Fed Key Points

- The FOMC left interest rates unchanged in the 5.25-5.50% range, as expected, and the median Fed member still expects 3 rate cuts in 2024.

- Chairman Powell sounded like someone who was looking for an excuse – any excuse – to cut interest rates in his press conference.

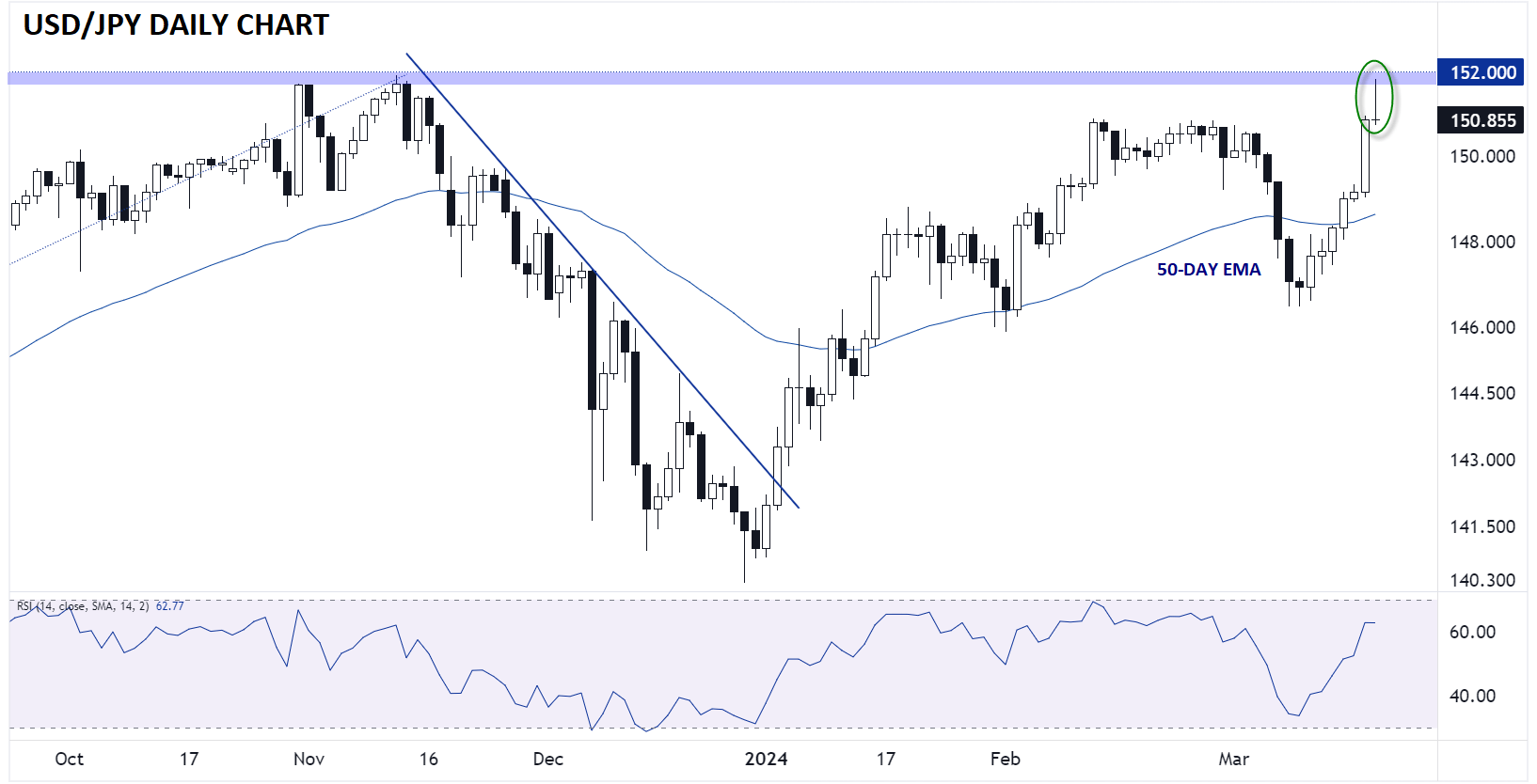

- USD/JPY reversed off 34-year highs near 152.00 – have we seen a near-term top form?

What Was the Fed Interest Rate Decision?

The Federal Reserve’s FOMC left interest rates unchanged in the 5.25-5.50% range, as expected.

There were no changes to the central bank’s balance sheet plans.

This is the fifth consecutive meeting where the Fed left interest rates unchanged.

Fed Monetary Policy Statement

This section will be short: The FOMC made only one small tweak to its statement, removing the reference to job gains “moderating” since early last year:

Source: FOMC

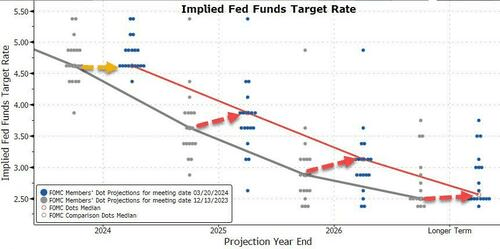

Fed Dot Plot and Summary of Economic Projections

As expected, the evolution (or lack thereof) of the Fed’s “dot plot” of interest rate expectations was a key focus for the market. Defying many analysts’ expectations for a decline to just two expected interest rate cuts this year, the median Fed member still expects three rate cuts in 2024 (by one):

Source: FOMC, Zerohedge

Notably however, the median Fed member did revise up their forecast for interest rates in 2025 to 3.9%, meaning that only three interest rate cuts are expected next year, down from four in the December 2023 Fed meeting. For what it’s worth, the 2026 interest rate forecast was similarly revised up by 25bps.

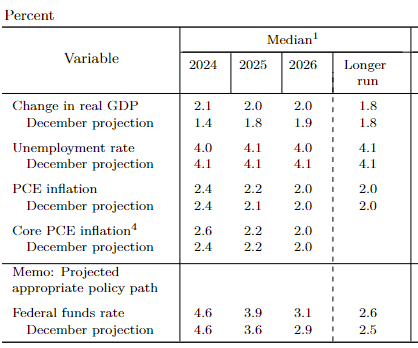

As for the more traditional economic forecasts, there were several notable updates to the 2024 forecasts:

- The Core PCE inflation forecast rose from 2.4% to 2.6%

- The unemployment forecast fell from 4.1% to 4.0%

- The GDP forecast rose sharply from 1.4% to 2.1%

It’s a bit early to get too worked up about longer-term forecasts, but the Fed also revised up its forecasts for GDP in 2025 and 2026, with minimal tweaks to the 2026 forecasts.

Source: FOMC

Fed Chairman Powell’s Press Conference Analysis

As we’ve noted in the past, Chairman Powell has shown a consistent tendency to “walk back” or moderate the message from the Fed’s monetary policy statement in recent meetings, but as we go to press, he seems to be looking for reasons to cut interest rates if inflation

Headlines from Chairman Powell’s press conference follow (emphasis mine):

- ECONOMY HAS MADE CONSIDERABLE PROGRESS, INFLATION HAS EASED SUBSTANTIALLY.

- ONGOING PROGRESS NOT ASSURED THOUGH, THE PATH FORWARD IS UNCERTAIN.

- RISKS TO ACHIEVING FED GOALS ARE MOVING INTO BETTER BALANCE.

- LABOR DEMAND STILL EXCEEDS LABOR SUPPLY, GDP FORECASTS WERE REVISED HIGHER BECAUSE OF DATA ON LABOR SUPPLY.

- NOMINAL WAGE GROWTH HAS BEEN EASING.

- INFLATION EXPECATIONS REMAIN WELL ANCHORED.

- OUR POLICY RATE IS LIKELY AT ITS PEAK.

- WE ARE PREPARED TO KEEP RATES HIGH LONGER IF NEEDED.

- UNEXPECTED WEAKNESS IN THE LABOR MARKET COULD WARRANT A RESPONSE TOO.

- ON THE BALANCE SHEET, WE DISCUSSED ISSUES RELATED TO SLOWING PACE OF DECLINE IN HOLDINGS, OUR GENERAL SENSE IS WE WILL START RUN OFF FAIRLY SOON.

- THE PROJECTIONS DO NOT MEAN HIGHER TOLERANCE FOR INFLATION.

- THERE'S SOME CONFIDENCE THAT LOWER MARKET RENT INCREASES IN HOUSING WILL SHOW UP OVER TIME, I'M JUST NOT SURE WHEN THAT WILL BE.

- THE RISKS ARE REALLY TWO SIDED NOW.

- THOSE JANUARY AND FEBRUARY INFLATION NUMBERS DID NOT ADD TO OUR CONFIDENCE.

- WE WANT TO SEE MORE DATA THAT GIVES US HIGHER CONFIDENCE ON INFLATION MOVING DOWN SUSTAINABLY.

- I DON'T THINK WE KNOW IF RATES ARE GOING TO BE HIGHER IN THE LONGER RUN.

- IT IS STILL LIKELY IN MOST PEOPLE'S VIEW THAT WE WILL HAVE RATE CUTS THIS YEAR, BUT IT DEPENDS ON THE DATA.

- I'M LOOKING FOR DATA CONFIRMING LOW-INFLATION DATA LAST YEAR.

- ULTIMATELY, WE DO THINK FINANCIAL CONDITIONS ARE WEIGHING ON ECONOMIC ACTIVITY.

- WE TEND TO SEE A LITTLE BIT STRONGER INFLATION IN THE FIRST HALF OF THE YEAR.

- WE NEED TO TAKE TIME TO ASSESS IF RECENT INFLATION REPRESENTS MORE THAN BUMPS IN THE ROAD.

- WE ARE CLOSELY WATCHING LAYOFFS, INTIAL CLAIMS ARE VERY VERY LOW.

- WE DO EXPECT THE UNEMPLOYMENT RATE TO MOVE UP.

US Dollar Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

Any time we see major US economic data and developments, USD/JPY tends to have the “cleanest”, most logical reaction. As the daily chart above shows, USD/JPY has reversed sharply after nearing its 34-year high near 152.00 earlier today. As long as we don’t see any late-breaking surprises from Mr. Powell, it’s possible that the pair has seen a near-term top and could continue to edge lower in the coming days.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX