What happens in high volatility?

When volatility is high, retail traders flock to the markets in droves looking for those outlier winners and chasing the excitement. Many traders can do really well in periods of low volatility, but this isn’t always the case.

The fear of missing out can drive impulsive or risky decisions, which might have a negative effect on performance – as when GameStop stock spiked earlier this year.

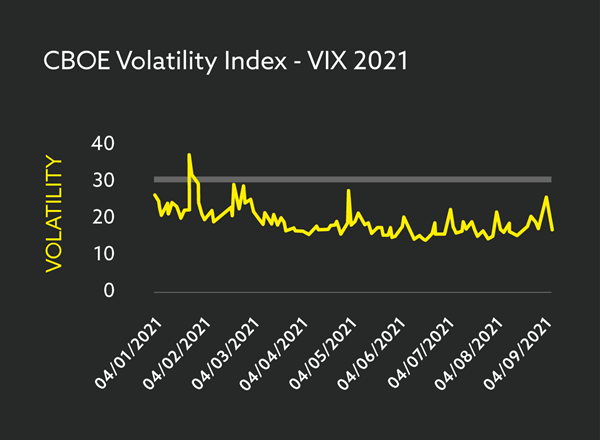

In 2021 so far, there have only been 4 trading days where volatility closed above 30, all back at the end of January when Reddit traders took on the hedge funds. Since then, we’ve seen much more modest levels of around 15-20.

Trading volumes tend to fall when volatility is lower. Many traders stay out of the markets, waiting for more movement. But we believe that periods of low volatility make trading less risky, and are therefore a really great time to work on trading plans, keeping disciplined and using the slower markets to make better decisions.

Do traders perform better in high volatility or low volatility?

We’ve analysed over 10,000 retail traders, comparing their performance on high-volatility days to low-volatility days to glean some insights into their behaviour. Overall, traders perform 21% better on their returns when volatility isn’t high (below 30).

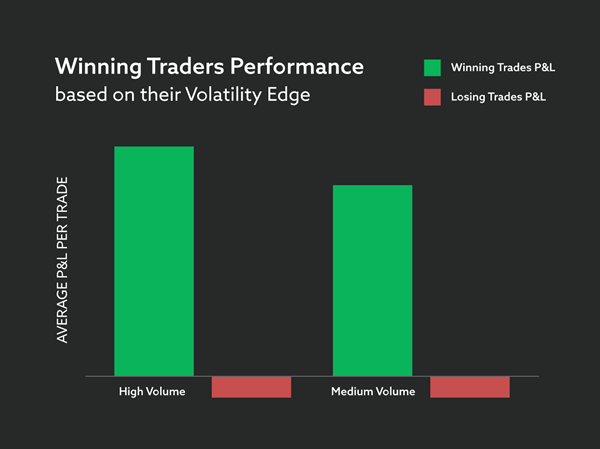

We also found that 41% of traders have a volatility edge – that is, they perform differently in volatile conditions. Some of this 41% trade better. They have larger profitable positions, while their losing trades remain similar. So they can keep risk in check when volatility is high, while taking advantage of the larger movements to capture greater returns.

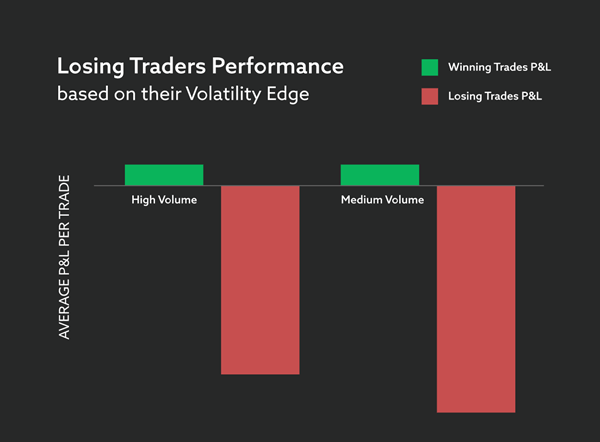

Others fare less well. These losing traders actually have smaller winners – they find it harder to stay in profitable trades for long enough to capture the upside. At the same time, their losing trades get larger as they fail to amend their positions to take the additional volatility into account.

Overall, higher volatility makes holding onto large winning trades more difficult for less-experienced traders, while also harming their performance on losing trades.

Why do traders perform better when volatility isn’t high?

For beginners, high volatility could actually be the worst time to start trading. A really strong start – which could be simply good luck – can lead to over confidence, and a really bad day can destroy a new trader’s account before they have had a chance to really get familiar with trading. Plus, high volatility can cause a number of behavioural biases to come into play which can negatively impact performance:

Herd instinct

Herd instinct is where traders make decisions based on what they think other traders are doing instead of doing their own analysis, under the assumption that other traders have done their research.

When enough people adopt this way of thinking, bubbles can form and inexperienced traders may not be equipped to handle the new market conditions. We saw this happening earlier this year with GameStop.

Loss aversion

Loss aversion causes traders to act irrationally. Humans experience losses more severely than equivalent gains. So when a market is volatile, traders perceive the losses as worse than the gains, even if they are the same. Then they begin making impulsive and irrational decisions to avoid another loss.

FOMO

Fear of missing out (FOMO) heightens emotions when volatility is high, making the chances of irrational trades more likely. Traders are afraid they are missing out on a big market opportunity, so ignore their trading plans and make higher levels of risky trades.

As Warren Buffet said, ‘Be fearful when people are greedy, and greedy when people are fearful’. FOMO traders do the exact opposite, resulting in panic buying, then panic selling.

How does volatility affect your trading?

It’s important to know how volatility impacts your performance, so you can protect your weaknesses and play to your strengths. For example, if low volatility makes you restless and bored, it may lead to overtrading. Or if high volatility makes you stressed, you make start oversizing your trades.

On the other hand, if low volatility helps you remain calm you could gain valuable experience trading with discipline in slower markets. Or high volatility may allow your trades to deliver in a timeframe that suits you.

You just need to make sure you know which type of trader you are.

|

Perform well |

Perform badly |

|

|

High volatility |

Energised |

Excited |

|

Low volatility |

Controlled |

Bored |

What can traders do?

Each trader should understand their own strengths and weaknesses in different market conditions.

During quieter times, the lower stress levels can benefit less-experienced traders: making it an ideal time to practise discipline and good risk management.

When trading in fast-moving markets, it’s important to curb the large outlier losing trades that contribute hugely to losses.

Generally, if there is a high-volatility day in the markets, the next day is 89% likely to also be highly volatile. This is important. Don’t sit out one busy day, and expect markets to quieten down quickly, as history has shown that this is not the case.

On the other hand, a medium-volatility day (10 – 30 on the VIX) will be followed by another medium day 98.6% of the time. So it’s also important to not anticipate high volatility that doesn’t materialize.

Some other interesting facts:

- High-volatility days are more likely to be down days on the S&P (54% DOWN)

- When volatility is less than 30, the S&P is more likely to be UP (56%)

- Very low (less than 10) volatility days are more likely to be Fridays, and more likely to be in December

- High volatility (greater than 30) days are more likely to be Tuesdays and more likely to be in October

Market volatility does affect a trader’s performance, and traders, on average, perform better when volatility isn’t high – even though some experienced traders can take advantage of the larger moves. So identify whether volatility is a strength or a weakness for you, and adapt your trading strategy accordingly.

Open a demo account to build your volatility strategy in a risk-free environment.