"if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so. And if we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well."

The Fed Chairs’ tone has become increasingly hawkish with each outing, and after a long slumber, the hawk within the Fed Chairman is rapidly increasing altitude.

Against this, earlier today, Westpac Consumer confidence in New Zealand fell to 92.1 in the first quarter of 2022, down from 99.1 in the final quarter of 2021. Anything below 100 indicates “there are more New Zealanders who are pessimistic about the economic environment than there are those who are optimistic".

Today’s fall takes the indicator to the lowest level since the Global Financial Crisis in 2008 and comes on the back of higher mortgage rates and rapidly spiralling prices for household goods, food, and fuel, all of which are eating into household budgets.

Todays slump in consumer confidence comes after evidence the housing market has started to slow and may raise questions about whether the RBNZ will need to raise interest rates as aggressively as the market has priced.

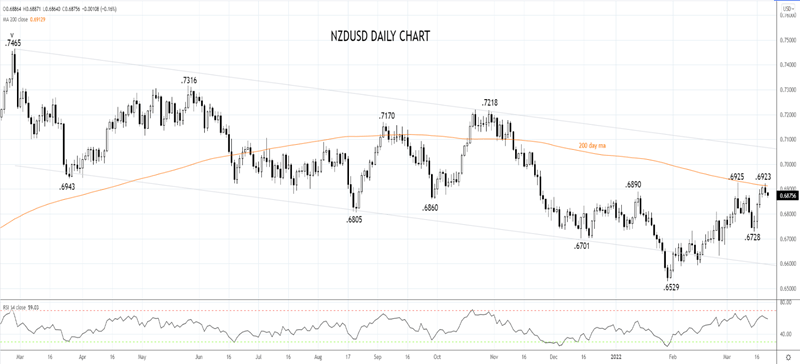

Following the softer consumer confidence data, the NZDUSD is trading marginally lower at .6876, after rejecting resistance yesterday at .6925 coming from the 200-day ma and March 7th high, which leaves a double top in place.

As such, while below .6925/35, a short-term bearish bias is in place, looking for the NZDSD to rotate lower towards support at .6800c. The stop loss on the bearish view would be a sustained break/close above .6925/35.

Source Tradingview. The figures stated areas of March 22nd, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade