Traders are feeling generally optimistic as they sit down for the first “full” trading day of the new year, with major European indices trading more than 1% higher across the board at the start of the US session. Beyond the overall sense of optimism and opportunity that characterizes every new year, traders are watching two key macroeconomic stories to start the trading week:

China reopening

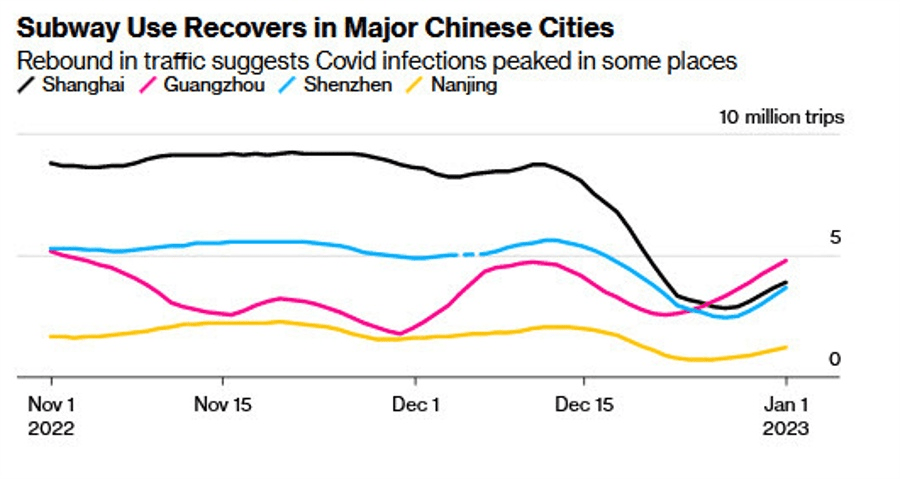

The world’s second-largest economy is one of the biggest sources of risk as we move through 2023, but based on some preliminary signs, China may be past the worst of its Covid surge as it seeks to transition out of the “Zero Covid” policy that characterized the last three years. While most traders are skeptical of traditional economic data coming out of the country, subway usage (a proxy for economic activity more generally) has risen over the last two weeks in a number of major Chinese cities according to Bloomberg:

Source: Bloomberg

There will undoubtedly be more suffering and setbacks to come, but markets are always forward-looking and based on the early evidence, China’s economy could be well on its way back to “normal” in the first quarter of the year, raising global growth as a whole for the coming year.

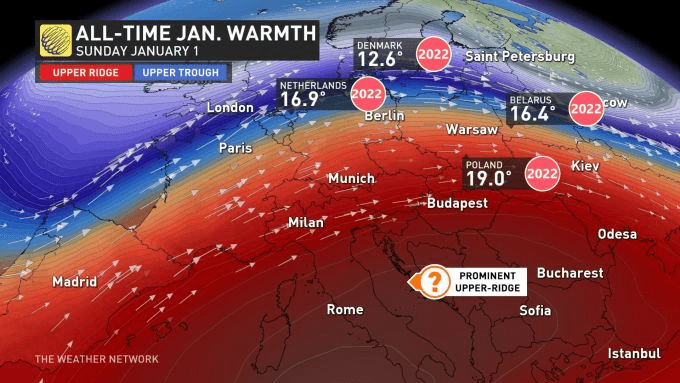

Europe’s heat wave

For months, traders have been concerned about natural gas shortages leading to an “energy crunch” in Europe amidst the ongoing Russia-Ukraine war, but after a relatively warm start to the winter, fears of a worst-case scenario were already fading… and that was before the weather around the New Year shattered thousands of temperature records across the continent. According to The Weather Network, temperatures were 15-20+ degrees Celsius above the average this time of year in many European cities:

Source: The Weather Network

With the odds of 2023’s direst economic scenarios for both China and Europe already fading, traders are understandably bidding up most global stock indices.

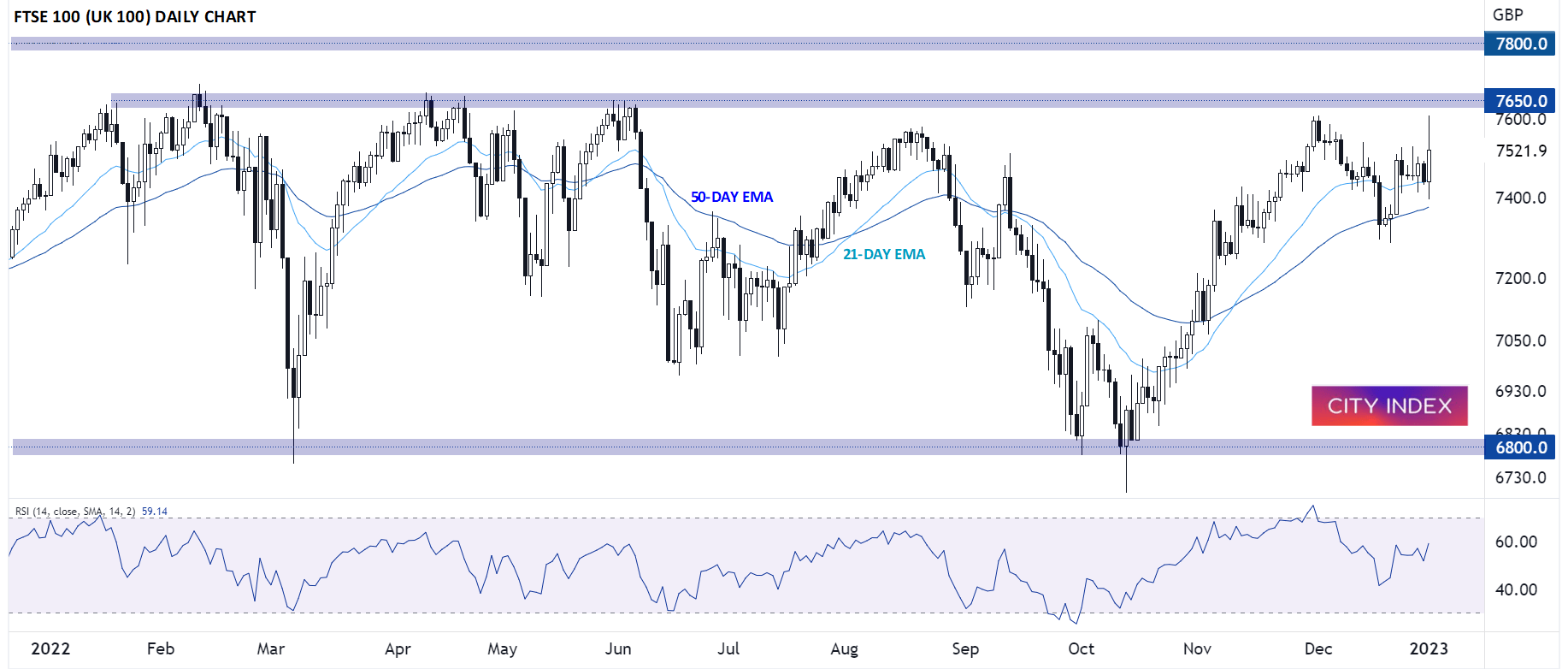

Index in focus: FTSE 100 (UK 100)

As we go to press, the equity market showing the most strength is the UK’s FTSE 100 (UK 100). The index is gaining nearly 1.5% to start the new year, and more importantly, it has rallied up to test its highest level in seven months and is within striking distance of its post-Covid highs in the 7700 area. The index consistently found resistance in this area throughout the first half of 2022, but if bulls are able to push it sustainably above the 7600-7700 range, a continuation toward the all-time record highs in the 7800-7900 zone is in play this month.

Source: Tradingview, StoneX

After a rough 2022 across the board for index investors, traders are hoping the New Year’s cheer can start 2023 off on the right foot!

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade