Market Summary:

- Jerome Powell hinted that the Fed may need to raise interest rates further, although vowed to “proceed carefully as we decide to tighten further or, instead, to hold the policy rate constant and await further data”

- Whilst Powell’s Jackson Hole speech was not as hawkish as the one he delivered in 2022, it seems to have convinced markets that at least one more rate hike could be in the pipeline

- Fed Fund futures imply an 85.5% chance of the Fed keeping rates on hold in September, although they are beginning to price in another 25b hike in November with a 48.4% probability

- Federal Reserve member Loretta Mester also said that the Fed may need to hike one more time, on the sidelines of the Jackson Hole conference

- The US 2-year yield closed at a 17-year high of 5.06% - its highest weekly close since June 2006

- The US dollar index rose for a sixth week, although it gave back half of the Jackson Hole gains in the second half of Friday’s session

- Friday produced a spinning top Doji just beneath the May high, so perhaps the dollar’s rally is losing steam

- Gold also produced a spinning top Doji around 1920

- Wall Street took Powell’s speech within its stride with the S&P 500, Nasdaq 100 and Dow Jones all printing small bullish candles on Friday

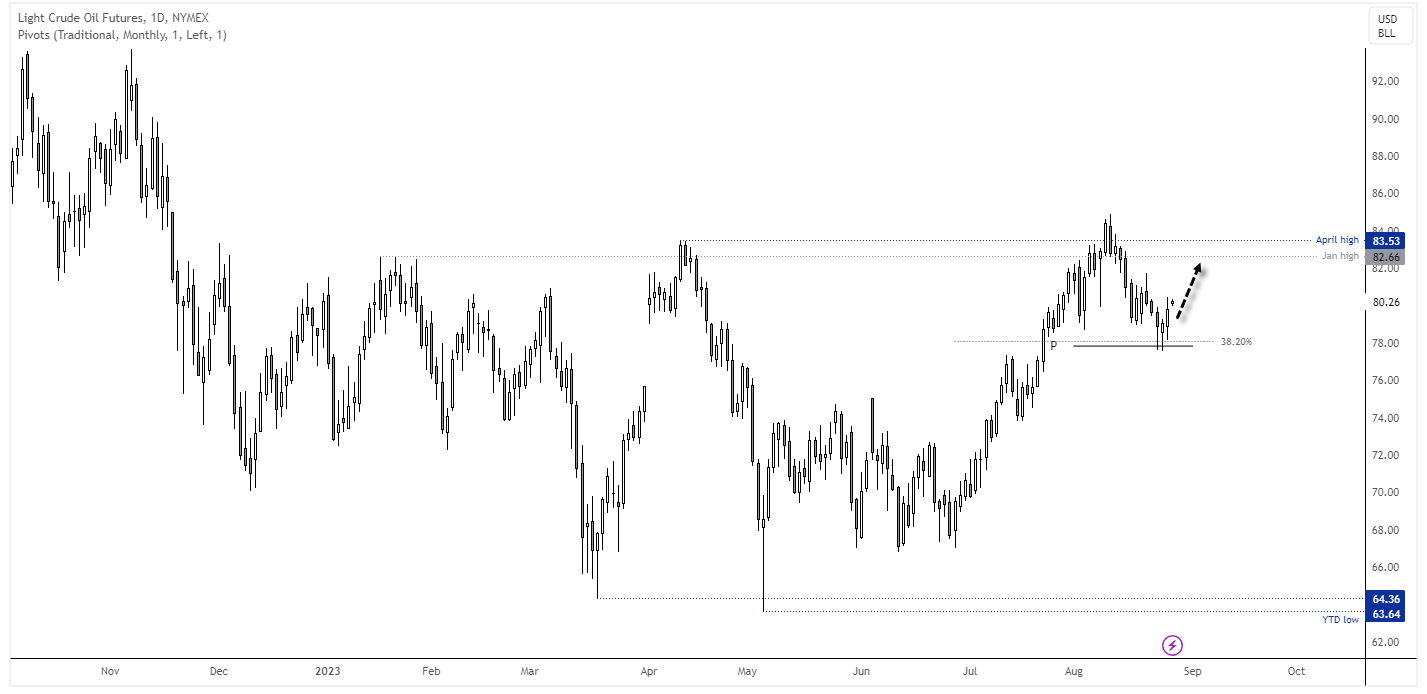

- WTI crude oil rose for a second day on Friday and has gaped up above $80 today, thanks to rising diesel prices, all in oil rigs and a fire at a key refinery in Louisiana

- China reduced stamp duty on stock trading from today in an attempt to boost market sentiment.

- Bank of England (BOE) Deputy Governor Ben Broadbent warned that UK interest rate may have to stay high “for some time yet”

- Australia’s Treasurer Jim Chalmers said over the weekend that they are watching China “very closely” because it has “obvious implications for us here in Australia”

- ECB member Martins Kazak warned that it may be too early for the ECB to pause their tightening cycle

Events in focus (AEDT):

- 11:30 – Australian retail sales

- UK public holiday

ASX 200 at a glance:

- The ASX 200 was lower for a second consecutive week, although the high to low range was less than half of the week prior

- Support was also found at the 100-week EMA just above 7100

- The mild gains on Wall Street Friday and 0.28% rise of SPI futures suggests the ASX 200 may hold above Friday’s low today

- 7100 and 7090 and key support levels for bulls to defend, 7148-7150 is a key resistance zone for intraday traders

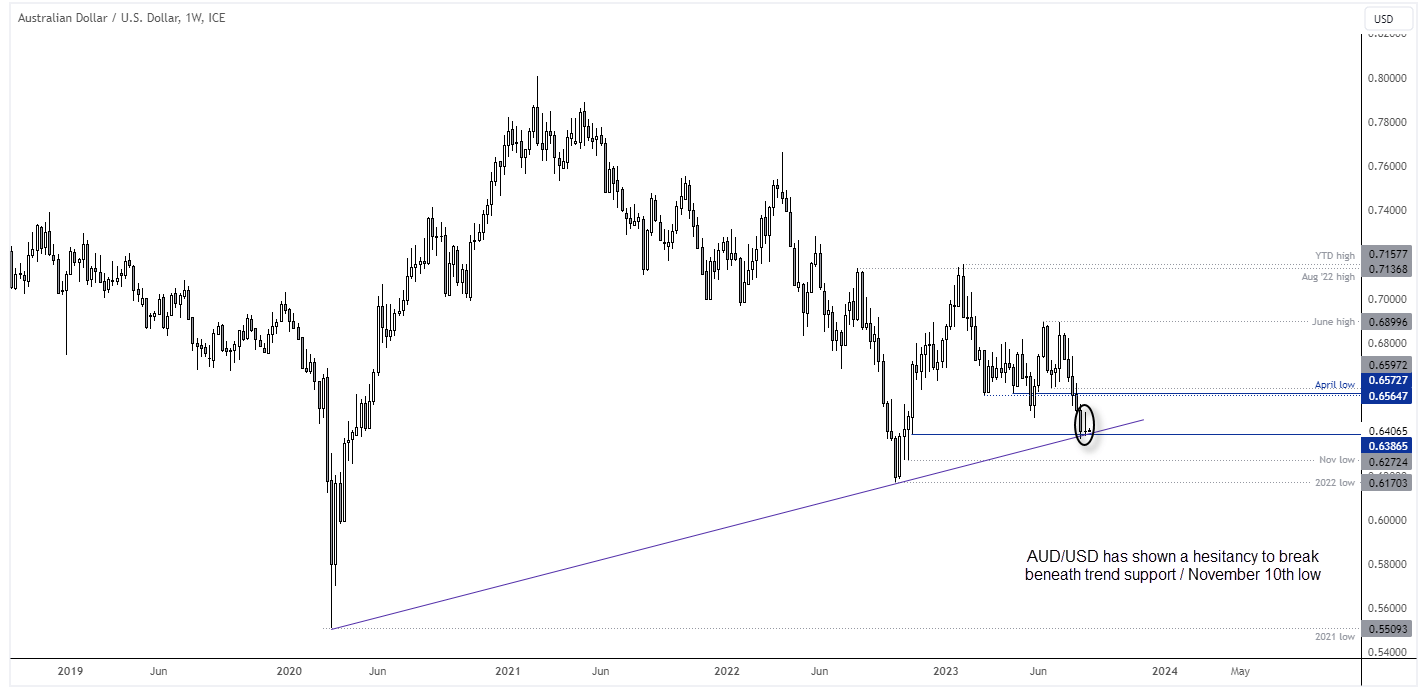

AUD/USD technical analysis (weekly chart):

AUD/USD fell for a sixth week, although only just. The Aussie formed a slightly bearish inside week (inverted pinbar) which held above trend support and the November 10th low for a second week, which underscores the significance of 0.6386 (it formed on the day US inflation was much weaker than expected). With the US dollar index forming a Doji on Friday beneath the May high, I am favouring AUD/USD being above to hold above last week’s lows for now and reverting higher. Although I also suspect volatility will be lower with no significant news scheduled today and the UK on a public holiday.

WTI crude oil technical analysis (daily chart):

WTI crude oil has retraced from it August high and found support around the monthly pivot point and 38.2% Fibonacci level. It is not yet clear whether we have seen ‘the’ corrective low, which could indicate a break to new high, or we’re still within a correction. But with supply concerns brewing in the background and the US dollar index stalling near the May high, I favour at least a modest rise for oil prices. Any pullback within Friday’s range could help increase the potential reward to risk ratio, and the bias remains bullish whilst prices remain above last week’s lows. $82 seems like a feasible target for bulls, or the Jan / April highs.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade