GBP/USD Q2 2024 forecast

- UK CPI is expected to be stickier than US inflation to the year end

- BoE downwardly revised UK growth & the Fed upwardly revised its GDP outlook

- The BoE & Fed are expected to start cutting rates in June

- Both central banks are expected to cut by 75 basis points

- A stronger US economy could support a bearish GBP/USD bias

- GBP/USD tests multi-year rising trendline support

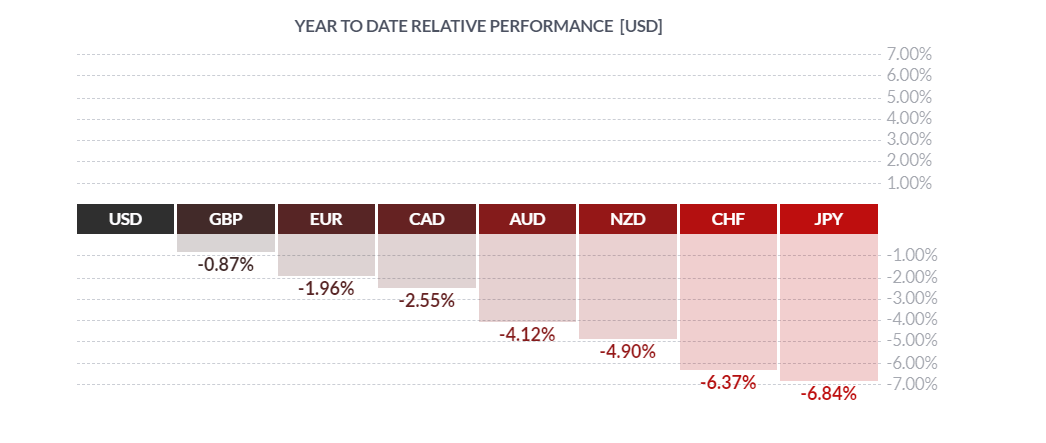

The pound was one of the strongest G10 currencies at the start of 2024, supported by the view that the BoE would be one of the last major central banks to start cutting interest rates.

Source: finviz

Sticky inflation, above the central bank's 2% target, and signs of a modest economic recovery saw the markets pricing the first BoE rate cut in August, compared to a June Fed rate cut. However, BoE expectations changed in the final weeks of the quarter, sending the pound sharply lower.

Looking out across the second quarter, attention will remain firmly on central bank rate cut expectations.

- The BoE meetings are on May 9 and June 20

- The Federal Reserve meetings are on April 30- May 1, and June 11-12.

Inflation

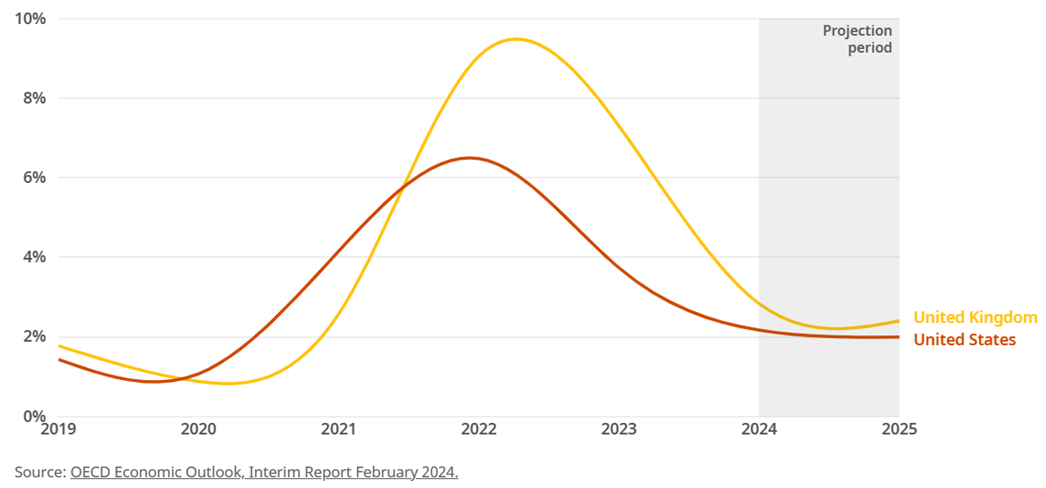

In recent quarters, inflation has been a central focus, key in deciding when central banks could start to cut rates.

UK CPI cooled to 3.4% YoY in February, marking a 3-year low. As the Office of Budget Responsibility (OBR) forecasts, it is expected to continue trending lower, potentially dropping towards the central bank's 2% target in April. While inflation is expected to trend towards 2% in the coming months, the BoE sees it rising to 2.75% in the latter part of the year, highlighting the bumpy road ahead.

Meanwhile, US inflation has been hotter than expected over the past two months, raising concerns that the final stretch to the Fed’s 2% target could be extended. The Fed upwardly revised its 2024 core inflation projection to 2.6%.

According to the OECD, UK inflation could remain above US inflation in Q2, which could see the market favour the Federal Reserve cutting interest rates ahead of the BoE, supporting the GBP versus USD.

GDP

The UK economy tipped into recession at the end of 2023. However, the monthly GDP data for January and timelier PMI suggest that the downturn will be short-lived and that a return to growth is on the cards in Q1, thanks to strength in the service sector. The services PMI for March remained solid at 53.5, above the key 50 level, indicating expansion as we head into the second quarter.

However, the outlook for the UK economy is still shaky. The BoE downwardly revised its growth forecasts in the February meeting from 0.2% in 2024 to 0%.

Source: BoE

Meanwhile, the US economy has proved more resilient, with solid PMI data. The US economy is expected to achieve a soft landing, and the Federal Reserve upwardly revised its growth forecasts for 2024 in the March meeting to 2.1%, up from 1.4% projected in December.

The US economy is expected to outperform the UK economy in Q2, which would favour the BoE cutting rates ahead of the Federal, supporting GBP/USD weakness in Q2.

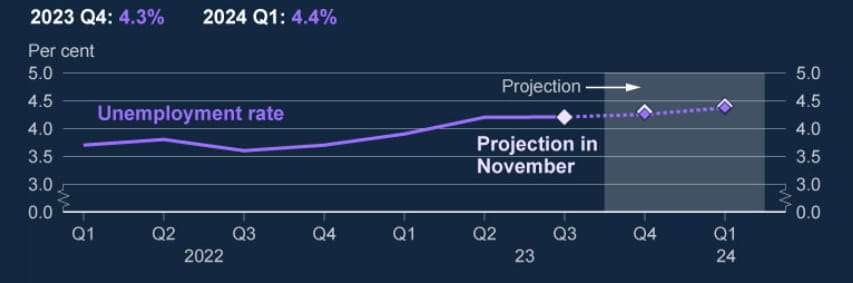

Labour market

UK jobs data shows some signs of weakening after unemployment ticked higher and job vacancies fell for a twentieth straight month. Wage growth slowed to 6.1%, its slowest pace since 2022, and is expected to continue trending lower. Looking ahead, unemployment is forecast to rise further to 4.4%.

Source: BoE

However, the National Living Wage will increase by close to 10% again in April; while this is unlikely to impact the wider pay numbers significantly, the BoE will want to see more evidence of pay slowing before acting to cut rates.

With solid job creation, the US jobs market has remained resilient, although wage growth could be starting to soften. The latest figures show a 0.1% MoM increase in wage growth. Unemployment also ticks higher at 3.9%.

While job creation in the US is stronger, wage growth is higher in the UK. However, the UK jobs market could cool faster, given the weaker economic growth outlook. This could drag on GBP/USD.

Rate cut expectations.

In the March MPC, the BoE left interest rates unchanged at a 15-year high, as expected. However, the vote split was less hawkish than expected, with the two policymakers who had previously voted for a rate hike voting for a cut. This pivotal meeting marked the first time that no policy members have voted to hike rates since 2021. It removed the final obstacles for the central bank to start cutting. Following the meeting, the market raised June rate cut expectations and priced in three cuts in 2024.

Perhaps the only point to be aware of is that the central bank will release a quarterly report in May and August but not June. While it is not unheard of for the central bank to change monetary policy without the quarterly projections, it is more usual that such decisions are taken using the quarterly projections.

In the final Fed meeting of Q1, the Federal Reserve left rates on hold at 5.25%—5.5%, as expected. Interestingly, the central bank upwardly revised its inflation and growth projections while still maintaining the three-rate cut guidance. This technically lowers the bar for a June rate cut.

After the March central bank meetings, the market is pricing in roughly equal probability of the rate cuts by the BoE and the Federal Reserve in June, at 70%. The market is also pricing 75-basis-point rate cuts by both the BoE and the Fed in 2024.

A word on energy

It's worth keeping an eye on oil prices, which have been grinding higher across the first quarter of the year. Higher oil prices often feed through the economy, turning into higher prices at the petrol pumps while infiltrating into price increases across industry sectors. Should we see, oil prices continue to rise across the second quarter of the year, which could be an obstacle to cuts by both the Federal Reserve and the Bank of England.

Politics

The governing Conservative party is not expected to call an election this quarter. However, there have been some rumblings about removing Prime Minister Rishi Sunak. So far, this seems like nothing more than speculation, but should these rumors prove to be more than speculation, the pound could be vulnerable.

Risks to watch for

One of the risks this quarter is that the US economy remains resilient, and US inflation stays sticky around these levels. In this case, the Fed could struggle to cut rates at the pace and scale that it has guided towards. Under these circumstances, the USD could push higher, pulling GBP/USD lower.

Conclusion

Both the Fed and the BoE are expected to cut rates in June and by 75 basis points this year, leaving little difference between the two central banks. This could support a range-bound move in GBP/USD this quarter.

However, Q2 UK growth is expected to be weak while the US economy could remain resilient. GBP/USD could come under pressure if data magnifies the divergence between the two economies.

GBP/USD forecast -technical analysis (weekly chart)

After facing rejection at the 200 SMA, GBP/USD is back-testing the rising trendline support dating back to late September 2022. A break below this support and 1.25 the psychological level is needed to expose the 100 SMA 1.2290 and 1.20 the October 2023 low.

Should the trendline support and 1,25 hold, buyers will look to rise above the 200 SMA at 1.2885. Above here, buyers could gain traction towards 1.3125, the 2023 high.