The ETH/USD has climbed above $2K for the first time since August, when it made a high of $2030 before plunging. Bitcoin, which crossed $30K a few days ago, was still going strong at the time of writing. It looks like the Shanghai Upgrade has done more good than harm to the ETH/USD outlook. So, where does Ether go from here?

What is Ethereum’s Shanghai Upgrade?

The Shanghai Upgrade, also known as “Shapella,” means users who had staked their ether in order to secure and validate transactions on the blockchain – or simply put, people who had locked up their coins for rewards – can now withdraw. This is the biggest transition for Ethereum since its “Merge” upgrade last year.

Until the Merge upgrade, Ethereum relied on miners to secure blockchain by using computers to solve complicated mathematical puzzles. That consumed a lot of energy. To solve this issue, the network would now count on validators, i.e., ether holders who lock up their coins, to verify new transactions. In return for locking up their coins, they were rewarded with certain amounts of new coins.

Therein lied the problem: Validators were not able to withdraw their coins.

The solution: The Shanghai upgrade.

Why is ETH/USD rising?

There has been a lot of buzz around Ethereum’s Shanghai hard fork, which some had anticipated would have weighed on ETH/USD. Obviously, this hasn’t happened (yet), which suggests investors are continuing to warm towards the second largest crypto. The Shanghai upgrade could encourage more institutional investors to participate in staking, and thus provide more support for ETH/USD.

In fact, it is not just Ether finding love – the crypto sector as a whole has been finding some love of late.

Indeed, Ether’s fresh rise to above $2K comes on the back of improved risk appetite across financial markets, with stocks, gold and bitcoin all rising noticeably in recent times. The US dollar has weakened, and risk appetite has been supported by growing signs that US inflation has peaked, and that the days of interest rate hikes are numbered.

Following Wednesday’s release of US CPI data, investors were already feeling that we are now a lot closer to the peak in terms of interest rate hikes, now that the annual rate of consumer inflation has cooled to 5.0%. On Thursday, we had more data supporting this narrative as producer prices came in well below expectations. Accordingly, the odds of a 25-basis point rate hike in May have drop to 67%, according to the CME’s FedWatch tool.

ETH/USD outlook: What’s next for ether?

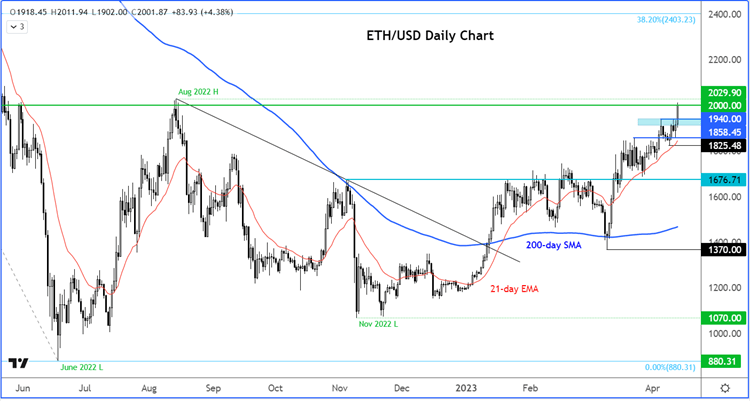

Well, ETH is now 45% better off compared to the low of $1370 made in March. Ether’s ascend has been nice and steady in recent days, creating a strong technical bullish price structure. Given that the prior sell-off was triggered around the $2K in August, don’t be surprised to see some profit-taking here.

However, the path of least resistance is clearly to the upside and in this current macro backdrop we could see short-term dips to find buyers around support levels.

The next nearest support below $2000 is at $1940, the base of Thursday’s breakout and a prior resistance range. Even if Ether deviates below this level a little, this wouldn’t materially change the bullish technical outlook for as long as it doesn’t create a new low beneath $1825, the most recent low prior to the latest rally.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade