US futures

Dow futures +0.31% at 39179

S&P futures +0.22% at 5175

Nasdaq futures +0.3% at 18128

In Europe

FTSE -0.01% at 7764

Dax +0.18% at 17996

- Stocks trim gains after signs of sticky inflation

- PPI rose 0.6% MoM in February

- The data raises doubts over the Fed’s ability to cut rates

- Oil rises after a bullish IEA oil market report

Stocks trim gains after signs of sticky inflation

U.S. stocks are Heading for a positive open, although futures have trimmed their gains as investors digested a barrage of U.S. economic data and stickier-than-expected inflation.

US PPI came in hotter than expected, rising 0.6% MoM in February from 0.3% previously. Meanwhile, on an annual basis, PPI rose 1.6%, up from 1% previously. The data adds to signs of persistent inflation and supports the view that the Federal Reserve will be in no rush to start cutting interest rates. Following the data release, two-year treasury yields ticked higher, and US equity futures trimmed gains.

The CPI figures earlier in the week highlighted the sticky nature of US inflation. Together, the reports raise questions over whether the Federal Reserve will be able to cut interest rates three times this year, as was forecast in the Fed’s median dot plot in December.

Interest rate expectations have been dialed back considerably since the start of 2024 and may need to be dialed back further. The dot plot will be one of the key focuses of next week's FOMC meeting.

Elsewhere, data showed that US retail sales rose by less than expected, increasing 0.6%MoM in February after falling a downwardly revised 1.1% in January.

Meanwhile, initial jobless claims were stronger than expected at 209k, down from 218K.

Corporate news

Tesla is looking to open over 1.5% lower after UBS cut its price target on the EV maker citing downward risks to the delivery forecasts.

Nvidia is set to open 1.8% lower, extending the recent setoff in the AI chip maker ahead of the company's annual developer conference on Monday.

Dollar General is set to open 6% higher after the discount retailer forecast encouraging 2024 sales, and expects steady demand thanks to price-conscious shoppers.

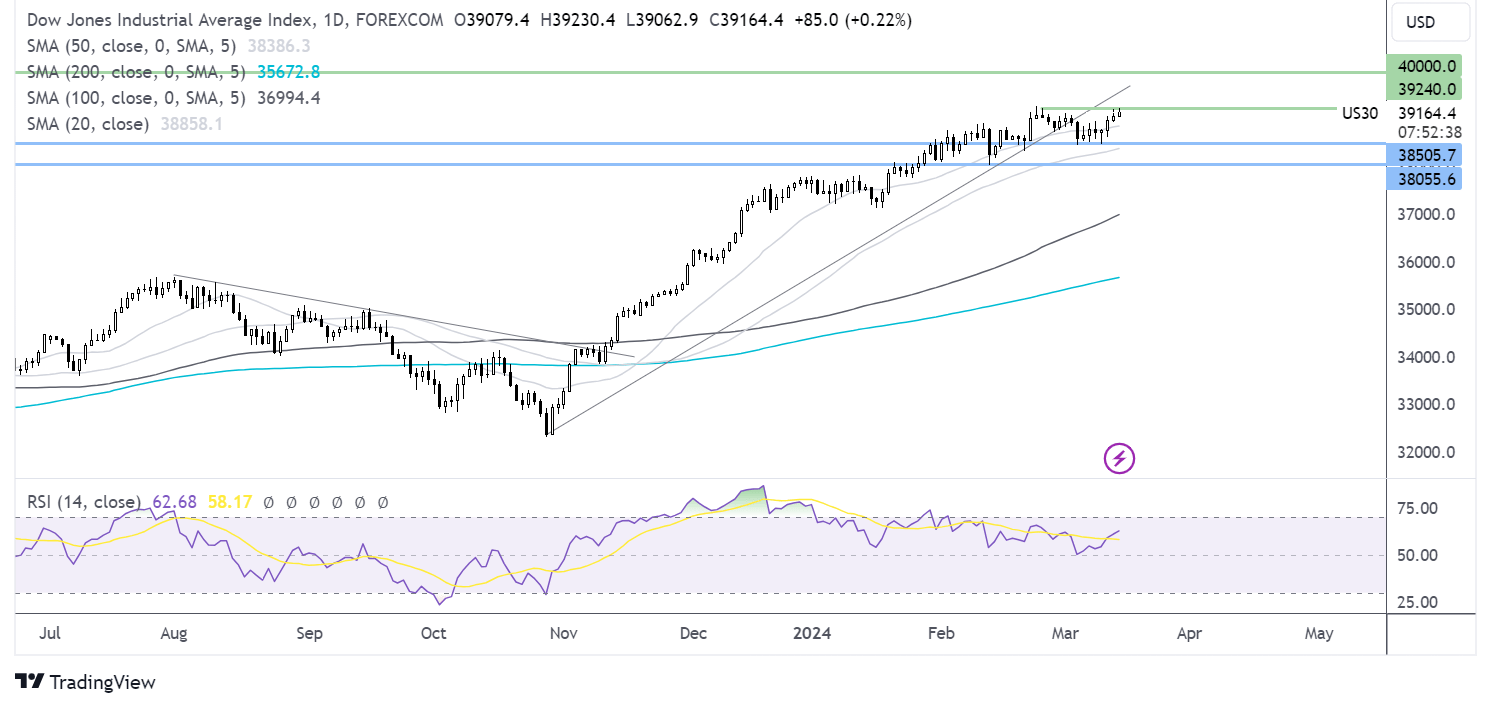

Dow Jones forecast – technical analysis.

The Dow Jones is scaling towards fresh all-time highs, and the RSI is supportive of further gains. A rise over 39284 opens the door to 40,000 , the psychological level. Buyers remain in control above 38,500. Below here 38,000 the February low comes into focus.

FX markets – USD rises, EUR/USD falls

The US dollar is rising after signs of persistent inflation raised questions over the Fed's ability to cut interest rates in June and whether it will be able to cut rates three times this year.

EUR/USD is falling against the stronger dollar as the ECB is expected to cut rates in June, and the Greek central bank chief even went as far as saying that the ECB should cut rates twice before the summer. There is no high impacting eurozone economic data due today.

GBP/USD is drifting higher amid a lack of fresh economic data but is broadly supported by expectations that the Bank of England will begin cutting interest rates after the Federal Reserve.

Oil rises after a bullish IEA oil market report.

Oil prices are rallying for a second straight day as investors digested the International Energy Agency's (IEA) latest oil market report and after US gasoline inventories fell for a sixth straight week.

The IEA raised its 2024 demand growth forecast by 110,000 barrels per day from its previous report. They also warned that the global economic slowdown could act as an additional headwind to oil use. Oil demand growth is expected to be 1.3 million barrels per day this year down from 2.3 million barrels in 2023.

In addition to an upward revision to the demand outlook, the IEA also cut its 2024 supply forecast amid lower output from non-OPEC nations and after factoring in the latest cuts from OPEC+.

All in all, this is a bullish report, and that's being reflected in the rise in oil prices, with WTI hitting $80.00 a barrel.