US futures

Dow futures -0.04% at 39050

S&P futures 0.02% at 5071

Nasdaq futures 0.15% at 17952

In Europe

FTSE -0.13% at 7677

Dax 0.48% at 17507

- Indices inch higher as the economic calendar heats up

- US durable goods & consumer confidence are under the spotlight today

- Lowe’s falls as net sales drop

US durable goods fall sharply, consumer confidence data up next

U.S. stocks point to a quiet start as investors pause for breath ahead of key economic data and more corporate earnings.

Today, durable goods orders -6.1% MoM in January, worse than the -4.5% drop forecast and well below 0% MoM in December. The figures failed to cause a stir in the markets. Broadly speaking, US economic data has been holding up well, highlighting the economy's resilience.

Looking ahead, attention now turns to the Conference Board consumer confidence figures for February, which is expected to rise to 115, up from 114.8 in January, the highest level that it has been since late 2021. The improving consumer outlook comes as the US job market remains solid, wage growth is strong, and the Federal Reserve is expected to start cutting rates later this year.

For more clues on when the Fed could start loosening monetary policy, the markets will watch core PCE data on Thursday, the Fed's preferred inflation gauge. Any signs of sticky inflation would give the Fed more reason to keep rates high for longer.

The market is currently pricing in around 81 basis points of rate cuts this year, down significantly from 133 basis points just a few weeks ago.

Tomorrow also sees the release of the fourth quarter GDP, which is expected to show some cooling in the US economy, although not to the extent that the Fed will be compelled to start cutting rates sooner.

Corporate news

Lowe’s is set to open lower after reporting a drop in Q4 net sales amid an ongoing slowdown in spending on home improvement. Comparable sales decreased 6.2% in three months to February the 2nd due to cooling DIY demand and unfavorable January winter weather. Total sales fell 17% compared to a year ago to $18.60 billion, slightly ahead of estimates of $18.47 billion.

Zoom video is trading 13% higher premarket after delivering better-than-expected results and announcing a $1.5 billion share buyback. The video conferencing company posted EPS of $1.42 on $1.15 million in revenue, both ahead of forecasts.

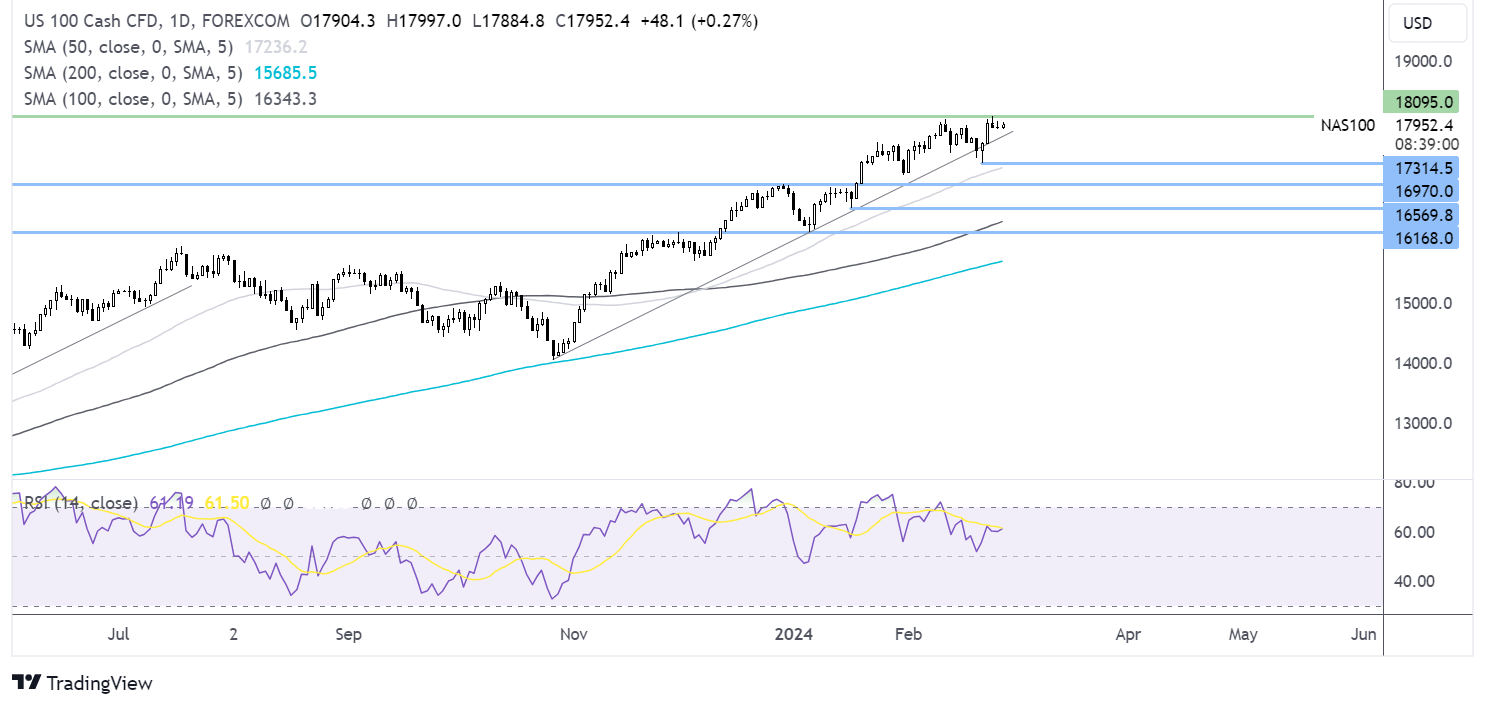

Nasdaq 100 forecast – technical analysis

After rallying to an all-time high on Friday, the price has since slipped back below 18000, which is now the level that buyers will look to push the price over. On the flip side, support can be seen at 17315, last week’s low, with a break below here creating a lower low and exposing the 50 SMA.

FX markets – USD falls, EUR/USD rises

The USD continues to fall, tracking yields lower ahead of Thursday's key inflation release and comments from several Federal Reserve officials who could give further clues on when rate cuts will begin.

EUR/USD is rising after German consumer confidence improved slightly. GfK consumer sentiment index rose to -29 from -29.7 amidst optimism surrounding rising wages and hopes that the ECB will soon start cutting interest rates.

GBP/USD is holding steady after a pronounced decline in UK food inflation, which fell to 5%, down from 6.1% in January. According to the British Retail Consortium, this marks the lowest food inflation figure since May 2022.

Oil falls on Israel-Hamas ceasefire hopes.

After solid gains in the previous session, oil is falling as choppy trade continues. Hopes of a ceasefire in the Israel-Palestine conflict are growing, which is pulling prices lower.

Overnight, President Biden says that Israel had agreed to stop the war in Gaza over the Islamic holy month of Ramadan on condition that Hamas releases hostages. Ramadan begins on March 9th and is now considered a key deadline in the aim for a deal to pause the conflict.

Looking ahead, attention will be on US crude in venture ease, which is expected to rise 5.6 million barrels in the week ending February 23rd after a 5.35 million barrel build in the week ending February 16th.