US futures

Dow futures +0.1% at 39054

S&P futures +0.02% at 5175

Nasdaq futures -0.23% at 18169

In Europe

FTSE +0.05% at 7751

Dax +0.38% at 17962

- Stocks fall away from record highs

- US economic calendar is quiet

- Retail sales & PPI later in the week

- Oil rises as Russia attacks ramp up & as the demand outlook improves

Stocks ease in wait and see mood

U.S. stocks are heading for a quiet start amid a subdued mood. Investors await more economic data later in the week for further clues about when the Fed may cut interest rates.

The S&P 500 rose to a fresh record high yesterday thanks to a soaring Oracle share price and despite slightly hotter than expected US inflation data, which failed to dampen expectations of a rate cut from the Federal Reserve in the coming months.

Despite inflation being above the central bank's 2% target, investors remain firm on the idea that the Fed will start cutting interest rates this year. The market is pricing in a 66% probability of the first rate cut coming in June, down from 75% a month ago.

While there is no economic data for investors to sink their teeth into today, retail sales and producer price data are due later in the week. These figures could provide more of an indication as to the health of the US economy and the likelihood of the Federal Reserve being able to cut rates in June.

Corporate news

Dollar Tree has lost almost 9% in premarket trading after the discount store operator posted disappointing Q4 earnings and amid plans to close 970 stores. Dollar Tree posted EPS of $2.55 below the $2.66 forecast by analyst. Revenue was also slightly short of forecasts at $8.64 billion.

Cryptocurrency related stocks such as MicroStrategy and Marathon Digital are rising as Bitcoin rose to a fresh record high from in strong BTC ETF inflows and ahead of the halving event in April.

Tesla is set to open over 2% lower after Wells Fargo downgraded the EV maker to underweight from equal weight.

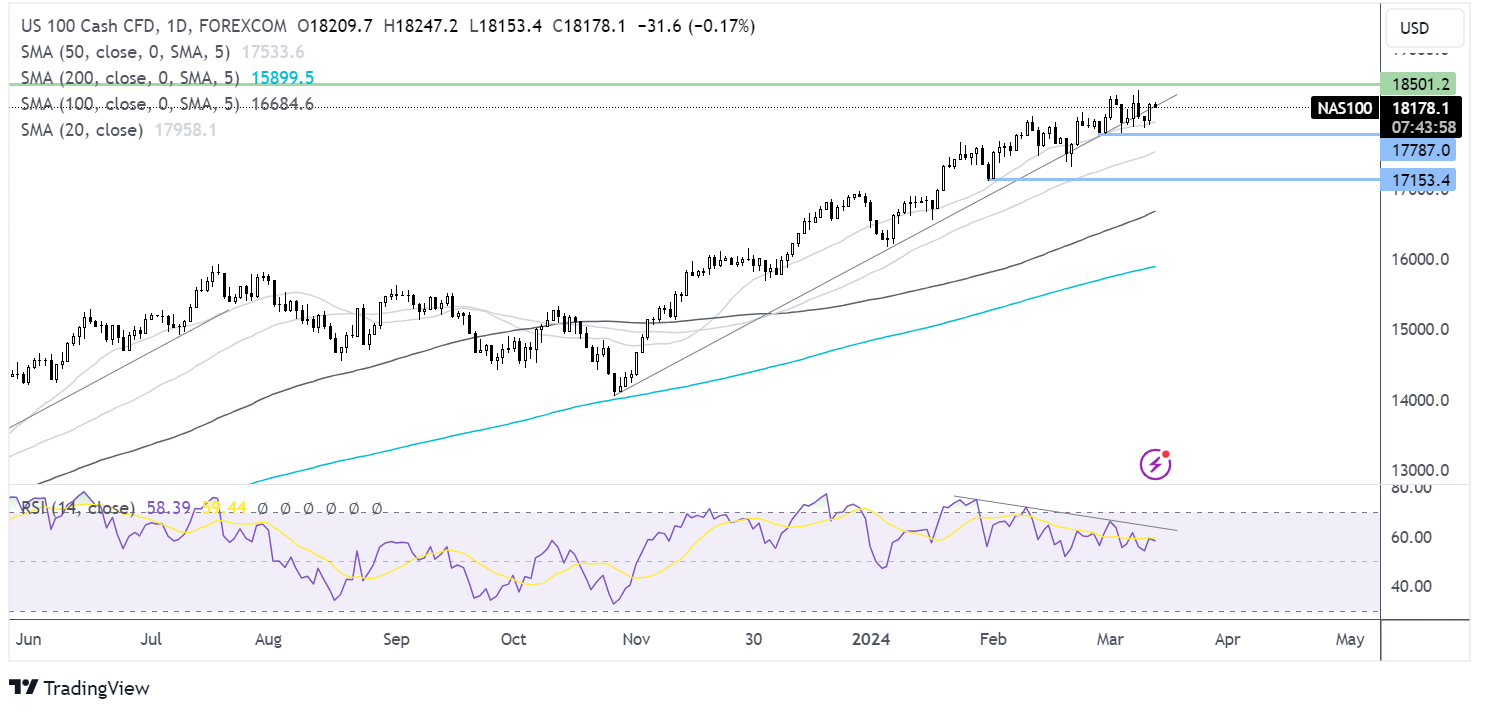

NASDAQ 100 forecast – technical analysis.

The Nasdaq continues to be guided higher by the 20 SMA, which has limited losses across the week and has risen above the rising trendline. Buyers will look to extend gains to fresh all-time highs and on towards 18500. Support can be seen at 17800, the 20 SMA, and 17750, the March low. Below here 17150, the February low comes into focus.

FX markets – USD unchanged, GBP/USD steady

The US dollar was relatively unmoved by yesterday's hotter-than-expected inflation data. Despite inflation proving to be sticky and remaining persistently above the Fed's 2% target, the market continues to price in a June rate cut by the US central bank.

EUR/USD is inching higher after ECB officials signaled a preference for a June rate over April. French Central Bank President Francois Villeroy de Galhau and Austrian Holzman echoed Christine Lagarde’s view last week when she pointed to a June cut. Meanwhile, industrial production fell 3.2% month over month after rising 2.6% in December.

GBP/USD is unchanged despite the UK GDP showing that the economy has returned to growth. GDP rose 0.2% MoM January in line with forecast and after a contraction in the previous month. The data suggests that the UK could return to growth in the first quarter after tipping into recession in Q4 of 2023.

Oil rises as Russian attacks ramp up and amid improving global demand outlook

Oil prices are rising, with WTI pushing above the 200 SMA as Ukrainian attacks against Russian energy infrastructure intensify, and the market remains optimistic about the global demand outlook.

Drone attacks in Russia have halted operations at several oil refineries as Ukraine ramps up its efforts to hit Russia's export machine. The attaches raise worries about tightening supply.

Meanwhile, signs of strong demand are also helping oil prices push higher despite sticky US inflation.

API US crude inventories fell last week, which is a sign of robust demand. Meanwhile, OPEC left its forecast for oil demand growth unchanged at 2.25 million barrels per day in 2024, above other forecasts. The International Energy Agency expects demand growth to be lower and will update the market on Thursday.

The oil market has broadly shrugged off news of hotter-than-expected US inflation, which is not expected to derail interest rate cuts this year. As a result, the risk environment has remained relatively upbeat.