- Gold analysis: Why has it eased from record highs?

- What to expect from the Fed and gold’s reaction?

- Gold technical analysis

Gold video analysis

Gold has been falling back in the past week and a half after hitting a record high at $2195. The key question is whether today’s FOMC policy decision will cause it to fall back even further, or will it trigger a fresh wave of buying that could propel the precious metal towards a new all-time high. Regardless of the post FOMC reaction, the long-term trend is bullish on gold, and as a result I would concentrate on looking for bullish setups near support than bearish ones, until such a time we get a clear indication that the metal has topped.

Gold analysis: Why has it eased from record highs?

In short, because of profit-taking amid a broad-based dollar recovery and the recent rise in US bond yields, which has held back zero- and low-yielding assets across the board, including precious metals, Japanese yen and Swiss franc. Rising yields basically increase the opportunity cost of holding such assets for yield-seeking investors.

The dollar and yields have risen owing to renewed strength in inflation data last week. Investors are now expecting the Fed to be even more cautious about the timing and magnitude of any potential rate cuts this year. Consequently, they are anticipating that the Fed will update its economic forecasts (i.e., the “Dot plots”) at its meeting later today to reveal a slightly more hawkish projection of interest rate path. The December dot plot had a median estimate of 3 rate cuts this year. Now, there is a good chance that the median could drop to 2 cuts. These expectations have helped to light a match under the US dollar’s bull fire, following last week's unexpectedly high CPI and PPI reports. However, despite these developments, Fed fund futures continue to indicate around 60% probability of a rate cut in June.

Gold analysis: What to expect from the Fed and metal’s reaction?

One thing appears almost certain is that there won’t be any changes in interest rates at this meeting and possibly next one in May. But the fact that the dot plots will get updated at today’s meeting means it is very important for the dollar and gold. These dot plots, plus Chairman Powell’s remarks at the FOMC press conference will be very important to pay attention to. Will the Fed still keep three rate cuts in its dot plots, or will it indicate two rate cuts for 2024 instead?

Given the recent surge in the dollar's strength, it appears that the market anticipates the FOMC to unveil a more hawkish stance in the dot plots, suggesting fewer than the previously projected 3 rate cuts in 2024. However, this expectation seems to have been already factored into the market, with the current anticipation being only 68 basis points of Fed cuts for the year. If the FOMC adjusts its projections to indicate 50 basis points of cuts for this year, there could be some potential for modest further strengthening of the USD. Nonetheless, for the dollar to sustain its upward momentum at these high levels, the Fed would need to adopt a significantly hawkish stance, which seems improbable in my opinion.

Conversely, if the median forecast remains at three or increases beyond that, it would constitute a dovish surprise, likely leading to a broad-based weakening of the dollar. Such an outcome could propel gold towards a new record high.

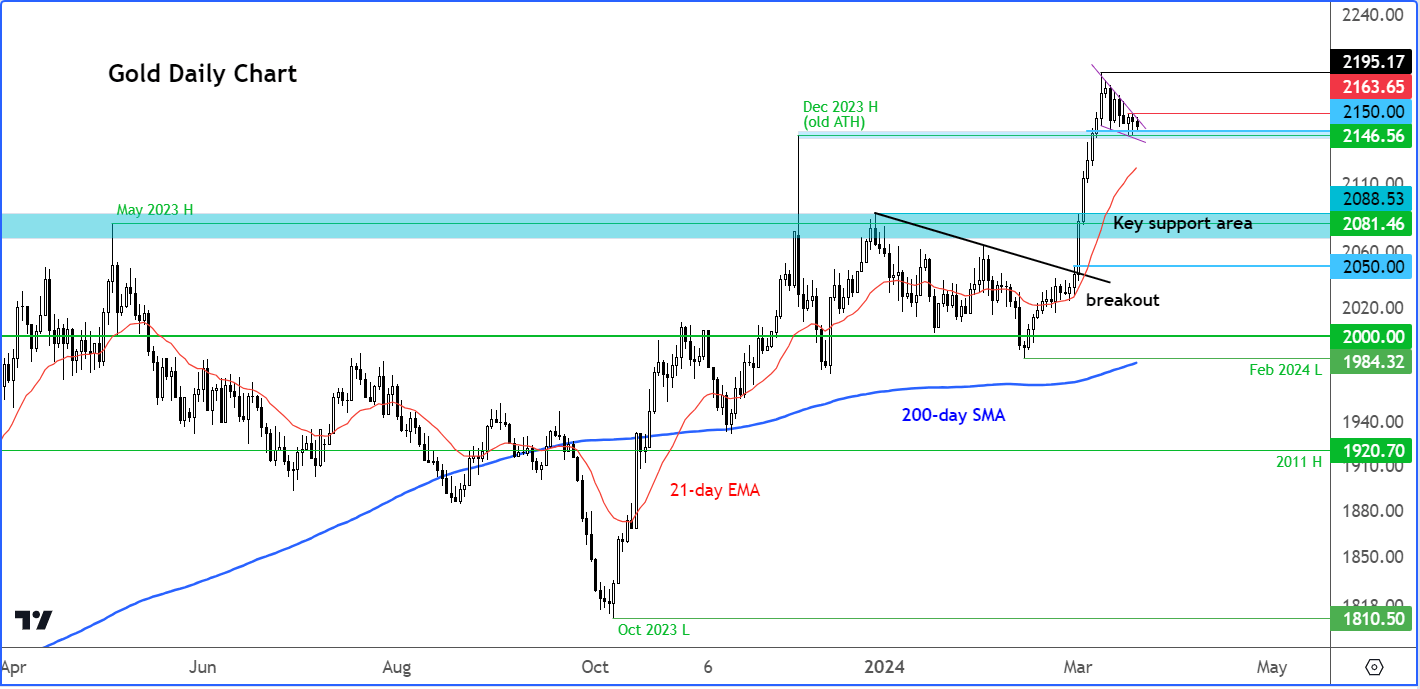

Gold technical analysis

Source: TradingView.com

Ahead of the FOMC meeting, gold remains in consolidation mode. While there is a possibility we could see further short-term weakness, there is no question about the direction of the long-term trend.

At the time of writing, it was still holding above short-term support seen around the $2145/$2150 area (where it had peaked in December). The 1.5-week consolidation has allowed gold to work off its short-term overbought conditions without giving bac significant gains. Today’s FOMC-driven price action will be key.

If, after the Fed’s meeting, gold continues to hold above the $2145/$2150, perhaps following some whipsawing, then this would indicate to me that it wants to head further higher. For extra confirmation, I would like to see it break above the bearish trend of its recent consolidation pattern.

However, if the $2145/$2150 support area breaks on a daily closing basis, then this could pave the way for a deeper correction towards a much stronger support zone around the $2080/90 area, where it had formed major highs in previous years, until this year’s decisive breakout.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade