- FTSE analysis: Could the UK index start catching up with global indices?

- Improving UK data could help UK markets

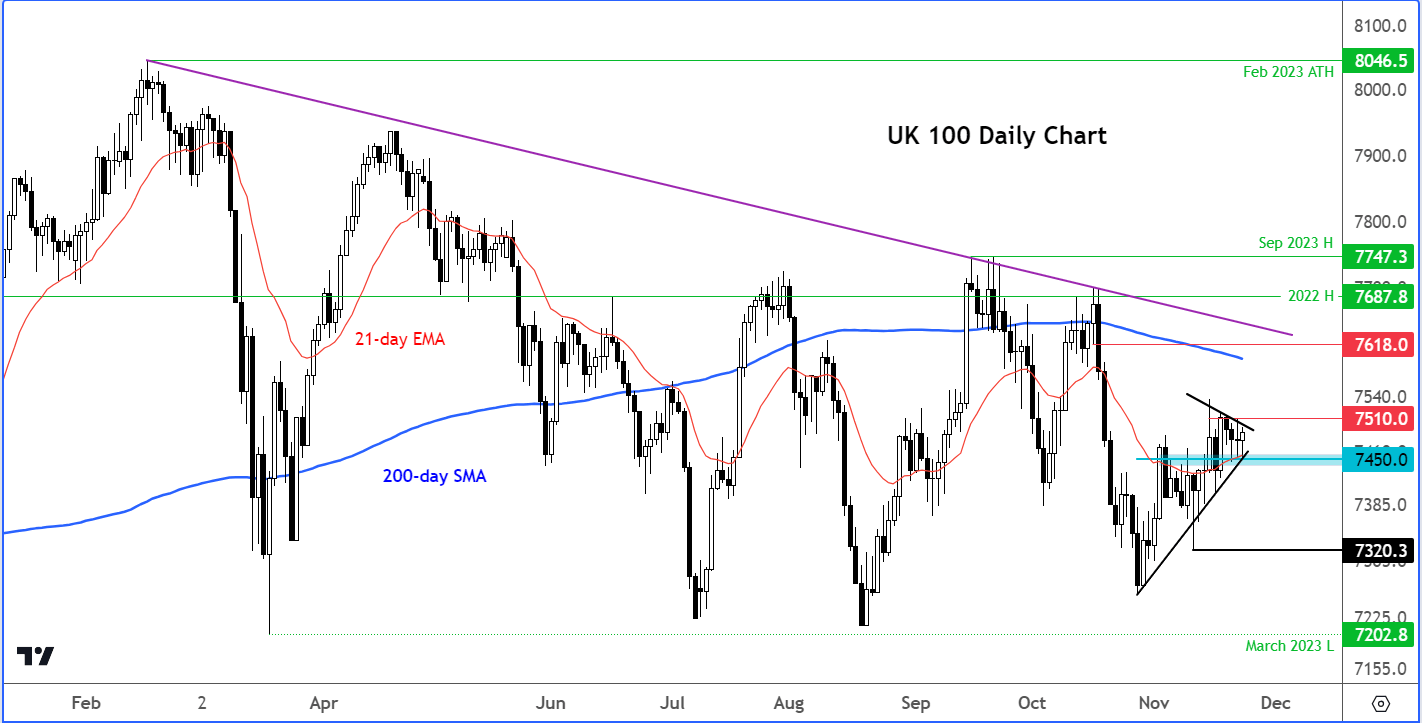

- FTSE technical analysis

FTSE video analysis

The ongoing stock market rally continues. With the US Thanksgiving holiday keeping trading on the quieter side on Thursday, the European markets edged higher. The DAX has now completely made back the entire losses it suffered between September and October. Other mainland European indices have similarly made strong gains, along with Wall Street. But frustratingly for the UK market, the FTSE has not shown much desire to go higher. Will that change as we head towards the end of the month?

FTSE analysis: Could the UK index start catching up with global indices?

Global markets have been excited by the possibility of central banks adopting a more dovish stance moving forward, with signs of global inflationary pressures slowly moving to normal levels. In the UK, times are tough. Inflation has been very slow to move down and interest rates are going to remain high for a long time as a result. This prevented the FTSE to further expand its rally earlier this year when it hit a new all-time high in February. Since then, the FTSE has struggled to find any sustainable support, hurt by concerns over China, UK’s struggling economy and high interest rates across the world.

However, we have had some positive data out of China, the UK and US in the last couple of weeks, which may mean the worst days are behind us, especially as there is now diminished macro concerns compared to a few months ago.

Improving UK data could help UK markets

Last week saw UK inflation come in sharply lower to an annual pace of 4.6% from 6.7% previously. While the CPI-related optimism quickly faded, the downside has been limited with the FTSE clinging onto key support at around 7450. On Thursday, we learnt that the UK’s services sector unexpectedly rose back above the expansion threshold of 50.0 in November, according to surveyed purchasing managers in the industry. The services PMI came in at 50.5 vs. 49.5 expected and last. The manufacturing sector remained in contraction (46.7), albeit at a less worrying pace than the month before (44.8) and better than expected (45.0). The data helped to lift the pound across the board, but it didn’t have much impact on the FTSE, with the index falling in the first half of Thursday before recovering in the afternoon.

FTSE technical analysis

Source: TradinView.com

As mentioned, the FTSE has been unable to partake in the same upward momentum witnessed in other European and US stock markets over the past several weeks. The FTSE is lagging behind and needs to make up ground. However, in recent days, there has been a positive development as the FTSE has climbed back above the 21-day exponential moving average and overcome resistance at the 7450 level. This suggests a potential resurgence of bullish momentum in the UK markets. At moment, the 7450 level is continuing to hold as support having undergone several tests from above this week, indicating the possibility that bulls might intervene to drive the index higher as we enter the twilight stages of the week, and month.

Despite consistently forming lower highs throughout the year, the UK index has not experienced a significant sell-off. Instead, it has predominantly held within a broad consolidation range. Remarkably, the index has successfully maintained levels above the March low of 7202, even in the face of several bearish attempts to breach this threshold—twice during the summer and once in October. The impressive bullish resilience exhibited in the midst of various macro risks suggests that the index, having endured relatively minimal damage, might now be poised to rise on the back of positive developments. There is a good possibility that we might see a rally aiming to test the 200-day average and previous resistance in the 7600-7620 range in the near future. To start an ascend towards that level, short-term resistance at 7510 must be taken out first.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade