US futures

Dow futures +0.02% at 34300

S&P futures +0.07% at 4390

Nasdaq futures +0.15% at 14930

In Europe

FTSE +0.50% at 7310

Dax -0.2% at 15676

- US Composite PMI forecast at 52 in August

- Nvidia to report after the close

- USD rises after gloomy PMIs in Europe

- Oil drops ahead of EIA inventory data

Europe PMIs drop, US PMIs up next

US stocks are set to open cautiously higher as investors weigh up gloomy European business activity data while also look ahead to US PMI data and Nvidia’s earnings after the close.

A sharp downturn in business activity data in Europe has helped bond yields drop on both sides of the Atlantic, lifting stocks higher.

US PMI data is due shortly and is expected to show that the service sector PMI is expected to ease to 52.2 in August from 52.3. The manufacturing sector is expected to shrink at a slower pace of 49.3 from 499 in July, and the composite PMI is set to hold steady at 52.

The data comes as US 10-year yields pull back from the recent 26-year high and ahead of the start of the Jackson Hole Symposium tomorrow.

The Fed could address the re-acceleration of the US economy despite the most aggressive hiking cycle in decades. Yesterday, Fed official Barkin highlighted solid retail sales and recovering consumer confidence as signs that the economy could remain strong.

In addition to economic data, investors will be looking towards Nvidia’s earnings due after the bell. The shares in the AI chip stock have surged over 220% so far this year, thanks mainly to the stellar forecast in May. Expectations are riding high with revenue expected to rise to $11 billion, up 65% from a year earlier and up from $7.2 billion in the previous quarter.

The hype surrounding AI has helped fuel a rally in tech stocks this year.

Corporate news

Foot Looker slumped 31.4% after the sportswear retailer posted falling sales for another quarter, slashed its outlook, and paused dividends due to a weaker consumer.

Peloton tanked 25% after the exercise bike retailer forecast Q1 revenue below estimates as consumers prioritise travel and experiences over its equipment.

Kohl’s rose 3.5% after the department store beat profit expectations amid leaner inventories, fewer discounts, lower costs and a broader retail weakness.

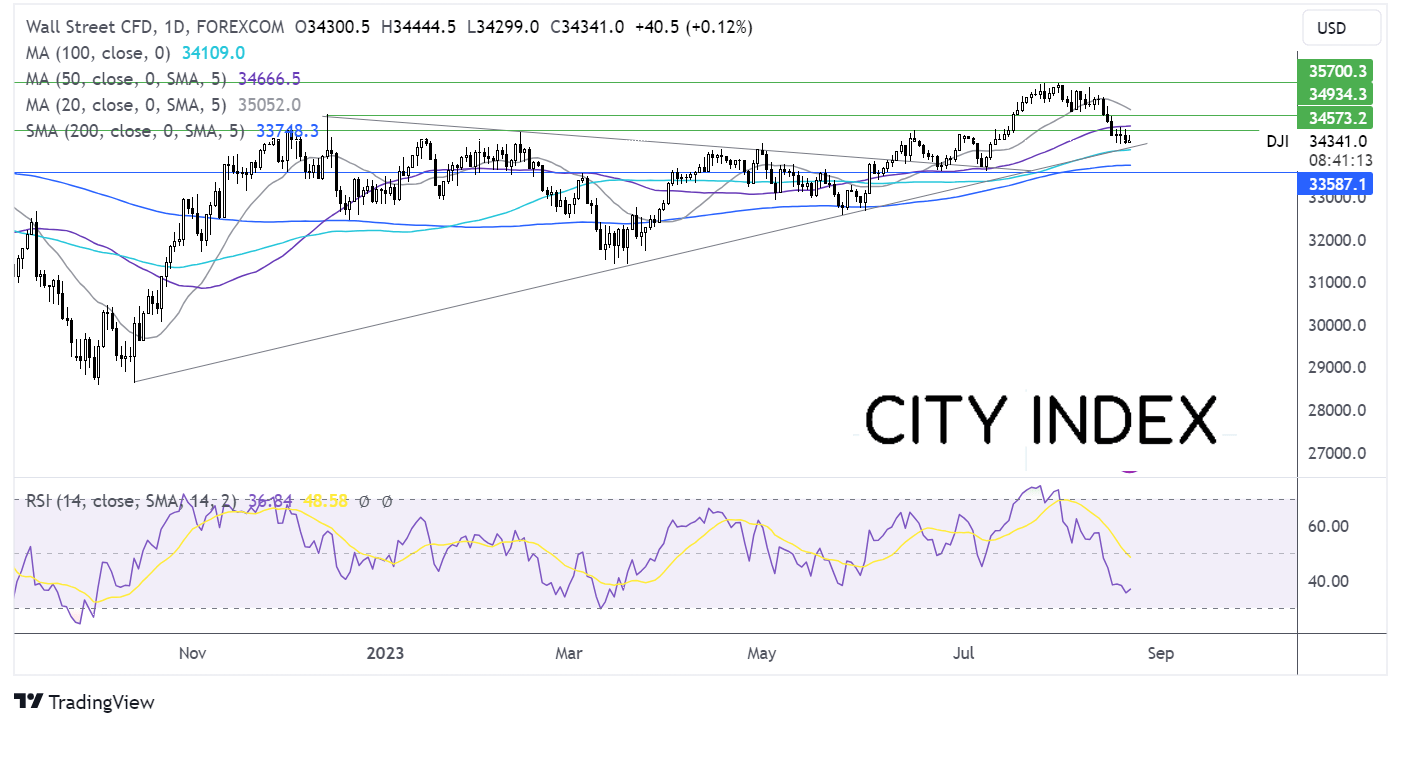

Dow Jones forecast – technical analysis

Dow Jones has broken below its 20 & 50 sma and is testing rising trendline support dating back to October 2022 at 34100, which is also the 100 sma. The RSI below 50 supports further downside. A break below 34100 could expose the 200 sma at 33750 and the July low at 33600. On the upside, resistance can be seen at the 50 sma 34665 which coincides with Monday’s high. A rise above here and the December peak of 34940 brings 35000 back into focus.

FX markets – USD rises, GBP falls

The USD is rising amid rising recession fears in Europe and ahead of US PMI data later today. While questions over further rate hikes from the ECB and the BoE are rising, the Fed is expected to keep rates higher for longer

EURUSD has fallen to a 2-month low after the eurozone service sector PMI unexpectedly contracted sharply in August to 48.3 from 50.9, raising doubts over whether the ECB will hike interest rates again in September. The market is now pricing in just a 50% probability of a September hike.

GBPUSD is falling after UK business activity unexpectedly shrank, with both manufacturing and services seeing a drop in demand, raising concerns of a recession. The data places doubts over whether the BoE will continue hiking interest rates

EUR/USD -0.28% at 1.0813

GBP/USD -0.75% at 1.2639

Oil drops after gloomy PMIs

Oil is falling after gloomy economic data raises concerns over the demand outlook and as investors look cautiously ahead to the start of the Jackson Hole Symposium tomorrow.

Eurozone & UK PMI data showed a marked slowdown in business activity, particularly manufacturing, suggesting that the economy could contract in the current quarter as interest rates hikes filter down into the real economy. The deteriorating economic outlook is hurting the oil demand outlook.

Furthermore, the Federal Reserve Chair Jerome Powell is likely to pedal the higher rates for longer narrative, which could depress growth, hurting the oil demand outlook further.

According to the API, crude oil stockpiles continued to fall, dropping by 2.4 million barrels. This was below the 2.9 million barrels expected.

EIA stockpile data is due later.

WTI crude trades -1.4% at $78.40

Brent trades -1.34% at $82.61

Looking ahead

14:45 US PMI data

15:00 US New Home Sales

15:30 EIA Crude Oil stockpiles