When is Shell due to report Q1 earnings?

Shell is due to report Q1 results on Thursday 5th May

What to expect

Expectations are for adjusted earnings of $7.5 billion for the first three months or EPS of $2.12; this would be over double the $3.2 billion recorded in the same quarter a year earlier and up firmly from the $1.67 reported for the previous quarter.

Strong trading

Oil and gas prices surged across the quarter as Russia invaded Ukraine. Oil prices alone jumped 30% in a highly volatile quarter. As we saw with BP today, Shell’s oil and gas trading business is expected to benefit significantly from the increased volatility in the market. BP said that trading was “exceptional”. There is no reason to assume that Shell’s trading would be different.

Exit from Russia

As far as the exit from Russia is concerned, Shell is far less exposed than BP was. Shell has already said that it expects a write-down in the region of $4-$5 billion from its withdrawal from Russia, including a 27.5% stake in the LNG Shakhalin gas field.

Green credentials

While Shell is still highly dependent on oil and gas, there has been a reluctance to invest heavily in transitioning towards a greener energy-producing machine. That said, Shell invested in Savion, the solar and energy storage developer in the US, at the end of last year. Investors will be keen to hear more about the great energy transition with EV charging, renewables, and biofuels needing to happen this decade – something Shell is acutely aware of.

Returns to shareholder

In February, Shell said it would increase its Q1 dividend by 4% to $0.25 per share. The group also announced an $8.5 billion repurchase program for the first half of 2022. The potential for higher shareholder returns is likely to be the main focus.

Windfall tax

Where there is oil and profits, there is always some controversy, and calls for a windfall tax are certainly growing louder, particularly given the cost of the living crisis engulfing the UK.

Where next for the Shell share price?

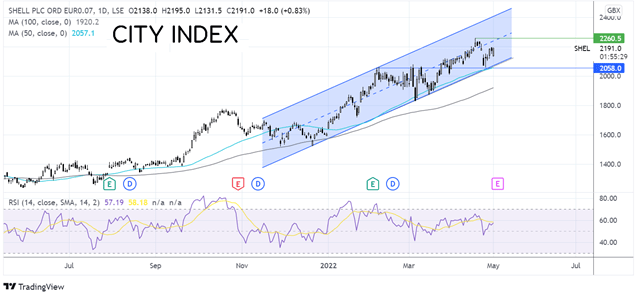

Shell has been trending higher, forming a series of higher highs and higher lows since last year. The stock has rallied over 30% so far this year, reaching an all-time high of 2060.

Since late November, the price traded within a rising channel and above its 50 & 100 sma. The RSI remains in bullish territory, although it has slipped below 60, suggesting that momentum could be slowing.

Buyers would be looking for a move over 2200p the May high to push higher to 2260 and fresh all-time highs.

On the downside, sellers would look for a move below 2055, the 50 sma, and the lower band of the rising channel. A break below here could expose the 100 sma at 1925.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.