- AUD is widely regarded as being a proxy for all things China, including the CNH

- A such, it’s not unusual for USD/CNH and AUD/USD to move in lockstep

- USD/CNH broke out of its trading range on Tuesday but AUD/USD did not

- China will release its monthly data dump later Wednesday

The Australian dollar is widely regarded as being a proxy for all things China: it’s economic performance, trends in financial markets and even the Chinese currency, the yuan. Often, movements in AUD can look like they’re in lockstep with the CNH, as demonstrated earlier this year when both hit fresh pandemic- era lows against the US dollar. As a free floating G10 FX name aligned to China, many investors see the AUD as a safer way to express a view on China than investing in China itself.

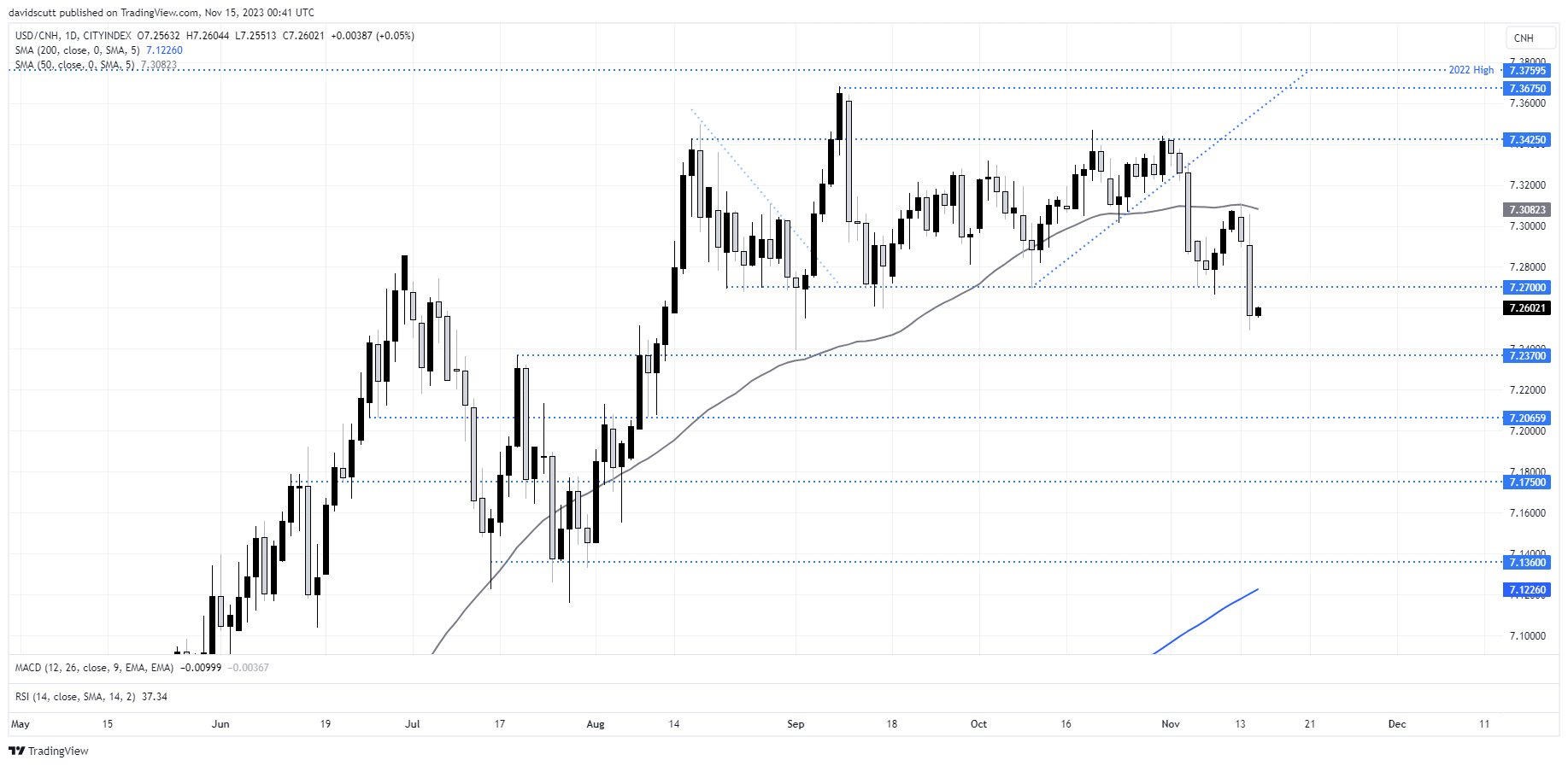

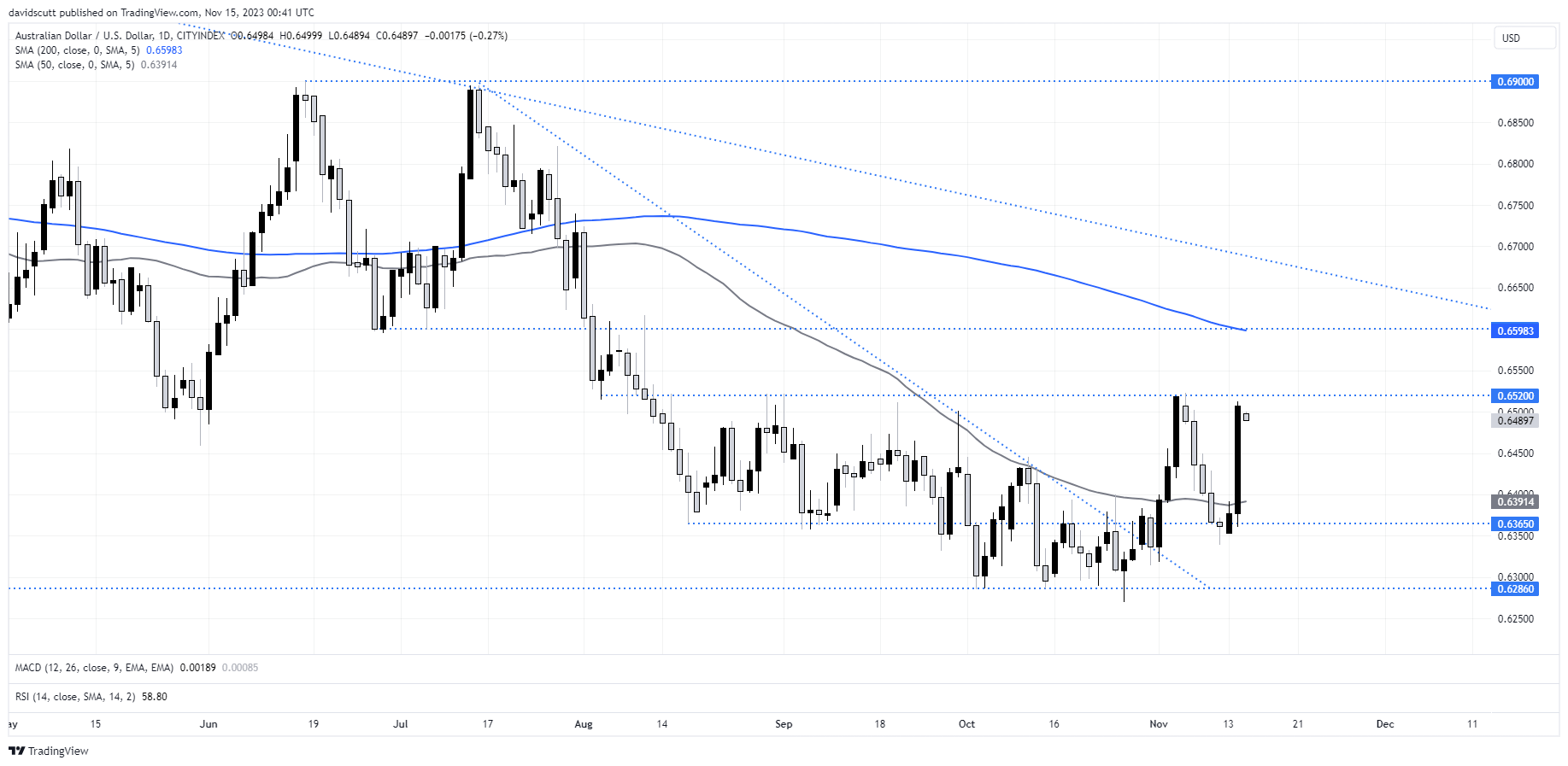

Given how close the relationship between the currencies can be at times, it’s noteworthy to see how both fared against the US dollar on Tuesday following the release of the latest US consumer price inflation report. Both currencies enjoyed large gains against the greenback, but only the USD/CNH managed to break out of the sideways trading range it’s been stuck in since August.

USD/CNH breaks sideways range

AUD/USD remains stuck in sideways range

As seen in the AUD/USD daily chart, it too has been sideways range trading over pretty much the same period but didn’t manage to break free like the CNH. As such, it will be worthwhile keeping an eye on whether USD/CNH can kick on with the move as it will likely increase the risk the AUD/USD may do the same by clearing resistance at .6520.

Markets will receive updated economic data from China later Wednesday with the release of retail sales, industrial output, fixed asset investment (including property investment) and unemployment figures for October. With a weak outcome widely expected based on soft economic data from China released so far, any unexpected outperformance could see AUD/USD join the yuan in breakout territory.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade