US futures

Dow futures 0.21% at 38805

S&P futures 0.79% at 5158

Nasdaq futures 1.26% at 18033

In Europe

FTSE 0.16% at 7742

Dax 0.28% at 17998

- Alphabet’s Google & Apple in talks over AI Genie

-

FOMC rate decision on Wednesday

-

Nvidia’s annual conference kicks off

- Oil rises after China data

Tech stocks rise overshadowing central bank jitters

U.S. stocks are pointing to a positive start, boosted by tech stocks, and as investors look ahead to this week's eagerly awaited Federal Reserve interest rate decision.

Today's move higher comes as stocks recover from losses from last week’s losses following stickier-than-expected inflation data, which raised concerns that the Federal Reserve will keep rates high for longer.

The Federal Reserve’s two-day meeting kicks off tomorrow, and the rate announcement is due on Wednesday. The Fed is widely expected to leave rates on hold but could adopt a more hawkish stance owing to the persistent nature of inflation.

The Fed’s new projections will be in focus, and the dot plot could be revised downward to two interest rate cuts this year, down from three forecast in December.

As well as the Fed, attention is on tech stocks, which are outperforming on AI optimism amid Apple / Google talks and as the Nvidia annual developers conference kicks off.

Corporate news

Alphabet is set to open 5% higher, and Apple is rising 1.3% premarket on news that the two tech giants are in talks to include Google's Gemini AI features in iPhones. Talks are still in the early stages, and no agreement or branding has yet been decided. The news comes as Apple has lagged behind its peers in rolling out AI features.

Nvidia is under the spotlight, with the GTC annual developer conference is scheduled to start later today. Nvidia is widely expected to unveil its new flagship chips created for AI development.

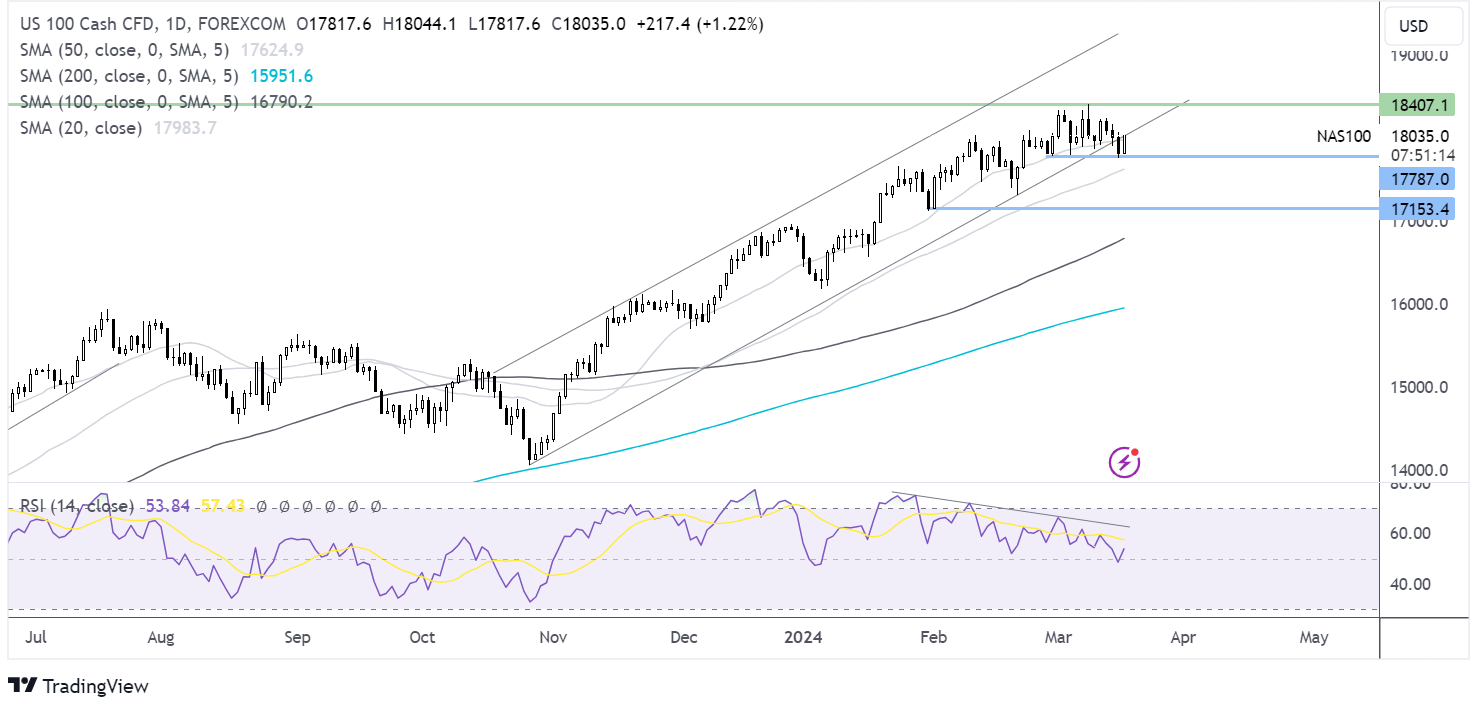

Nasdaq 100 forecast – technical analysis.

The Nasdaq has fallen out of the rising channel within which it has traded since mid-October, although it has found support at 17760, the March low. Bulls are attempting a recovery and will need to rise above the lower band of the rising channel around 180000 to bring 18420, the all-time high, back into focus. Meanwhile, a break below 17760 is needed to create a lower low and bring 17160, the February low, into play.

FX markets – USD holds eases, EUR/USD rises

The US dollar is edging lower after gains in the previous week following stickier-than-expected inflation. This has raised the likelihood that the Federal Reserve will keep interest rates high for longer. The Fed meeting kicks off tomorrow, and a rate announcement is due on Wednesday.

EUR/USD is edging higher, back above 1.09, after eurozone inflation confirmed that CPI cooled to 2.6% YoY in February, down from 2.8%. The data comes after the ECB left interest rates on hold at 4% earlier in the month, and policymaker Olli Rehn confirmed that the ECB had started discussing when to cut interest rates.

GBP/USD is inching higher ahead of a busy week for the pound, with CPI data due on Wednesday and the Bank of England interest rate decision on Thursday. While CPI is expected to coo to 3.6%, this is still well over the central bank's 2% target, so no changes to rates are expected from the Bank of England on Thursday. Clues over the timing of the first-rate cut could also be in short supply.

Oil rises after China data

Oil prices are inching higher after rising over 3.5% across the region the previous week, supported by supply concerns as Ukraine increased its attack on rushes energy infrastructure and after Chi

Chinese industrial production came in stronger than expected, rising 7% year on year in February, defying expectations of slower growth of 5% and marking the fastest pace of growth in two years. Accelerating output in Chinese factories increases the demand for fuel, pushing oil prices higher.

Meanwhile, Ukraine also increased attacks on Russian oil refineries over the weekend. Ukraine has adopted a new military strategy seeking to weaken Russia's oil export machine.