- FTSE analysis: HSBC, Glencore hurt by disappointing earnings

- China’s latest efforts to shore up stock market keeps FTSE’s downside limited

- Attention will turn to the upcoming earnings results from Nvidia

The FTSE was once again among the laggards in the first half of Wednesday’s session, hurt by weaker earnings. Europe’s other indices were mostly positive as Carrefour rallied to lift the French CAC to a new high. Meanwhile, US index futures were a touch lower ahead of minutes from the last Federal Reserve last policy meeting, as well as the much-anticipated earnings from Nvidia.

FTSE analysis: HSBC, Glencore hurt by disappointing earnings

In the UK, sentiment was hurt following disappointing earnings from some of the major companies listed in London. Shares in HSBC dropped over 7.5% after announcing an 80% decline in fourth-quarter profit. Subpar earnings from Glencore, a commodities trader, and Rio Tinto, the world's largest iron ore miner, exerted downward pressure on the basic resources sector, causing it to plummet to a four-month low. Not all of Europe’s earnings were bad, however. Among them was Carrefour, which saw its shares rise after the French grocer revealed plans for a share buyback, despite disappointing quarterly sales.

China’s efforts keep downside limited

The losses were limited for the FTSE, however, with investors keeping an eye on the rebounding Chinese markets. Stocks rose in China overnight, following policymakers' lates efforts to bolster investor confidence. China has implemented a ban preventing major institutional investors from decreasing their equity holdings at the beginning and end of each trading day, marking one of the government's most assertive effort yet to support the nation's heavily-underperforming stock market.

Attention will turn to the upcoming earnings results from Nvidia

It is after all, “the most important stock on earth,” according to Goldman Sachs. Nvidia will publish its results after the close of Wall Street today, and the numbers could have major repercussions for US indices and the tech sector in general. Nvidia has been the central player in the artificial intelligence surge. So, it has the potential to significantly impact markets due to its substantial weighting in equity indices. After all, it has accounted for one-third of the Nasdaq 100 Index's gains this year and is also viewed as an indicator of the global economy's well-being.

Here's our Nvidia earnings preview, written by my colleague Matt Weller, containing everything you need to know.

FTSE analysis: Technical levels to watch

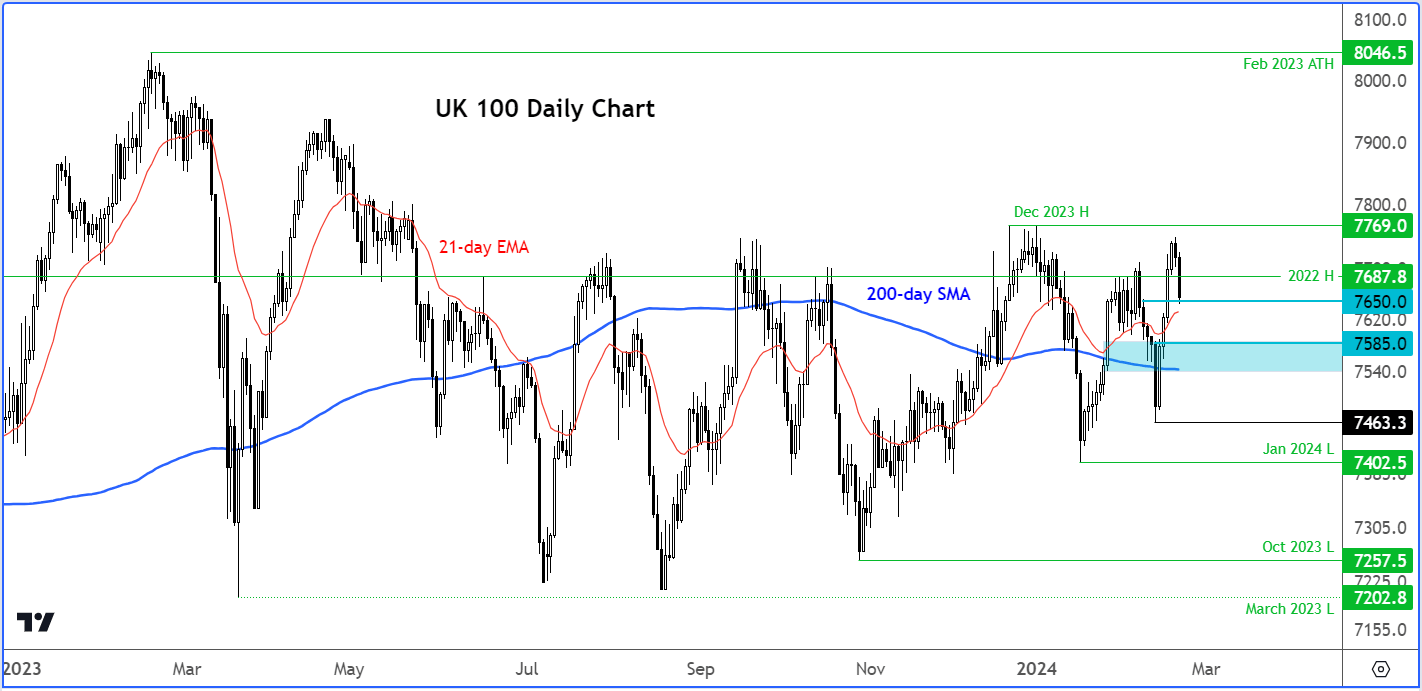

Source: TradingView.com

Today’s latest selling means the large side-ways price action on the FTSE continues for yet another day, further extending the disparity between it and mainland European indices. That said, the UK index has consistently found buyers on the dips and has made progressively higher highs in the process. The most recent high was formed in December at just under 7770. This is now the next target for the bulls. Above here, the all-time high of 8046 what was hit last February will be the subsequent objective.

On the downside, the first line of support was being tested at the time of writing at 7650. Below this level, we have the shaded blue area on the chart starting from 7585. Finally, this month’s low at 7463 would be the last key level that needs to hold. A potential break below that level would probably invalidate this moderately bullish technical outlook on the FTSE.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade