The Federal Reserve meeting this week is a highly anticipated spectacle, similar to a magic show with a renowned magician who has the power to make interest rates, inflation, and economic growth disappear or reappear with a wave of a wand.

Interest Rates

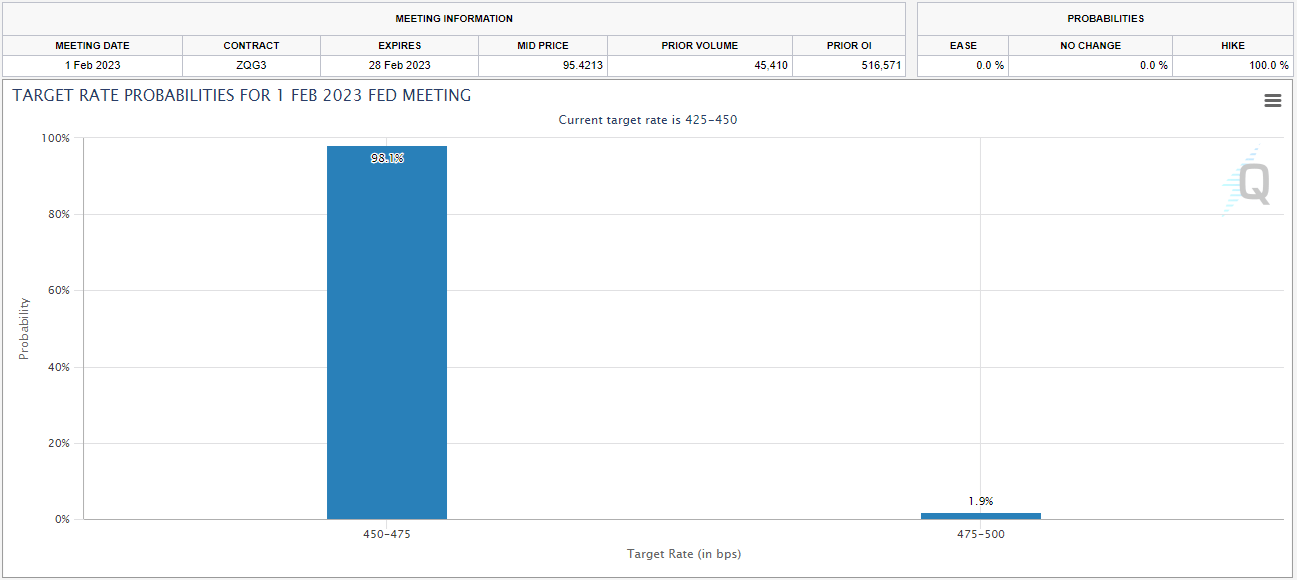

The current expectations are for the Fed to raise interest rates by 25bps to the 4.50-4.75% range. While this meeting’s interest rate decision is as close to a “done deal” as we ever see with central banks, any hints about how Powell and Company see interest rates evolving in the March meeting and beyond will still move the market.

Source: CME FedWatch

Inflation

The magician's challenge will be to balance inflationary pressure with economic growth. Inflation has been falling recently, but some at the Fed still believe there’s a risk that price pressures become entrenched in a reinforcing cycle. The Fed has maintained a target inflation rate of 2% and provide an update on the current inflationary trend in its statement; for its part, the market will be keen to see if the Fed starts to relax its hawkish rhetoric around inflation.

Economic Growth

Economic growth remains a key concern for the Fed, as the US and global economy show signs of slowing amidst higher interest rates. The Fed's recent statement indicated that economic activity has moderated, with the pace of job gains slowing and consumer spending plateauing. The Fed will need to assess whether the current pace of growth is sustainable and if additional support is required.

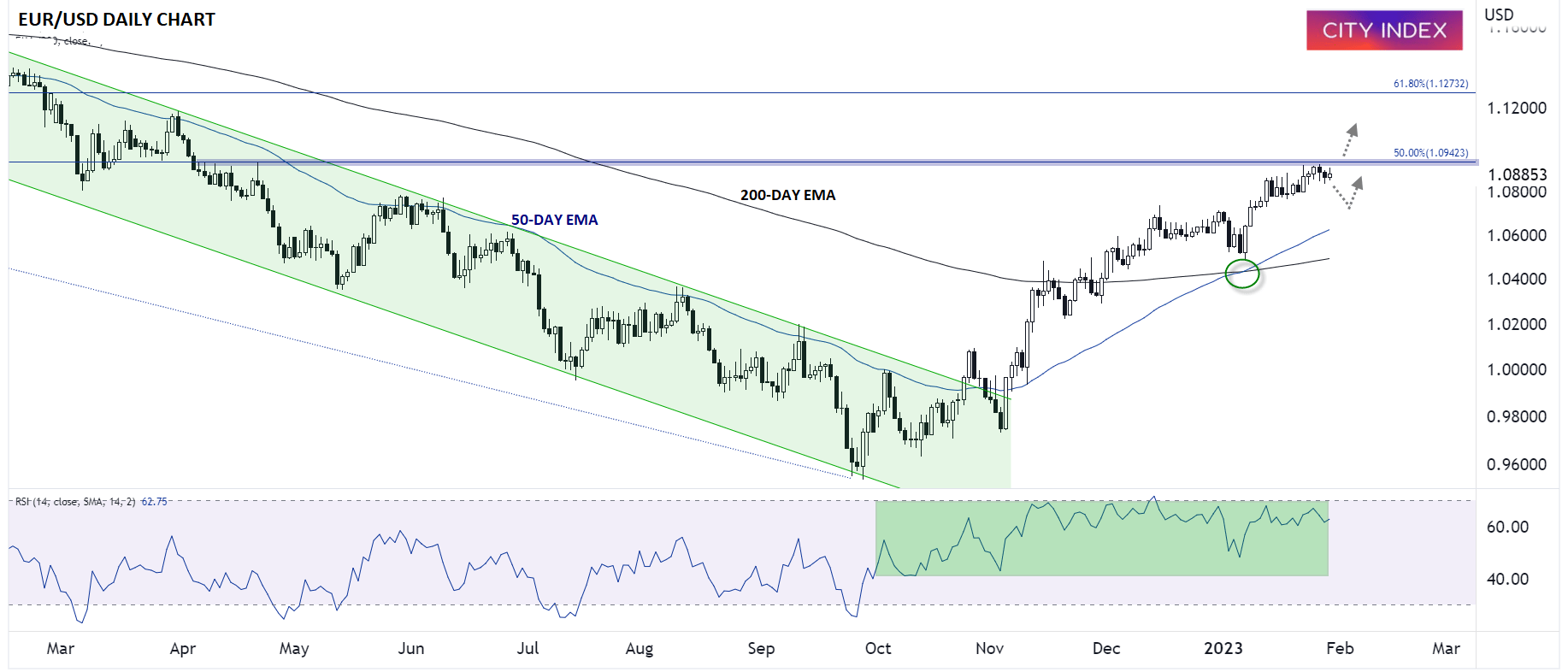

Chart to watch: EUR/USD

The world’s most widely-traded currency pair has been trending consistently higher (showing weakness in the US dollar relative to the euro) since bottoming in late September. As the chart below shows, the uptrend remains healthy, with prices consolidating near the yearly highs, the daily RSI locked firmly in a bullish zone, and a recent “golden cross” of the 50-day EMA above the 200-day EMA all supporting prices.

Unless we see a truly shocking development, traders will likely continue to buy dips in EUR/USD, with potential for the pair to break out to a new 10-month high above 1.0940 if the Fed is relatively dovish compared to the ECB.

Source: TradingView, StoneX

The Big Question

The big question on everyone's mind is, will Fed Chairman Powell be able to pull off another successful performance? The market is watching with bated breath, as the outcome of this meeting could set the tone for the rest of the year. Will the magician deliver another outstanding performance and leave the audience in awe, or will he drop the ball and cause market turbulence?

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade