Market Summary:

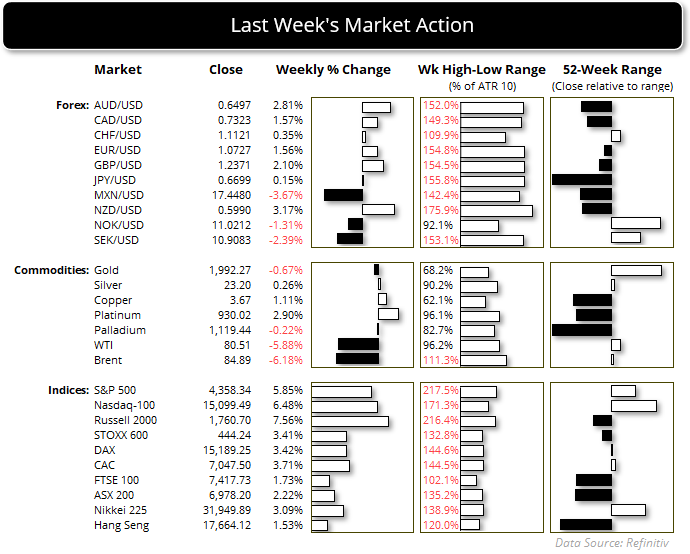

- The US dollar was the weakest major currency on Friday (and last week) following a softer-than-expected nonfarm payroll report

- The US economy added just 150k jobs October, compared with 180k expected and 197k prior (September’s figure was also downgraded from 336k)

- The unemployment rate rose to a 21-month high of 3.9% and average hourly wages (a key inflationary input) softened further to bolster bets that the Fed have reached their terminal rate

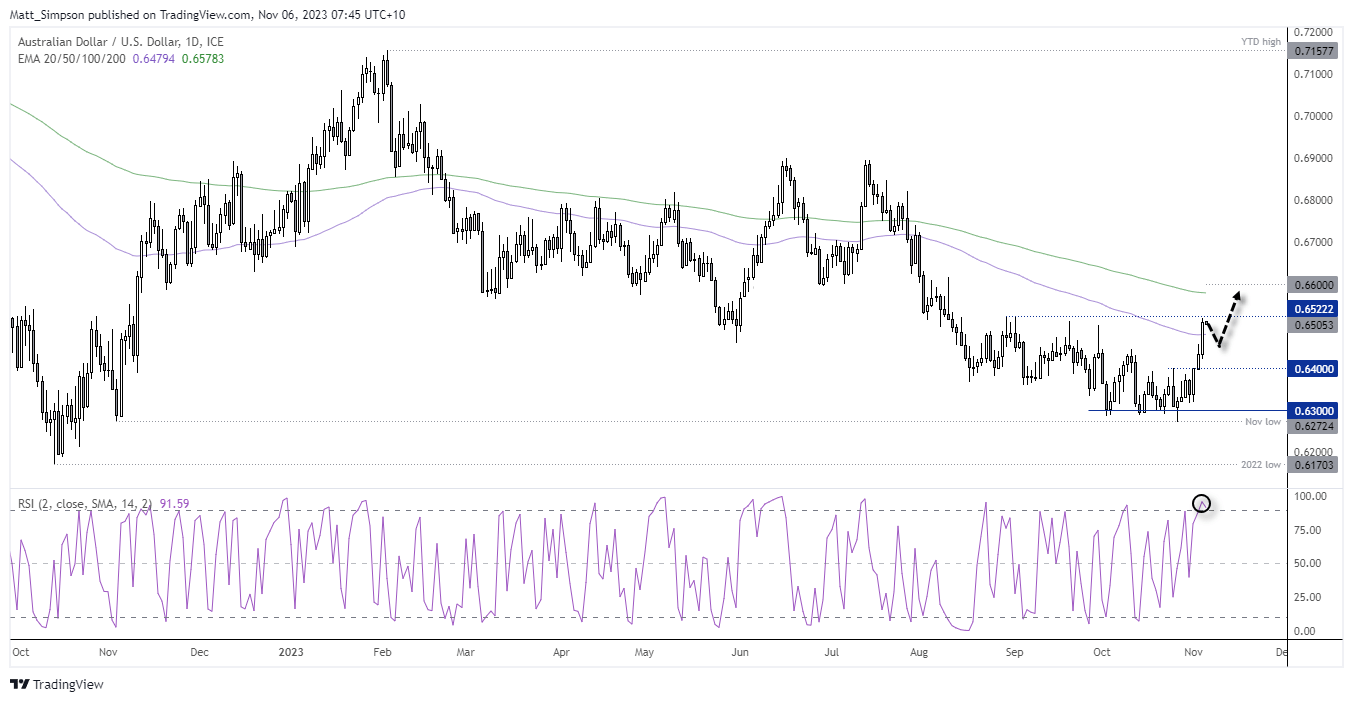

- The US dollar suffered its worst weekly performance in four months, allowing AUD/USD to enjoy its best week of the year and close above 65c. AUD and NZD were also the strongest forex major last week.

- The US 2-year yield fell to a 2-month low and the 10-year a 3-week low, allowing risk assets to rally

- The S&P 500 and Nasdq 100 posted its strongest weekly gain in twelve months

- The RBA is expected to raise interest rates by 25bp tomorrow according to Bloomberg survey, with an “overwhelming majority” of economists tipping the cash rate to rise to 4.35% and break a 4-meeting pause. RBA cash rate futures only imply a 50% chance of a hike, although it is worth noting that they have been less reliable of late with them implying a 100% chance of a hold at one of their more recent hikes.

- Gold prices saw another break above $2000 on Friday but it failed to see a daily close above this key level, to once again underscore that it has entered a period of choppy trade in the daily timeframe after a strong rally from $1813 at the beginning of October

- WTI crude oil was lower for a second consecutive week and formed a bearish engulfing candle on Friday. $80 is holding as support for now, a break beneath which brings the $77.33 high into focus for bears.

Events in focus (AEDT):

- 11:00 – Australian inflation expectations (Westpac-Melbourne Institute)

- 11:30 – Australian job adverts (ANZ)

- 11:30 - Japan services PMI

- 18:00 – German factory orders

- 20:00 – Eurozone composite, services PMI – final (S&P Global)

- 20:30 – UK construction PMI

- 20:30 – Eurozone Sentix investor confidence

- 02:00 – US consumer confidence (Conference Board)

- 02:00 – Canada Ivey PMI

- 03:00 – Fed Cook speaks

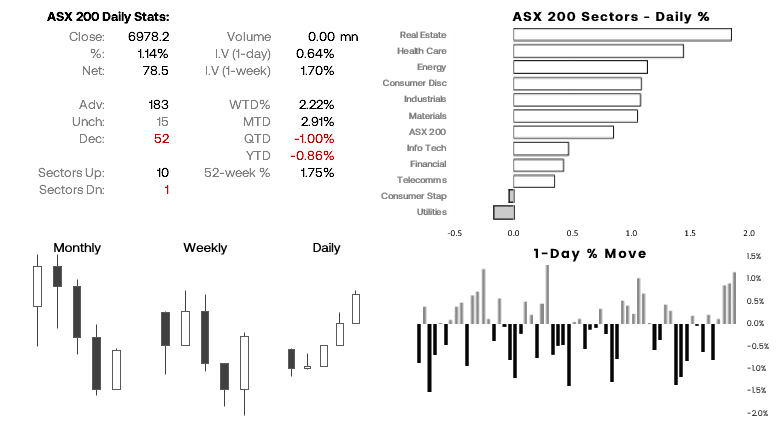

ASX 200 at a glance:

- The ASX 200 rallied for a fourth day on Friday, and enjoyed its best daily performance in seven weeks

- 8 of its 11 sectors rose last week, led by real estate and info tech

- 7,000 is a likely resistance level today ahead of tomorrow’s RBA meeting, with expectations of a rate hike (where a hawkish hike could cap further gains over the near-term)

AUD/USD technical analysis (daily chart):

The weak nonfarm payroll report has cemented expectations that the Fed have reached their peak rate, and renewed expectation of an RBA hike tomorrow has sent AUD/USD strongly higher. The Aussie has closed above 65c but stalled just beneath the August 29 high, which is acting as resistance during early Asian trade. With the RSI (2) overbought with prices below resistance, perhaps we’ll see a retracement have of tomorrow’s RBA meeting. But with a hike now fully expected, it may take a hawkish hike (such as the obligatory comment that “further tightening may be required”) to see it materially rise after the meeting. And that brings the 200-day EMA into focus around 66c.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade