FTSE falls amid rising concerns over China and ahead of a big week for central banks

- China CPI falls -0.5% YoY in November

- Fed, ECB & BoE rate decisions this week

- FTSE tests 200 DMA resistance

The FTSE along with its European peers, are broadly heading lower at the start of a key week for central banks, which sees rate decisions from the BoE, the ECB, and the Federal Reserve. Dovish pivot rate bets have helped boost stocks across November, although stronger US jobs data on Friday has raised doubts about the extent of cuts expected in 2024.

The week, expected to be the last busy week for risk events ahead of Christmas, has set off on a softer footing after Chinese inflation jitters.

China's inflation fell -0.5% YoY in November after falling -0.2% in October. PPI also extended declines, dropping -3 % after falling 2.6% in October.

Deflation in China has ramped up concerns over a Chinese economic slowdown after coming hot on the heels of mixed data points across November. The data raises concerns about a weak demand outlook and more support being needed for the fragile economy.

Weak data from China often goes hand in hand with weakness in miners and resource stocks and comes after Anglo America dropped 19% on Friday as it announced a cut in capital expenditure.

Looking ahead, there's no economic data due today, but attention will be on tomorrow's US inflation report, which could be key for further clues as to whether the Federal Reserve could adopt a more dovish tone at this week's FOMC meeting.

The Bank of England will also be in focus, and policymakers have been sounding more hawkish in recent speeches, which could keep the pound supported and hurt the outlook for the multinationals, which will be hit by a less favorable exchange rate.

FTSE forecast – technical analysis

FTSE has extended gains from the November 30 low of 7385, rising above the 50 & 100 SMAs, but the move higher is being capped by the 200 sma at 7575.

Supported by the RSI above 50, buyers need a break above here to test the year-long falling trendline resistance at 7630, ahead of 7700, the October high.

Failure to rise above the 200 sma could see sellers look to 7500 round number and 100 sma. A break below here and 7450 brings 7385 back into target.

EUR/USD under pressure with ECB & Fed in focus

- ECB & Fed expected to leave rates unchanged

- ECB speaker Elizabeth McCaul in focus

- EUR/USD found support at 1.0750

EUR/USD is extending losses after falling 0.3% on Friday ahead of a key week with the ECB and the Federal Reserve rate decisions.

Today, the eurozone economic calendar is quiet; attention will be on ECB executive board member Elizabeth McCaul, who is due to speak. Any comments and views on inflation or the economy could influence EUR.

Recent ECB speakers have sounded more dovish, acknowledging the significant decline in inflation, which cooled to 2.4% YoY in November, close to the ECB's 2% target. Inflation data from Germany on Friday showed that the region's consumer price index cooled to 3.2%, its lowest level in 21 months. The weak inflation backdrop could allow cutting interest rates sooner.

The ECB meets on Thursday and is expected to leave rates at 4% but could provide some clues about when the first rate cuts could happen. The market is pricing in an interest rate cut as soon as March.

Meanwhile, the US dollar is finding support from stronger-than-expected U.S. jobs data on Friday. The unemployment rate unexpectedly ticked lower to 3.7%, and job creation rose 199k, highlighting the resilience of the U.S. jobs market.

Today, attention turns to U.S. consumer inflation expectations, which are expected to rise from 3.6% to 3.8% in November. The data comes which come ahead of tomorrow's consumer inflation report and Wednesday's Federal Reserve interest rate decision.

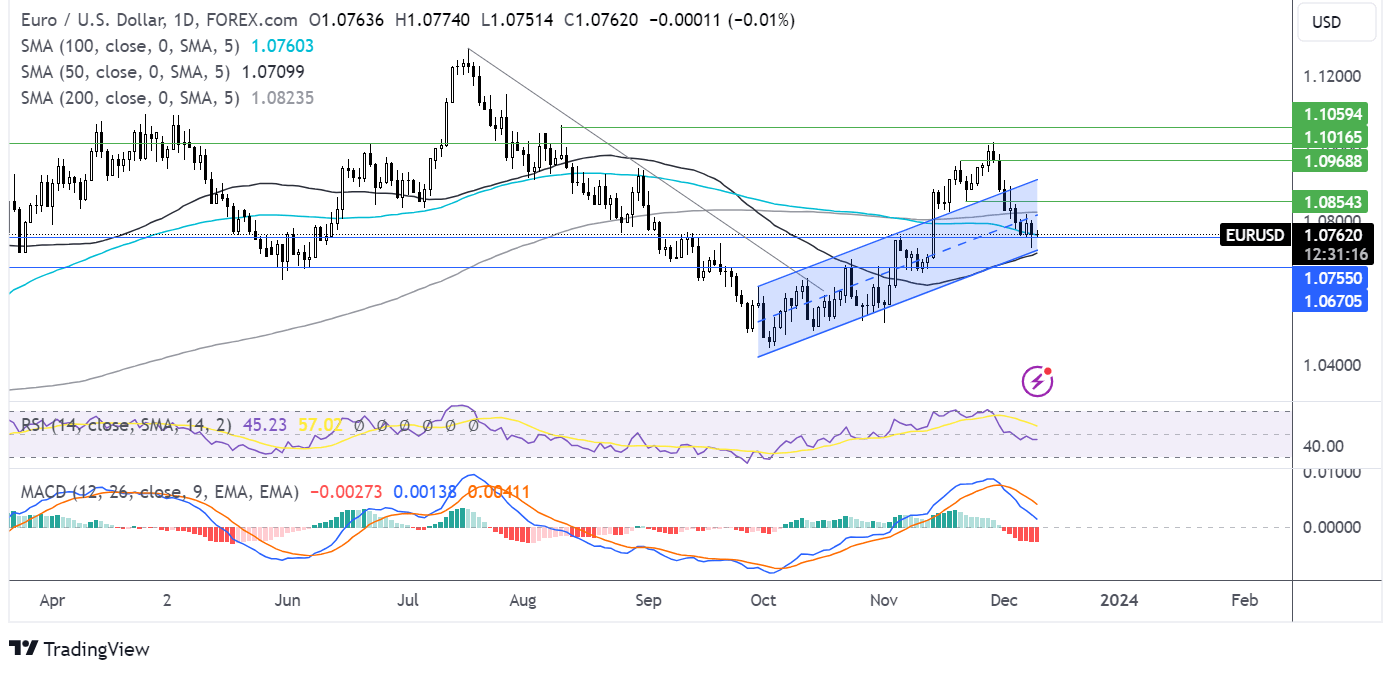

EUR/USD forecast – technical analysis

After falling below the 200 SMA, EUR/USD found support around 1.0750, the early November high.

While the bearish MACD and the RSI below 50 support further downside, sellers need to break below 1.0750 and 1.0725, last week’s low to extend the bearish move. A break below here and 1.0710 the rising trendline support and 50 sma could see sellers extend losses towards 1.0650.

Meanwhile, buyers need to rise above the 200 sma at 1.0825 to gain momentum and drive prices towards 1.0930.