Last week saw the S&P 500 end a run of 5-week winning streak. This is likely to keep the bulls on the sidelines at the start of this week, as there’s now an increased risk of a deeper pullback, with technical selling supplementing a darkening macro-outlook. So, our short-term S&P 500 forecast is bearish.

The selling has been triggered by concerns that central banks are overtightening at a time economic data is deteriorating. The probability of another 25bps Fed hike has grown to about 75% and could rise further should inflation data on Friday underscore concerns about sticky inflation.

We will hear from the heads of the Fed, ECB, BOE and BOJ all on Wednesday. If they maintain their recent hawkish rhetoric, then concerns will intensify that the actions of central banks will create a hard landing for a global economy already reeling from the impact of high prices.

Last week, nearly all the latest global PMIs came in weaker, with manufacturing remaining in contraction territory and in most case deteriorating. The subdued economic activity has investors worried that a recession is looming large. Today’s release of German Ifo (88.5 vs. 91.5 last) raised those concerns further and saw the German DAX index drop to its lowest point of the month.

Adding to overtightening fears is China, where the economic recovery has stalled. Overnight the Chinese markets fell further lower.

So, without any fundamental stimulus to trigger a change in the mood, this could be another volatile week for risk assets.

S&P 500 forecast: Technical analysis

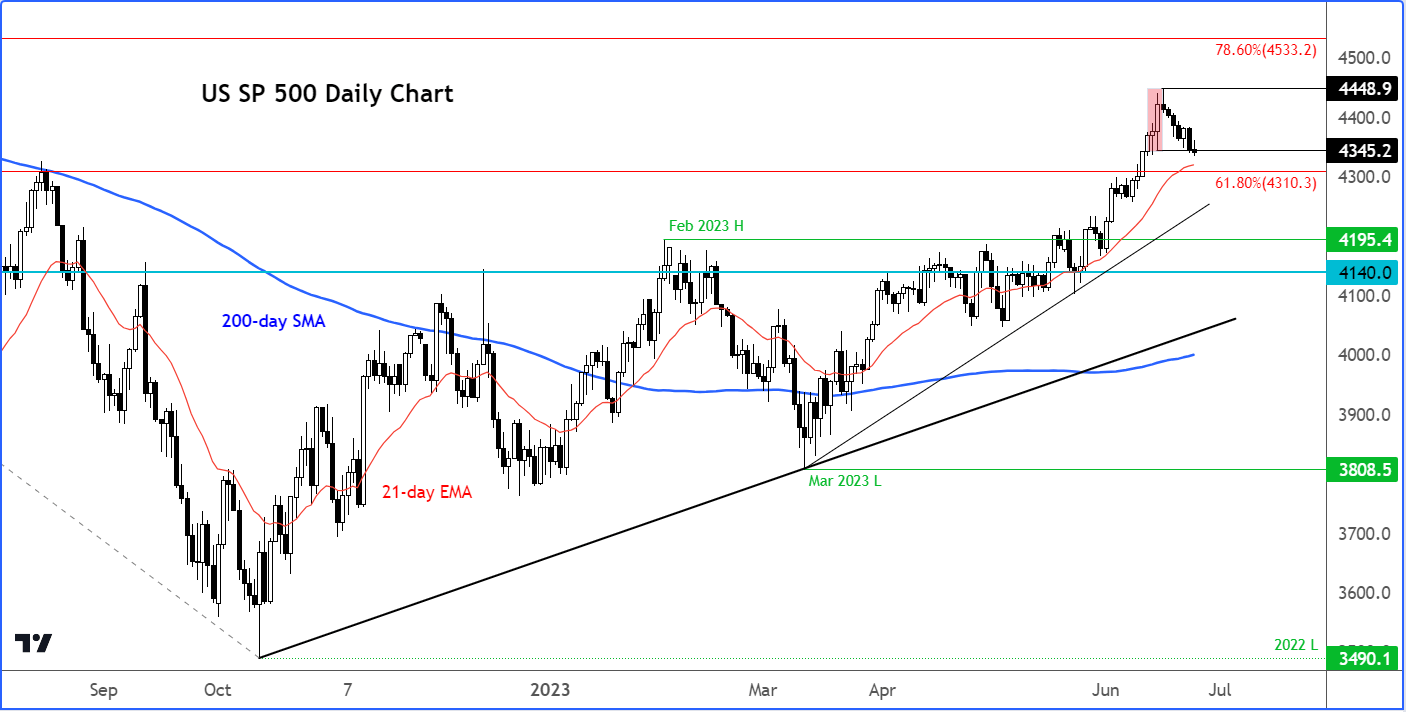

The loss of bullish momentum means there’s a greater risk for a downside move from here. A clean move below support at 4345 could see the index head back down towards the short-term bullish trend line towards 4250ish, with the subsequent downside target being the Feb 2023 high at 4195.

On the upside, well, we need to see a confirmed bullish signal to re-establish the short-term bullish bias. Until that happens, the bulls may wish to wait for a confirmed reversal signal first.

Spirce:TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade