- EUR/USD forecast has been lifted by falling Fed hike expectations and hawkish ECB

- German data continues to point to gloomier outlook

- Lagarde and Knot comments point to more rate increases

The EUR/USD is as flat as a pancake this week, but after the recent weakness, it may be about to start rising again. While German data has softened, ECB’s hawkish rhetoric hasn’t. What’s more, the Fed’s rate hike probabilities have fallen, which has increased the dollar’s correction potential and thereby improved the EUR/USD forecast. With the FOMC already entering the black-out period, and just a couple of important data pointers to watch between now and the June 14 meeting, there won’t be many catalysts to fuel the dollar rally directly.

EUR/USD forecast: Weak German data vs. hawkish ECB

Piling the pressure on the euro has been weak German data and there was more of that this morning as the Eurozone’s economic powerhouse reported a meagre 0.3% rise in industrial production in April – less than expected and make back a tiny bit of the 3.4% drop in March. Expectations had been for a 0.6% rise. This comes after German manufacturing PMI data last week shrank at its fastest pace in three years. German factory orders fell 0.4% in April, among other misses.

So, incoming data paints a gloomy outlook for the German economy but that hasn’t stopped the ECB from being consistently hawkish. And it is precisely this why the EUR/USD is continuing to hold its own relatively well in recent days.

Indeed, one ECB official who is not so dovish is Knot, who said the central bank should not hesitate to keep raising rates if inflation stays highs, and foresees rate increases in the next two meetings. The ECB’s subsequent meetings will become data-dependent, he added.

ECB President Christine Lagarde yesterday reiterated her call for more tightening.

US dollar weakens

Boosting the EUR/USD forecasts is the slight decline in Fed hawkish expectations after Monday’s publications of a weak ISM services PMI data. The market is pricing in around 81% probability that the Fed will keep rates on hold next week, according to the CME FedWatch tool.

On Monday, fresh doubts emerged about whether the Fed will hike interest rates at all this summer, as the latest ISM services PMI raised concerns the US economy is heading for a recession. The latest data came after Friday’s jobs report showed a rise in both jobs gained and the rate of unemployment, leaving traders guessing as to which employment survey to trust. Accordingly, the mixed jobs report could not convince investors fully to price in more than a 50% probability of a June hike. Already lower, the odds of a June hike tumbled to near 20% after the ISM PMI showed worrying signs.

The next big US data release is the inflation report, due for publication on June 13th, a day ahead of the FOMC’s rate decision.

EUR/USD Forecast: Technical analysis

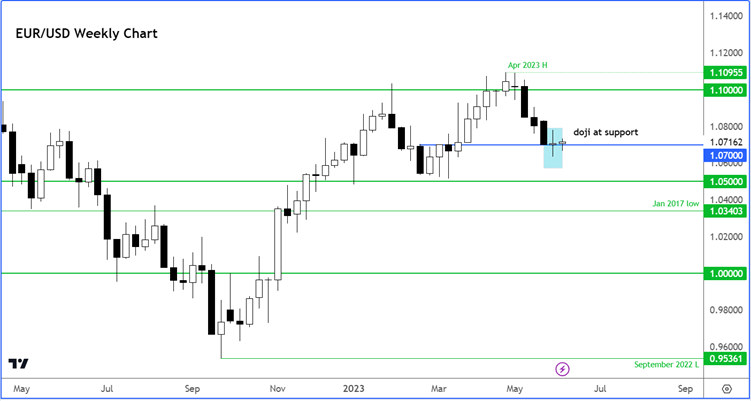

The weekly chart of the EUR/USD shows price made a small doji candle at around the key 1.07 support area last week, ending a streak of 4 losing weeks. The indecisiveness suggests that the bearish momentum has faded and that the bulls may step back here. If so, we could see the exchange rate climb back towards 1.10 area in the coming weeks, Fed permitting.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade