In early April and after the price of Bitcoin surged by 20% in just one day, we penned an article asking, “Is it back?”. The bullish Bitcoin view in the article, supported by video chart analysis posted just 24 hours before the rally commenced on the City Index website.

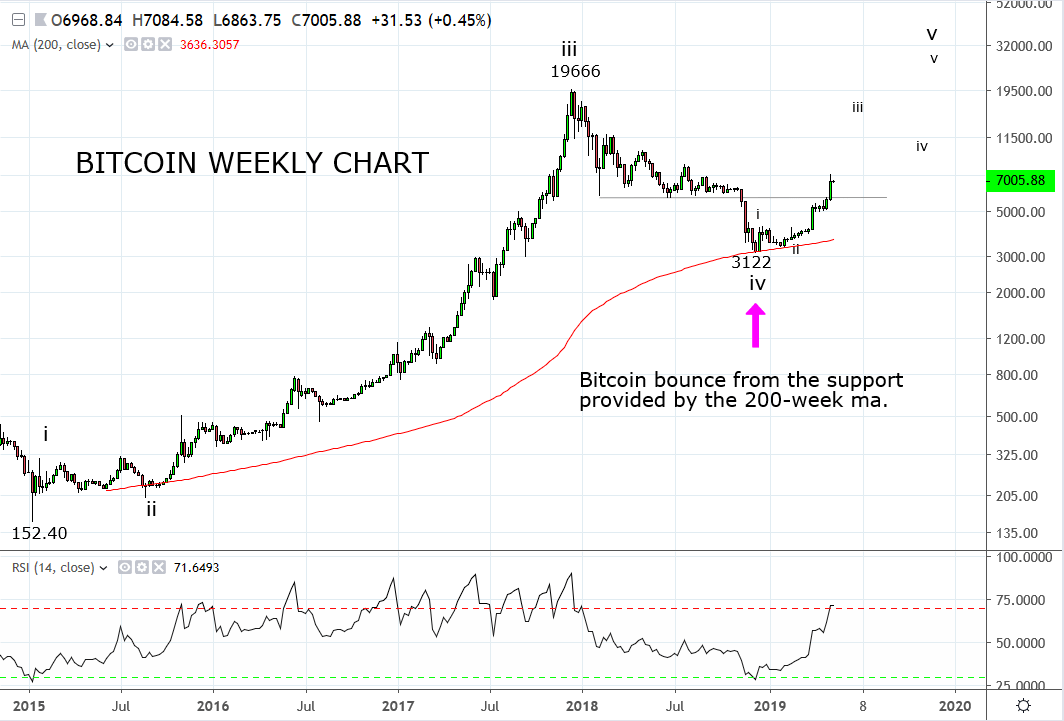

The reasons for the bullish view were predominantly based on technical analysis and included the emergence of a rounded bottom/loss of downside momentum on the daily chart as well as bullish divergence as viewed on the RSI indicator. The weekly chart confirmed that at its lowest traded price of 3122, last December, Bitcoin had held the critical support coming from the 200-week moving average.

Based on this analysis, it was suggested buying Bitcoin near 3925. The first two profit targets were easily achieved. The final part of the plan was to take profit on the remaining one-third portion of the original trade near to 8000, an ambitious, “blue sky” type target.

However, as volatility has increased as witnessed by a further 40% rally in the first two weeks of May and based on the chart below a reassessment is required.

The weekly chart below uses a log scale as opposed to the linear scale most commonly used in trading. With a linear chart, the price on the Y-axis or vertical axis is scaled to be equal, so $2, $4, $6, $8 are all the same distance apart.

In a log chart, price is scaled according to percent changes, so two equal percent changes are going to have the same vertical change/distance. A log scale is very useful when charting securities that have moved by large percentages over a short period, such as Bitcoin.

Based on the strong rally viewed in Bitcoin in recent months and the log chart below, it appears the price of Bitcoin can rally further than originally anticipated. As such, we will stay with our core long position and should a dip back towards 6000 eventuate, it will be watched carefully for a trading opportunity to rebuild Bitcoin longs.

Source Tradingview. The figures stated are as of the 2nd of May 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.