DAX rises to fresh all-time highs ahead of Eurozone inflation data

- S&P500, Nasdaq100 rose to record highs

- Eurozone CPI to cool to 2.5% YoY

- DAX rises towards 18000

Dax is opening an all-time high following in the footsteps of the NASDAQ 100 and the S&P 500 yesterday after US inflation cooled in line with expectations fueling bets that the Federal Reserve will start to cut interest rates in June.

Inflation increased at the slowest pace in almost three years as core PCE slipped 2.8%, down from 2.9%. Personal spending fell for the first time in five months, fuelling market expectations that the Fed could start to cut rates in the coming months.

Attention now turns to eurozone inflation figures, which are also expected to cool to 2.5% YoY, down from 2.8% in January. The data comes after German inflation figures also cooled to 2.6%, in line with economists' forecasts.

Cooling inflation is helping to fuel bets that the ECB will also move to cut interest rates sooner rather than later despite policymakers' reluctance to discuss rate cuts.

As well as rate cut bets, AI optimism is also helping to drive the rally, which has seen global stocks reach record levels.

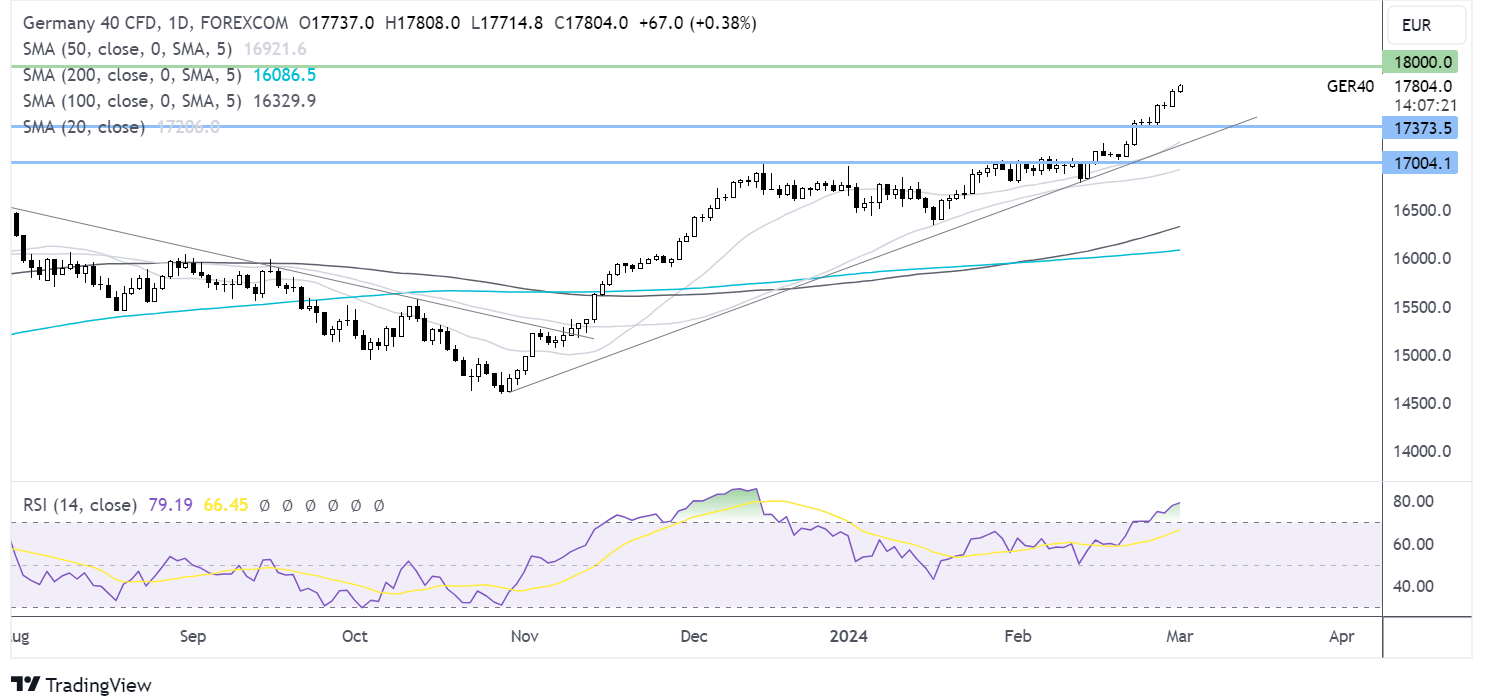

DAX forecast – technical analysis

DAX has risen to a fresh all-time high above 17,800 as it continues to grind toward 18,000. The RSI in the overbought territory should warrant some caution as a pullback, or at least a period of consolidation, could be on the cards.

Support can be seen at 17375, the weekly low, with a break below here opening the door to 17000, the round number, and the early February high.

USD/JPY rises post inflation data, US ISM manufacturing up next

- BoJ’s Ueda pushes back on rate hike bets

- US core PCE cools in line with forecasts

- USD/JPY rebounds back towards 150.50

USD JPY is rising, recovering from yesterday's losses after US core PCE data and after comments from Bank of Japan governor Kazuo Ueda.

Ueda warned it was too early to claim victory over inflation, achieving the central bank's 2% target, stressing the need for more data. His comments contrasted with BoJ board member Takata, who yesterday called for the central bank to begin talking about moving away from negative interest rates.

As a result, the yen has seen heightened volatility over the past two days -rising sharply yesterday before giving back those gains and more today.

Meanwhile, the US dollar is rising versus its major peers for a second straight day as investors continued to digest the US inflation data

While annual inflation rose at the slowest pace in almost three years, monthly cost PCE rose at 0.4%, its strongest rate since February last year, and service inflation rose to a 12-month high.

The data comes as Federal Reserve policymakers say they need more evidence that inflation is cooling towards the 2% target before considering cutting rates.

According to the CME fed watch tool, the market is pricing in a 70% probability of a rate cut in June.

Today, attention turns towards ISM manufacturing PMI data, which is expected to improve slightly to 49.5, up from 49.1. Why the level 50 separate expansion from contraction

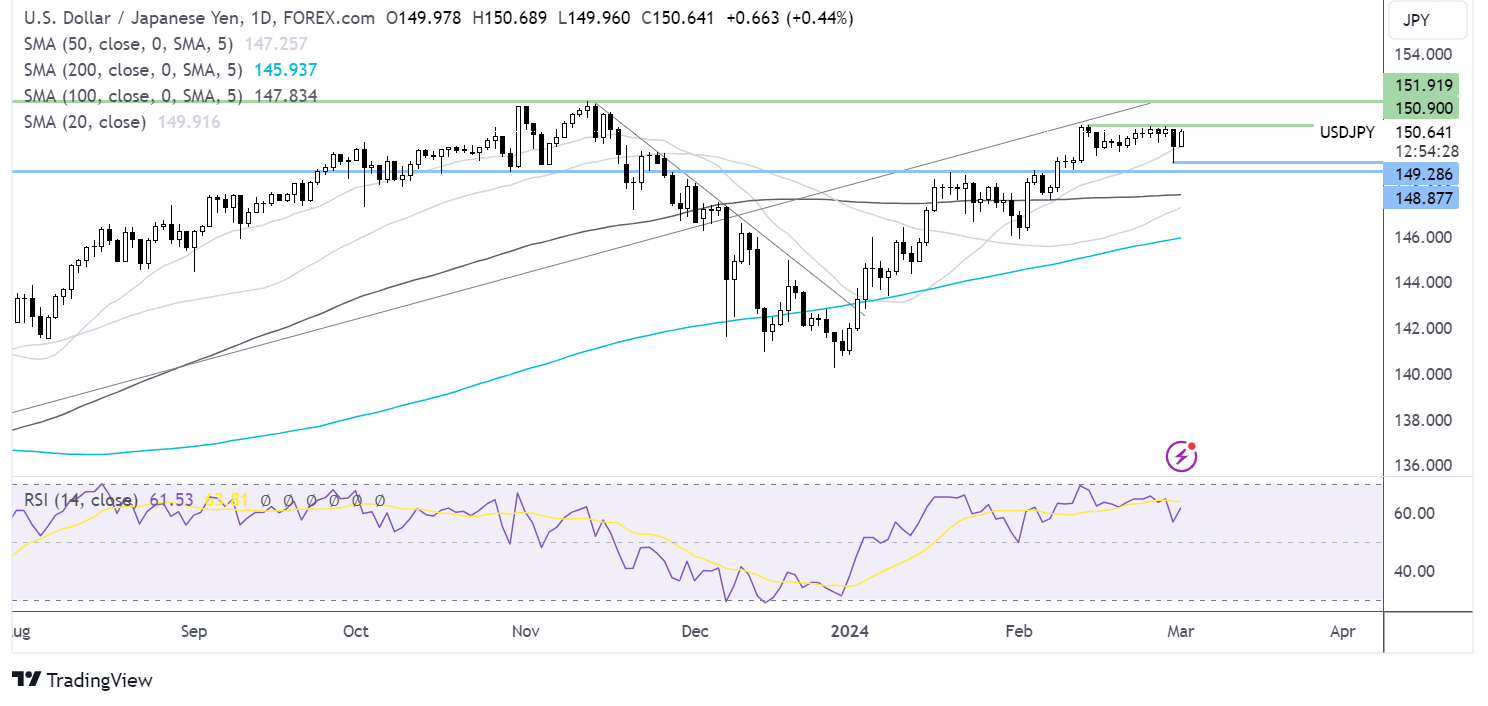

USD/JPY forecast – technical analysis

After briefly spiking lower to 149.20, the price rebounded above the 20 SMA, heading towards 150.50.

The long lower wick on yesterday’s candle suggests little selling demand at the lower levels.

Buyers will look to push the price back towards 150.90, resistance to the 2024 high. A rise above here brings 151.90, the multi-decade high, into focus.

On the downside, support can be seen at 149.20, yesterday’s low, and 148.80, the January high.