- Silver just logged its largest daily gain in months

- Other low or no-yielding assets have been rallying since late last week

- Risk management is important for anyone trading silver right now

Silver has recorded its largest gain in months, sparking plenty of excitement on social media and other investment platforms that the move may be the start of a prolonged price rally. Watching other non-interest bearing physical and digital assets such as gold and bitcoin take flight, it feels eerily similar to the “silver squeeze” era of 2021.

Silver is not bitcoin

But while supply and demand fundamentals explain much of the move in bitcoin, it’s drawing a long to suggest that has implications for the silver market. There’s no halving of supply impending while demand is largely reflective of trends in industrial and jewelry manufacturing. Sure, gold is rallying too, but the move in precious metals comes across as momentum rather than fundamentally driven, at least in the near-term, meaning it could reverse just as fast as it started.

But fundamental tailwinds are there

While I’m cautious regarding silver's sudden pop, there are fundamental tailwinds working in the favour of low or no-yielding assets right now. As mentioned in a sperate trade idea Monday, US market-based inflation expectations have taken off, especially over shorter time horizons.

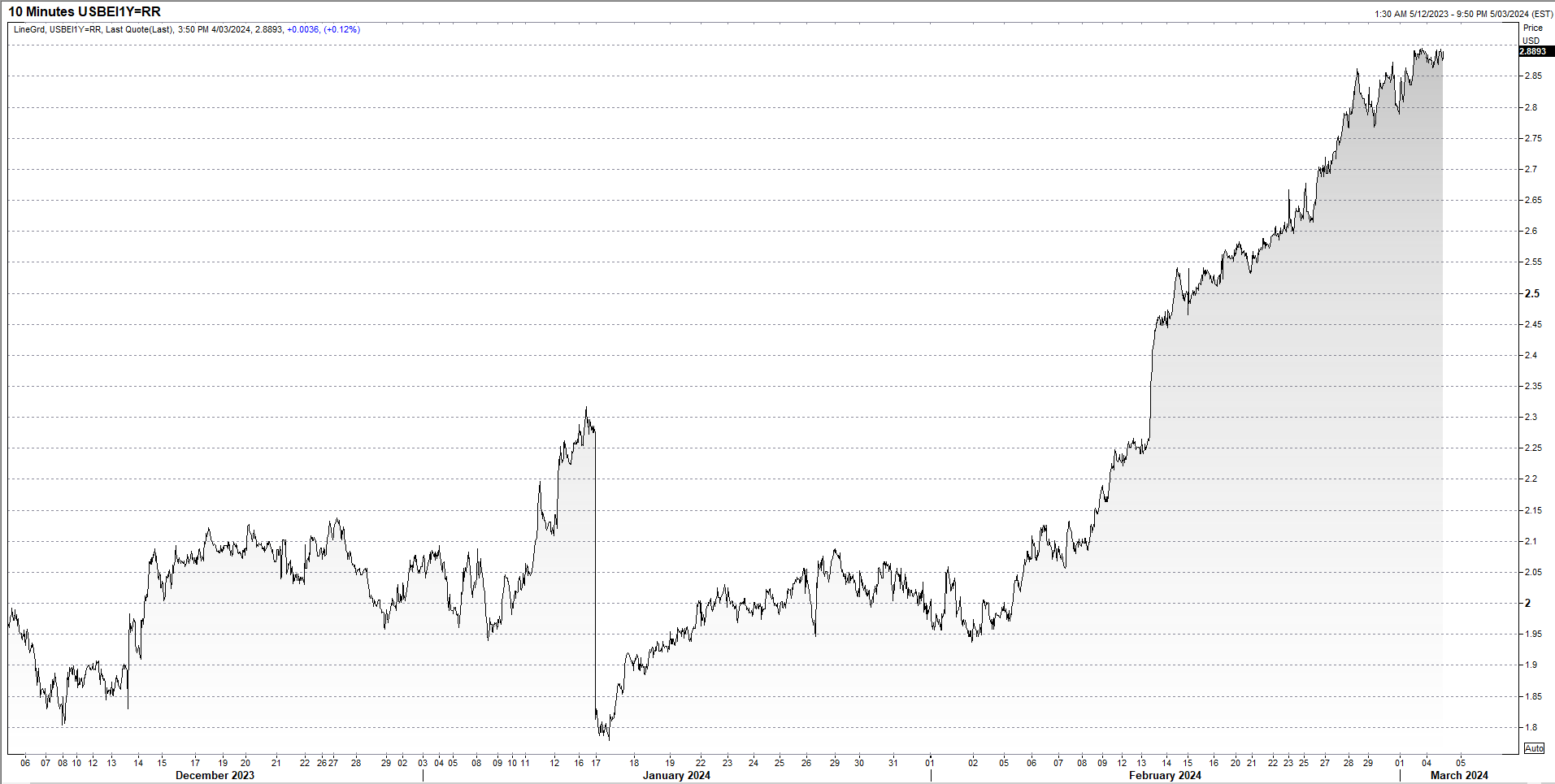

The chart below shows US one-year inflation breakeven rates in the past three months, tracking where markets see inflation averaging over the next 12 months.

Source: Refinitiv

From the lows hit in the middle of January, the rate has surged more than 110 basis points to nearly 3%, miles above the Federal Reserve’s 2% mandate. Yet, the chorus of Fed speakers rolled out every day continue flag rate cuts rather than rate hikes.

Real US yields – which measure the yield on bonds relative to expected inflation – have also come off their highs even though they remain at elevated levels. On occasion, they can be influential on low or no yielding assets, boosting them when real yields fall and vice versus.

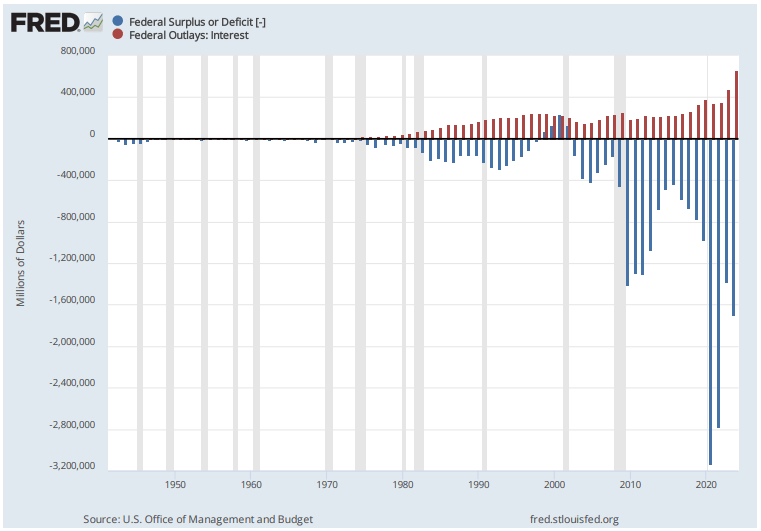

On the fiscal side of the equation, the US is running the largest budget deficit outside of crisis periods in modern history, only surpassed by the Great Depression, Great Recession (GFC) and pandemic over the last 100 years. When you look at the two presumptive Presidential candidates for the 2024 election, and the gridlock in Congress the latest polls suggest that may bring, it’s difficult to see the budget trajectory or interest outlays trend changing for the foreseeable future.

Source: St Louis Fed

But they are hardly new news

I get why traders and investors want hard assets. But these developments are hardly new, especially the fiscal situation.

Perhaps a weak manufacturing PMI will be looked back on as the catalyst that sparked the great bull market in precious metals. But, then again, maybe it won’t be. Unless you have extreme conviction of the sustainability of the silver move, make sure your risk management practices are in tip-top shape.

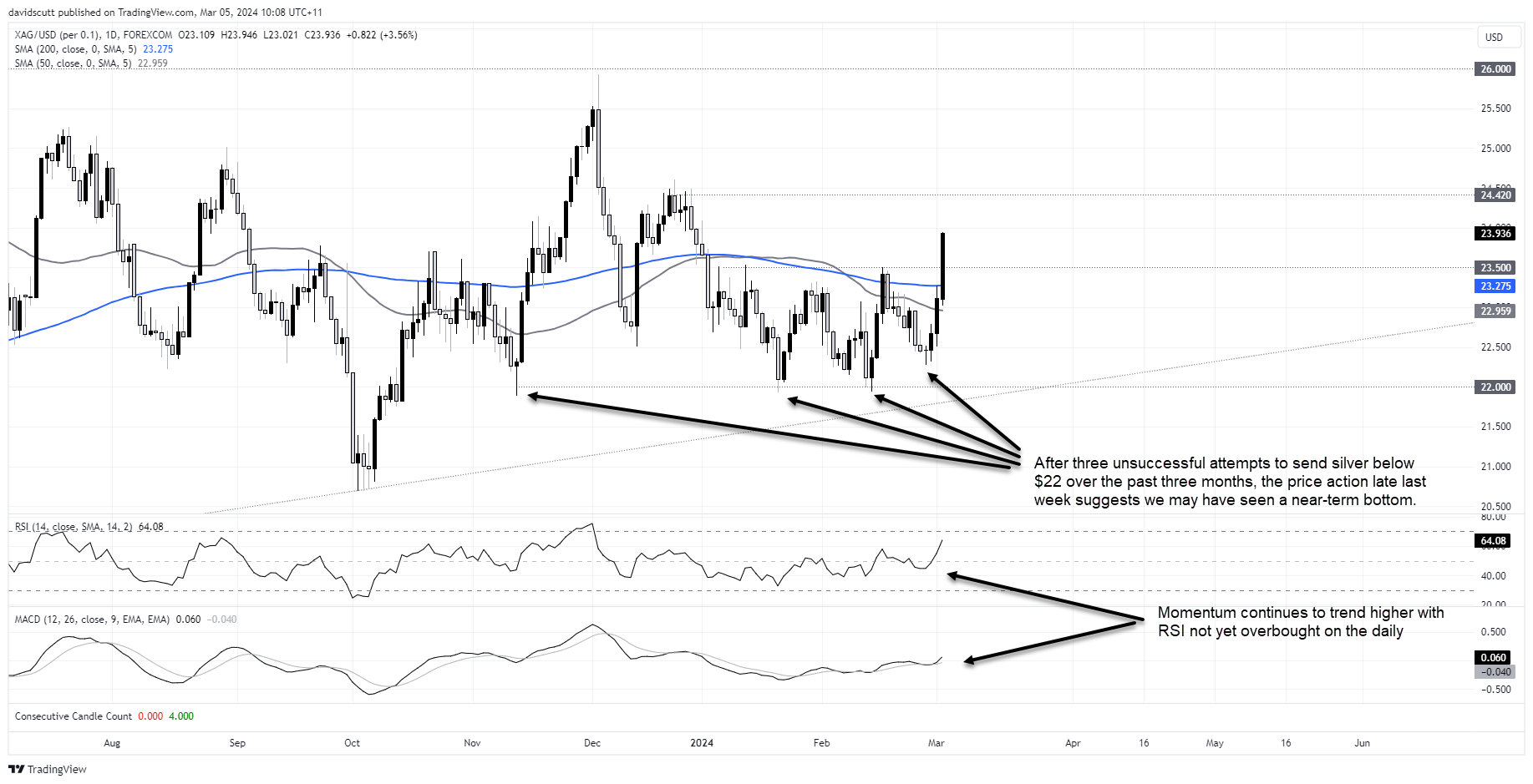

Silver bulls eyeing retest of December highs

To the charts and you can see why silver has caught the attention of the trading community.

Having bounced on three separate occasions from support at $22 since November, buyers weren’t even willing to see another test before moving in last week with a reversal from below $22.50 resulting in a dragonfly doji candle printing on the daily. Ever since, the candles have been getting ever longer and more bullish, seeing resistance at $23.50 give way easily.

Ahead, the next upside target is around $24.42 – where silver was rejected on sic consecutive days in late December. Should the squeeze manage to take out that level, an even harder test above $26 awaits where other rallies stalled in May 2022 along with April, and December 2023.

Even though the price has strong upside momentum right now, siting right between resistance and support, the risk-reward for taking a position doesn’t screen as particularly strong.

For those keen to get long, which is the way I’m leaning right now, the options are to buy now with a tight trailing stop-loss, to wait for a pullback towards $23.50 before buying to improve the risk-reward, or buy a clean break of $24.42, should the price get there.

For those looking to fade the move, which I deem as a low probability play given the momentum, you could sell now with a trailing stop loss targeting a decline to $23.50. Alternatively, you could wait to see whether the rally fails to break $24.22, allowing for shorts to be placed with a stop above targeting a reversal to $23.50.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade