Fed Key Points

- Momentum for an imminent Fed interest rate cut has waned amidst strong job growth and stubbornly above-target inflation.

- 3- and 6-month annualized Core CPI has turned higher in recent months, hinting that the disinflationary trend may be stalling

- Traders are pricing in a small, but non-zero, chance of a Fed rate hike in 2024. Those odds could grow with a couple more hotter-than-expected inflation reports.

Since the start of the year, traders’ expectations for the Federal Reserve's 2024 interest rate outlook have taken a sharp turn, going from pricing in seven 25bps (0.25%) interest rate cuts to just three such reductions today.

Why this sudden change?

It boils down to stubborn inflation rates and surprisingly strong US job market figures, which have thrown a curveball at the standard economic forecasts. Tackling the latter first, the monthly Non-Farm Payrolls report shows that the US economy created an average of over 210K net new jobs in the second half of 2013, barely a slowdown from the first half of the year and still well above the growth needed to keep up with population gains. Last month, we learned that the pace of job growth may, if anything, be accelerating at 353K in the first estimate.

While strong growth in the jobs market is certainly important, the developments on the inflation front are even more consequential to the Fed’s future interest rate path.

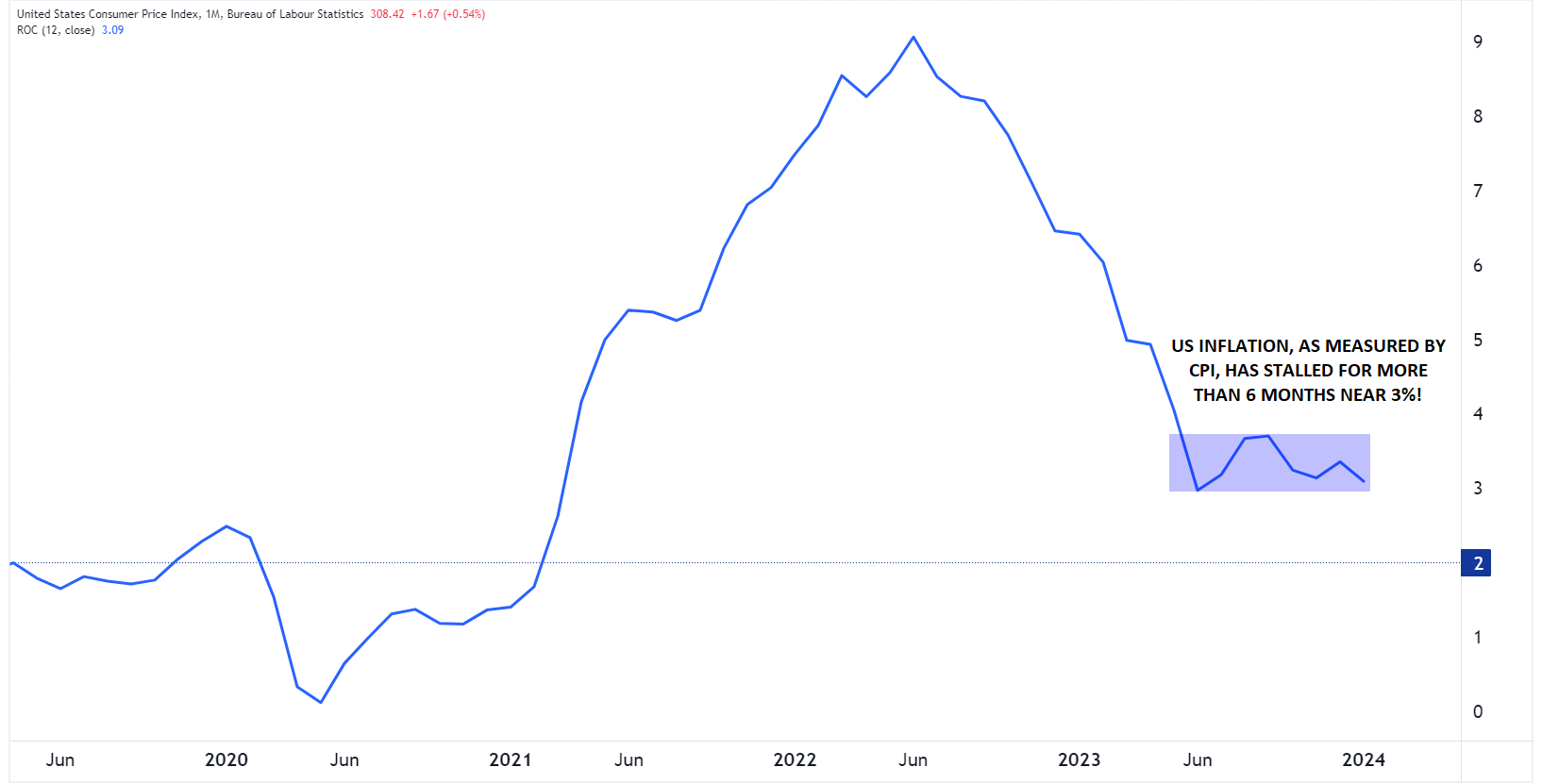

Persistent Inflation Woes

Lately, US inflation rates have been stuck on a plateau, showing little sign of dropping back to the Fed's long-term target of 2%. The Consumer Price Index (CPI) for January clocked in at a 3.1% increase from the previous year, overshooting economists' average predictions of a 2.9% rise. This marks the eighth consecutive month where inflation has hovered around or above the 3% mark.

Source: TradingView, StoneX

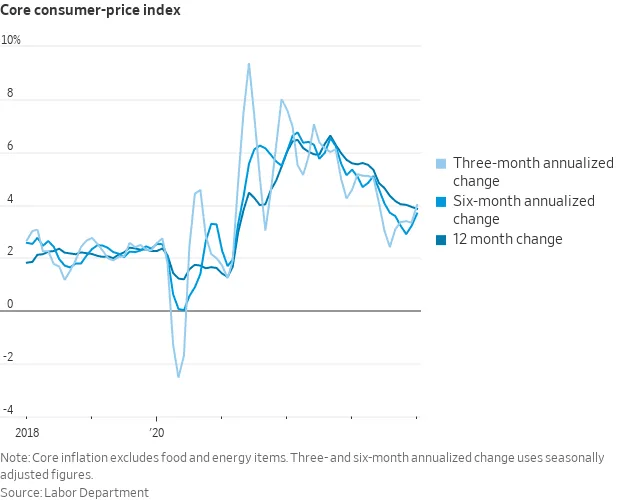

When we zero in on the core CPI—which strips out the more unpredictable food and energy prices—we find it's been sticking around the 4% mark since September. This January, it rose by 3.9% compared to last year, again outpacing the forecasted 3.7%:

While any given monthly reading is prone to one-off distortions, economists have noted that both the three-month and six-month annualized core inflation rates in January indicate that we're far from hitting our targets. The three-month rate jumped to 4% from 3.3%, and the six-month rate to 3.7% from 3.2%:

Source: Labor Department

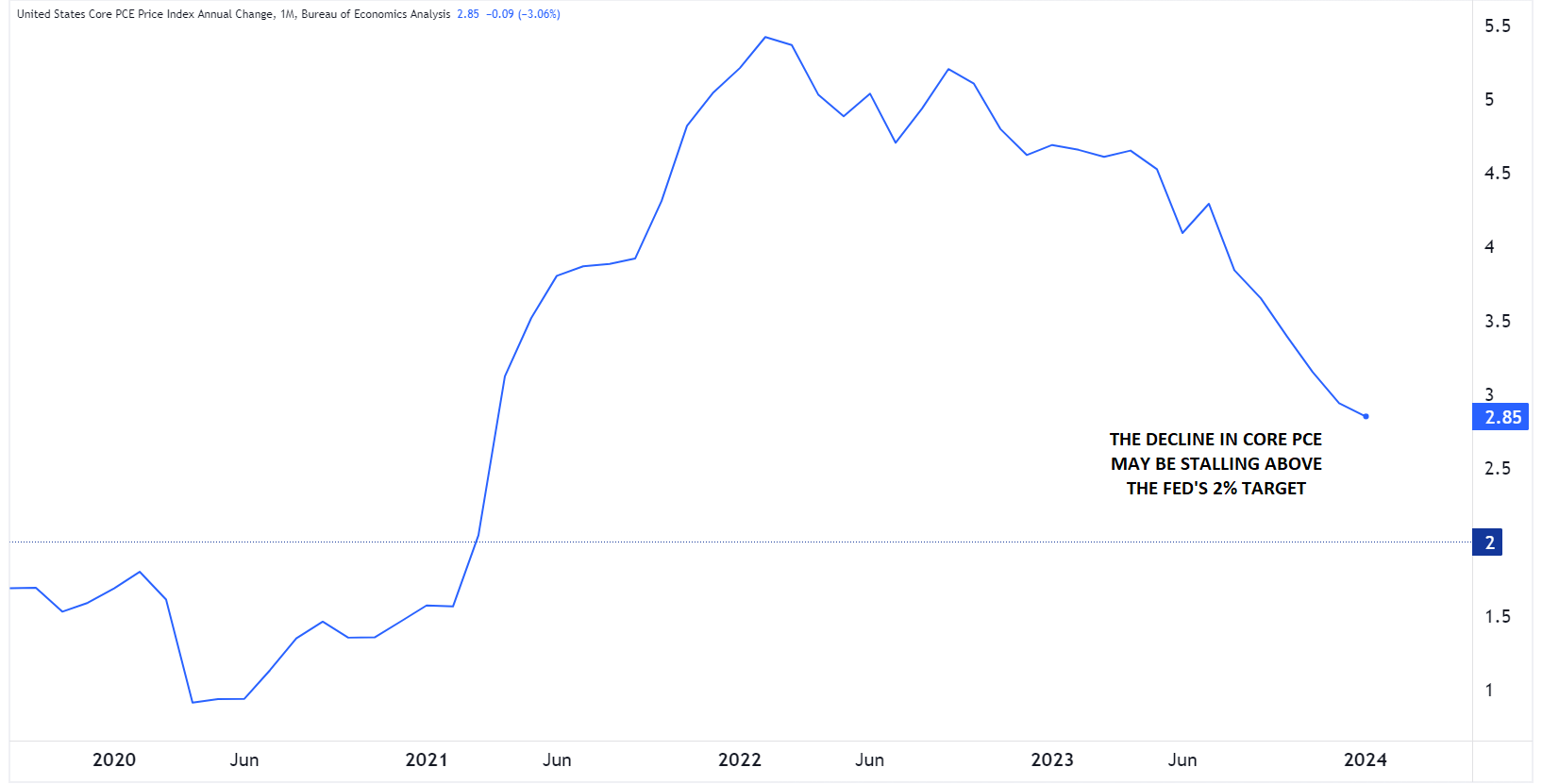

Many argue that the Fed pays closer attention to the Personal Consumer Expenditure (PCE) inflation index, also known as the PCE deflator—and they're not wrong. But here's the kicker: Even by that more conservative measure, the disinflationary (falling inflation) trend is showing signs of losing steam well above the Fed’s 2% target level:

Source: TradingView, StoneX

Will We See a 2024 Fed Rate Hike? Why it’s Not as Crazy as it Sounds

Recent inflation data has left market watchers a bit disillusioned. As noted above, the market was betting on more than seven rate cuts of 0.25% in 2024 as recently as the start of the year. Fast forward to now, and expectations have adjusted to just three cuts, aligning more closely with the Fed's own predictions. Notably, during this period, the yield on 10-year US government bonds has risen from 3.8% to 4.3%.

In a surprising turn, the market has even begun to factor in the possibility of a rate hike this year, though the probability remains low at ~8%. This is a significant development that few analysts saw coming, and even Fed Chair Jerome Powell seemed to dismiss the idea of a rate hike in the near term:

![]()

Source: Atlanta Fed Market Probability Tracker

This shift means investors are starting to hedge their bets, preparing for a potential increase in interest rates. But if the chance of a hike edges closer to 50%, we could be in for some rocky times in the markets.

A stronger US Dollar, rising government bond yields (meaning lower bond prices), and a possible correction in the stock market could be on the horizon, especially if upcoming inflation and job market data exceed expectations. But for now, most market forecasts don't predict such dramatic shifts.

The 2024 Presidential Election’s Impact on Fed Interest Rates

Everyone in the financial world is trying to pin down exactly how many rate cuts we might see in the US in 2024. Right now, no one's seriously considering the likelihood of a rate hike…but maybe they should.

Given the recent inflation data, there's a real chance that stubborn price pressures could throw a wrench in the works for both policymakers and market watchers.

Further confounding the outlook, November brings a tightly-contested Presidential election in the US, making the path forward even more fraught for the Fed, which prides itself on being politically independent. Historically, the US central bank has sought to avoid dramatic changes to monetary policy ahead of elections, but there have been election years in the past, like 2000 and 2004, when rate hikes were part of the landscape. At a minimum, the upcoming election may tip the central bank toward being more passive in either direction as we enter the second half of the year.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX