- Iron ore futures are in a growing bear market

- Chinese property construction is the largest single source of steel demand globally

- A sizeable inverse hammer candle last week set the tone for the price action seen over recent days

- Bias remains to sell rallies

Iron ore futures are in an increasingly ugly bear market, spiraling lower since the beginning of the year after defying bears throughout much of 2023. With the price catching up to what fundamentals had been warning for months, traders are wondering how far the move can extend?

While there’s a common misconception that you need to be iron ore expert to have an edge, for what it’s worth, iron ore futures chart beautiful on the daily, providing ample room for those who want to look exclusively at price to have trading success.

Fundamentals have been warning about a downturn

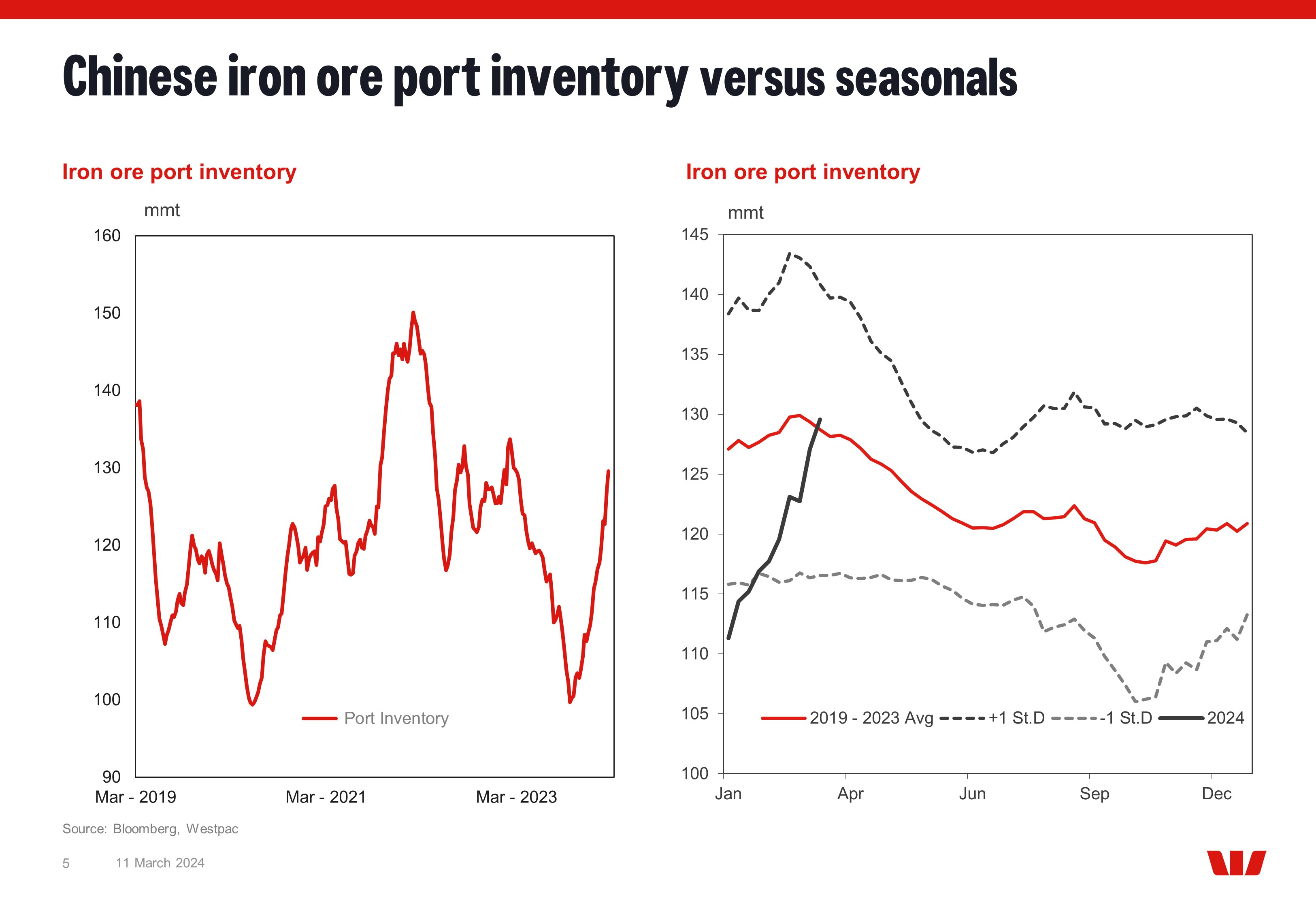

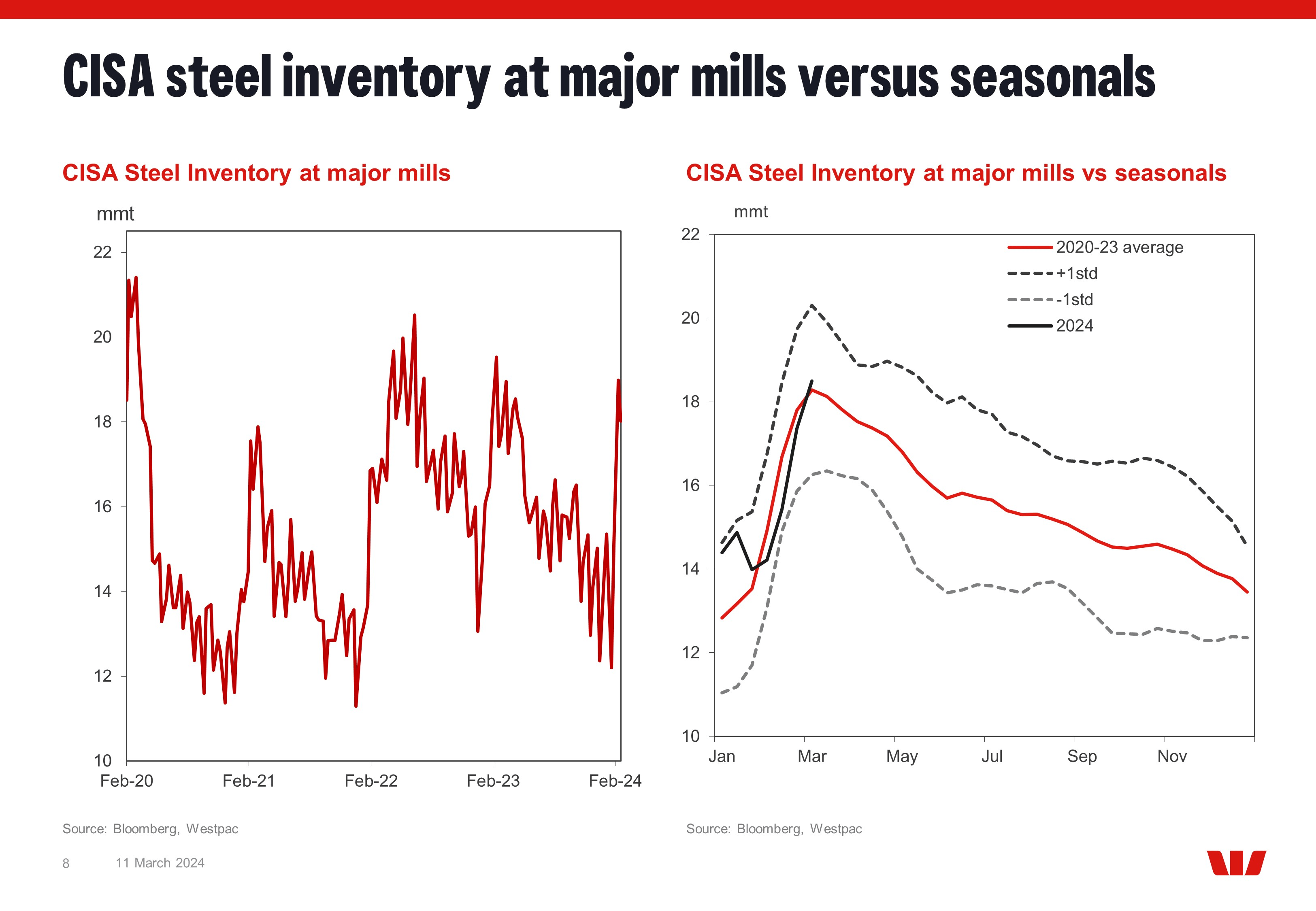

Before we look at the technicals, it’s worthwhile looking at some of the fundamental factors that may explain the unwind we’re seeing right now. Robert Rennie, a commodity markets expert from Australia’s Westpac Bank, provided some fantastic charts on X earlier this week revealing Chinese iron ore port inventories swelling rapidly in 2024, mirroring similar trends in Chinese steel inventories.

Source: Robert Rennie, X

While restocking is not unusual in China ahead of the spring construction season, the build coincides with weakening steel production and price reductions from some Chinese mills, fitting with the bearish price action seen recently.

Compounding concerns, China’s Housing and Urban-Rural Development Minister Ni Hong reiterated over the weekend the state’s long-held view that “houses are for living in, not for speculation”, dashing hopes for a loosening of property construction restrictions.

Even after the sharp downturn in Chinese construction activity last year, it remains the single largest source of steel demand globally, making iron ore prices particularly twitchy to changes in the demand outlook.

And now the iron ore price is responding

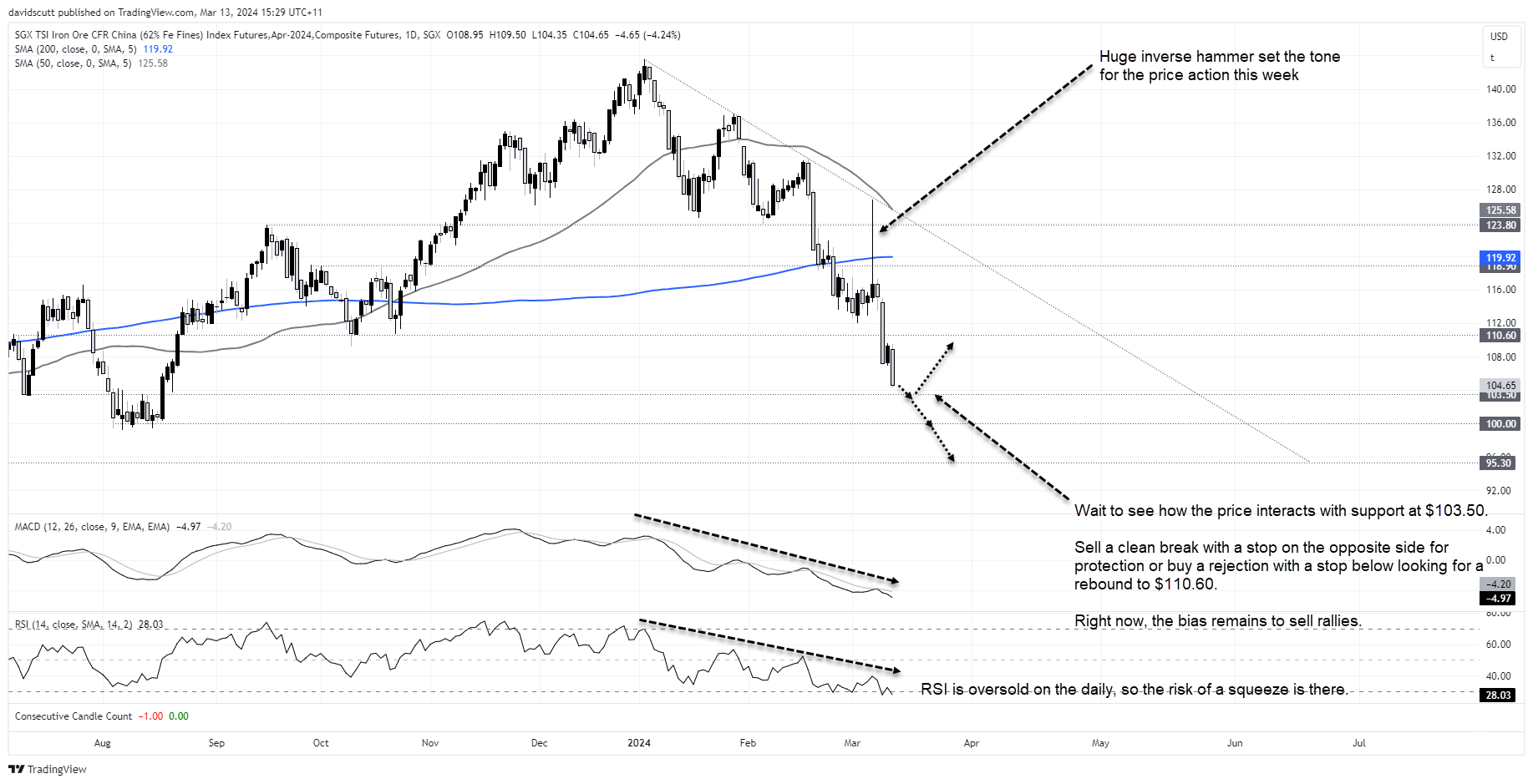

It’s not just the fundamentals that explain the rout in futures. So too does the technical picture.

Looking at the most actively traded April 2024 iron ore futures contract on the SGX, even without the commentary above, the seeds for the latest leg lower were sown last week with the massive inverse hammer candle printed on Thursday. It looks like a market feed issue, yet after checking on multiple platforms, it’s there.

The reversal that day, sending the price back through the 200-day moving average to briefly retest the downtrend from the beginning of the year before unwinding into the close, goes someway to explaining the ugly price action we’ve witnessed since, seeing the price take out support at $110.60.

After a modest bounce on Tuesday, futures are offered yet again on Wednesday, setting the scene for a potential retest of the next layer of support at $103.50. Below, $100 and $95.30 are the next downside targets.

Above, $110.60 is the first upside target along with minor resistance at $112. $118.90, with the 200-day moving average just above, are the next levels to watch.

While buying here is akin to catching a falling knife, that comes with the caveat that the price is also oversold. Bias is to sell rallies given the prevailing trend but wait for the price action to tell you what to do.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade