US futures

Dow futures 0.16% at 39149

S&P futures 0.20% at 5093

Nasdaq futures 0.35% at 17971

In Europe

FTSE -0.13% at 7689

Dax 028% at 17440

- Indices pause for breath around record highs

- US core PCE inflation data will be the main focus

- Oil falls on increased supply and demand concerns

Stocks start quietly with inflation data in focus

U.S. stocks are pointing to a quiet open on Monday after a record run in the previous week, and as investors look ahead to key inflation data on Thursday.

The hype over artificial intelligence got a shot in the arm after consensus-beating results from Nvidia, which helped both the S&P 500 and the Dow Jones climb to record levels last week.

This week, attention is focused on economic data, inflation, and the Federal Reserve's path for interest rates. Thursday sees the release of the core PCE index, the Fed's preferred gauge for inflation.

The data comes as investors have repriced rate cut expectations since the start of the year, with June now seen as the likely start of rate cuts. This is more or less in line with what the Fed has suggested.

As well as core PCE data, Q4 GDP data is also due on Wednesday, which is expected to show that economic growth may have slowed in recent quarters.

Earnings season is also coming to a close, but there are still major retailers on tap this week, with Lowe’s, Macy's, and Best Buy set to report quarterly earnings across the week. Investors will be watching closely for any signs of a spending slowdown.

Corporate news

Ford will be in focus after the automaker confirms it has stopped shipments of all its 2024 model F-150 lightning trucks on sighting quality cheques.

Berkshire Hathaway will also be under the spotlight after announcing its results over the weekend.

Meanwhile, Tesla rival BYD, the Chinese EV maker, unveiled a new electronic supercar this weekend that can hit speeds similar to those of high-end models such as Ferrari.

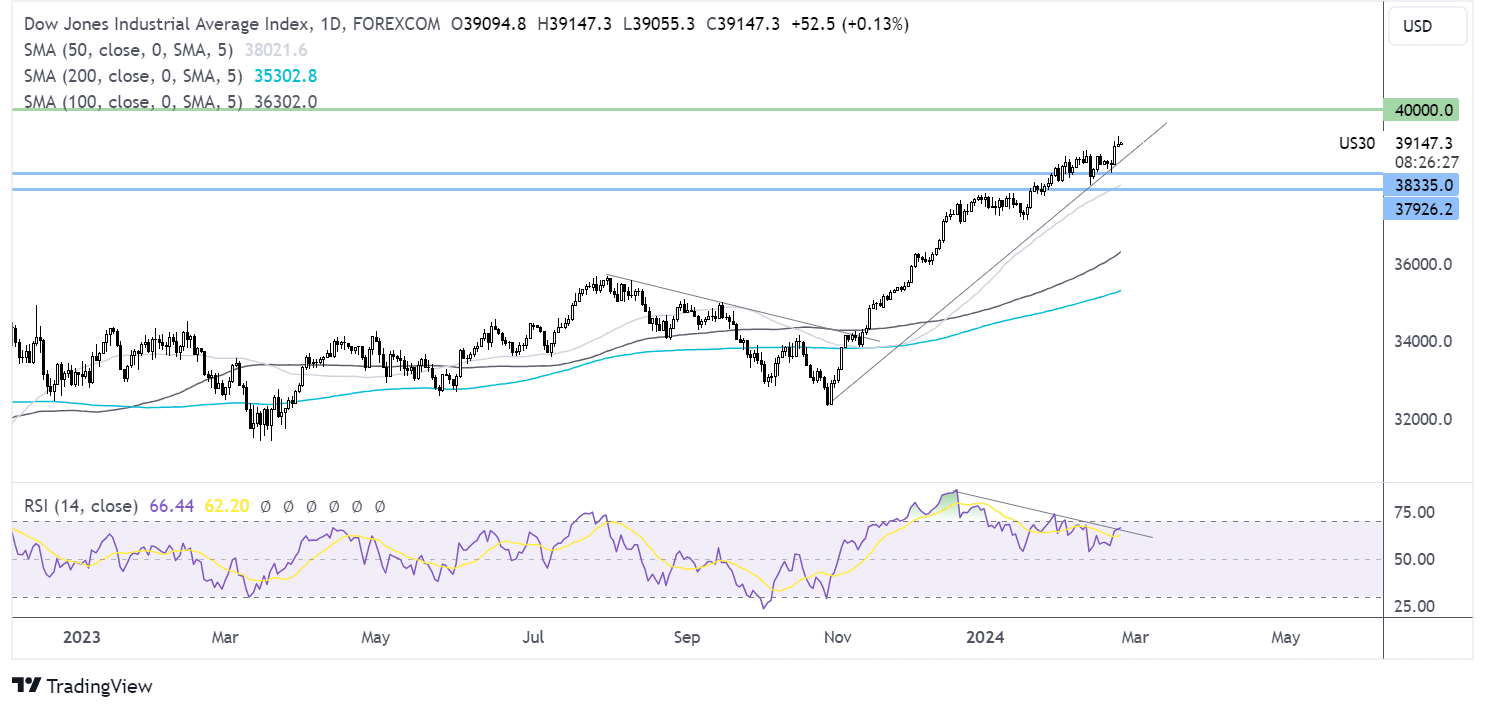

DJIA forecast – technical analysis

The Dow Jones continues to trade above its rising trendline, hovering around all-time highs. Thr RSI bearish divergence suggests that the index could struggle from here, with at least a period of consolidation on the cards. Support can be seen at 38335, last week’s low, with a break below here opening the door to 38000, the February low. On the upside, buyers will look to scale to fresh all-time highs towards 40,000.

FX markets – USD falls, GBP/USD rises

The USD booked its first weekly decline since the start of the year last week and is kicking off today on the back foot. Investors are cautious ahead of Thursday's inflation data, which could provide more clues over when the Fed will cut rates.

EUR/USD is rising, adding to last week's gains amid a weak U.S. dollar and as investors await her speech by EC president Christine Lagarde. Despite the ongoing economic downturn in the region and cooling inflation, the central bank has been reluctant to discuss cutting interest rates.

GBP/USD is heading for a fifth straight day of gains, marking its longest winning run this year. The pound has performed well across the past week despite little in the way of high impacting data. Currency remains propped up on the whole by the expectations that the Bank of England will not be among the first major central banks to cut rates. The market is widely expecting the central bank to cut rates in August.

Oil falls on rising supply & a weak demand outlook

After falling 3.4% across the previous week, oil prices extend those losses on Monday amid slowing demand and rising non-OPEC supply.

Weekly data from Baker Hughes showed the number of U.S. oil rigs rose by six last week; meanwhile, the Wafa oilfield in western Libya also resumed operations following a short halt over the weekend. Increased supply kept the pressure on oil prices, as did the prospect of higher interest rates for a longer time.

Concerns over possible delays to interest rate cuts by the Federal Reserve and other major central banks are also weighing down oil prices. High-interest rates for longer could hurt the demand outlook and economic growth.