- Chinese stocks have rebounded strongly since returning from the Lunar New Year break

- Additional measures to support buying activity have been reportedly rolled out by policymakers in recent days

- China’s A50 is testing the downtrend it’s been in since 2021. Hong Kong’s Hang Seng has also managed to overcome sellers at 16400.

China’s state-endorsed equity market recovery continues to go from strength to strength, building upon a lengthy and growing list of measures being rolled out by policymakers designed to coerce traders into buying.

While there are valid claims to call the rebound manufactured, fake or unsustainable, seemingly punishing those inclined to sell, no one can deny it isn’t working. It is.

There’s evidence foreign investors are starting to return after an initial reluctance to participate, contributing to some mainland indices posting their longest winning streaks in more than a year either side of the Lunar New Year break.

However, there are numerous hurdles to overcome, including breaking the ugly downtrend Chinese stocks have been in since the first wave of the pandemic passed in early 2021. Ever since it’s been one-way traffic.

Until now, perhaps.

Chinese stock indices testing long-running bearish trend

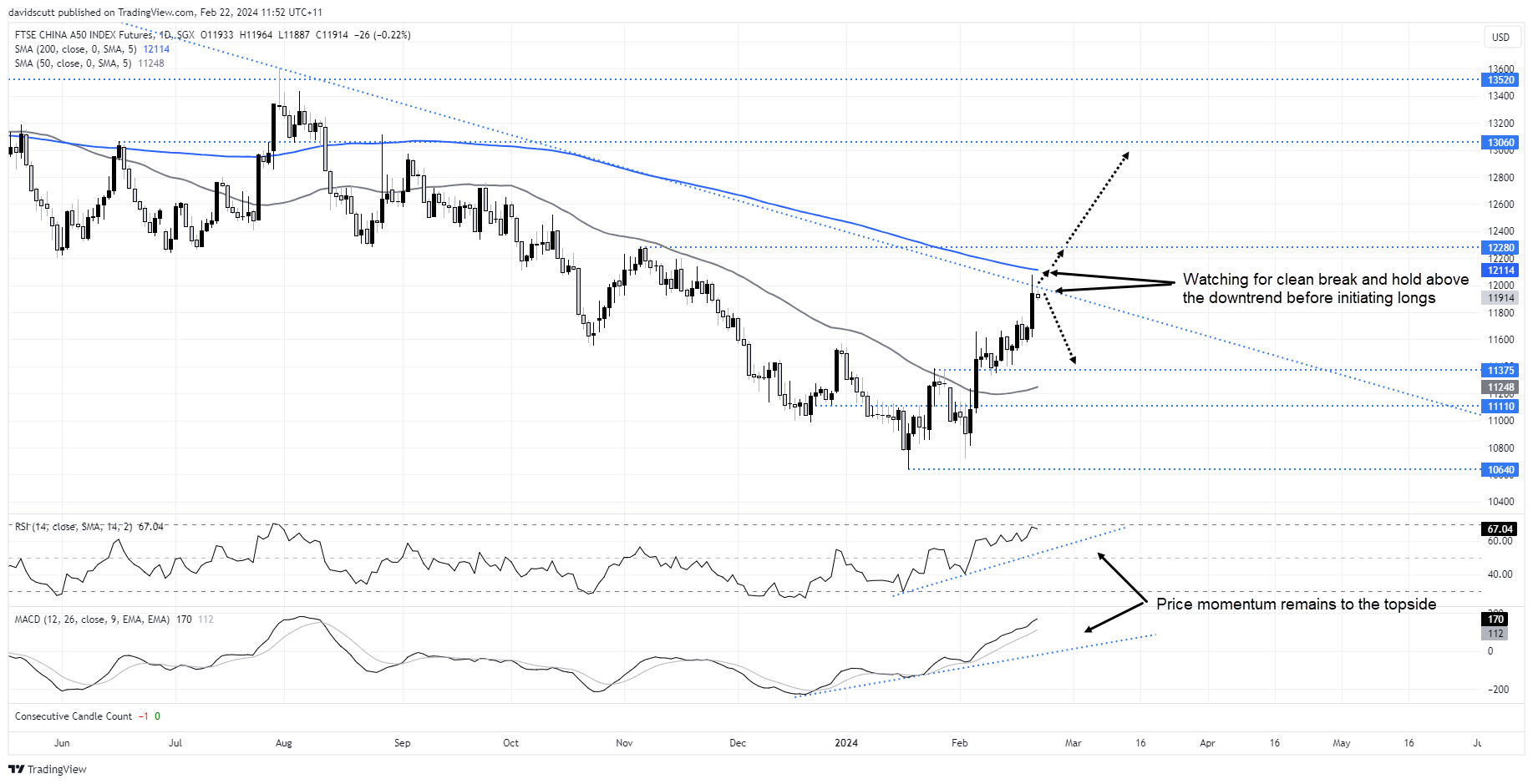

Having added over 12% from the lows struck in January, the China A50 index is threatening to break its long-running downtrend, providing another potential positive to spark further inflows should the bear trend finally break.

As seen in the A50 futures chart below, the first test was unsuccessful with gains fading away after initially breaking through on Thursday. However, the reversal was hardly significant, suggesting buyers and sellers may tango again today, especially if China’s ‘National Team’ decides to intervene.

Whatever happens, the proximity to the trendline opens the door to numerous trade setups depending in how the price action evolves. The bias now is higher, putting traders on alert for a break of not only the downtrend but also the 200-day moving average located slightly above.

Key level provides two-way trade ideas

Personally, given how poorly the market has traded over the years without state-backed assistance, I’d like to see a break and close above the 200DMA before initiating a long position, allowing for a stop to be placed below both for protection against a potential reversal. On the topside, futures peaked around 12280 back in November, making that the first upside target. Above, futures did plenty of work either side of 13060 in the second half of 2023 with the triple top of 13520 the next level after that.

Should the upside momentum start to reverse from these levels, it provides an opportunity to initiate shot positions – with a stop above the trendline and 200DMA -- targeting a potential retest of the lows hit earlier this year. 11375 is the fist level I’d be watching on the downside with the 50DMA not far below that.

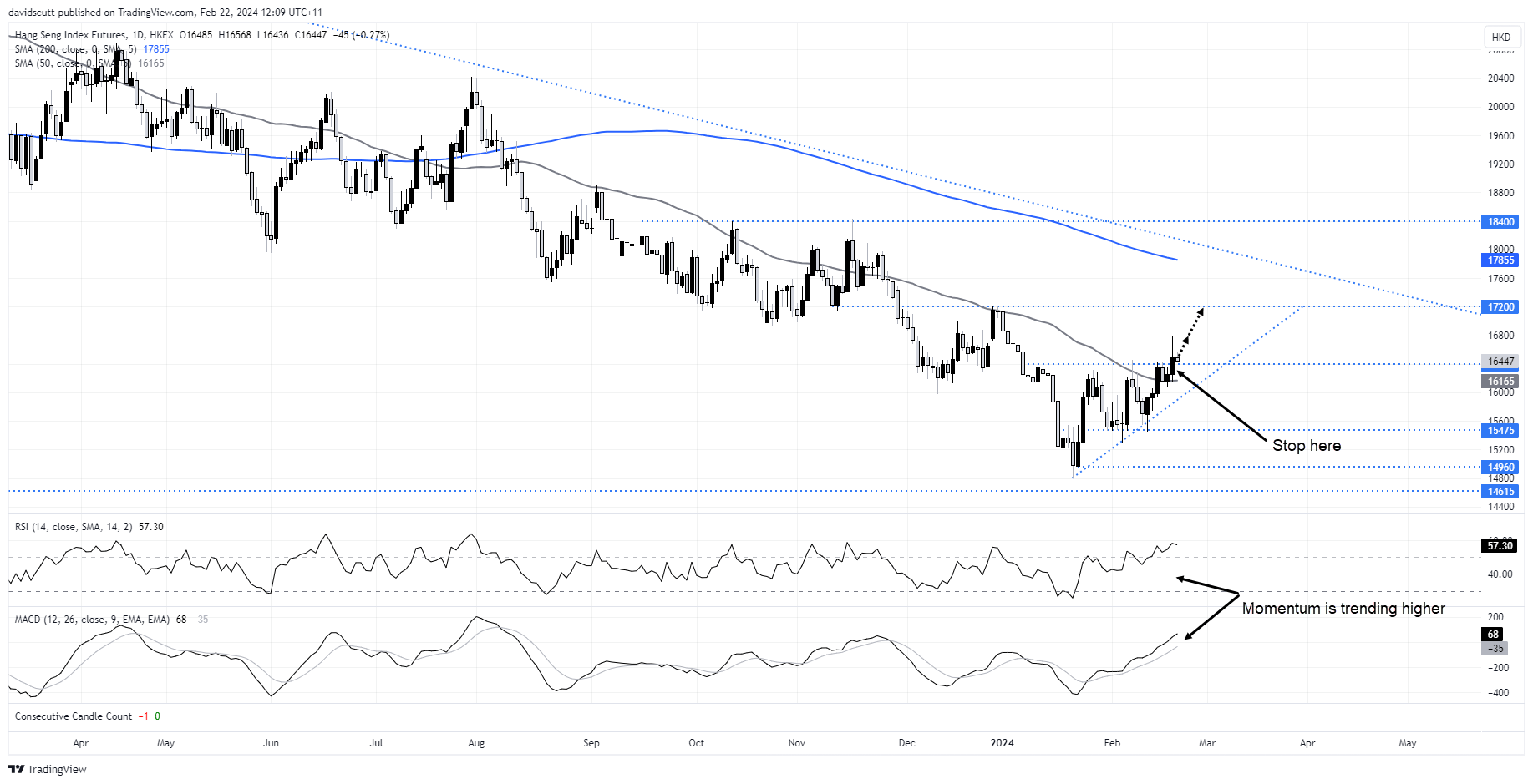

Hang Seng clears sellers parked above 16400

Hong Kong’s Hang Seng is another Chinese market that’s rebounded, although it’s move has been more of a grind rather than a surge, leaving it someway off retesting the downtrend it’s been in since 2021. However, having overcome stubborn resistance at 16400 on Wednesday, the proximity to that level provides another interesting setup for bulls.

The price action following the topside break was not overly convincing, with Hang Seng futures reversing hard later in the session after initially trading up to as high as 16800. The early moves on Thursday may provide clues as to how the index will fare for the session.

If 16400 holds, it will allow traders to go long, with a stop below, targeting a push back to 16800 or even 17200 depending on whether we see an early thrust. With minor uptrend support and 50-day moving average not far below 16400, the setup for a potential short is not compelling around these levels.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade