US futures

Dow futures -0.20% at 34366

S&P futures -0.7% at 4430

Nasdaq futures -1.28% at 15177

In Europe

FTSE +0.24% at 7440

Dax +0.61% at 15715

- US data continues to bear forecasts

- Jobless claims fall to 216k

- Apple falls on fears that China will extend the iPhone ban

- Oil hovers around a 10-month high

Data continues to beat forecasts

US stocks are heading for a lower start a amid rising inflation concerns amid upbeat data from EU S and rising oil prices fueled bets that the Federal Reserve may need to raise interest rates higher.

US ISM services PMI yesterday was stronger than expected, new orders rose as did prices paid raising inflationary pressures. meanwhile oil prices remain around 10 month highs supported by an extension of oil supply cuts from Saudi Arabia and Russia, also fueling inflation concerns.

US jobless claims unexpectedly fell to 216k from 229k, missing forecasts of a rise to 234k. The data points to a jobs market which is showing resilience, despite the aggressive hikes by the Federal Reserve.

The data comes after U S Federal Reserve official Susan Collins said that the central bank could proceed cautiously with another rate hike.

The market does not expect the Federal Reserve to raise interest rates in September however the probability of a rate hike in November has increased to 43% up from 39% just a day earlier.

The uptick in hawkish Federal Reserve bets is being reflected in the market as bond yields tick higher, the USD rises and stocks fall, led lower by tech stocks.

Corporate news

Apple will be under the spotlight after falling sharply yesterday amid a reported ban in China on government officials using iPhones. The stock drop 3% yesterday and is set to fall a further 3% amid fears that the ban could be broaden The timing here is particularly poor given the unveiling of the new iPhone next week.

Charge Point falls over 10% as the EV charger maker posted Q3 revenue forecasts below expectations. It also announced a 10% cut to headcount. The firm has started to struggle since Tesla started making its own charging network.

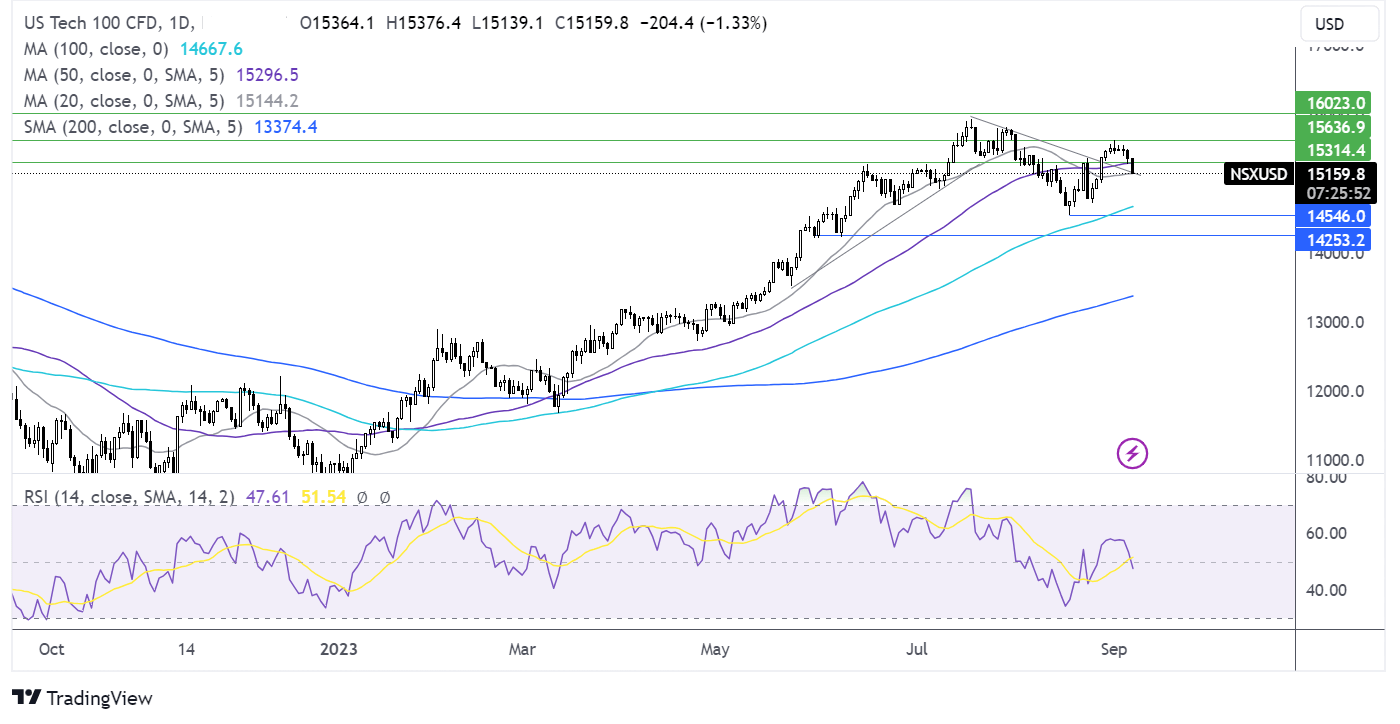

Nasdaq 100 forecast – technical analysis

After running into resistance at 15630 the Nasdaq broke below its 100 sma and is testing the confluence of the 20sma and the falling trendline support. This combined with the RSI falling below 50 keeps sellers hopeful of further losses. A break below here opens the door to 14,550 the August low. On the upside, should the trendline support hold buyers could look for a rise towards the 50 sma at 15300 ahead of 15630 the September high.

FX markets – USD rises, GBP falls

The USD is rising on a combination of safe haven flows and hawkish fed bets following yesterday's stronger than expected ISM services data and comments from fed official Susan Collins who suggested that the Fed could proceed cautiously with another hike.

EURUSD is falling amid rising concerns over the health of the eurozone economy. German industrial production fell by more than expected, dropping -0.8% MoM in July and the euro zone Q2 GDP was downwardly revised to 0.1% QoQ from 0.3% initially.

GBPUSD is falling to a fresh three month lab that's investors rain in Bank of England rate hike bets following governor Andrew Bailey's testimony before the treasury Select Committee. Mr Bailey said that UK interest rates were much nearer their peak than before. UK house prices fell 4.6% in August the largest decline since November.

EUR/USD -0.30% at 1.0690

GBP/USD -0.35% at 1.2463

Oil hovers around a 10 month high

Oil is edging modestly lower after nine straight days of gains the longest winning run in four years. the price is hovering just below a 10 month peak reached overnight.

Oil prices are being lifted by supply concerns after Saudi Arabia and Russia announced that they will extend the combined 1.3 million barrel per day oil production cut until the end of the year.

Meanwhile, demand concerns of offsetting further gains amid expectations that the Federal Reserve could raise interest rates further, and as China economic growth falters, hurting the demand outlook.

WTI crude trades -0.13% at $86.98

Brent trades -0.13% at $90.28

Looking ahead

15:00 Fed Harker speaks