to-date uptrend remains intact, potentially opening the door for a move up toward 16,000 if earnings results and the Fed decision are favorable.

- Only a break below support levels at 15,250 and 14,650 would erase the Nasdaq 100’s near-term bullish bias.

Nasdaq 100 Fundamental Analysis

Last week, we highlighted the Nasdaq 100’s 2nd worst day of the year, where the tech-heavy index fell more than -2% on the back of mediocre earnings results from Netflix and Tesla.

So far, bulls have stepped in to buy the dip, but the index is approaching its biggest hurdle of earnings season over the next two weeks, including results from Big Tech behemoths Microsoft and Alphabet, the parent company of Google, after the bell today. Traders expect $2.54 and $1.32 in EPS from MSFT and GOOGL respectively, but even more important than last quarter’s earnings will be the companies’ guidance for future profits and revenues (recall that disappointing guidance is part of what drove NFLX down more than -8% after earnings last week).

From a fundamental perspective, the next couple of weeks will be when the proverbial rubber hits the road for the Nasdaq 100. With the index still hovering near bull market highs and up more than 40% on the year, investor expectations are clearly elevated, leaving little room for error.

Nasdaq 100 Technical Analysis – NDX Daily Chart

Source: TradingView, StoneX

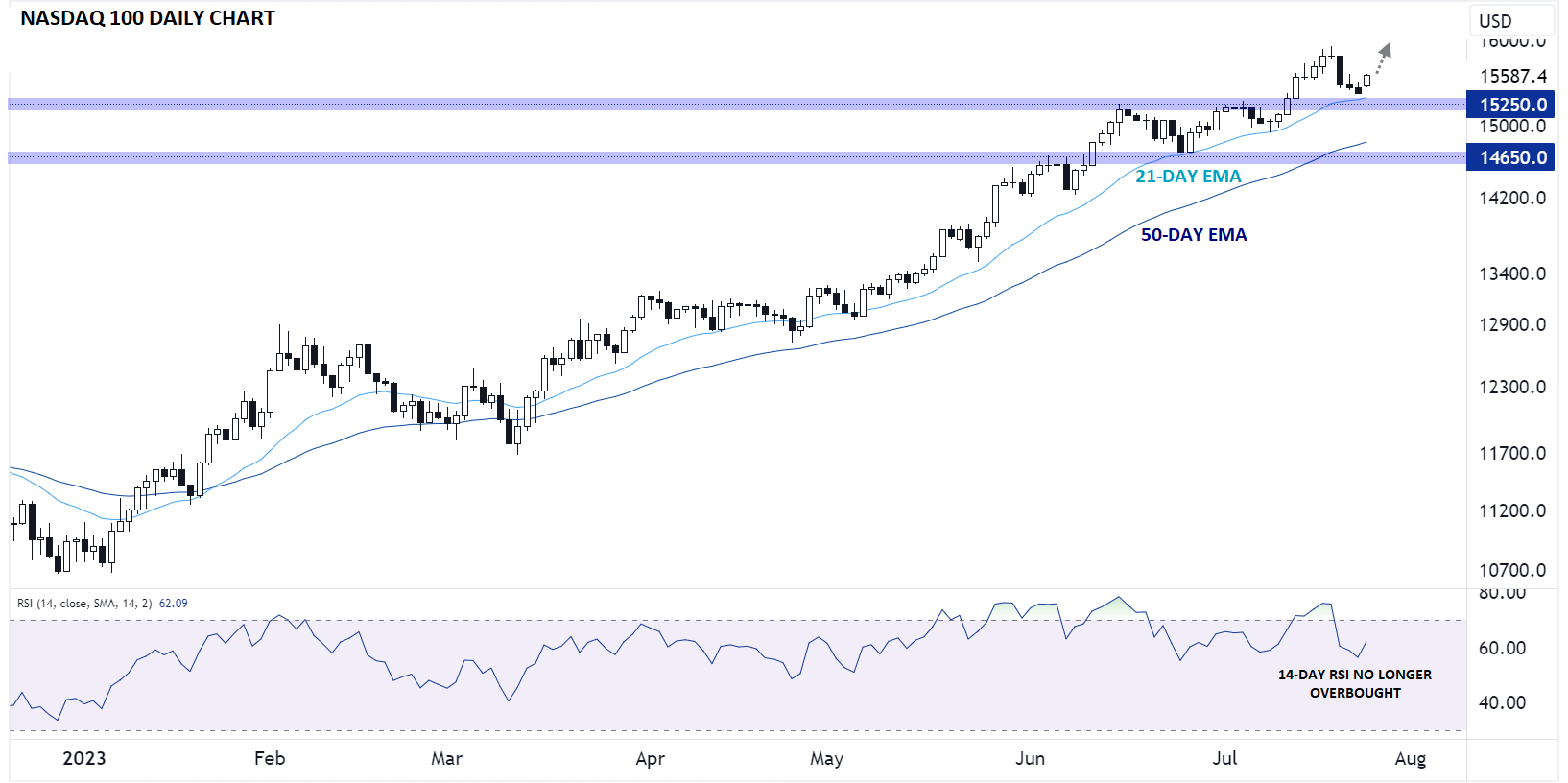

As the chart above shows, the Nasdaq 100 (NDX) remains in a healthy uptrend despite last week’s wobble, with prices holding comfortably above the short-term 21-day EMA and the medium-term 50-day EMA, as they have most of this year. Last week’s pullback alleviated the overbought condition in the 14-day RSI, potentially clearing the way for another leg higher if earnings results (not to mention tomorrow’s Federal Reserve meeting) are favorable.

For now, the path of least resistance remains to the topside for a potential retest of the 16,000 level. Only a break below previous-resistance-turned-support in the 15,250 area would call the established uptrend into question, with a break below support in the 14,650 area required to erase the bullish technical bias entirely.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX